Brandscreen Asia Pacific programmatic report, Q4 2013

by Ciaran O'Kane on 18th Dec 2013 in News

Programmatic media-buying rose 70% in Asia Pacific in the last year, propelled by continued growth in the Chinese ad market, according to Brandscreen.

However, the rapid development of this market is disrupting the dominance of earlier leaders, including the erosion of Google’s market dominance.

The number of media campaigns using programmatic media-buying grew 70% year-on-year in Asia Pacific during the fourth quarter of 2013, with the volume of display ad impressions allocated to retargeting up 200%, according to the latest report from Brandscreen.

The real-time media platform’s latest Asia Pacific Real Time Media Insights Report for the fourth quarter, 2013, also revealed ad inventory on Chinese-only sites performs 243% better in terms of price when compared to global inventory.

The increased take-up is also having a positive effect on price performance of inventory in China.

“Global CPM rates are a bit higher than local [Chinese], and CPC is on par for both,” according to the report.

This plus the accelerated uptake of retargeted ad solutions means CPA is 74% lower on average than for non-retargeting impressions across the Asia Pacific region.

“Data shows the addition of third party data to retargeting impressions further improves results, despite the added cost of the data,” according to Brandscreen.

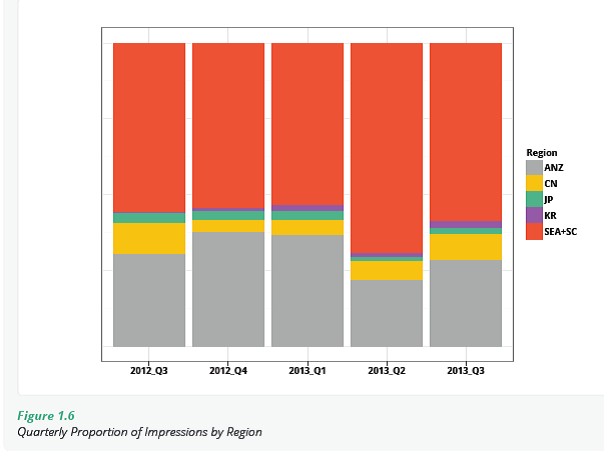

Meanwhile, Brandscreen also reported a 437% quarter on quarter increase in the number of programmatic ads it served in the booming Chinese market, thus shifting the market dynamics of the Asia Pacific region, although the South East Asian and Subcontinent regions continue to generate the bulk of spend.

Increase in number of advertisers buying programmatic

Brandscreen also credited the overall improved cost-efficiency of programmatic with fuelling the number of advertisers purchasing ad inventory via such methods, with the number of programmatic campaigns up 70% from the fourth quarter of 2012, during the period.

This also prompted Brandscreen’s number of partner integrations – the actual number of inventory and data partners to which it has access – to also increase by 51% from the same quarter last year.

Decrease in Google’s share of programmatic market

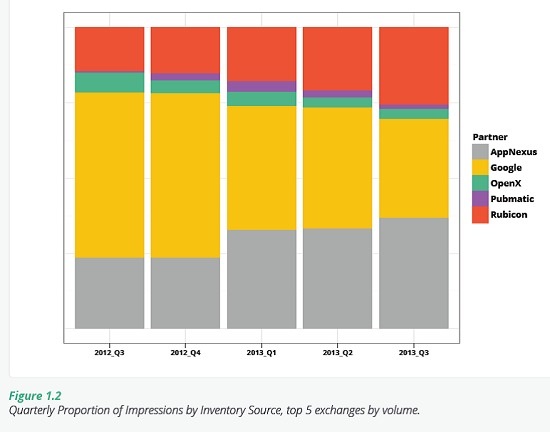

As a result, competition among inventory suppliers also began to heat up in the region throughout 2013, with newcomers such as Facebook Exchange (FBX) and several China-based exchanges entering the market, leading to a proportional decline in Google’s market share (see below chart).

China continues to embrace RTB

The number of ads served programmatically by Brandscreen in the Chinese market also grew 437% compared to the previous quarter, according to the paper, with the company crediting as the big four exchanges in China –Taobao, Tencent, Sina, and Baidu – as fuelling this trend.

This trend is further squeezing the markets share generated by the Japanese and Korean regions, although the South East Asian, Subcontinent, as well as Australia and New Zealand markets, still make up the bulk of programmatic spend in the territory (see below chart).

Methodology

All the data used for producing the analyses presented here was collected by Brandscreen. The data was aggregated across all clients and accounts, at a weekly or quarterly granularity.

Follow ExchangeWire