‘Programmatic Trading & Data Transparency: Lessons & Parallels from the Airline Industry’, by Eswar Sivaraman, Data Science Group Director, PulsePoint

by Romany Reagan on 9th Sep 2013 in News

The airline travel industry was revolutionised by online travel agencies (OTAs) 15 years ago (e.g., Priceline, Orbitz, Opodo) – today, the parallels with programmatic trading and its impact on online advertising are striking. OTAs enabled real-time access to fare and inventory availability across airlines, and reduced the role of travel agencies as a middleman. Today, programmatic trading via real-time bidding (RTB) stands to displace advertising agencies in all but direct sales, with efficient real-time access to inventory, at scale, and aligned with advertiser needs.

The access to real-time fare availability via OTAs put tremendous competitive pressure on the airlines to add ‘value premiums’ on their products that had become commoditised with transparency in fare and schedule availability. Targeting travelers with loyalty programme incentives and the promise of superior service and product quality became essential for maintaining price premiums. Transparency in access and on-demand information availability enabled fairness of choice for the travelers, while driving the airlines to improve cost efficiency against competitive revenue pressures. In particular, the ability to compare on-time performance of flights was an innovation in the spirit of data transparency. The end result of such competitive pressures is quite clear – (i) wins for the traveler and airlines that delivered value in fare, schedule, and service quality, and (ii) pressure on high-cost airlines to improve quality of product and service. The consolidation and mergers seen in the US airline industry since the end of 2009 is an attempt to overcome such uncompetitive cost inefficiencies.

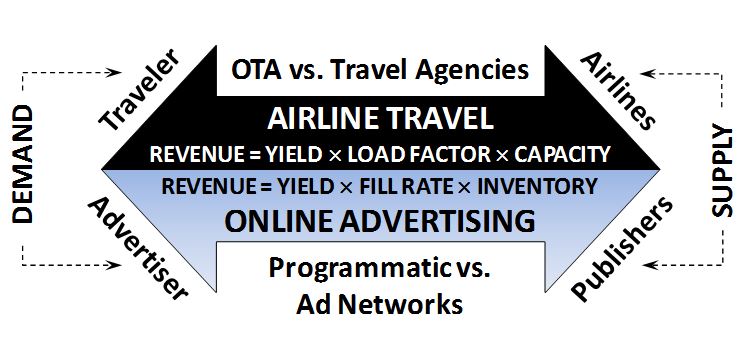

However, such pressures have yet to arise in online advertising, despite the similarities. To understand this requires a deeper look into the revenue models of the two industries, as illustrated below:

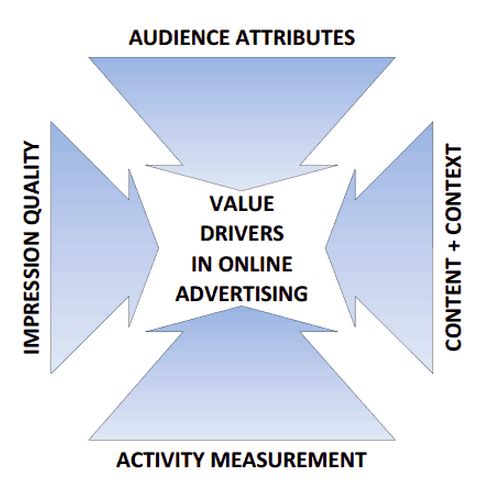

The revenue models of the two industries are strikingly similar, i.e., Revenue = Yield x Fill Rate x Inventory, with (i) yield = average CPM (or fare) of paid impressions (passengers), (ii) fill rate = % of paid impressions (% of filled seats), and (iii) inventory (capacity) being the total saleable supply. The key difference between the two industries is that increases in capacity are cost-prohibitive for the airlines, while increase in impression supply is technically unbounded with just a marginal increase in variable computing cost footprints. This is the reason why airlines require an average load factor of 85% or more, while a premium network/exchange might deliver excellent revenue to a publisher with a fill rate in the range of 10-20%. Increase in inventory supply is undoubtedly great for long-tail, revenue share players, but it leaves much uncertainty around publisher monetisation. The growth in inventory supply has not kept pace with advertiser needs for transparency around page content, impression quality, and user attributes. It is this difference that is the source of much inefficiency in the online advertising industry today, and which draws away from the potential and promise of programmatic trading.

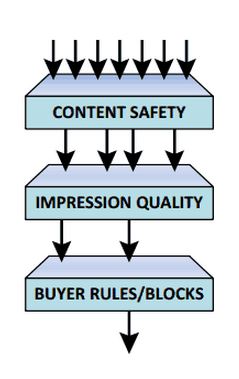

The visual alongside is a schematic representation of the filters that apply against inventory processed in a standard Ad Exchange. A significant portion of the inventory is filtered for issues of content safety (hate, pornography) and impression quality (fraud and bot checks) before being enabled for bidding across the exchange. Further scrutiny of impression-level data attributes is undertaken by the buyer before a bidding decision is made. There is a considerable amount of inefficiency in this process that (i) prevent publishers from fully monetising their inventory and (ii) advertisers from receiving best returns for their investments.

The efficiencies introduced by OTAs in the travel industry were tremendous in their impact on customer choice and value, primarily because of the transparency of all facts relevant to the traveler. Such an ideal seems as yet distant for online advertising partly through the proliferation in inventory supply of doubtful origins, and a lack of full transparency about each impression. The former issue is beyond the scope of this paper, while the latter is an opportunity for the industry to bridge the gap between bid- and ask-price valuation while creating victories for both publishers and advertisers.

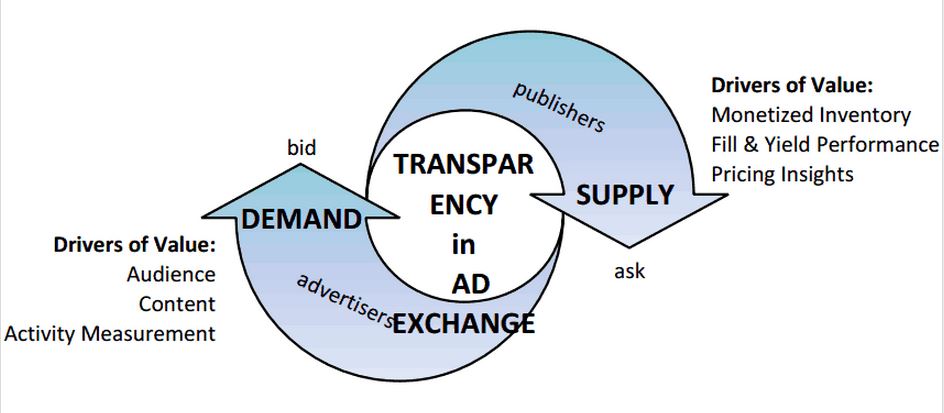

Ad Platforms are uniquely positioned to package and transmit impression-level attributes that are of value to the advertiser while helping publishers rightfully monetise and minimise the gap between their ask price and advertiser valuation. The figure below captures the role of the exchange in facilitating transparency of attributes that drive value for both the publisher and the advertiser.

A principled focus on data transparency for both parties has been the constant target at PulsePoint to ensure that the exchange is part of a value chain and not merely a link in the supply chain. Each impression is bundled with environmental attributes about the user (with and without the cookie), contextual categorisation of the site, and filtering decisions on impression quality. Audience activity measurement, i.e., engagement metrics, will likely emerge as a key component for advertisers to track ROAS, beyond transactional metrics like impressions or clicks. User engagement and viewability of ad creatives can be tracked via 3rd party systems like MOAT, Integral, Spider.io, RealVu, etc.

A principled focus on data transparency for both parties has been the constant target at PulsePoint to ensure that the exchange is part of a value chain and not merely a link in the supply chain. Each impression is bundled with environmental attributes about the user (with and without the cookie), contextual categorisation of the site, and filtering decisions on impression quality. Audience activity measurement, i.e., engagement metrics, will likely emerge as a key component for advertisers to track ROAS, beyond transactional metrics like impressions or clicks. User engagement and viewability of ad creatives can be tracked via 3rd party systems like MOAT, Integral, Spider.io, RealVu, etc.

However, there is much that the publishers can facilitate with greater transparency on all impression attributes to enable contextualisation, and user identification. Publishers would get real-time page-level categorisation of their sites while boosting ad relevancy to deliver a better user experience. More transparency would give publishers the ability to reveal, and monetise the true value of their inventory while also ensuring safe environments for advertisers.

According to IDC, programmatic now accounts for 17 percent of total UK display advertising sales and is estimated to grow to 30 percent by 2016 and both IDC and Forrester are projecting that brands and advertisers will ultimately spend most of their digital-advertising budgets programmatically. Data technology and transparency have transformed the airline and travel industry, making it better and more efficient for everyone – from consumers to businesses – and there is no reason why similar efficiencies cannot be expected from the ad industry. As media becomes more digitised, programmatic will become essential to both brand and performance advertisers. This, coupled with a future where a growing percentage of publishers are selling inventory only on ad exchanges, means that increased data transparency will be critical in bridging the value gap between advertisers and publishers.

Programmatic trading is growing strong, but with added transparency, will truly unlock its potential for delivering value to both publishers and advertisers, much like what was seen in the airline industry. The airline industry has since ridden the data transparency revolution to better unbundle their product and charge value premiums for different customer segments, to avoid complete commoditisation. In a similar sense, increasing transparency will help publishers better unlock premium value for their content, and Ad Exchanges can facilitate the discovery of these insights.

AdvertiserDataDisplayProgrammaticPublisher

Follow ExchangeWire