IAB Europe: Digital Ad Revenues Record Double Digit Growth

by on 20th May 2014 in News

Digital ad spend in Europe increased by 11.9% last year to surpass the €27bn mark, with the UK extending its lead as the most developed market in the region, although growth in Western Europe’s second-largest market (Germany), was relatively flat, according to figures released by the IAB.

The figures – dubbed the AdEx Benchmark study – released today (20 May) suggest that total spend was €27.3bn with spend on mobile establish a double-digit market share for the first time, accounting for 11.5% of total digital spend, representing a growth rate of 128.5% compared with 2012.

Meanwhile, online video advertising also showed strong growth, increasing by 45.4% in 2013, to nearly €1.19bn. This is the first time in Europe that online video has crossed the €1bn mark. The display ad market experienced the highest growth across the three categories recorded (display, search and classifieds, plus directories) at 14.9%, with a total value of €9.2bn.

Search showed growth of 13% - and a market value of €13.4bn, while 2013 classifieds and directories market was relatively stable at €4.6bn showing growth of 3.6%.

A regional break down of the market demonstrates that Russia and Turkey were the top markets for individual growth (26.8% and 24.3% respectively), however, there was little change at the top of the pecking order.

Neither of these markets where in the top 10 most valuable digital advertising market, plus it is also worth noting that the annual growth rates in both Russia and Turkey have both slowed down compared to 2012 when growth in Russia was 34%, followed by Turkey with a 30.4% growth rate.

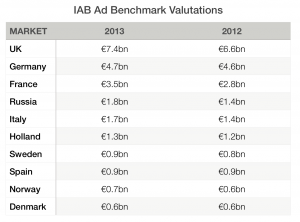

The chart below shows the UK was the most valuable market generating €7.4bn in 2013 (up from €6.6bn the year beforehand), whereas the region’s second-most valuable market was relatively flat at €4.7bn, compared to €4.6bn a year earlier. This was followed by France which generated €3.5bn, significantly up from €2.8bn in 2012.

This upsurge in the French market could be indicative of the implementation of French media consortia La Place Media, and Audience Squared (both of whom were formed in 2012, taking impact in 2013), which collectively represent 15 of the markets premium publishers.

This upsurge in the French market could be indicative of the implementation of French media consortia La Place Media, and Audience Squared (both of whom were formed in 2012, taking impact in 2013), which collectively represent 15 of the markets premium publishers.

This is in addition to the plethora of private media exchanges already present in there, this makes France one of the most mature markets for automated media trading.

ExchangeWire sources claim the above mentioned events helped buoy an "otherwise flat" marketplace, but the IAB figures suggest these assessments may have been a bit pessimistic.

The IAB figures show a slowdown in spend in the Nordic markets with the other entries in the top 10 also showing a slowdown, with digital ad spend growth in Denmark, Norway and Sweden all showing signs of relatively flat growth.

DACHDigital MarketingDisplayEMEAMartechMobileNordics

Follow ExchangeWire