Yahoo Earnings: Just Above Estimates

by Rebecca Muir on 20th Apr 2016 in News

Yesterday (19 April) Yahoo! Inc. (NASDAQ: YHOO) announced earnings and revenue just above analyst estimates.

Yahoo's struggle continues; there are concerns in all corners of the business: search, content, mobile, native, video, and social. Yahoo CEO, Marissa Mayer, said she is doing everything to facilitate a beneficial corporate sale; shareholders’ “top priority”.

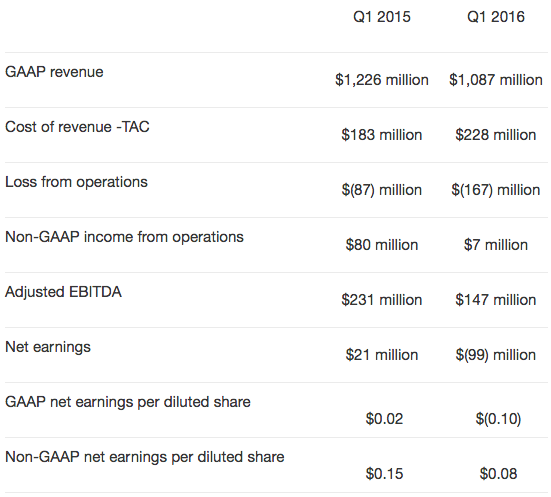

First-quarter earnings per share was USD$0.08 (£0.06), USD$0.07 (£0.05) lower than the year-earlier period, but one US cent above Wall Street estimates. Gross revenue fell year-on-year, reported as USD$1.09bn (£0.76bn) – compared to USD$1.23bn (£0.86bn) last year.

Source: Yahoo

Yahoo’s search and content offerings have floundered over the past few years, failing to fight toe-to-toe with Google and Facebook.

Search revenue

– Gross search revenue was USD$820m (£574m) for the first quarter of 2016, a decrease of 15% compared to the first quarter of 2015

– GAAP search revenue was USD$492m (£344m) for the first quarter of 2016, a decrease of 9%, compared to the first quarter of 2015

– Cost of revenue - TAC paid to search partners was USD$144m (£58m) for the first quarter of 2016, a 44% increase compared to the first quarter of 2015

– The number of paid clicks decreased 21%, compared to the first quarter of 2015

– Price-per-click increased 7%, compared to the first quarter of 2015

Display revenue

– GAAP display revenue was USD$463m (£324m) for the first quarter of 2016, a 1% decrease, compared to the first quarter of 2015

– Cost of revenue - TAC paid to display partners was USD$83m (£58m) for the first quarter of 2016, a 1% increase, compared to the first quarter of 2015

– The number of ads sold increased 8%, compared to the first quarter of 2015

– Price-per-ad decreased 6%, compared to the first quarter of 2015

The board of directors at Yahoo formed a strategic review committee of independent directors to consider strategic alternatives for the company alongside its continued consideration of a reverse spin. Since the launch of the process in February, management has worked diligently with the committee and its independent legal and financial advisors to engage with interested strategic and financial parties.

Yahoo’s board took on bids on the sale of its core assets in the last few days. According to an article on Re/code earlier this week bidders included Verizon, TPG, and a joint offer from Bain Capital and Vista Equity Partners. The bids were reported to range from USD$4bn (£2.8m) and USD$8bn (£5.6m).

In December 2015, Yahoo shelved its planned spinoff of its stake in Chinese e-commerce giant Alibaba. Three months later (February 2016), it was announced that Yahoo would consider a “reverse spin”, effectively separating its core assets from its Alibaba holdings.

Mobile, Video, Native, and Social

Mayer’s plan to increase Yahoo’s strength in the market includes capitalising on the opportunities in mobile, video, native, and social (Mavens). Mavens' revenue represented 33% of traffic-driven revenue in the first quarter of 2015, and increased to 38% in the first quarter of 2016.

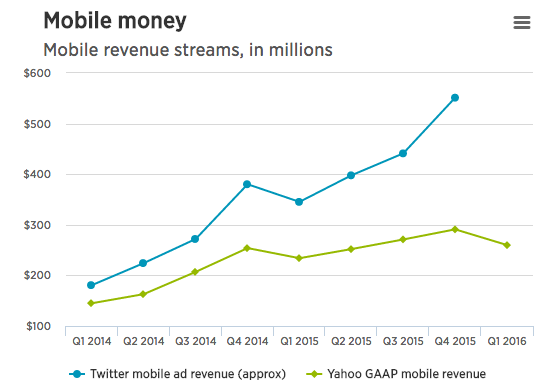

Mobile revenue represented 21% of traffic-driven revenue in the first quarter of 2015, and increased to 25% in the first quarter of 2016. Gross mobile revenue for the first quarter of 2015 and 2016 was USD$391m (£274m) and USD$412m (£288m), respectively. However, Yahoo’s mobile revenue stream is not matching the growth rate of other internet platforms, such as Twitter.

Source: CNBC

Yahoo’s reported mobile revenue dipped between Q4 2015 and Q1 2016 – from USD$291m (£204m) to USD$260m (£182m). However, overall Mavens revenue increased slightly year-on-year to USD$390m (£273m) from USD$365m (£256m).

Non-Mavens revenue fell from USD$742m (£519m) to USD$644m (£451m) year-on-year.

GAAP search revenue fell by 9%, compared to the same period in 2015. Meanwhile, GAAP display revenue rose by 1% year-on-year at USD$463m (£324m).

Company update

– Introduced an enhanced mobile search experience, making it easier for users to get the most relevant, specialised information about sports teams, players, presidential candidates and movies.

– Launched new features for Yahoo Mail Android and iOS apps that help users stay organised and get more things done quickly. New features include customisable swipe options, actionable notifications, recent attachment features, new colourful themes, and 3D gestures.

– Unveiled the new Yahoo App and Homepage that allow users to more easily access related news they're interested in, share their commentary on news they read, and stay apprised of developments with real-time notifications when stories are updated.

– As part of their commitment to delivering the best sports content experience on Yahoo Sports, they introduced Yahoo Esports, a premium destination that aims to become the most comprehensive guide for esports fans. The site features reporting, blogging, video commentary, match pages, team rosters, stats, related schedules, scores, and a live-chat feature where fans can connect with the community.

– Yahoo Sports continued to build on past success in live streaming events through new and expanded partnerships with professional sports organisations like the NHL, PGA, and MLB.

– Announced that Yahoo Finance, the site that provides users with "unparalleled access to data, analysis and insights", will host the first-ever live stream of the Berkshire Hathaway annual shareholders meeting.

– Held three well-attended Yahoo Mobile Developer Conferences in San Francisco, Taiwan, and Hong Kong, where Yahoo introduced new tools as part of the Yahoo Mobile Developer Suite designed to help developers grow their apps and build their businesses. New features include a redesigned Flurry Analytics platform, a new Flurry App, tvOS analytics support, and direct ad serving capabilities.

– In March 2016, they appointed two new directors who each bring a strong expertise in complex business matters: Cathy Friedman and Eric Brandt. Cathy Friedman spent 23 years at Morgan Stanley as a strategic and transaction advisor. Eric Brandt brings significant financial and business management experience as a former pharmaceutical and technology executive, and was most recently involved in the acquisition of Broadcom Corporation by Avago.

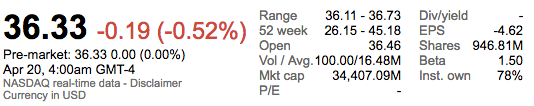

Source: Google Finance

DisplayEarningsProgrammaticSearch

Follow ExchangeWire