Online Advertising Climate in Germany: the adscale Analyzer 1/2013

by Romany Reagan on 28th Feb 2013 in News

The German market for digital advertising is currently being shaped by two main developments: the demand for automated media purchasing, as well as efficient campaign control via real-time bidding and targeting. Both are clearly impacting the price level. The prices in 2012 were on average 42% higher than the average price over the past three years. In addition to RTB and targeting, the persistent high demand for large-area special ad formats and video advertising influence this development. This is confirmed by the results in the current adscale Analyzer 1/2013, a study focused on price development in the German online advertising market.

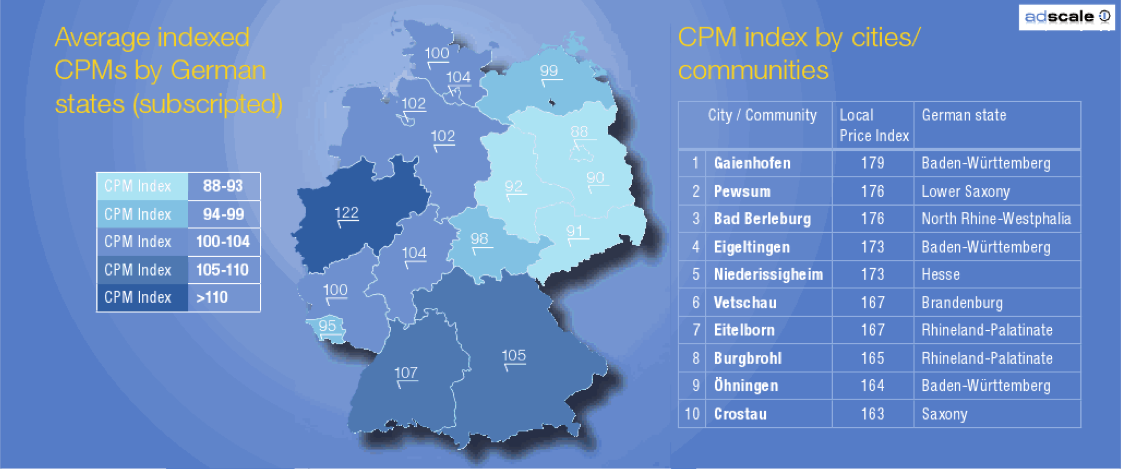

The study, entitled ‘A Regional Focus on Online Advertising’, additionally shows that on average higher CPMs are paid in southern and western Germany than in northern and eastern Germany. The highest average CPMs are found in North Rhine-Westphalia, where the average price for 1,000 advertising contacts is 22% above the national average. Baden-Württemberg and Bavaria follow in second and third place with figures seven and five percent above the average CPM.

Regional advertising business offers tremendous potential

In the latest study, adscale has analysed where the most ad impressions were delivered in Germany, where the highest CPMs were paid, and where the best click rates were achieved. In the price ranking according to cities and communities, the leader comes from Baden-Württemberg: In this price index, Gaienhofen (79% above the national average), a community in the district of Constance, leads the pack. Second place goes to Pewsum in Lower Saxony (76% above the national average), followed by Bad Berleburg in North Rhine-Westphalia (76% above the national average) in third place.

Since many ad impressions are delivered to German urban centres in particular, adscale has additionally examined which German cities record the highest volume of ad impressions per inhabitant. In this regard, Dresden leads the ranking. In Dresden, 56% more ad impressions are generated per inhabitant than the average number delivered to the 20 cities with the highest number of ad impressions. An above-average number of ad impressions is also achieved in Bonn (52% above the city average) and Munich (30% above the city average).

RTB and high demand for branding advertising formats influence price level

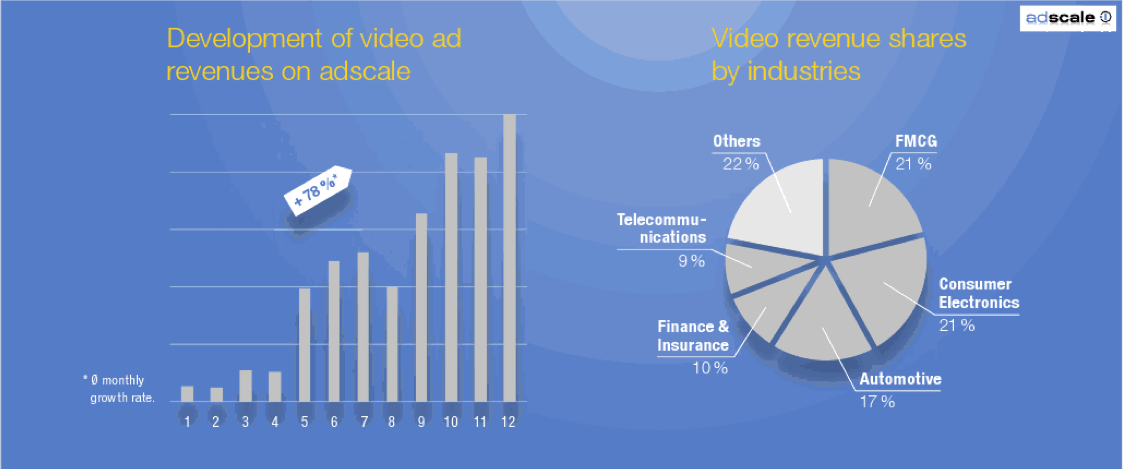

When viewed according to advertising formats, video ads and large-area special ad formats achieve higher prices in absolute terms than the IAB standard advertising materials. However, prices are growing even with IABs: in 2012 the advertising prices for standard advertising materials were 43% higher than the 2011 level, while special advertising formats in the same time frame demonstrated a 38% increase in CPMs. One cause for the above-average price increase of standard advertising formats is the trade of IAB formats via RTB.

Click rates, according to advertising formats, also show stabile development: across all ad formats, the interstitial reaches the highest click-through rate (CTR) with an average value of 3.20%. Video ads (CTR 2.42%), layers (CTR 1.48%), and banderoles (CTR 1.47%) have also generated a particularly high number of clicks. Among the standard advertising materials, the medium rectangle emerges with a CTR of 0.13%.

Survey method

The calculations presented in the adscale Analyzer are based on real-time data from the online exchange’s database, which reflect both the supply and the actual bookings made on the exchange. The objective of the survey is to make the online advertising market more transparent, analysing over 13.8 billion ad impressions per month and 44.4 million unique visitors (77.3% of German Internet users according to comScore, January 2013) and a portfolio of more than 5,000 websites.

AdvertiserDACHDisplayDSPProgrammaticSSP

Follow ExchangeWire