The Elephant in the Changing Room: Why Fashion Retailers are Adopting Technology to Slash Discounting & Boost Net Margins

by Hugh Williams on 14th May 2018 in News

Moss Bros, East, Mothercare, Carpetright, Toys R Us, Maplin, New Look, Poundworld, and House of Fraser – it has been a torrid 2018 for the UK high street with liquidations, CVAs, and restructurings. Here, David Courtier-Dutton, founder and CEO, SoundOut, explains that every brand has its own particular challenges, but a combination of sluggish consumer spending, the relentless march of the online-only retailers, and Brexit currency pressures have led to what is beginning to look like an earthquake in the brick-and-mortar sector. And it's not going to get any better any time soon.

The internet has given consumers unprecedented price transparency. As a result, net margins are on the floor and, in particular, the high fixed costs of traditional retailers make them ill equipped to cease the march of the internet-only players whose business model gives them a huge commercial advantage.

The high street is going out of fashion

Nowhere is this challenge more acute than in fashion retail. When 90% of consumers favoured traditional brick-and-mortar retailers, they could just about keep their heads above water – but online sales of fashion will account for over 25% of total fashion spend this year and are continuing to grow at 25% year-on-year. We are at a tipping point; and the trend is most definitely the friend of online pureplay retailers.

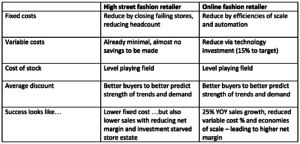

It's really about fixed versus variable costs. Before a single customer walks through the door, a traditional retailer has retail outlets, warehouses, shop assistants, rent, rates, bills, cleaners, etc., that are either nonexistent in an online model, or which are significantly reduced. Indeed, a traditional brick-and-mortar fashion retailer has fixed costs of approximately 25% (AlixPartners, 2017), add the cost of the stock (around 40%) and the traditional retailer has a persistent fixed cost of 65% of turnover leaving 35% gross margin. From this must be deducted the average discount to clear all stock – which is typically 30% in fashion, leaving just 5% net margin.

Compare this to the fixed overhead of pureplay online retailers such as ASOS and Zalando – these are typically around 10% (almost a third of a brick-and-mortar competitor) giving a gross margin of around 50%. Knock off the same 30% average discount to clear stock and you get a margin of around 20%. But an online retailer has additional variable costs – principally distribution costs (and free returns) and these amount to around 15% of turnover – leaving a comparative net margin of 5%.

So, on the face of it, there is a level playing field. Both on and offline models have similar overheads and similar net margins, but because the online retailer converts 20% of costs from fixed to variable (i.e. only incurred when a sale is made) the risk profile of an online retailer is materially reduced.

Add to this the fact that online retail is growing at around 25% year-on-year, while high-street sales growth is essentially stagnant (if not going into reverse) and the outlook for the high street is indeed bleak. If the high-street retailer reduces turnover by 5%, the net margin is also reduced by 5% (i.e. to zero), if the online retailer suffers a 5% reduction, then it still remains profitable (1% margin on the above example). It may not seem like much of a difference, but it has a dramatic impact on the strategies being employed by each:

For both types of retailers, squeezing additional efficiencies from fixed and variable costs becomes ever harder over time; but there is one item above that, if addressed, could add up to 30% of net margin (yes NET) that is simply not being addressed and is waiting to be unlocked. Discounting is a fact of life in retail – but why is it that Zara’s average discount across all stock is sub 20%, while for a typical competitor the number is around 30%? This gives Zara an extra 10% net margin to play with, to invest in high-speed local sourcing, technology, state-of-the-art logistics and still deliver a bottom that is the envy of the high street.

For all the cost cutting, smart sourcing, personalisation, and supply-chain optimisation, there is a simple truth that sets good retailers apart from bad: whatever the reason, they buy more accurately. If you stock the right products, at the right price, in the right quantity, you have more shelf space, more cash working profitably, and less discounting – all of which drops directly to the bottom line. Put another way, a retailer with a 5% net margin that can reduce their average discount across the business from 30% to 25% will double profits – and valuation.

So, why does Zara discount so little? Because the accuracy of their buying (i.e. predicting actual demand for each item) is far more accurate than others on the high street. In an ideal world, a retailer would sell every piece at full price: i.e. exactly match supply to demand. If they did that, they would enjoy net margins/profits of around 35% of turnover rather than 5%. For every 1% less average discount translates directly to 1% to the bottom line (net margin).

The time has come for fashion and other retailers to embrace what could become their golden goose – 30% of all their income is lost through poor decisions around what and how much of each item to stock. Divert some technology investment to cracking that golden egg and the margin pressure will be off. The technology already exists in the form of consumer-driven predictive analytics and machine-learning technologies, but it requires leadership to push through change as it involves a (sometimes painful) move away from buying being a largely creative-based discipline. It is disruptive and potentially painful, but it has to be done. If you cannot get leaner, and you want to survive and prosper, you need to get smarter.

Unsurprisingly, it’s the pureplay online retailers that are the first to embrace this.This content was originally published in RetailTechNews.

Customer ExperienceE-CommerceIn-store

Follow ExchangeWire