ExchangeWire Investment Report - Q1 2021

by Mathew Broughton on 17th May 2021 in News

Highlights

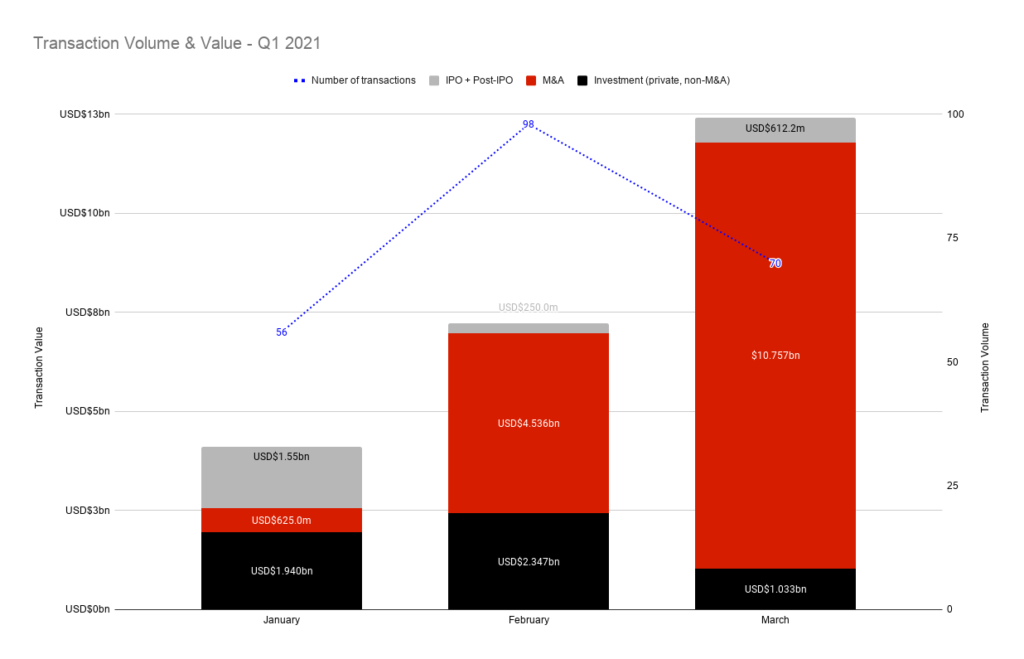

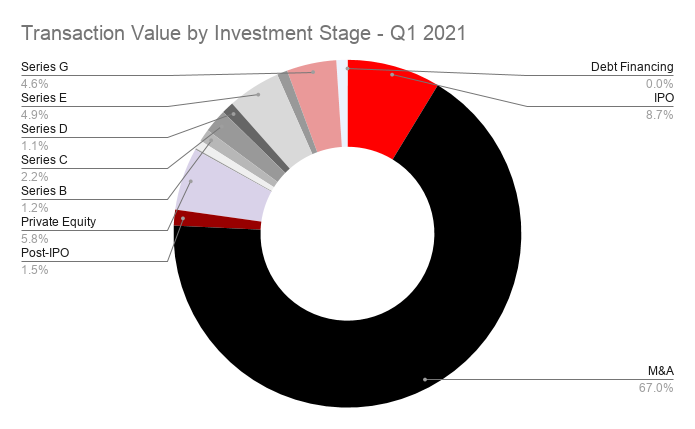

- Total recorded investment across the advertising and marketing technology industries in Q1 2021 surpassed USD$23.7bn, with an average disclosed transaction value of USD$244.8m.

- M&A activity amounted to 67% of total funding, with consolidation driven by mobile players, private equity, and a rampant SPAC market.

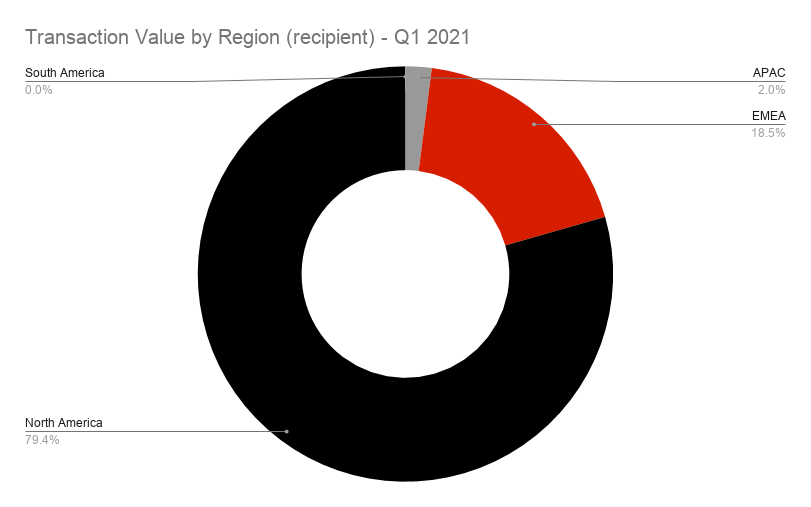

- North America-headquartered companies attracted the overriding majority (79%) of investment, followed by EMEA (18.5%) and APAC (2%).

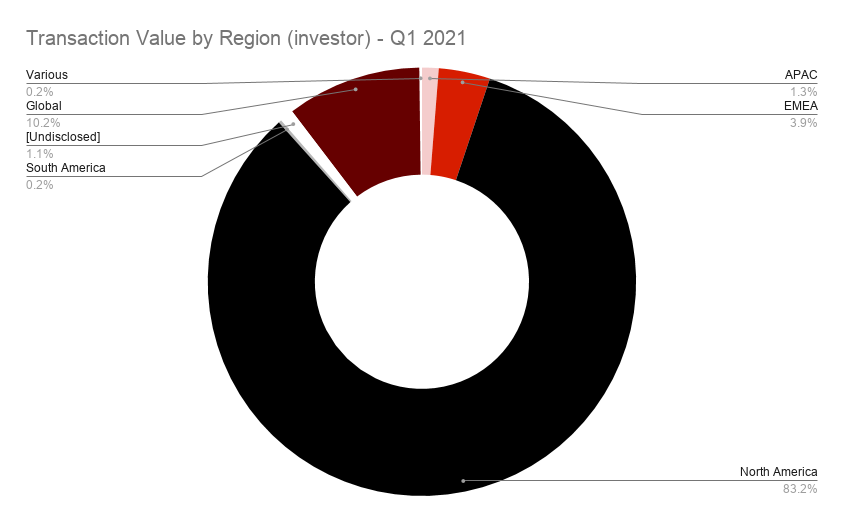

- EMEA-based investors were underrepresented throughout the quarter, with only 3.9% of total funding having been led by investors in the region.

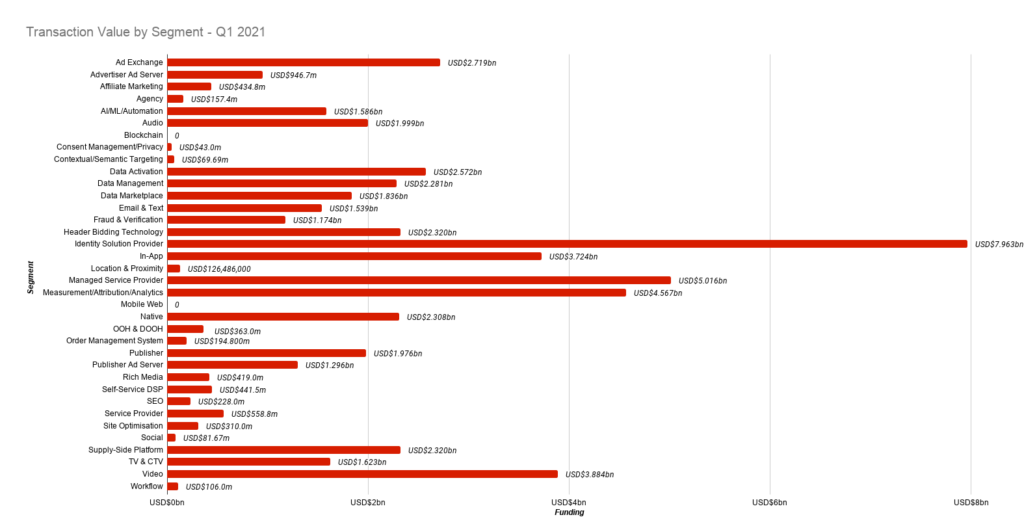

- Strong investor interest in the identity solution (USD$7.96bn); measurement/attribution (USD$4.56bn); video (USD$3.88bn); and in-app (USD$3.72bn), segments.

Investment

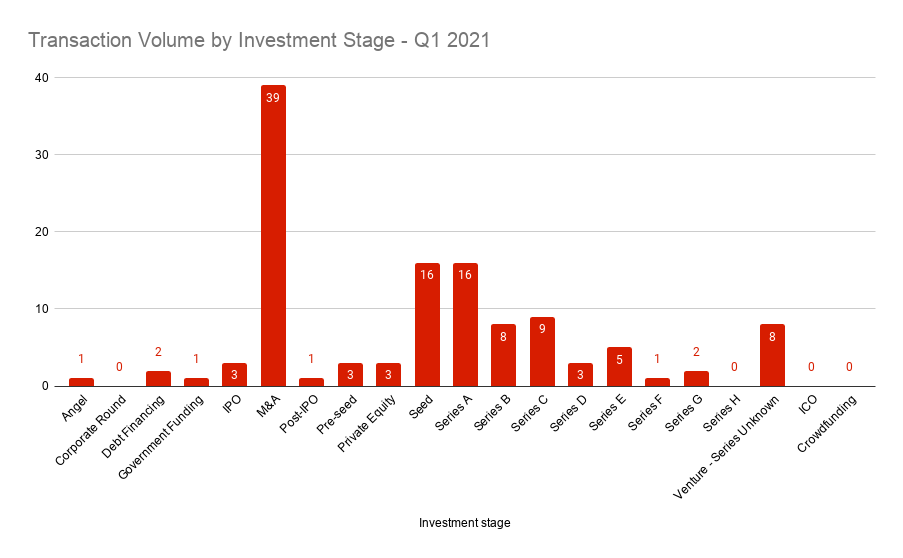

Investment in private ad tech and martech companies (excluding M&A transactions) surpassed USD$5.41bn through Q1 2021. Early-stage investment was healthy, with 40 companies receiving funding at the pre-seed, seed, Series A, and Series B stages, with these startups netting a combined USD$500.7m. Meanwhile, 20 funding rounds took place at the Series C-G stage throughout January-March, with these firms securing USD$3.28bn.

While private equity acquisitions of ad tech and martech companies surged throughout the quarter, non-M&A transactions supported by PE firms were also strong during Q1. EQT-owned digital experience management software provider Sitecore landed USD$1.2bn in January, billed as the largest single capital investment in the martech space. Meanwhile, email sending and optimisation platform SparkPost secured USD$180m in a growth funding round led by Philadelphia-based LLR Partners.

IPO and post-IPO

Ad tech and martech IPO and post-IPO activity, excluding new listings derived from reverse mergers instigated by SPACs (covered in M&A below), reached USD$2.41bn through Q1 2021, at an average transaction value of USD$603.0m. Three firms went public in the quarter via a traditional IPO, namely customer experience and market research firm Qualtrics (USD$1.55bn at a valuation of USD$15bn); Taiwanese AI marketing platform Appier (USD$262.2m at a valuation of USD$1.47bn); and DSP operator Viant Technology (USD$250m at a valuation of USD$2.5bn). Despite the sector maturing over the course of the previous decade, publicly-listed ad tech companies remain in the minority, hence it is encouraging to see multiple listings in a single quarter, with more expected in the coming months (see "Forecast" below).

M&A

Total M&A activity in the ad tech and martech sectors dominated the first quarter of 2021, with consolidation accounting for USD$15.9bn from 39 transactions, representing in excess of 67% of the total transaction value and 30% of total transaction volume. The bullish public equity market in ad tech, fuelled by widespread digital transformation as a result of lockdown measures imposed due to Covid-19, has driven valuations upwards at a rapid rate, in turn whetting the appetites of exit-hungry investors. Sixteen deals topped USD$100m throughout the quarter, while five reached USD$1bn+, namely those of Auth0 by Otka (USD$6.5bn); TripleLift by Vista Equity Partners (USD$1.4bn); ironSource by Thoma Bravo Advantage (USD$1.3bn); SpotX by Magnite (USD$1.17bn); and Adjust by AppLovin (USD$1.0bn).

SPAC-led reverse-mergers, typically supported by a private investment in public equity (PIPE) transaction, have been a prominent feature of the investment landscape in recent months, and so too were they in ad tech. The aforementioned Thoma Bravo Advantage-led acquisition of ironSource took the combined entity to a valuation of USD$11.1bn, while ION Acquisition Corp. snaffled Taboola for USD$545m at a valuation of USD$2.6bn, following the collapse of the former's planned merger with fellow native advertising provider Outbrain.

Vista Equity Partners' acquisition of TripleLift is symptomatic of the ramping-up of involvement of private equity firms in the industry over the last three years, which is set to further snowball as these PE firms reap the rewards of successful exits, primarily via IPOs. Ad tech and martech companeis which have received significant funding sums from private equity firms have in turn been particularly active acquirers in recent months. Prime examples of this include Blackstone-acquired Vungle, which purchased marketing intelligence platform AlgoLift in October and game analytics platform GameRefinery in March, and KKR-backed AppLovin in its purchase of Adjust.

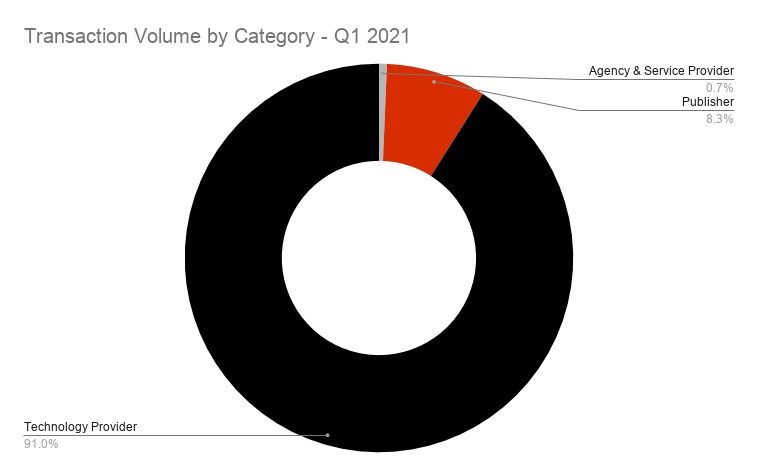

Company type

By segment, identity solution providers dominated with USD$7.96bn of investment throughout Q1, driven largely by the USD$6.5bn acquisition of Auth0 by fellow US-based ID management firm Okta. The strength of the segment as a whole is notable given lingering concerns over third-party solutions, regardless of whether they operate using a cookie or not, however such solutions are still seeing significant interest from publishers and buyers looking to further leverage their first-party data sources. Moreover, firms specialising in contextual and semantic targeting only garnered USD$69.7m, and consent management providers just USD$43m, in comparison, though many scaled ad tech vendors are transitioning to a contextual-led approach, without necessarily self-labelling as such. One caveat to the strength of the identity solution market is low transaction volume, with the investment stemming from just seven transactions. By contrast, concerns over measurement and attribution in the looming privacy-first era have driven a surge of interest in companies operating in this space, generating USD$4.57bn from 32 transactions, representing over one quarter of total transaction volume.

In terms of emerging sectors, out-of-home (USD$363m) is unsurprisingly sluggish in comparison to TV & CTV (USD$1.62bn) and audio (USD$1.99bn), however this is expected to rebound in the second half of the year as coronavirus-led restrictions are eased. Any recovery is likely to be particularly strong within the Japan and Asia-Pacific region, with DOOH highlighted by professionals in the region as the most promising channel for future growth prior to the pandemic.

Funded company location

EMEA-based companies garnered close to one-fifth of investment receipts in Q1 2021, USD$4.4bn at an average transaction value of USD$163m, as innovations in the market driven by long-term exposure to privacy regulations piqued the interest of investors. By contrast, funding of APAC-based firms, at USD$482.1m, was relatively muted throughout January-March.

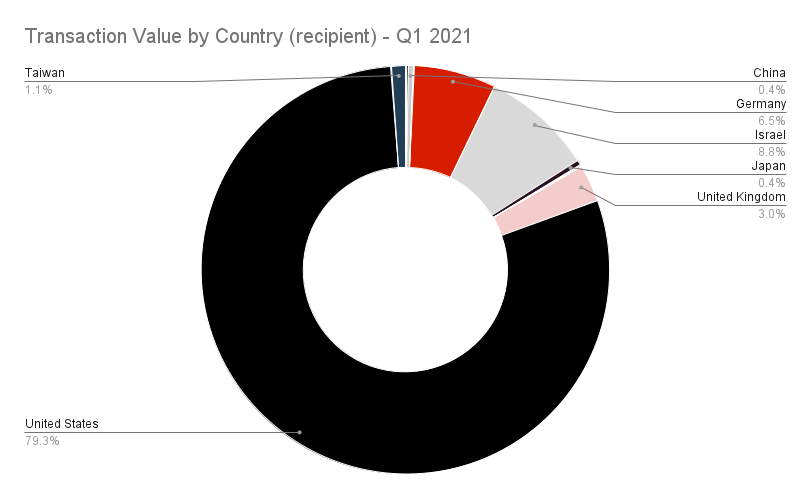

By country, the United States continues to dominate ad tech and martech investment wins in terms of both value (USD$18.8bn) and volume (72 transactions). Israeli companies attracted the second-highest level of investment, generating USD$2.09bn from 8 transactions. PIPE financing connecting to SPAC-driven reverse-mergers were responsible for both the top two most-valuable transactions in Israeli ad tech companies through the quarter, namely app marketing platform ironSource by Thoma Bravo Advantage for USD$1.3bn (at a valuation of USD$11.1bn), and USD$545m for native advertising provider Taboola in conjunction with its reverse-merger with ION Acquisition Corp.

Investment source

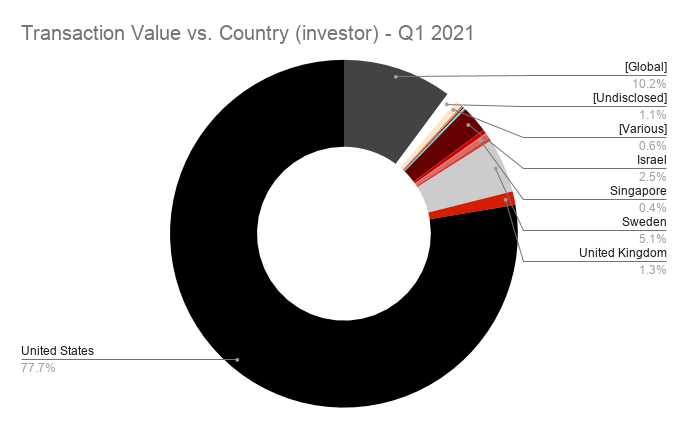

Similarly to investment receipts, North America dominated, with 77.7% of total investment stemming from rounds led by US-based companies. Notably however, while EMEA-based companies attracted 18.5% of funding, European and Middle Eastern investors are underrepresented, leading rounds contributing to only 3.9% of total investment. With EMEA-based ad tech companies now, rightly, attracting significant sums of funding as a result of innovation and longer exposure to privacy regulations such as GDPR, both corporate and VC investors in the region risk being left behind. This discrepancy was particularly evident in later-stage investment, representing a missed opportunity for EMEA investors with scaled and exit-hungry companies having to look outside of the region for funding.

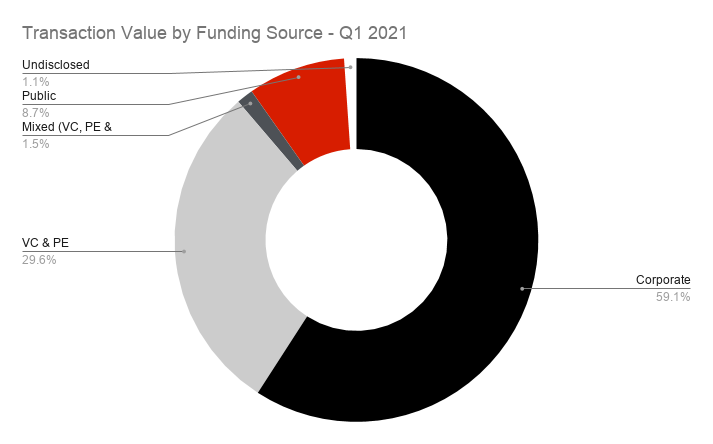

Given the prevailing conditions fuelling M&A activity at lofty valuations, it is unsurprising to note that investment predominantly stemmed from corporate sources (USD$14.04bn, 59.1% of total) in terms of value. However, venture capital and private equity involvement in the industry was also strong, with nearly double the number of total transactions (74 compared to 34) than corporate-led.

Forecast

I. M&A activity to continue to thrive

Consolidation within the ad tech and martech industry is set to continue at its recent highs, sustained by a perfect storm of heightened PE involvement; bullish public equity markets; Covid-driven digital transformation; and innovative solutions arising at the dawn of the privacy-first era.

In the remainder of 2021 it is expected that further M&A transactions will occur between the gaming and ad tech ecosystems, with transactions being instigated by both sides of the divide as evidenced by Zynga's recent USD$250m acquisition of Chartboost. This mutual interest between publisher and technology vendor is not limited to gaming, with publisher troves of first-party data likely to prove hugely enticing for tech suppliers, while publishers will look to onboard tech solutions to leverage their data. The television and streaming landscape is expected to see a significant proportion of this consolidatory activity, with deals already noted including Meredith TV properties (USD$2.7bn by Gray Television) and Grupo Televisia (USD$4.8bn by Univision), alongside a rumoured combination of AT&T's WarnerMedia division and Discovery, valuing the former at approximately USD$50bn.

While "pure-play" M&A activity is set to continue to thrive, SPAC-led reverse mergers in the US may decline in the coming months in the wake of increased scrutiny from the Securities and Exchange Commission (SEC). However, this may be offset by an relaxation of rules across the Atlantic, with the UK Financial Conduct Authority (FCA) proposing the easing of regulations surrounding SPAC listings following a review conducted by Lord Hill. With this background of regulatory uncertainty, it is expected that SPACs which have already listed will aim to conclude reverse mergers rapidly in the coming months. Examples which are considering targets in the ad tech and digital marketing ecosystems include Coliseum Acquisition Corp.; Group Nine Acquisition Corp.; Forest Road Acquisition Corp. II; Laris Media Acquisition Corp.; Liberty Media Acquisition Corporation; Progress Acquisition; Tailwind Acquisition Corp.; and Virtuoso Acquisition.

II. IPO activity to grow, before tailing off by 2022

Non-traditional IPO approaches, aside from SPAC-led mergers, have also seen success in recent months and could further incentivise new listings in the sector. The auction hybrid model employed by Unity in its highly successful listing last year, in which which prospective investors could submit multiple bids at specific price values, rather than a traditional telephone-based approach where interested parties could purchase blocks of unpriced shares, stands as a good example of this.

This likely to extend for the next few quarters, however the ongoing rotation of tech stocks outside of top-performing quintile brackets is likely to mean IPO activity tails off by the close of the year in deference to M&A and private investment growth. This levelling off is likely to be accelerated by any wider correction in public markets as a result of potential factors including setbacks in national coronavirus recovery roadmaps, the further surge in US federal debt, and a continued fall in the commercial property sector.

III. Investment in EMEA-based companies to grow

The deprecation of third-party cookies within Google Chrome and that of Apple's IDFA is likely to fuel interest in EMEA-based operators, which have an early-adopter advantage as a result of exposure privacy-focused legislation (namely GDPR). This interest is likely to initially stem from corporate sources, particularly in the US where firms are facing a plethora of proposed state-level privacy laws, most notably in Hawaii, New York, North Dakota, Maryland, and Massachusetts, alongside the pressures instigated by Apple and Google. As discussed above (see "Investment Source"), the under-representation of EMEA-based investors is of concern, however this heightened level of international interest in the region may trigger a wave of funding from these participants.

The entrance of sector-dedicated investment vehicles in the video games industry in recent years has bolstered private funding in the space, particularly for early-stage firms, with these firms accounting for over 14% of total investment at seed and Series A stage in gaming last year (see "Investment Source - 2020" section in TGE Investment Report - Q4 and Year-End). The recent launch of similar vehicles focusing on ad tech is likely to further fuel early-stage funding volume within the sector, as well as encourage generic portfolio funds to invest.

IV. Growth across DOOH, gaming, and commerce media

The return of in-person activities and commuting as coronavirus restrictions are eased are set to drive a renewed interest in digital-out-of-home advertising, with investments here forecast to rise significantly in the second half of the year. This will be compounded by the greater confidence marketers now hold in their digital activities as a result of operating on a remote basis through the bulk of 2020, in turn driving the democratisation and digitisation of a traditionally static and tightly-controlled segment. While physical retail is set to recover, commerce media is set to continue its sharp rise as consumers retain newly-formed digital shopping habits. This will be further sustained by a greater involvement of traditional brands, particularly CPGs, in direct-to-consumer practices, alongside the continued rise of "native" DTC firms.

Video gaming saw a profligate rise in users, and investment, over the course of last year in the wake of stay-at-home measures. With this now looking to be a sustained trend, ad tech firms within the space can expect to see further funding over the next few quarters, bolstered by extraordinarily high valuations attained over the past few months. Moreover, gaming publishers publishers have access to an extraordinary amount of first-party data, thus expect further interest in these firms, and for these publishers to snap up ad tech operators as they seek to leverage their access to data. However, it is impossible to ignore the potential headwinds gusting from Apple's deprecation of IDFA and implementation of its App Tracking Transparency (ATT) framework. In recent years, in-app advertising (IAA) has been as important a revenue stream as in-app purchasing (IAP) for mobile gaming companies, thus any effect on campaign effectiveness caused by the IDFA deprecation is likely to see a return of greater focus on IAP in the short term. However, user acquisition (UA) is where the changes are likely to have their most substantial effect. Last year, AppsFlyer forecast that £37bn would be spent on UA by gaming firms by 2022, with the sector responsible for an estimated 40% of all paid media spend for app installations. Any deprecation of user-level tracking is likely to hinder these efforts, particularly on the Apple ecosystem with traditionally higher per-user spend, meaning a tougher 2021 could be in store for operators in highly-competitive mobile gaming sectors such as casual and hyper-casual.

The ongoing consolidation in the ad tech and martech industry will be discussed in-depth at ATS London 2021, 3rd-4th November. For tickets and further information, please visit the ATS London 2021 event portal.

Comprehensive details on companies operating within the advertising technology and marketing technology industries can be found within the WireDex online directory.

Follow ExchangeWire