What Were the Key Trends of 2014?

by on 8th Jan 2015 in News

The quest for 'actionable data', 'talent', and a 'single customer view' were the top priorities last year among of media professionals surveyed by ExchangeWire, as the phrase "big data" becomes almost ubiquitous in the marketing industry.

To mark the launch of ExchangeWire Research, Rebecca Muir, ExchangeWire, head of research and analysis, offers her take on industry trends over the past 12 months based on this primary market research, and comes as ExchangeWire Research launches a 2015 survey now open for participation.

Throughout 2014 ExchangeWire asked leading professionals from top agencies, trading desks, publishers, brands and technology providers what they thought would be the key drivers of success in 2014. This report summarises our findings and explores the development of the key themes throughout the year. ExchangeWire would like to take this opportunity to thank all our readers who took the time to complete our research surveys during 2014.

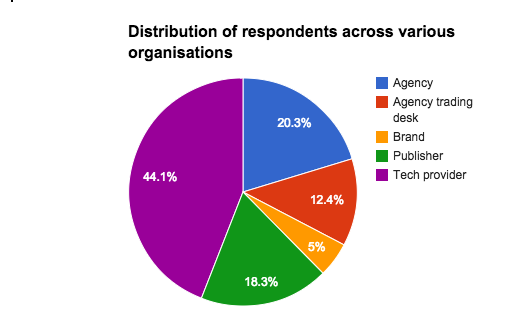

A total of 255 responses were collected during this research. 44% of respondents represented technology providers, 20% came from agencies, the publishing world accounted for 18%, 12% from agency trading desks the remaining 5% of responses came from brand representatives. (Figures have been rounded). Respondents were asked to describe what they thought would be critical to success and answers were categorised by ExchangeWire’s research team.

Figure 1: Distribution of respondents across various organisations as defined by ExchangeWire, selected by individual respondents. Source: ExchangeWire Research, 2014.

Actionable data

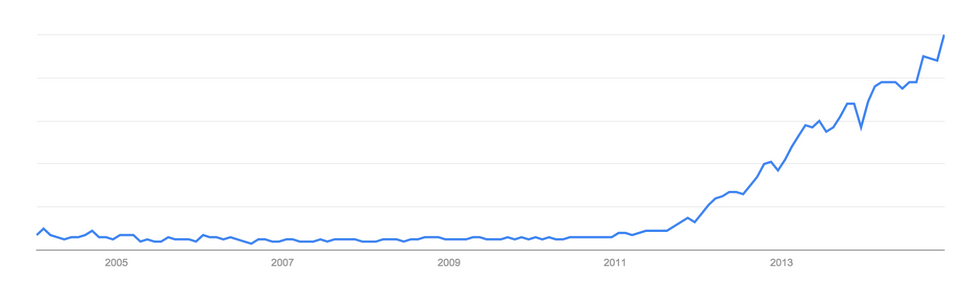

The single most important factor in achieving success, cited by 28% of respondents was the ability to create actionable data. Unsurprisingly; the publisher group was under-represented in this category (11% of responses came from this group vs. 18%). The technology provider group was over-represented making up 50% of the respondents. The agency, agency trading desk and brand groups made an equal contribution to the category based on overall respondents. The graph below illustrates the relative search interest in the term “big data”. We can see that there was very little interest before January 2012 after which, considerable growth occurred.

Figure 2: Search interest over time for the phrase “big data”. Source: Google.

However, there have been far too many cases of organisations collecting data for the sake of data; as if success is linked to the amount of data that has been amassed. Instead, the focus needs to be on creating “actionable data” - data which leads to an outcome. One brand respondent summarised the challenge as “Ensuring data is stored and manageable and that the business can deliver on actionable insights”. This statement serves to remind marketers that the business goals should be at the heart of all decisions.

A technology provider summarised the thoughts of many when it comes to creating action from data “Finding talent to mine [data]”. This is a problem that is well documented, in 2013 Capgemini reported that over 90% of companies recognise a gap in digital skills, yet only 46% are investing in digital skills training and perhaps most worryingly only 4% of companies said they align their training efforts with their digital strategy. The skills required today to create actionable data are not just Excel and statistics but database use and econometrics. Earlier in the year, ExchangeWire published an article which discussed how big data can be used in a transformative way and the skills and techniques required for success.

It is worth commenting on the role of Data Management Platforms (DMPs) at this point as although only picked by 6.4% of respondents, the correct implementation and use of a DMP is a major step towards actionable data. DMPs have evolved significantly moving from third party audience targeting platforms towards becoming end-to-end audience management tools which ingest and segment multiple sources of data. The desire for more and more data has created a need for data normalisation in order for marketers to make sense of the numbers. DMPs have stepped up to the plate to address this challenge. However, DMPs still have some evolving to do, mobile data is still not easy to implement and it can be troublesome to integrate online and offline data.

Single customer view, across devices

The next most critical issue was being able to create a single customer view across multiple devices (12.4% of respondents). This challenge was most prevalently cited by the agency group (28% vs. 20% of overall) and the publisher group (24% vs. 18% of overall). This suggests that this is a problem which is most heavily felt by those who are executing media buys and reporting back to clients rather than a problem which is felt by brands themselves.

The problem with creating a single customer view which spans multiple devices

A 2013 report published by Ofcom revealed:

- 80% of UK adults have access to the internet at home via a fixed or mobile broadband connection or via a mobile handset

- The average household now owns more than three types of internet enabled device, with one in five owning six or more

- Tablet ownership has more than doubled in the past year (from 11% of homes to 24%)

- Laptop and desktop internet users spend at least 35 hours online each month

- A fifth of mobile internet users have bought goods or services from their phone

These five data points clearly illustrate that if brands want to understand how their consumers interact with them across each of these devices, which they need to do to be able to optimise marketing. Traditionally marketers have relied on desktop cookie tracking to target and track their online audiences, however, desktop cookies to not prevail across multiple devices. What is required is a single cross-device audience ID. Earlier in 2014, ExchangeWire published an article discussing how this could be achieved.

Other key drivers of success

There was an even distribution of respondents who thought that data protection (10%); and segmentation, targeting and modelling (10%); were the key drivers to success this year. These topics were important mostly to brands and publishers which is not surprising as they are the two groups who hold the most precious data and stand to make the biggest gains from improved ad delivery.

Other important factors reported were; tech integration; attribution; viewability, fraud and transparency and although these were reported far less frequently than the other topics discussed in this report.

ExchangeWire Research launch

ExchangeWire Research's pre-launch survey aims to help produce an outlook on the programmatic industry in 2015. The survey is now live for all readers to participate in, and help build data around the programmatic advertising industry. Those interested in participating are automatically entered into a prize draw to win £250 Amazon vouchers.

Follow ExchangeWire