How Life-Event Data Allows Retailers to Leverage Consumer Spend in Slow Economic Times

by Lindsay Rowntree on 4th Dec 2017 in News

It’s a challenging time for traditional bricks-and-mortar retailers as they struggle with the weak economy, writes Danny Crowe, planning director at lifestage marketing company, TwentyCi, exclusively for RetailTechNews.

Sources, including the British Retail Consortium, agreed that pre-Christmas spending was down in October and even Black Friday sales have been disappointing both on the high street and online. When consumers’ budgets are so tight that even the peak shopping periods fail to deliver, it’s more important than ever for retailers to understand their customers and make sure that every interaction they have with them is completely relevant.

As PWC’s 'Total Retail Global 2017' report showed, customer-centricity (understanding what a prospective customer is doing and why they are doing it) is the best way to build firm customer relationships; while a separate report from Cognizant showed that UK shoppers can become indifferent to retailers if they receive irrelevant offers from them. Only 38% believe that retailers actually use their data effectively; while 51% say that the offers they receive do not offer value and 56% claiming the products are not relevant.

Retail marketers instinctively know that acting on consumer insight is essential; with many rightly obsessed with finding patterns of consumer behaviour to help inform and implement personalised marketing campaigns. This kind of analysis makes it possible to put customers and prospects into specific segments so they can then receive appropriate communications. For instance, a wine retailer will put a regular customer who has stopped buying into a ‘lapsed’ marketing programme, with offers of increasing value to entice them back.

Context provides the missing link

This is a good first move; and yet it lacks one essential element: context. In other words, for our wine retailer, the missing link is understanding why their customer stopped buying wine. But how do they find this out?

One of the best ways he/she can add context to their customer knowledge is to use life event data. Whether it is moving home, having a baby, going to university, or retiring, all of these events have a massive impact on consumers’ lives – and on their purchasing behaviour too. Factual life-event data is far more powerful than inferred data that is more commonly used in marketing, as it enables brands to truly understand the motivations driving consumer activity rather than having to make assumptions.

Indeed, using homemover data, we have found that there is an interesting observed correlation between moving home and wine purchasing. Many people run down their wine supplies for several months before they move. Then, post move, they stock up again.

So, for the wine retailer, knowing that a ‘lapsed’ customer has sold their house subject to contract will give them valuable context to explain what is causing their behaviour change. So, instead of sending a series of discount offers while someone is planning to move (which will be seen as irrelevant and, perhaps, annoying), the retailer can wind down communications until the customer moves. At that point a bulk-buy offer or even a celebratory bottle of fizz is likely to do far more to stimulate sales.

More than CRM

Bringing context into marketing decision making brings a new spin to CRM. Instead of 'Customer Relationship Marketing', a better definition in today’s data-rich, always-on and connected world is ‘Conversations that are Relevant and Measurable’. By understanding the motivation behind the behaviour, brands can move beyond tactical offers to deeper ongoing relationships where communications are not just about eliciting sales, but about giving consumers what they need according to a bigger picture of their life events. It’s looking beyond one transaction or online search and playing a longer game.

The opportunities that this approach offers retailers can be seen very clearly within the homemover market. It typically takes at least 18 months from start to finish for people to move, including 12 months post-move when the main home improvement spend occurs. So, identifying people during the homemover process offers the chance to reach people at a time when they are likely to make many more major purchases compared to normal. The purchasing power of homemovers equates to £12bn annually across the UK – with those purchases being typically spread across at least 12 months.

Leveraging homemover purchasing power

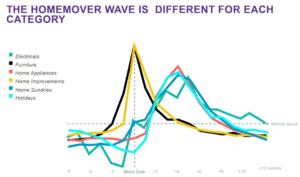

An example of how this works can be seen in the graph below, where we have mapped data from major brands against our database of 99.6% of all UK homemovers – giving them insight into the relationship between customer behaviour and the homemover process. These 'homemover waves' show when purchasing dips and spikes across several industry sectors, as homemovers shift from putting their house on the market, through to moving in, and beyond. So, for example, furniture buying actually kicks in before people move, DIY happens at the point of moving in, electrical goods are bought a month or more afterwards and, presumably following the stress of the move, holidays become a big purchase between two to six months post-move.

For retailers who have mapped their own data against our homemover data, this insight has proven invaluable. For a start, they can identify what proportion of their customers are homemovers. For some brands, the proportion can be massive with, for example, 20% of bed buyers and 35% of consumer electrical buyers being homemovers. By understanding the size of the opportunity that homemovers provides them they can allocate budget accordingly.

The next step is to then track their database against homemover data so that they can identify which of their customers are moving at any given time; and then send them communications that are relevant to where they are in the homemoving process. Homemover waves look different for each brand so, armed with the knowledge about how and when homemovers buy their products, a retailer can ensure that they reach people at the right time with the right message.

In addition, for retailers with a bricks-and-mortar presence, any customer who is actively looking to move home should have a warning flag to trigger strong retention activity. Even if someone moves two miles up the road, their shopping behaviour can change. So, if a homemover remains close to a retailer’s store then offer them ‘housewarming’ offers to keep them loyal. However, if they move a long distance from their local store, let them know where their new nearest outlet will be, along with the same kind of housewarming to entice them there.

Turning movers into customers

However, the 'homemover wave' doesn’t only help with customer retention. Where homemovers are quantified as a worthwhile opportunity for retailers, they can also target prospects who are moving and go out to get them in exactly the same way. Homemover data can be used across a wide variety of digital and traditional channels including direct mail, email, programmatic advertising, and social media; so brands can reach homemovers not only with the right message at the right time, but using the right channel.

In our experience, homemovers consistently outperform other retail consumers, remaining at the top of the pile for at least 12 months. So why aren’t all retailers creating homemover marketing strategies yet? One of the biggest barriers is the fact that they are not sure who should own the activity – Digital? CRM? Marketing? – making it difficult to secure budget. However, for retailers who have woken up to the opportunity, it is often viewed as their secret weapon that, once turned on, keeps flowing – a powerful resource that shouldn’t be overlooked, particularly in these uncertain economic times.This content was originally published in RetailTechNews.

Follow ExchangeWire