Work Together to Improve Expectation Management: Better Partnering Between Credit Services & Comparison Sites

by Lindsay Rowntree on 29th May 2017 in News

It’s possible to have a better experience at a budget motel than a five-star resort, purely because one meets our expectations and another doesn’t. Yet organisations typically do not model the expectations they set along the customer journey and whether they meet them or not because that task falls down the cracks between job descriptions, writes Amir Goshtai, managing director of propositions and partnerships, Experian Consumer Services.

Advertising and marketing are focused on creating awareness and excitement for their products. Designers see their job as to execute a vision. The net result is that expectation management is not an explicit part of anyone’s brief. Well, improved expectation management along the length of the journey is a must whether we seek to reduce negative experiences or to build positive ones.

In recognition that our customer’s journey through the world of credit is emotive, Experian has collaborated with Matt Watkinson, an internationally renowned customer experience expert and winner of the CMI’s Management Book of the Year for ‘The Ten Principles Behind Great Customer Experiences’. This article helps apply these principles to an important element of the money-comparison journey – the handover from comparison to lender.

There are three avenues of opportunity:

1. Model customer’s expectations

Working along the length of the customer journey from start to finish, identify what expectations are set at each stage and whether they are subsequently met. Pay particular attention to situations where no expectations are set at all, leaving the customer to form their own opinions. Simple messaging such as, “you’ll need the following to complete your application”, or, “transferring you to the lender’s site”, can make a huge difference by telling the customer what to expect next and reduce their uncertainty.

2. Implement pre-approved deals and move affordability checks further upstream

The fundamental expectation issue with the comparison-purchase journey is that final eligibility and affordability checking happens after product selection, and credit limits are communicated at the end. Until this crucial threshold is passed, customers can’t know whether they can actually have the product or not, and on what terms. If comparison sites and lenders continue to work together to move qualification checks up-stream, the customer experience is not only greatly improved, but the application processing is much more efficient.

Prequalification is the future, where the eligibility of a customer’s credit score and affordability assessment can happen earlier in the application process. This will enable customers to make more informed comparisons and better decisions about their financial options.

3. Finally, take a leap

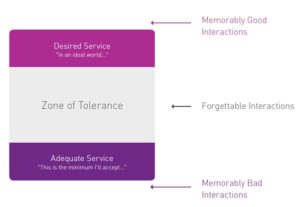

For every experience, two levels of service quality are crucial for brands to understand. On the one hand, the level that customers would deem adequate – queuing for five minutes at a bar, for example. On the other, what they would find desirable – like getting served immediately.

Between these two poles is a zone of tolerance where our experience is above adequate, yet below desirable. The experience is acceptable, but unmemorable. This is why we can drive down the motorway for an hour and not recall the journey. Nothing remarkable happened, so there was nothing to remember.

Source: Experian Consumer Services

Aim for bigger, more memorable

If we just improve our offerings incrementally, given that expectations always rise, most interactions will stay in the zone of tolerance. These improvements won’t affect customer perceptions of the experience because they won't remember them.

Businesses pour millions of pounds into customer experience projects that improve journeys incrementally – but have no radical impact simply because they don’t change the customer’s memory of the experience.

If we’re determined to increase satisfaction, alter brand perceptions, or even move the needle on loyalty, incremental improvement will not do it. The relationship is not linear in this way. In an intensely competitive market, improvements must be leaps: if we want to win customer’s appreciation, get out in front, and stay there!

As such, while marginal reductions in effort, slight improvements in expectation management, or a little more consideration for the emotions will always be welcomed by customers, these are short-term opportunities.

Now is the time to think big, act boldly, and work together towards a marketplace experience, where comparison sites facilitate the end-to-end purchase journey between consumers and lenders. If lenders and comparison sites are to take a big leap, it should be towards one another, creating the kind of seamless journey that customers know, love and, increasingly, expect.

If we’re determined to increase satisfaction, alter brand perceptions, or even move the needle on loyalty, incremental improvement will not do it!

Follow ExchangeWire