Ad Tech 2016: Consolidate, Commoditise & Converge

by on 11th Sep 2015 in News

Writing exclusively for ExchangeWire, Pat McCarthy, SVP corporate marketing at AppNexus (pictured) shares his thoughts on what will happen in Ad Tech in 2016.

Earlier this year, Terence Kawaja, the inventor of the LUMAscape and one of the most perceptive actors in the advertising technology sector, predicted a period of massive upheaval. Of the roughly 2,000 companies currently involved in ad tech, he expects that no more than 150 will live to see a successful IPO or acquisition. Most others will disappear entirely. Out of this process of creative destruction, a small number of single-platform players will remain standing.

I believe Kawaja is right. By this time next year, the ad tech landscape – or, if you will, the LUMAscape – will look nothing like it does today. The year 2016 will see some companies fail and others swallowed whole. Most importantly, the very way that digital advertising is transacted will change fundamentally – and for the better.

In this hyper-competitive environment, the question for all market participants is whether they are prepared to meet the challenges (and capture the opportunities) of three interrelated trends. I call them the Three Cs: Consolidation, Commoditisation, and Convergence.

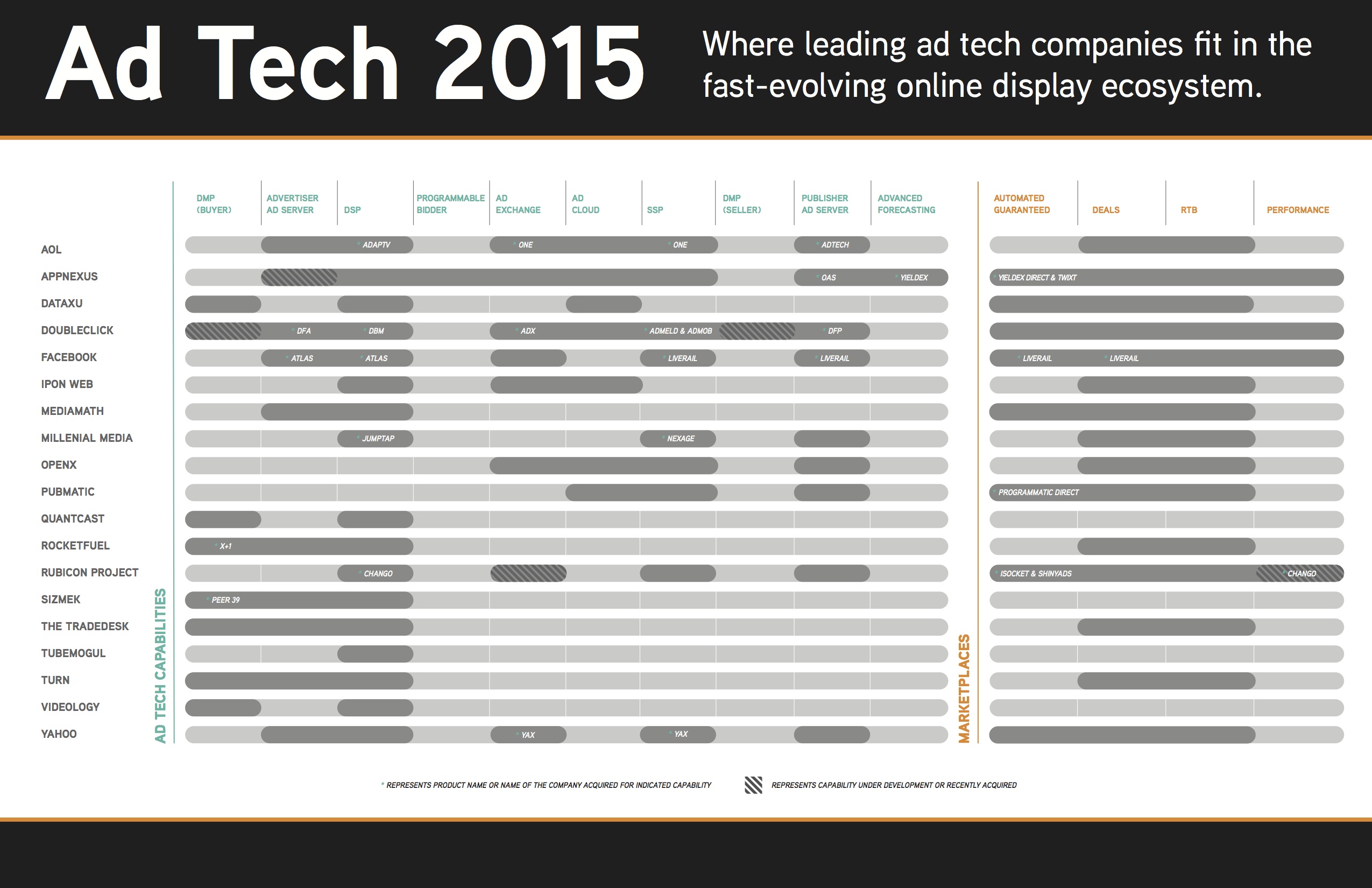

Consolidation: If the objective of ad tech is to streamline and simplify the process by which digital inventory is bought and sold, then the status quo is decidedly unsatisfying. Casual observers are apt to laugh at how many product acronyms and categories our industry has invented (SSPs, DSPs, DMPs, sell-side servers, buy-side servers) and scratch their heads at the complexity of our marketplace categories (RTB, PMPs, automated guaranteed, deals). Indeed, the lack of agreement on terminology has made it challenging even to compare one analyst report to another. How can we understand our market when we don’t even have a lingua franca to discuss it?

As point solutions are absorbed by a small number of mega platforms, much of this complexity will fade away. In the end analysis, the surviving platforms will perform the classic functions of a digital marketplace by powering trade, providing credit and clearing, ensuring quality and transparency, and offering reporting and analytics.

Simply put, advertisers and publishers won’t need to stitch together a confusing array of point solutions. They’ll have the option of using one platform to execute sales, serve ads and track monetisation and performance. The result will not only be simplicity, but more importantly, less friction and latency and greater efficiency.

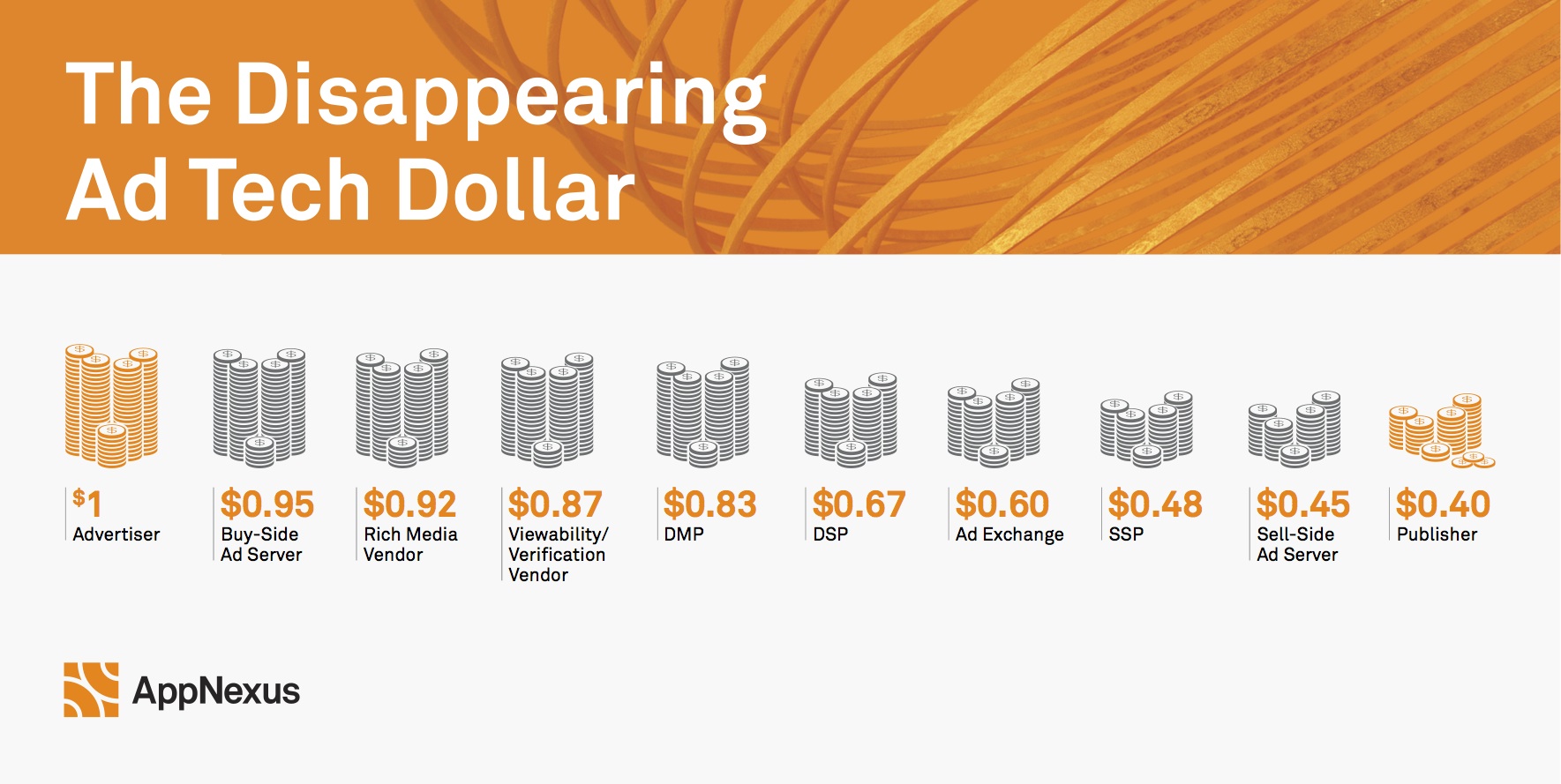

Commoditisation: For advertisers and publishers, alike, consolidation will herald a welcomed change – commoditisation. Not only does complexity open the door to arbitrage, inefficiency, latency, and fraud; it also takes an enormous bite out of advertising dollars. Simply put, more actors in the middle means less power behind spend. (The numbers in this graphic are notional and intended to illustrate the point.)

As the model shifts from stitched-together point-solutions to single platforms, services that used to take a significant cut – from ad serving and data integration to reporting and viewability – will become commoditised, and even standard.

Why should advertisers pay extra for viewability reporting if they’re using a single platform? Why should publishers pay extra for managing waterfalls if the single platform they use can manage allocation and yield across multiple marketplaces (e.g., RTB, deals, automated guaranteed)? Why should anyone carve out extra budget for a single-channel video vendor when a single platform can power exchanges across formats (video, audio, display) and devices (mobile, desktop, tablet)?

One of the great frustrations with ad tech is that it can chip away at a dollar more quickly than the tax man. That reality is about to change, and companies that can’t adapt to this era of commoditisation will be left behind.

Convergence: In a world dominated by a small number of mega platforms, the key standard by which actors will be judged is convergence. That is to say, do the interests of the platform and its customers converge? Do the technological specifications of the platform converge with the technological needs of the client?

If the company operating an ad tech platform is also a media company, chances are, its interests conflict with those of its customers. After all, why should an advertiser entrust its budget to a media company that is incentivised to divert ad dollars to its digital properties; and why should a publisher trust a competing content provider with the monetisation of its inventory?

The only compelling reason for advertisers or publishers to take that risk is the supremacy of the platform’s technology. However, in the absence of technological convergence, the risks outweigh the rewards. In this new world, open platforms – those that allow customers to control their data and allocation – will enjoy a marked advantage.

As I often tell new team members, if you like routine and constancy, this is probably not the industry for you. If you welcome change and thrive on competition, then you’ll probably like the Ad Tech Power Game.

Strap yourselves in: 2016 looks to be a wild ride.

DisplayIndustry InfrastructureMartech

Follow ExchangeWire