AA/WARC Reveals Increased Spend on Almost All Digital Channels

by Hugh Williams on 2nd Nov 2017 in News

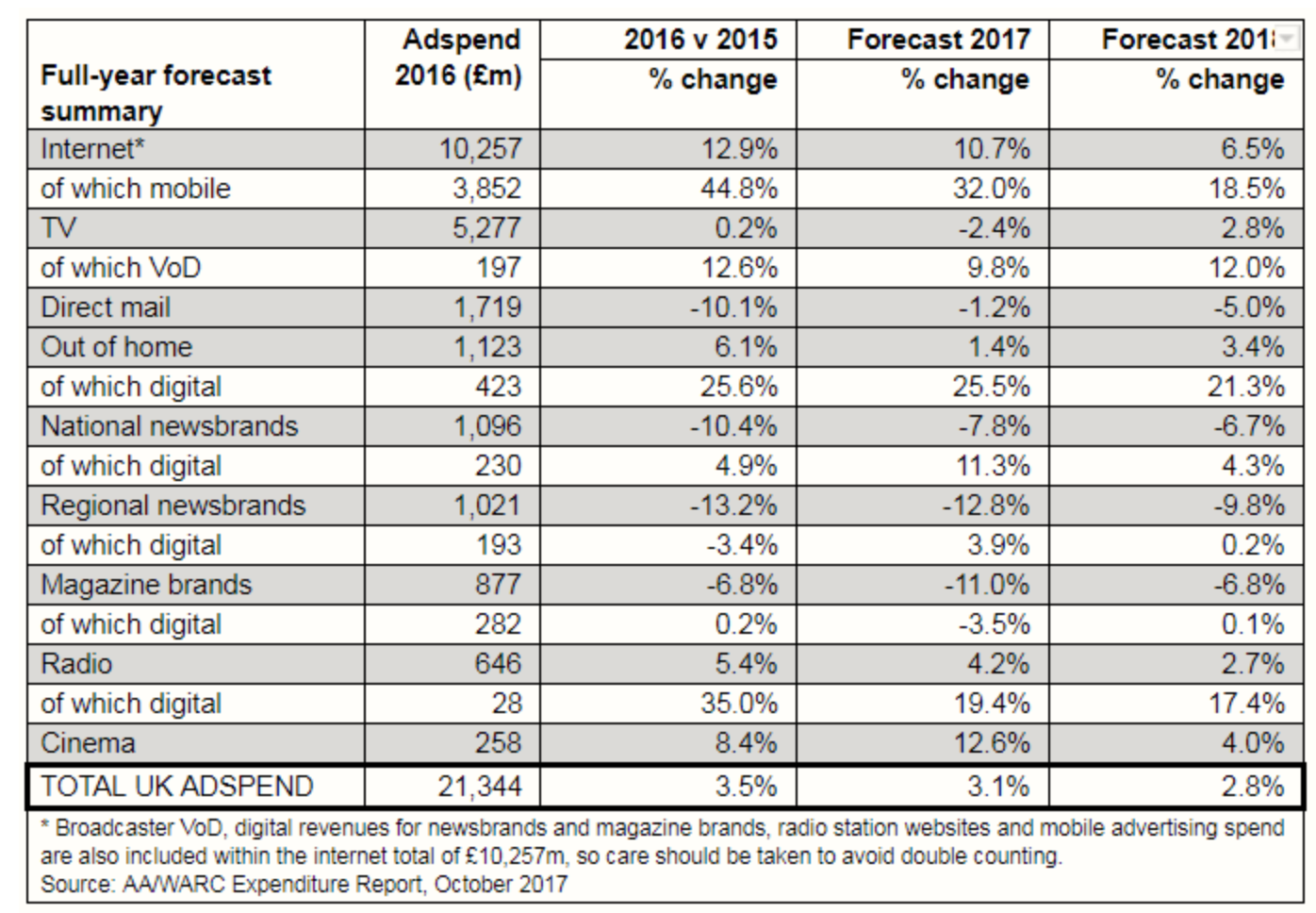

UK advertising expenditure grew 3.7% year-on-year in the first half of 2017 to £10.8bn, the highest total for the first six months on record, according to the AA/WARC’s expenditure report.

Mobile spending was up 38.1% across the six months, while overall internet spending was up 13.8%. Almost all digital channels recorded a notable increase in spend, with VOD up 8.8%, digital out-of-home up 29.1%, national newsbrands’ digital revenues up 15.6%, and digital radio up 22.2%.

Other key findings include:

- Only magazines saw falling digital revenues, with spend down 9%

- TV spend was down 4.4% across the first half of the year

- Growth is forecast to slow to 3.1% in the second half of 2017

- In 2018, ad spend is now forecast to grow 2.8%, to £22.62bn

- Mobile, which grew 44.8% last year, is forecast to increase 32% this year to £5.08bn, before growing a further 18.5% to £6.02bn in 2018

ExchangeWire spoke to some of the digital advertising industry’s top thought leaders about what the latest report means.

James Sandoval, CEO & founder, MeasureMatch, comments on the strong levels of spend, despite challenges such as the impending GDPR. He says: "Strong, continued growth in online ad spend reflects brands' ongoing confidence in digital media to deliver positive ROI. Despite a multitude of systemic challenges – from measurement to brand safety, from GDPR to changing consumer expectations – ongoing innovation is ripe and ironing out these challenges facilitates continued growth of the digital marketing economy.

"At the heart of this confidence is marketers' growing comfort in using advanced customer experience measurement systems to glean accurate, omnichannel insights and to tie these insights to customer relationship management to continually optimise marketing investments into 2018 and beyond.”

Rachel Forde, CEO, Spark Foundry UK, agrees with this sentiment, noting that political uncertainty could have easily harmed spend: “This record set of results is a very positive marker for the industry, showing real confidence in UK advertising, despite ongoing political instability. Digital is clearly the engine room for growth across the board, and we can see an acceleration for some of the more traditional media via digital platforms. Despite a drop in print revenues, newsbrands in particular have seen a growing digital spend, along with radio and out-of-home. Mobile continues to consistently make an impact, with its huge growth of over 36%, causing overall internet spend to increase.

“There is a huge opportunity for brands wanting to balance a combination of innovation with traditional media – these figures prove that the industry as a whole is benefiting from a growing number of consumer-facing channels, with more ways than ever before to speak directly to audiences.”

Despite uncertainty, areas such as OOH and audio have thrived, as noted by Evangelos Sideras, joint managing director, UK, Media iQ Digital Ltd: “Despite cautious tones from the industry in 2017, this report shows that all mediums have seen growth in advertising expenditure. It is an indicator that, despite economic uncertainty in the UK, confidence remains in marketing from brands, especially in emerging digital mediums such as out-of-home and audio. This also highlights that brands are looking to truly innovate from a marketing and creative standpoint by reaching their consumers in many different ways, and through a variety of mediums. Based on the advertising spend forecasts outlined, the future of the UK media landscape appears positive and provides the platform for marketers to excel.”

A chance for developing platforms

Matt Teeman, managing director, Primesight, also comments on the positive results for OOH: “The solid performance of UK advertising expenditure in the first half of 2017 is encouraging, given the perceived uncertainties in the economic climate. In particular, the investment decisions by OOH media owners to continue to increase access to the medium through the installation of digital screens is proving a sound strategy. Digital OOH grew faster in H1 2017 YOY comparisons than any media channel, except mobile. This confidence in the medium meant a consolidated growth rate across all OOH of 0.6% for the half year, which outperformed the negative changes experienced across TV, news brands, and magazine brands. Clients are clearly embracing the technology and audiences delivered by the OOH channel as a strong communication platform for both tactical and brand-building messaging.”

Stuart Taylor, CEO, Kinetic, notes that digital innovation has been key to OOH’s growth: “This is a strong and encouraging set of results for the out-of-home industry, reflective of a growing confidence in the sector among UK advertisers, despite recent economic uncertainties.

“Overall growth in the sector has been driven by a rapid increase in digital-out-of-home ad spend; which is, once again, the second-fastest growing medium after mobile. This is down to the trust brands and advertisers alike have placed in the medium to deliver on engagement strategies and create unique and powerful experiences based on context and location.

“Digital innovation has also had a crucial role to play in the sector's growth, with new and exciting inventory emerging on an almost monthly basis, bringing with it new and improved formats, and providing advertisers with smarter, more sophisticated opportunities to connect with audiences on the move. The recent relaunch of the Piccadilly Lights, JCDecaux’s London digital network, and Exterion Media’s DX3 are just some of the many examples of such innovation at scale.

“Years of sustained growth have successfully established DOOH as a robust and unique media channel in its own right, bringing reach, flexibility, value, geotargeting, and cutting-edge technology to UK's advertisers; and now the medium is increasingly seen as an extension to digital display.”

Simon Kilby, group commercial director, Bauer Media, points to what the results mean for audio: “These positive results are a clear sign of the confidence brands have in commercial radio as we continue to achieve growth in an increasingly competitive advertising market. In particular, there has been a big demand for digital audio, with an increase in commercial opportunities thanks to diversification of audio channels and new ad tech. The phenomenal growth of 39% in digital audio spend demonstrates the intense interest in this medium, with plenty of avenues, such as podcasts and branded playlists, expanding rapidly.”

But damaging results for TV

Tom Smith, head of biddable media, mporium, notes that spend on traditional formats has taken a hit: “Digital advertising, once again, takes pole position in the AA/WARC expenditure report. Whilst this is certainly nothing new, it is another indication cementing the important role that digital now plays within the UK advertising landscape. Digital’s increasing dominance shows a significant shift in the ways in which we now encounter ads. For that reason, traditional formats have taken a slight tumble, with TV’s ad spend down 4.4%. Now that three-quarters of the UK public use a connected device whilst watching TV (known as ‘second-screening’), it is no wonder that advertisers are staying ahead of the game. This has been reflected in the continued increase of mobile growth within internet spend, as digital platforms on those devices become of more relevance to target potential consumers.”

Mobile remains the King

Jo Sutherland, UK MD, Fetch, says that these results prove that: “Mobile’s strong performance will no doubt continue in the next few years. Half of the UK’s internet time is now spent on smartphones and consumers are showing no signs of slowing. At Fetch, we recently conducted a mobile detox that actually increased levels of anxiety amongst employees, who felt disconnected from their families on WhatsApp and were unable to price check items on Amazon. The detox revealed just how important our smartphones are to us on a personal level. And with mobile search now overtaking desktop, and smartphone shopping accounting for two-thirds of UK e-commerce by 2020, brands will be expected to ramp up ad spend towards reaching customers on the personal devices on which they are dependent.”

Amit Dar, head of strategic partnerships, Taptica, also points to the continued dominance of mobile: “Smartphone shopping is set to account for around two-thirds of total online e-commerce by 2020 in the UK; and the latest AA/WARC report highlighted continued growth in investment in this area. Mobile spend has grown 44.8%, accounting for the entire internet growth during Q2 of this year; and we predict that this will continue to increase as consumers increase their reliance on mobile devices for everything from playing on apps, to price checking products, to browsing social media.

“People now spend more time on social media than in the pub with their friends, meaning brands need to utilise this behaviour and target consumers when they’re most tuned in on their mobile – their primary device – which is reflected in the forecast for 2018, which indicates that mobile spend will outpace broadcast in 2018. Brands must continue to innovate with their ad creative and strategies, and not just rely on the same mobile formats to reach target audiences.”

Celine Saturnino, COO, Total Media, also comments on mobile’s influence on overall spend: “The AA WARC results demonstrate an unprecedented growth in expenditure, as spending on digital accelerates at a breakneck pace – accounting for 54% of all spend. It is fantastic to see this growth, as well as the upwards revision of their growth forecast for 2017 by 1% to 3.1%. This is in line with what we see from most of the brands we work with, who are increasing their digital investments in line with consumer behaviour and campaign performance.

"Overall, increases have largely been driven by huge investments in mobile advertising, and it is great to see that ad spend is catching up to consumer behaviour. Beyond this, the digitisation of all media and the advanced data-led opportunities available are opening up new and interesting ways for brands to talk to their audiences and deliver a better customer experience. This boosts investment into channels that are innovating, as we have seen with large increases in digital OOH and, as we should expect, into digital audio and other broadcast opportunities as they develop into 2018 and beyond.”

What does the future hold for publishers?

Julia Smith, director of communications, Impact Radius, says newspapers are continuing to feel the squeeze: “UK advertising may have delivered the highest H1 on record but, looking at the sectors, it’s unsurprising to see newspaper brands show a decrease. This is likely to be due to the increased pressure in this area, coupled with the ever-changing industry models. This has meant that publishers need to look beyond the current solutions and focus on embracing technological solutions. Traditional newspaper brands and key publishers in the industry need to identify the issues and swiftly deliver solutions through the involvement in alliances, or even blockchain technology. The use of this will allow more revenue to be driven to the trustworthy channels of leading content-rich and brand-safe publishers.”

James Pringle, CEO and co-founder, Suggestv, sees brands seeking out more reputable publishers in the future: “According to the latest WARC report, magazine’s digital revenues went down 9%, marking the only downward trend of digital revenues across the board. However, with a heightened understanding of brand safety in recent months, and more focus on trust and transparency in the market, I’d predict that in 2018 we’ll see a move towards premium storytelling for brands, which will work in publishers’ favour.

“Despite not having the reach of the big tech companies, reputable publishers can offer valuable and engaged audiences and positive, premium brand associations. I’d encourage brands not to overlook the power of digital publishers for reaching highly tuned audiences in a brand-safe way.”

Predictions going forwards

Will King, commercial director, Voluum, highlights that we need to see action on key industry challenges in 2018: “Despite UK economic uncertainty, it's very encouraging to see that UK advertising expenditure grew at a record high of 3.7% year-on-year in the first half of 2017. In even more positive news, mobile advertising continues to be in a healthy state, with growth at 36.1%. Being a key contributor in internet spend, it's evident that mobile is now hugely beneficial for many advertisers. However, with this kind of influence comes a lot of responsibility. With the rise of video as an extension of the mobile ad format, cross-platform measurement still continues to be a big challenge. Viewability, too, is still very murky. As we move into 2018, it would be good to see the industry take more action in combating some of the online dilemmas faced by many advertisers. This way we will be one step closer to cleaning up the supply chain.”

James Collier, co-founder, Prism, says that the industry needs to focus on serving quality ads: “It’s great to see strong growth from this report, and the forecast for 2017 raised up to 3.1%. We can see that the confidence is there – a great sign for the industry. Mobile growth this quarter is especially encouraging, boosting the overall 13% rise in internet spend and the sustained increase in investment the sector has seen this year.

"However, as mobile spend looks set to grow further in line with surging mobile usage, in order to sustain this growth of the industry, and drive it further, agencies and brands need to be mindful to ensure they are not saturating devices with ads. The negative impact of this is exaggerated on mobile through slow load times, user data costs, and the natural restrictions that come with a smaller screen. Instead, we need to focus on relevant, quality ads served in engaging formats that contribute to consumer experience. So long as this happens, I predict that advertisers will continue to see progressively better results as they invest in building meaningful relationships with consumers.”

Follow ExchangeWire