Weekly Focus: China Online Retail to Hit Trillion-Dollar Milestone

This week, the spotlight is on China, where the online retail market is expected to be the first worldwide to hit USD$1tn (£721.79bn) in sales this year.

This would be ahead of a previous forecast by Forrester, which projected the Chinese online retail market would reach the trillion-dollar milestone only in 2019. The research firm attributes the exponential market growth to increasing mobile and consumer spending, especially in categories such as fashion and grocery.

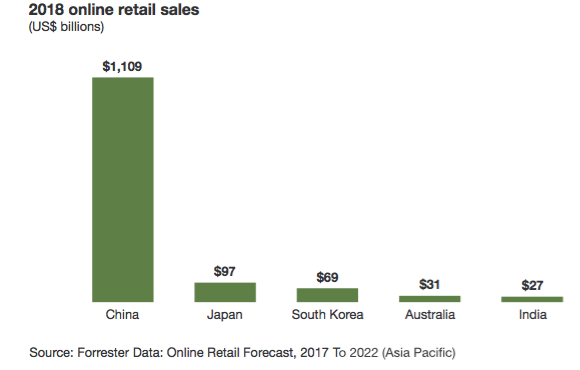

According Forrester's Delhi-based forecast analyst Satish Meena, who is the report's lead author, China will be home to 631 million online shoppers by 2022, compared to the current pool of 502 million. The country accounted for almost 83% of overall online retail sales in Asia-Pacific, where Japan, India, South Korea, and Australia also were major markets.

By 2019, India's online retail market would be larger than Australia and would be the region's fastest growing region. Alongside China, which was the largest global online retail market, they helped place Asia-Pacific as the largest region for online retail sales.

In addition, online would contribute 25% of the region's total retail sales by 2022, led by China and South Korea, where more than 31% of retail sales in these two markets would be transacted online.

The five key Asia-Pacific markets also see mobile as a primary channel and driver of online retail sales, especially since more than 1.2 billion smartphone subscribers resided in these markets last year.

Forrester predicted that mobile would push online retail at a compound annual growth rate (CAGR) of 17.64% to hit USD$1.7tn (£1.23tn) in 2022, up from USD$735bn (£530.52bn) last year. Mobile would account for 80% of total online retail sales by 2022, fuelled by lower data fees and the availability of affordable 4G devices. These favourable conditions would push the number of online shoppers in countries such as India, as well as further boost the adoption of mobile payments.

As the region's fastest growing market, the Indian online retail market would grow at a CAGR of 29.9% to reach USD$73bn (£52.69bn) in 2022, despite some bumps over the last two years. Growth had dipped to 39% and 26.4% in 2016 and 2017, respectively, compared to more than 100% in 2014 and 2015, noted Forrester, which attributed the slumps to new regulations, the government's demonetisation move, and launch of GST in 2016 and 2017.

By 2022, online is projected to account for nearly 5.7% of India's total retail sales. Amazon surpassed local e-commerce operator Flipkart for the first time in 2016 and is closing the gap to become the largest online retailer in the country, gaining ground amongst metropolitan Indian consumers.

Forrester noted that the U.S. e-commerce giant was claiming more market share across several categories, with the exception of fashion, which remained Flipkart's saving grace due primarily to its acquisitions of fashion online retailers, Myntra and Jabong.

And, while the Indian market player had secured USD$2.5bn (£1.8bn) in funding from Softbank last year, pushing its total fund to USD$6bn (£4.33bn), Amazon had pledged an investment of USD$5bn (£3.61bn) to help expand its Indian footprint. Forrester added that the U.S. vendor would continue focus on fashion and grocery this year, making it tough for Flipkart keep its foothold in 2018.

Online Grocery Cooking Up a Storm in APAC

And it seems 2018 also will be the year of online grocery, according to Forrester, which is predicting both online and offline retailers to announce more acquisitions and investment in this space.

In a separate report that assessed 27 global markets, including China, South Korea, Japan, and India, the research firm said the global online grocery market would more than double from USD$150bn (£108.27bn) last year to USD$334bn (£241.08bn) by 2022. Growth would be fuelled by higher investment from retailers in online platforms, Forrester said, with most of this spend to come from China, South Korea, Japan, U.S., UK, and France.

With online grocery sales accounting for just 2.9% of total grocery sales last year, both offline and online players would continue to clamour for a share of these high-frequency purchases and consumer loyalty.

This market segment, however, would prove challenging in terms of logistics and investment, especially as these would be expensive and complex to resolve. Forrester pointed to the market's unique traits, such as varying average basket sizes, low margins, time-sensitive delivery, and perishable products.

Regardless, with the market still largely untapped, retailers are eyeing a piece of the pie, the research firm said.

Just 12% of online consumers worldwide bought groceries on the same channel last year, when consumer grocery spend clocked USD$5.1tn (£3.68tn), or 35% of total global retail dollars.

In Asia-Pacific, the online grocery market was expected to hit USD$241bn (£173.95bn) by 2022, compared to USD$98bn (£70.74bn) last year, Forrester said. China would drive the bulk of sales, though, South Korea would lead in terms of market penetration, with groceries accounting for 25% of online sales by 2022, up from 12.8% last year.

Instagram Shopping Now in Australia

The photo-sharing platform has expanded its shopping feature to eight new countries, including Australia, Brazil, and Canada, enabling brands in these markets to tag and make products available for consumers to buy directly.

Officially launched in the U.S. last year, the feature was designed to ease the path for brands to lure followers to their e-commerce storefronts.

With the Shopping tags, Instagram posts would display popups with the product's price and a URL that would contain more information about the item. This also would include a 'Shop Now' button that directed consumers to the product page on the brand's online site.

Instagram previously said it planned to monetise the service, enabling retailers to display Shopping-tagged photos to users who were not following them.

Commenting on the launch, its head of business, Jim Squires, said: "People come to Instagram every day to discover and buy products from their favourite businesses. We want to be that seamless experience. Whether it's a local artisan, florist, or clothing store, shopping directly on Instagram has never been easier."

Australia would be the first Asia-Pacific market to access the Shopping feature, with local retailers Country Road, Meyer, and PepperMayo on board as pilot trials.This content was originally published in RetailTechNews.

AmazonChinaE-CommerceM-CommerceMobilePayment

Follow ExchangeWire