Fave Wants to Help SEA Merchants with Data & Partners

Daily deals app Fave is amassing a wealth of data and aiming to tap these customer insights, as well as industry partnerships such as Grab and Alipay, to boost returns for its merchants.

Such efforts would include further enhancements to a dashboard, Fave Biz, designed specifically for merchants to access data intelligence and improve their service offerings, Ng Aik-Phong, managing director of Fave Singapore, said in an interview with RetailTechNews.

The company's roots began in 2015 as fitness platform KFit, before it rebranded as 'Fave' and later acquired Groupon's business in Jakarta in July 2016. It then expanded its acquisition of the daily deals site's operations to Malaysia and Singapore last year, bolstering Fave's service offerings to include fitness as well as dining deals.

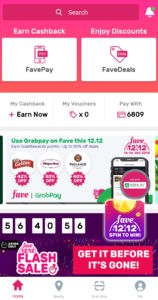

A key pivot for the business came with the introduction of its mobile payments platform, FavePay, in Singapore in August 2017, Ng said, which fuelled the company's first one million transactions in the city-state in September 2018.

A further second million in transactions was likely to be reached in early-2019, he said, noting that the mobile payments platform currently was accepted at 3,000 merchant locations in Singapore, including fast food chains Subway and Long John Silvers, and dining establishments Tung Lok Group and Food Republic.

To date, FavePay has processed more than USD$100m (£79.09m) in transactions across the three markets, where the Fave app has pushed more than 3 million downloads and handles more than 800,000 transactions, in total a month. A "few hundred thousands of users in Singapore" access the app each day, said Ng, who declined to reveal the exact figure.

Across three Southeast Asian markets including Malaysia and Indonesia, the app has registered more than two million downloads and processes more than 600,000 transactions each month. FavePay is accepted at more than 6,000 merchant locations across the three markets, where the Fave app boasts a merchant network of more than 15,000.

And it is looking to grow this number.

The company raised USD$20m (£15.92m) in Series B funds in September 2018, which it said would go towards its goal of serving 100,000 offline businesses by 2019.

And it hoped to achieve this by making it easy for consumers to transact with merchants and boosting repeat business, according to Ng. He explained that retailers had no qualms giving deals and discounts, but they also wanted more repeat patronage.

Taking the friction out of customer loyalty

Merchants regarded daily deals as a good platform to acquire new customers, not as a way to cultivate loyalty. This had driven Fave to introduce a cashback loyalty scheme that returned FavePay customers between 10% and 20% in credits after transacting with a merchant, which they then could redeem when they next returned to the retail outlet.

Customers would be able to see how much cashback was available for redemption and the credits would be automatically deducted at the next transaction. The platform offered immediate gratification for consumers when they revisited participating brands, he explained, noting that the cashback system was specific to the merchant, so businesses would benefit directly from offering deals that enticed consumers.

Merchants fund the cashback deal and decide how much cashback they want to reward customers.

In addition, FavePay transactions were cashless and processed using QR codes, reducing the potential for human error for merchants handling transactions, Ng said.

He noted that many loyalty programmes in the market were dependent on physical receipts and required customers to scan and submit the paper slips to shopping malls as proof of purchase. Others put the onus on customers to retain loyalty cards, on which retailers would have to stamp each time consumers visited their outlet.

"There's a lot of friction and perforation", he said. "So we solved this last-mile [challenge] through payments with FavePay. Once you trigger the payment, you can calculate how many rewards to return to customers, giving merchants a good loyalty programme [that encourages] repeat customers with less friction."

More importantly, Ng said, data could be seamlessly captured, since the payment transaction would reveal what customers bought and when they purchased it. This also would provide a more comprehensive profile of Fave customers.

The data also would reveal how much cashback the merchant had awarded the customer, he said.

According to Ng, merchants list their deals and offerings for free on the app. Fave collects a fee for every voucher or deal sold on its platform or via FavePay, where unused or expired cashback credits are returned to Fave. This currently generates most of the company's revenue.

It charges a merchant discount rate (MDR), of which he declined to reveal the exact figure, but he noted that this fee currently is waived and the company aims to drive transactions on its platform. MDRs are fees merchants typically pay for payment processing services on transactions.

The company plans to charge an MDR in future, said Ng, who also pointed to other ways that could generate revenue, such as providing advertising and marketing services for merchants and offering data insights they could use to drive their business.

He said Fave introduced a suite of advertising solutions earlier this year to help merchants looking to promote their brands on the platform, offering ad packages priced from S$3,000 (£1,739) and could encompass geotargeted popups, emailers, and ad banners. He added that the company currently sent out one million emailers a day.

Across the region, Fave's latest annualised revenue exceeded USD$100m (£79.6m).

Boosting deals with data & partnerships

Apart from transaction fees and marketing support, the deals platform also is looking to industry partnerships and data to help drive its ecosystem.

Ng said they are currently working to beef up Fave Biz, a dashboard that provides merchants access to customer insights, advertising services, as well as training tools.

"We want to provide more functionalities and data, including data that's actionable. For example, data about weather isn't actionable, but what if [we can alert] merchants that don't have a lot of customers between 4pm and 5pm, and suggest they do a flash deal during that time or provide a list of actions they can take to boost sales. We also want to make such features [on the dashboard] more self-service", he explained.

Through the Fave Biz dashboard, merchants are able to see data, such as the number of times customers have returned to their store, the number transactions on a weekly or daily basis, transactions across different outlets, the amount of cashback awarded, revenue generated by FavePay, payment history, average spend per customer, and customer reviews and ratings of their brand.

Access to the dashboard is priced at S$99 (£57.38) a month, but this fee currently is waived, Ng said, noting that the company may offer different pricing tiers for access to various datasets in future.

He added that it likely would begin charging for access to the dashboard next year, upon hitting "a certain value" for merchants.

In addition, Fave was keen to help bridge the gap between the online and offline realms, helping its offline merchants capture consumers who were looking for deals online.

Ng said: "We have a big asset base online. Fundamentally, it's about getting customers who are either looking for information online or buying online, to get them to do offline activities. So, how I look at O2O (offline-to-online) is that we're in a position to offer reach online and good data of online customers, and we can piece these together to help deliver more value to merchants that are offline."

Such efforts also went beyond Fave's own database as the company joined hands with other e-commerce players to grow its ecosystem, such as Grab, Carousell, and Alibaba's Alipay and Lazada.

For instance, in October, Fave announced a partnership with online commerce platform Grab to integrate the latter's digital wallet and food delivery services with its app, enabling Fave merchants to access these Grab offerings.

In turn, Grab also would integrate Fave mobile deals on its app and allow GrabPay users to purchase these deals. These would be facilitated through the former's suite of APIs (application programming interfaces), GrabPlatform.

Ng said: "We have to have data insights and good reach of online customers, and we [aim to] do it ourselves, as well as through working with partners. By doing all of this successfully, we create a ecosystem that supports a customer's entire journey, including when they watch movies, where they eat, and when food is delivered to them [via GrabFood]. Then we can truly unlock value for offline merchants."This content was originally published in RetailTechNews.

Customer ExperienceDataE-CommerceIn-storeMobileOmnichannelPayment

Follow ExchangeWire