Ad Blocking Predicted to Cost £14bn in 2015; Average Brit Spends Nearly 3 Hours a Day Online

by on 3rd Sep 2015 in News

ExchangeWire Research’s weekly roundup brings you up-to-date research findings from around the world, with additional insight provided by Rebecca Muir, ExchangeWire, head of research and analysis. In this week’s edition: Ad blocking to cost £14bn in 2015; Average Brit spends nearly three hours a day online; Half of publishers frustrated by programmatic demand incompletes; Smartphones account for 20% of ad views; and less than 30% of marketers use cross-channel tracking.

Global ad blocking to hit record figure

In the UK, 65% of consumers believe society would be worse off without high-quality, low-cost newspaper and magazine content, according to new research from Teads. In 2015, ad blockers will lead to £14bn in lost revenue. The majority of consumers (62%) underestimate the contribution of advertising revenue in sustaining the business models of publishers, for traditional newspapers around half of revenue comes from advertising, rising to 75% for purely online titles.

Justin Taylor, UK MD Teads commented: "Editorial content from premium publishers informs and entertains us every day, but most people don’t realise that it’s advertising that keeps this free or very low-cost. However, we can’t blame people for using ad blockers online. Advertisers must respond with far better ads that are less intrusive and more relevant to consumers."

Over fifty percent (52%) of consumers said that they were more likely to enjoy video advertising if it was relevant to the content they were reading, whilst 82% prefer video ads that they can control and skip.

One in every six waking minutes is spent online

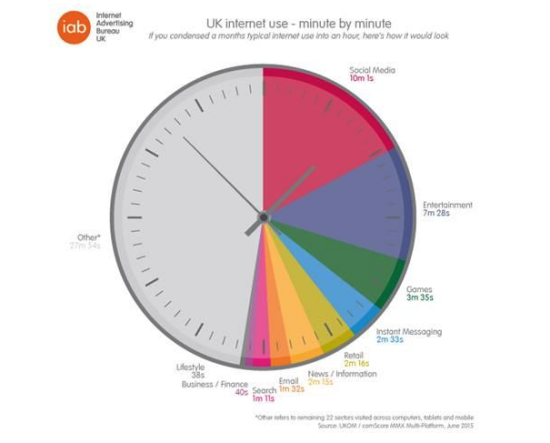

In the UK, the average consumer is spending an average of 2hrs and 51min a day online, equivalent to one in every six waking minutes, according to the IAB and UKOM. The majority of time is still spent on PCs/laptops at 1hr and 16mins (45%), closely followed by smartphone at 1hr and 9mins (40%), with the average time spent on tablet accounting for 15% of time spent, at 26 minutes.

Social media takes up the largest proportion of browsing time (16.7%) across all devices, accounting for over double the time spent on mobile than desktop (21.4% versus 9.8%). In contrast, entertainment accounts for double the amount of time on desktop than mobile/tablet (18.5% versus 8.3%).

Source: IAB & UKOM

Publishers frustrated with programmatic bidding

Globally, almost 50% (45.5%) of publishers state they are frustrated at not being able to have demand partners compete with each other on each impression, according to research by Technorati.

Almost half (49%) of publishers use passbacks and floor prices to maximise the yield of their programmatic inventory. Shani Higgins, CEO Technorati commented: "Publishers need a lot more help than they are getting to ensure an optimal trading process".

The majority of marketers (64.7%) are using one to five different programmatic demand solutions to monetise their ad impressions, a significant proportion of buyers (29%) and sellers (27%) are using more than six programmatic partners. The main barrier to integrating with more buying tools was "time or effort to integrate" (55%), followed by time or effort to manage each relationship (49.1%).

Inventory discovery (63%), deal negotiation (62%), and inventory packaging (45%) were cited as the most important areas for improvement in private marketplaces; whilst first-party data segments (69.4%) was highlighted as having the greatest impact on maximising ROI in private marketplaces.

One in five ads viewed from smartphones

In the US, video ad views grew 32% year-over-year, with 31 billion premium digital video ad views across the quarter according to FreeWheel’s ‘Video Monetization Report Q2 2015.’ Smartphone and OTT devices saw large growth rates (107% and 194%), with 20% of ad views originating from a smartphone. Smartphone viewers are most likely to watch short clips (67%), whilst viewers on tablet prefer to watch longer content (42%). In the US, 53% of mobile video ad views originates from iPhones, closely followed by Android (46%).

Live content saw a 146% year-on-year growth, with long-form content (20+ minutes) seeing a 26% year-on-year growth. The average live content ad break is 120 seconds long and contains 5.7 ads per break, the average on-demand ad break is shorter at 95 seconds, with an average of 3.8 ads per break. On-demand has a lower amount of ads as programmers are wary of over saturating digital viewers who have come to expect a lower ad load.

Cross-channel tracking still issue for marketers

Less than 30% of marketers, use cross-channel tracking, according to eMarketer’s ‘Mobile Marketing Measurement and Effectiveness Roundup.’ Globally, 6% of marketers believe that their current solution provided an adequate single view of their customers.

In the US, 40% of companies intend to use mobile coupons for marketing this year, projected to grow to 48% by 2017, with the number redeeming these coupons up 7.6% to 121.3 million. Nearly half (47%) of millennials had downloaded a shopping app in the past year, with females more likely to have done so (49% versus 44%). Mobile shopping app usage is skewed towards older millennials aged 23-to-30 (66%), compared with 47% of 18-22 years olds. The main reason cited for downloading a shopping app was that it was "easier to use than a mobile site" (54%), followed by "better discounts/lower prices" (27%).

Ad BlockingMeasurementMobilePMPProgrammaticPublisherVideo

Follow ExchangeWire