Publisher Co-operatives: A Global Trend

by Rebecca Muir on 13th Jan 2016 in News

Publisher co-ops are popular in Europe; but, until now, have failed to be successful in other continents. Jay Stevens, general manager, international (pictured below) at Rubicon Project spoke exclusively to ExchangeWire and shared his prediction that publisher co-ops are going to be a global trend, as more major publishers come together to pool and package first-party data along with their inventory, to offer advertisers access to finely targeted audiences, bought programmatically, at scale.

Today, there are nine publisher co-ops on the Rubicon Project platform; five of them launched in 2015. Often thought of as a largely European phenomenon, Stevens points out that of the nine publisher co-ops working with Rubicon Project, one is from the APAC region (Kpex – New Zealand), one is from the LATAM region (RPA Media Place – Argentina) and there’s also the global The Pangaea Alliance.

Stevens predicts that the rise in popularity of publisher co-ops is a trend that will blossom across the globe in 2016.

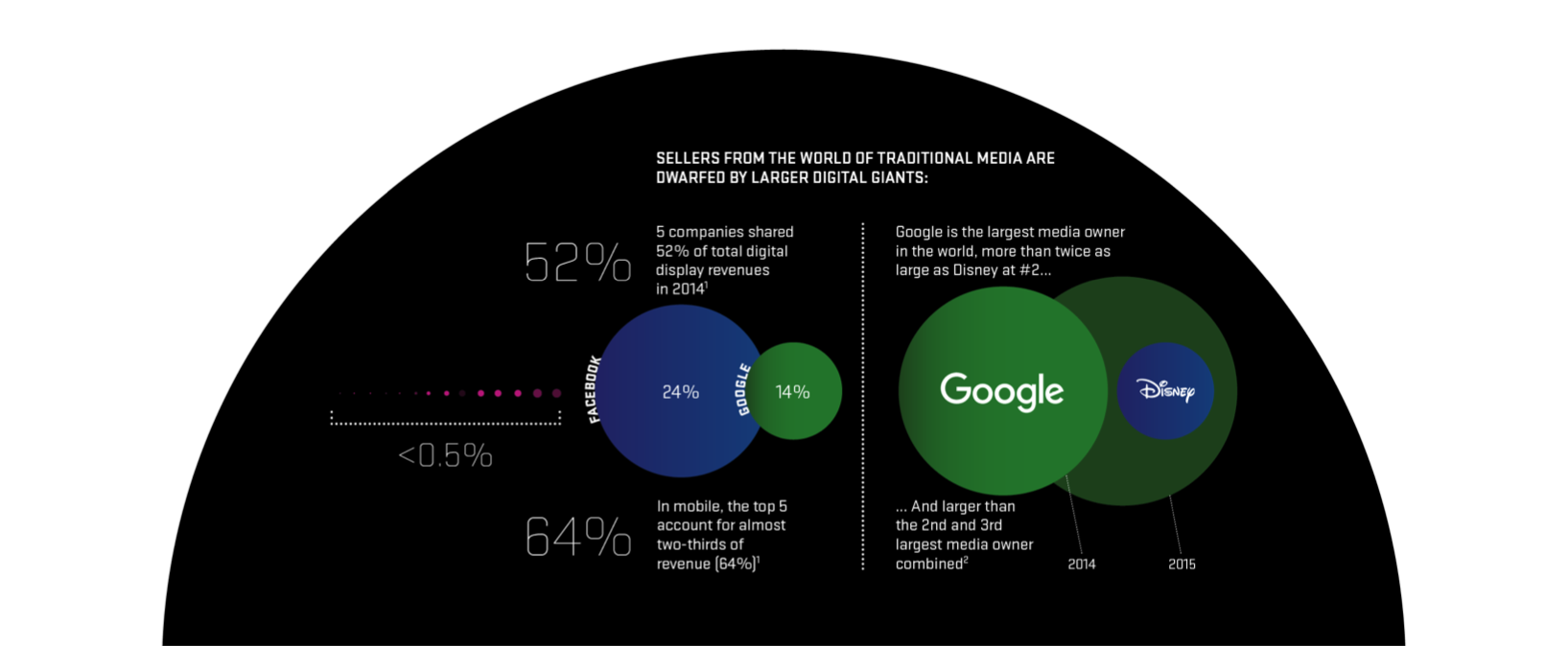

Publishers form co-ops with the aim of maintaining, if not growing, their share of digital revenue against the digital giants, namely Facebook and Google. Publishers that form co-ops see big increases in revenue, compared to independent publishers.

Digital Revenue Share

Sellers from the world of traditional media are dwarfed by larger digital giants, such as Google and Facebook. See below:

Source: Rubicon Project

Publishers in certain markets are more likely to establish co-ops, argues Stevens: “Usually a publisher co-op will form when a market has started to do a bit of programmatic and are seeing revenue from it, but publishers have not yet created teams to manage programmatic. Which makes it hard to establish publisher co-ops in Australia and the US, as there are already publisher teams maximising programmatic yield.”

La Place Media was the first seller alliance; it has now been operational for just over two years and reaches 70% of France’s online population. In its second year, La Place reported a 70% increase in CPMs and forecast 2015 revenues of €20m.

The Czech Publisher Exchange (CPEx) emerged in September 2013, and now sees more than 1.7 billion impressions a month, which is roughly equal to 200 impressions per user, per month. Most recently, CPEx has seen a 500% increase in revenue year-on-year from private marketplaces (PMPs) and a 280% in revenue from high-impact formats.

I quizzed Stevens about potential threats to the success of established publishers co-ops and it was refreshing to hear that the only real threat to success is lack of exclusivity when it comes to inventory access. Stevens said: “It is vital that the co-op publishers have exclusive access to the inventory that is to be sold programmatically. It’s only by doing this that they can control rates and avoid cannibalisation. It’s up to each co-operative to remain independent to their stakeholders. There has to be exclusivity, no stakeholder can have more power than another.”

This was the very problem that caused quadrantONE (an alliance of four of the biggest print and online publishers in the US: Gannett Co., Hearst Corp., The New York Times Co., and Tribune Co.) to fail in February 2013. “It [quadrantONE] didn’t last because there were back doors to the inventory that eroded the value”, said Stevens.

To download the full report, click here.

Ad NetworkDisplayExchangeIndustry InfrastructureMedia SpendProgrammaticPublisherTrading

Follow ExchangeWire