The Next Generation of Media Planning Tools for CPGs Will Come From Retailers

by Mathew Broughton on 29th Jun 2023 in News

In this specially contributed article from dunnhumby, Julie Jeancolas, global head of product, strategy & partnerships - retail media & personalisation, discusses the findings from their recent research on retail media, and how retailers can leverage powerful real-time insights to bolster their ROI.

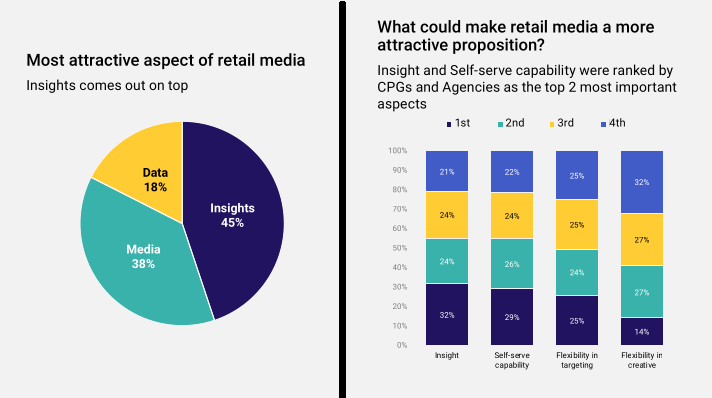

There’s a certain irony in the fact that, for a proposition that we all refer to as retail media, that latter element isn’t actually its most compelling. “Retail insights and media” doesn’t have the same ring to it, but there’s an argument to say that it might be a better name based on how industry professionals tend to feel about it.

We know this thanks to the results of a recent dunnhumby study, one which polled 300 brands and agencies on a range of issues relating to retail media. Asked which aspect of the discipline they found to be most appealing, “insights” was the leading factor (45% of respondents). Asked what would make retail media an even more attractive proposition, insights was again the top response.

be the most attractive element of retail media.

Now, respondents may be referring to retail media’s powerful measurement capabilities here, brands can use to get insight into factors like sales impact and ROAS. To me, though, this is less about understanding after the fact, and more about smarter planning upfront. With budgets under growing scrutiny, the data-driven insights that come with many retail media platforms can help brands zero in on specific problems and the audiences they need to solve them.

As much as this is an undeniably compelling prospect for brands, it holds clear commercial opportunities for retailers, too. Customer insights and media inventory can provide a lucrative revenue stream, particularly when monetised together. The problem is, despite having access to huge volumes of transaction and customer data, many retailers still don’t have the capability to turn that information into the actionable insights that CPGs want.

Providing easy access to insights

It’s with this challenge in mind that we developed a new insights module within dunnhumby sphere, our customer-first platform for retail media. Leveraging learnings from data science, retailers can generate the predictive and prescriptive real-time insights that brands need to create customer-centric and highly effective media campaigns.

Let’s look at what each of the components within our insights module can do, and some real-life examples of it in action.

- Getting a handle on overall performance

One key element is the exploration of brand performance. With this, users have the ability to explore the year-on-year performance of their brand and products. As well as helping them understand their success within the category, they can also identify key monthly trends and answer questions such as:

- What’s responsible for a decline in my performance?

- What is the growth opportunity, both for our products and the category?

- What should our campaign KPIs be?

- Which new trends should we pay attention to?

- What KPIs should we use to measure customer engagement?

When one coffee brand saw a decline in its mocha sales, for example, it used insights from brand performance to find out why. With the overall category growing, it quickly became clear that the problem was specific to the brand. A deeper look revealed that, while average spend per shopper was stable, actual customer numbers were falling.

Equipped with these insights, the brand shifted its focus away from rewarding existing customers with coupons. Instead, ad spend was used to re-engage lapsed customers and incentivise newly-acquired ones via the retailer’s website and on key social channels. Predictive insights also helped to understand at which point those new customers would become loyal, as well as their potential lifetime value.

- Understanding customer behaviours

Through our shopper insights tool, brands can analyse customer behaviours and demographics to refine their audience targeting strategies. Insight into cross-shopped categories also helps them understand which other products and brands shoppers are most likely to buy. This provides answers to questions such as:

- Which audience segments should I target?

- How should I adapt my messaging and creative?

- What promotional offers should I put in place?

Using shopper insights, one bread brand found that 50% of its customers were sensitive to price. This realisation informed a revised creative strategy that focused the messaging around value. For a leading yoghurt brand, on the other hand, learning that its customer base was made up mainly of mid-market shoppers drove it to double down on that segment via in-app coupons.

- Refining the strategy with store-level insights

With store insights, brands can find out which stores their customers are visiting, enabling them to define and plan their media strategy. More specifically, store insights help them answer questions including:

- Where are the best locations to reach my audience?

- Which store formats should I focus on?

With help from store insights, an energy drink brand saw that sales were experiencing the fastest year-on-year decline in the convenience format. Subsequently, its media budget was shifted to favour those stores. Supermarkets, where the brand was already growing consistently, were then deprioritised, increasing the effectiveness of its budget.

As well as helping CPGs to optimise their media spend, the Insights module also gives trade, shopper, brand, and e-commerce teams – as well as their media agencies – the ability to align and collaborate around a single dataset and source of truth. Ultimately, this enables them to build more customer-centric communication strategies, sync up their marketing activities, and improve their ROI.

Historically, media planning has relied primarily on panel data and surveys. By using data directly from retailers, however, CPGs now have an opportunity to transform the way they plan and buy media – reaching a whole new level of customer understanding and ad spend efficiency in the process.

Vitally, the more that retailers fuse their data with other sources, the more powerful these “planning engines” will become – which is why I believe that they hold the keys to the next generation of media planning tools.

AgenciesBrandsMediaResearchRetail Media

Follow ExchangeWire