Weve Rings In Privacy Change Amid Question Marks Over Pricing, Leadership

by on 24th Jun 2014 in News

Weve is preparing to exit the beta phase of its mobile display advertising project with question marks over who its next CEO will be, but does claim to have cracked a key component in the mobile advertising conundrum by introducing the European standard privacy icon to its ad formats.

But after an extended beta phase, where its pricing policies were called into question, media buyers are awaiting the robustness of its platform to be proven.

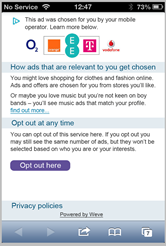

Weve, a joint venture between the UK’s three largest operators EE, O2 and Vodafone, has announced the introduction of EDAA’s (European Digital Advertising Alliance) AdChoices icon on every display ad it serves.

Also known as the AdChoices’ icon, web users can click on the triangular image and are then directed to a page informing them of how they have been tracked using behavioural targeting technology, plus also presents them with the choice of opting out of being served such ads.

The privacy icon, which is the industry standard denoting that a unit has been served using behavioural targeting, has been mandatory on desktop since 2013 as part of self regulatory industry push.

But this has not been the case on mobile, as behavioural targeting on desktop is performed priorly through the use of cookie data, which does not work as well on mobile, due to restrictions imposed by handset operating system (OS), such as Apple.

Weve, will now be using and serving the AdChoices icon on every display ad, for both mobile web and in-app display and has dubbed this move an “industry first” and hailed it as “a major step forward for promoting user privacy and control on the mobile web.”

Non-reliance on cookies

Once a user has opted out, they won’t see interest-based ads via Weve even if they subsequently acquire a new handset, this has been made possible as Weve’s ads are based on consent-based consumer data generated by its three shareholders.

Hence Weve is not solely reliant upon cookie data to offer this as a service.

In a press release announcing the service, Nick Stringer, chair of the EDAA, and IAB director of regulatory affairs, said: “Consumers need to have meaningful transparency and control over targeted advertising across all EU markets. Weve’s solution builds upon the industry-agreed desktop approach and leverages it in the mobile market.”

Copy-and-paste option?

James Chandler, Mindshare, global head of mobile, told ExchangeWire: “The principle is great, the IAB is trying to do likewise, but is likely to take longer given they have to get a lot of parties on board. So this is a good unilateral move from Weve.”

However, he does add that he had initial concerns about taking a ‘copy-and-paste’ approach from desktop to mobile, when it comes against all accepted wisdom.

“What we’re expecting of consumers is to see a tiny triangle, on a tiny banner, on a tiny screen and then click on it,” he added.

Weve preps full-scale launch, answers critics

This move comes six months after Weve announced it was to launch its display advertising service which lets advertisers bid on ad placements on third-party websites and apps with the inventory sourced via ad exchanges using Byyd’s Madison DSP.

The joint venture company, which claims to have an addressable market of over 22 million of the UK’s mobile users, made much of the fact that its service would let advertisers cross reference its own first party data with their own CRM systems, and positioned the service in competition to rival platforms such as agency trading desks.

Sean O’Connell, Weve’s head of product, told ExchangeWire that integrating with third party platforms would pose: “A level of risk that would be unacceptable to us.”

Again, this is due to the three Weve stakeholders’ instinct to err on the side of caution when it comes to its subscribers’ data.

Although A Weve spokesmen subsequently did not completely rule out the possibility of offering a self-serve and managed service display advertising service – in effect, white-label Byyd’s Madison service.

Speaking earlier this year, in answer to some of ExchangeWire readers’ questions, Henry Howe, Weve’s head of display, said: “We have built the Weve Mobile Audience Platform to effectively stand as an intelligent DMP.

“This allows us to hold the data from the operators securely and then make it available within our instance of the Adfonic [Byyd] DSP as the mechanism for campaign delivery with our audience applied.

“Our audience platform also houses the campaign data, which allows us to not just offer how many users clicked, but what was the demographic breakdown or social grade of those user who saw the ad or engaged with it in some way. It’s much more than just an ad-net[work], lots planned to build out the brand proposition for the rest of the year, video will be a focus for us too.”

Questions over pricing

In the initial aftermath of the launch, ExchangeWire sources questioned the prices being quoted per campaign, as well as the granularity of the targeting data offered by Weve.

One influential mobile media planner told ExchangeWire: “I think even Weve will admit it didn’t get its beta right, when it comes to pricing. They we asking for iAd-like prices.”

Perhaps this is why Weve’s beta-phase was extended beyond its initially planner three month beta? Plus in the interim, the joint venture company was hit last week by the news that it’s CEO David Sear is poised to leave the entity, with no named successor in sight as yet.

However, Weve is poised to fully launch its mobile display ad service next week, and hopes to come to market fully with a suite of case studies garnered from its initial beta phase. For instance, Weve claims it experienced a 0.002% consumer opt out rate compared to the total number of impressions it served in beta.

Weve hopes such data will further woo advertisers (and in particular the lucrative brand advertising budgets). Mindshare’s Chandler says: “The pricing from Weve is a lot ‘punch-ier’ now.

“In the initial phase it was pricey, but I’m in a wait-and-see mode. I’m happy to pay four times the industry average price [per campaign] if it works four times as well. But we have to wait.”

Ad NetworkAdvertiserBrandingCross-ChannelDataDigital MarketingDisplayExchangeMartechMedia SpendMobileProgrammaticTargetingTrading

Follow ExchangeWire