Why ExchangeWire is Boosting its APAC Focus

by on 7th Jan 2015 in News

Asia Pacific (APAC) is widely recognised as the world's fastest-growing advertising market, and ExchangeWire has appointed Eileen Yu as regional editor, to ramp up coverage of its programmatic sector, as the title increases its commitment to the territory.

Singapore-based Yu has over 16 years of experience on multiple tier-one technology titles including; ZDNet, and ComputerWorld Singapore, covering enterprise software, networking and data analytics. Her strong experience in covering the enterprise software market will give Yu a unique perspective of the market as the digital advertising in the region becomes more dependant on technology and data.

Yu's focus will cover the South East Asian and Australian markets with a focus on programmatic, advertising tech and marketing technology related content. She joins Wendy Hogan, who will continue as ExchangeWire contributing editor, APAC.

Regional Growth

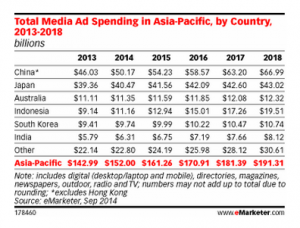

The research firm's Global Media Intelligence Report notes how the region's digital advertising market hit $41.33bn last year, representing a 18.3% increase, with China accounting for 45.9% of the market ($18.96bn), and Japan the second-most valuable individual market at $9.19bn.

The research firm's Global Media Intelligence Report notes how the region's digital advertising market hit $41.33bn last year, representing a 18.3% increase, with China accounting for 45.9% of the market ($18.96bn), and Japan the second-most valuable individual market at $9.19bn.

This is in addition to the company earlier forecasting that display ad spend using real-time bidding (RTB) in the APAC region (excluding Japan) will hit $118.3m in 2016.

Growth opportunities

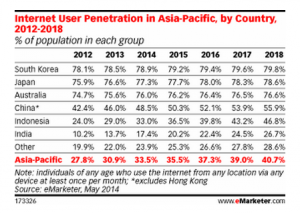

The potential scale of growth in the programmatic advertising sector there is highlighted when we look at the relatively low numbers when it comes to the total online audience. A further eMarketer report notes the total internet user base in APAC was 1.33 billion in 2014, making it the largest single regional online population globally, but this is at a penetration rate of only 33.5%. The research firm further forecasts that penetration rates will still be below 50% (40.7%) by 2018 (see chart below, right).

Such is the scale of the opportunity, and from figures like this it is also apparent how veteran digital advertising figures in the region such as Matt Harty, Experian, general manager, audience solutions, are quick to point out the dominance of print on most media plans..

But the transition to digital is happening, and programmatic is well placed to become the preferred option for executing media buys across different channels.

Region-specific challenges

But the local programmatic market does continue to be hampered by a number of stumbling blocks: namely, a lack of local market data; and a skills shortage in the region.

But local sources are also quick to highlight that many Western programmatic advertising firms eager to lay down remotes there often underestimate the intricate challenges posed by the scale of the APAC market.

Given the APAC region consists of an intricate patchwork of disparate markets - each with their own business customs and languages - parachuting foreign execs is strategy that invariably leads to a failure in market.

In an earlier piece for ExchangeWire, Phu Trong, TubeMogul, managing director, South East Asia, and IAB Singapore leadership council member, points out that the successful use of programmatic technologies can help advertisers manage the vast diversity of the APAC market more efficiently.

However in the same piece, Trong also raises how something has to change for this to happen, and this was further underlined in a recent ExchangeWire poll conducted in partnership with Google, identified a significant programmatic skills shortage in the region.

The results revealed how many digital media staff on the ground were unaware of the processes and benefits of conducting ad campaigns using programmatic technologies.

Failing to seize the opportunity

Failing to seize the opportunity

Equally as troublesome was the fact that there is mass tech fragmentation in the region, with almost half of all respondents (43.64%) claiming their company uses "five-or-more" technology platforms to "manage and execute media across various channels and point solutions".

For instance, 55% reported "skills sets of employees", when asked what what was their "biggest barrier to setting up the optimal organisational structure for programmatic?".

Hence, it is clear to see that much work needs to be done if programmatic advertising firms are to realise the scale of the opportunity in the market.

APAC market manoevuring & innovation

However, this is not to say APAC is bereft of innovation when it comes to the use of ad tech, to think so would be a complete misnomer.

However, this is not to say APAC is bereft of innovation when it comes to the use of ad tech, to think so would be a complete misnomer.

Given the comparatively low rates of internet penetration in the region mobile targeting is a particular area of focus. For this reason, it is unsurprising that Amobee (owned by Singapore-based mobile operator group Singtel) has made significant strides in establishing a cross-channel, cross-device end-to-end offering, following its dual purchase of Adconion and Kontera for a combined fee of close to $400m last year.

Add to this the recent launch of the InMobi Exchange (powered by Rubicon Project) in the region, and it's clear to see the anticipation among at tech players that APAC advertisers will be willing to pay top dollar to target consumers on their primary media consumption device.

Likewise, AdNear (another Singapore-based outfit) is also poised to help advertisers target the region's mobile users, having raised $19m in Series B funding late last year, in addition Wego launched its own publisher trading desk to leverage its own first party data.

Elsewhere, Australia continues to power ahead in programmatic with more budget at the agency level shifting to programmatic and sell-side initiatives like the launch of publisher consortiums to help local publishers compete with scaled media plays like Google and Facebook.

ExchangeWire to provide local intelligence & data

With all of this activity, it appears the region warrants enhanced coverage, and ExchangeWire aims to both chronicle this, as well as facilitate its further growth through both Yu's on-the-ground reporting, plus the output of its newly launched ExchangeWire Research, headed by Rebecca Muir.

This output will culminate with the next ATS Singapore, which has been confirmed for 6 July, 2015, more details to follow soon.

AdvertiserAPACATSCross-ChannelDataDigital MarketingDisplayIndiaLocationMedia SpendMobileSingaporeTrading

Follow ExchangeWire