The Future is Mobile - So, How Can Brands Harness It?

by on 29th Jun 2020 in Deep Dive

Whilst COVID-19 has wreaked havoc on much of the ad industry, certain channels have been able to ride the storm, experiencing a newfound boost or seeing pre-existing upticks accelerating. Mobile falls into the latter category: whilst global stay-at-home measures have made mobile phones the companion of many consumers, average time spent on mobile and app usage have been on the rise for quite some time.

With a larger audience and higher usage levels, mobile and in-app advertising have become fertile grounds for brands on the lookout for eyeballs: App Annie’s “The State of the Mobile in 2020”, which is based on 2019 mobile trends, predicts that consumers will have spent more than USD $380b (£297.9b) through mobile by the end of this year. Whilst this estimate does not account for the impact of COVID-19, recent figures suggest that mobile is faring relatively well amidst the crisis.

With consumer preference growing and the advent of 5G, it certainly is an exciting time for mobile. Whilst it has its own challenges, mobile’s prolific expansion, diverse and engaged audiences, and continuing innovation put marketers in a great position to take advantage of the clear opportunities the market has to offer.

PubMatic has produced this Deep Dive special, in partnership with ExchangeWire, analysing the current in-app landscape and covering the opportunities the market holds for advertisers. PubMatic is a leading sell-side platform that delivers superior revenue to publishers by being the SSP of choice for agencies and advertisers. By analysing over 15 trillion global advertiser bids flowing each month through its platform, PubMatic can observe real-time developments in the mobile space that may allude to broader digital industry trends, and can then compare this information to other published data to further understand changes in the mobile landscape. Programmatic tools and services are a vital facet of the entire digital advertising industry, with information sharing crucial to aligning the digital industry towards best practices and, ultimately, growth in mobile advertising.

In this DeepDive special:

– An overview of the growth of mobile advertising

– The state of play for in-app advertising

– The value that brands are yet to realise

– Predictions for the future of in-app mobile advertising

Growth

The most important trend is also the simplest – mobile app continues to be the preferred access point to the consumer’s digital world. In fact, the vast majority of today’s smartphone users spend most of their time in apps rather than web browsers, with the average person spending 2 hours and 57 minutes in apps compared to just 26 minutes on a mobile browser.

Consumers downloaded 204 billion apps in 2019, as users around the world shifted to mobile-first browsing behaviours. COVID-19 lockdowns saw even more people turn to mobile for information, entertainment, connection, and a sense of normality.

Mobile spend is on the rise

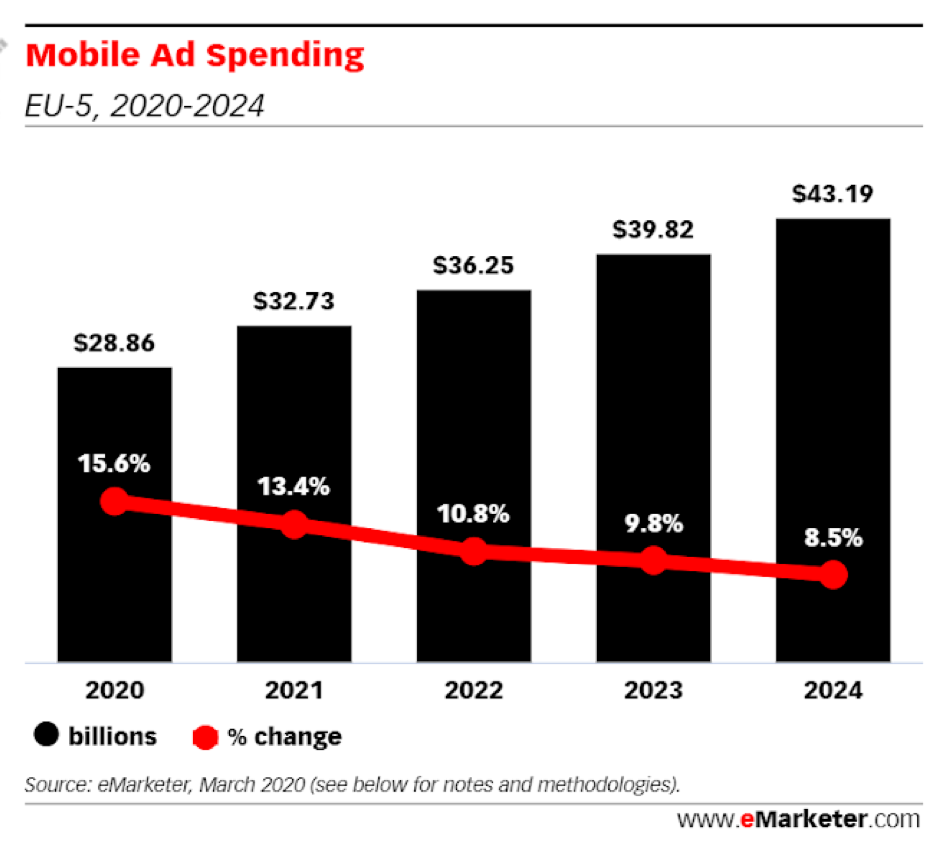

eMarketer projects that mobile ad spending in EU-5 (France, Germany, Italy, Spain and UK) will reach USD $43b (£33.7b) by the year 2023, up from USD $28b (£21.9b) this year. With numbers like these, it’s evident that this growing format is here to stay.

Brands prefer to buy apps programmatically

Among the Western countries, programmatic first took hold across desktop and mobile internet. It’s taken time for both mobile app developers (apart from social networks) and ad buyers to embrace programmatic, particularly with the latter being so used to transacting largely on cookie-based identifiers. While in-app programmatic still has its challenges, it is continuing to mature: today, the vast majority of mobile display ad dollars are programmatic. At PubMatic, we believe that programmatic strategies will get a larger portion of in-app advertising budgets.

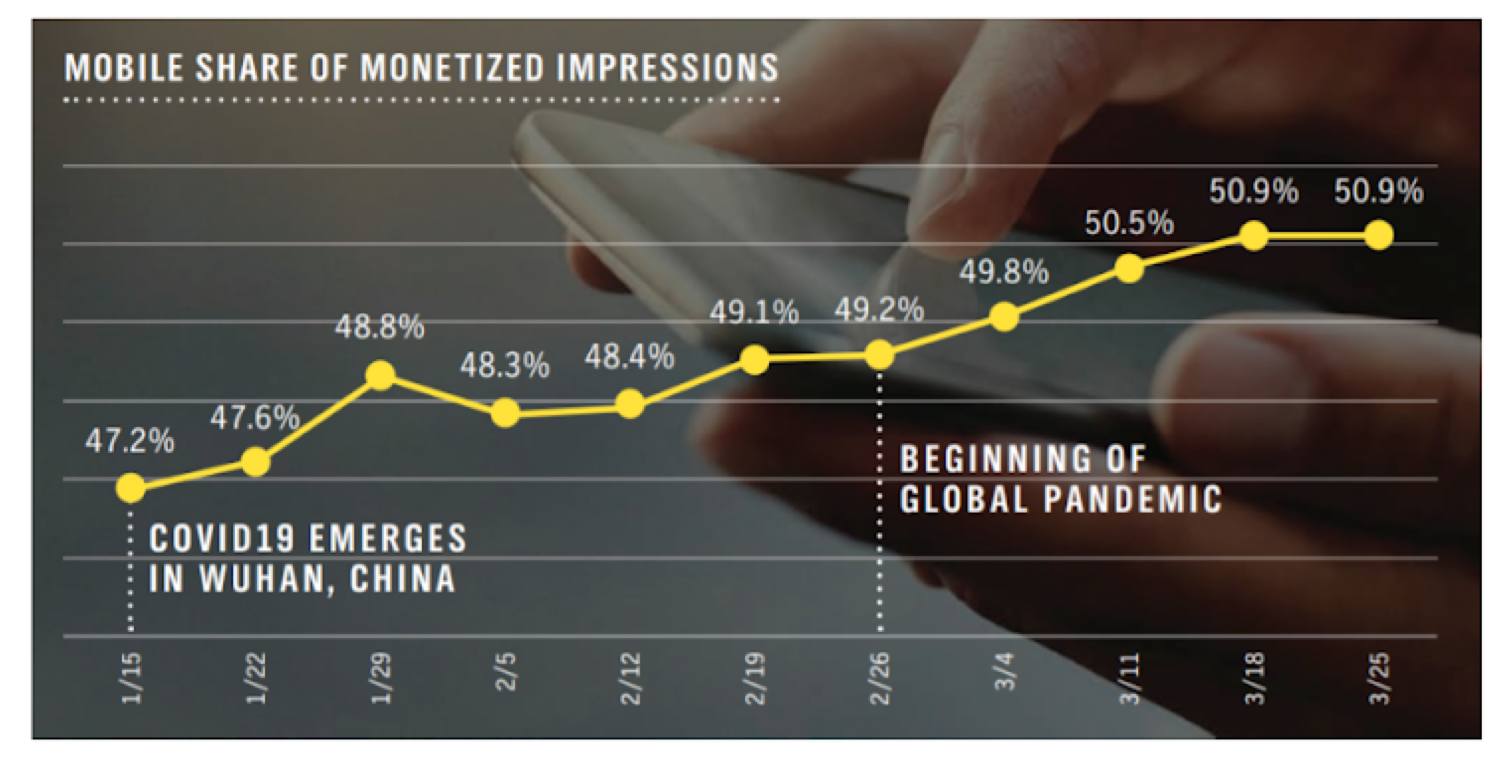

Shift from desktop to mobile is accelerating post COVID

Mobile was less impacted by coronavirus, with ad spending falling 15% post-impact (compared to desktop ad spending, which fell 25%). As a result, the shift in share from desktop towards mobile is happening at a quicker pace than before the pandemic: total mobile share of global ad spending reached 51% by the end of Q1, up from 48% at the beginning of March (before the onset of the global pandemic).

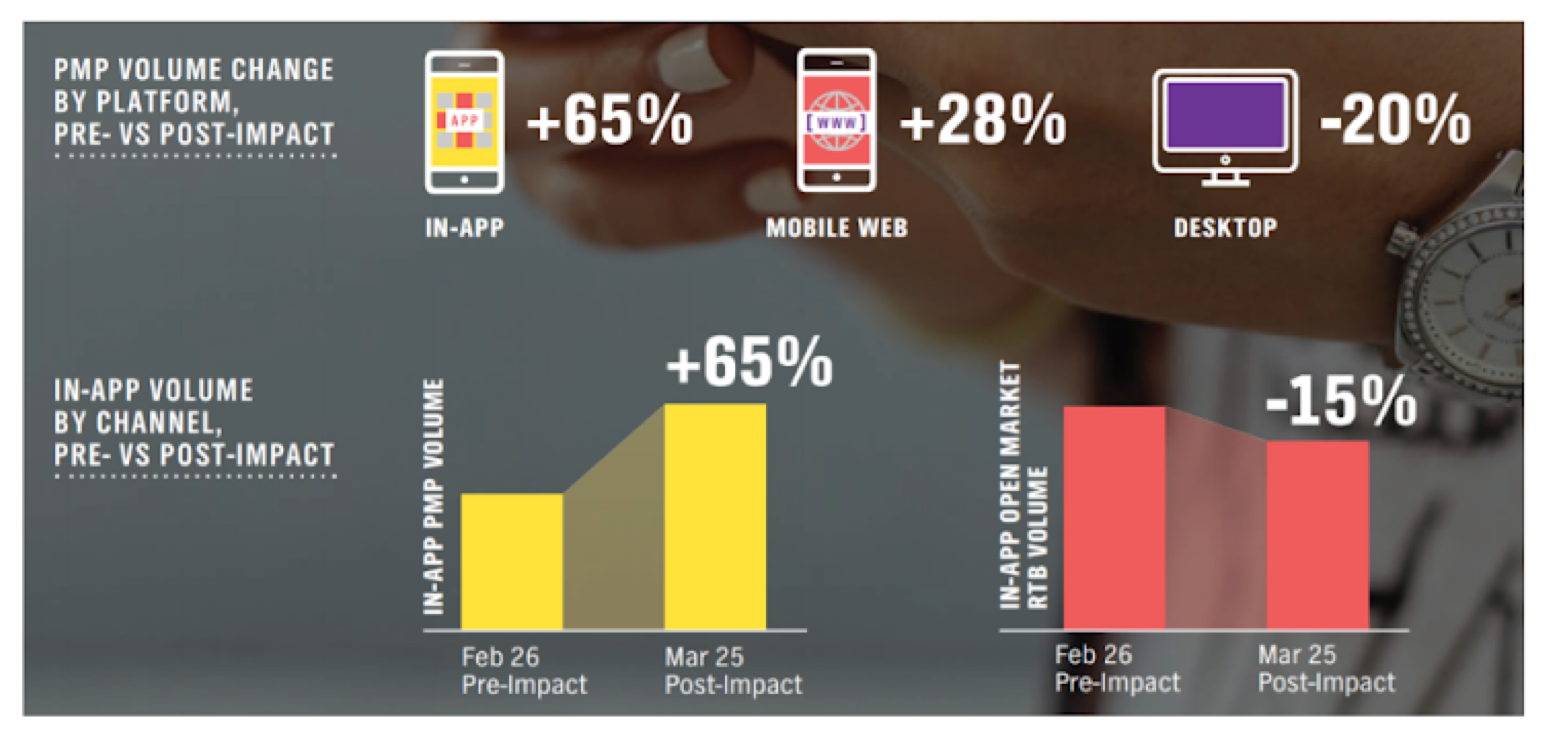

In-app ad spending moves towards PMPs

Advertisers have shifted their budgets away from the open market in favour of in-app PMPs. Mobile in-app PMP volume rose 65% during the pandemic, while desktop PMP volume fell 20%, alongside in-app volume in the open market, which declined by 15%.

In contrast, in-app PMP spending in EMEA nearly doubled (+96%) within the first five weeks of lockdown.

Mobile video ads contracted more than display

Mobile video spending was expanding at such breakneck speeds before the global crisis that, while mobile video ad spend declined during the pandemic, it contracted less than display overall.

The coronavirus pandemic has accelerated the shift in media buying from desktop platforms to mobile as consumers spend more time on their phones. While the volume of viewer impressions on desktop computers has fallen since the start of the health crisis, it remains steady for mobile devices. As the economy recovers, advertising will follow, giving publishers with advanced mobile advertising capabilities an advantage. While recent surges in viewership will likely recede throughout the summer, and as stay-at-home orders ease, the preference for mobile will remain, which will drive advertisers to mobile over the long term.

So, what do media buyers need to know about in-app advertising opportunities?

Demystifying in-app advertising - what buyers need to know

The increase in in-app spend has prompted marketers to build features like advanced search and opt-in push notifications. However, for many brands and agencies, incorporating a mobile app into the larger context of their marketing strategy remains a challenge.

Measurement and Transparency

Media buyers rely on a raft of metrics to measure the performance of their campaigns – and everything from clicks, installs and purchases can be used as a proxy for success. But a question more fundamental, and more difficult to measure in the in-app space, is whether or not the ad was actually seen.

In 2018, the IAB Tech Lab’s Open Measurement (OM) SDK was made widely available – it includes viewability trackers from multiple vendors in one handy SDK, thereby alleviating many of the difficulties experienced by developers. Rather than having to integrate with multiple vendors, developers can adopt a single standardised SDK, and buyers can finally get a true picture of whether their ads are being seen.

Then, last year, Tech Lab launched app-ads.txt – the app equivalent of ads.txt - making the app ecosystem a safer and more transparent place for buyers.

While adoption of both these measures was initially slow, growing awareness on both sides of the ecosystem has seen them gain traction.

With OM SDK is particularly important to app developers who are moving into programmatic, as 42% of brands and 48% of agencies cite viewability and measurement challenges as a key issue of in-app advertising. If an app developer overlooks integrating a measurement SDK, then their advertising clients will struggle to accurately measure the app’s ad viewability. And viewability impacts how campaigns get billed - mainly because advertisers use their programmatic buying platforms to selectively spend on highly viewable inventory. Since its release, OM SDK is the trusted standard for buyers, giving them more confidence to buy in-app.

Some managed in-app header bidding solutions, including PubMatic’s OpenWrap SDK, come pre-integrated with OM SDK, which ensures that all display and video impressions served by the SDK are viewability measured. If you’re looking to widely activate brand dollars, it’s important to choose a setup that includes OM SDK support.

Quality

Traffic quality concerns have alarmed some media buyers, causing them to take the white-listing approach of largely accessing mobile inventories via Private Market Place (PMP) deals. With much COVID-related content having been hit by keyword blocking in the last few months, publishers, especially news outlets, have felt the impact that brand safety filters on their revenues, and saw lower CPMs.

Unlike open auctions, PMP trading offers more control due to its exclusivity and, as such, inventory here is considered premium. PMPs provide greater transparency and control for all parties involved, providing a clear look at the inventory being bought, what CPM needs to be paid, and the types of creatives being displayed. It also gives advertisers access to premium inventories before they are made available for open auctions. Lastly, PMPs are a way to lock up inventory that’s absolutely working for buyers, to bring in first- or second-party data sets that can’t be released into the open markets, and to try and avoid some of the ad quality issues that often curb spend in open markets (such as fraud and brand safety).

In a PMP environment, deals can be created from a curated list of publishers that have deployed the OM SDK across EMEA. This tactic allows the brand to buy with confidence across a quality, measurable inventory pool using their verification vendor of choice. By accessing inventory in a Targeted PMP, a buyer would solve the challenges and also eliminate the need for multiple sell-side deals. Whether choosing to spend only with apps deploying the OM SDK, or category- or audience-curated PMPs, these options can be a great addition to an advertisers’ programmatic toolkit.

Targeting

Unlike web-based third party cookies, app targeting runs on Device IDs, which can lend themselves very well to targeted media buying:

- Device ID has a longer lifespan (as long as that of the handset); hence, the tracking and targeting of the user is prolonged, and could be more accurate.

- Whilst not infallible, device ID is generally unique to the owner of the device, so marketers can assume that they are likely to be targeting a unique individual.

- Cross-device tracking becomes more complete with device ID, allowing marketers to identify users on mobile, and to connect those same users with data from their desktops and connected TV devices.

- Location targeting becomes more far more effective and accurate.

When it comes to performance, methods that work for desktop do not necessarily translate to mobile - incorrect use of targeting parameters on mobile can result in mobile seeming to under-perform. One example of this is using cookies to determine a target audience compared to assessing the nature of the mobile application to identify a relevant mobile user (or audience).

If an advertiser were trying to identify vehicle owners via the internet, they would look for terms such as "car deals" in a user's browsing history. However, on mobile, app information, such as a user's download of a real-time traffic app, offers a more robust way of identifying current vehicle owners. In this instance, we can see that if the targeting parameters used on the web were applied identically to mobile in-app, then the advertisers would have missed a potential customer.

Engaging ad-experiences

We hear a lot of misconceptions around in-app marketing, especially around delivering experiences that are easy or intuitive for audiences. In the past, app advertising would focus solely on driving installs; but now, with the use of matching creatives with deep links, savvy advertisers are driving customers to specific places inside their app - creating an effortless route to purchase. The app ecosystem especially has proven how new companies who understand the advantages of mobile can disrupt existing verticals - from games, to finance, to retail, and beyond.

Using the right ad format is vital for engaging with the target audience. Rich media banners are commonly used by media buyers in in-app environments, but interest in in-app video is on the rise. Media buyers need to ensure they use a variety of ad formats and take advantage of this engaging media with a variety of different creative assets.

The 5G era

Mobile in-app advertising is about to get a huge boost from advances with 5G. By 2023, global 5G smartphone shipments will number over 424 million (compared to 73 million this year). 5G phones are expected to represent a major performance leap for user experience on mobile, particularly with high-definition media and interactive technologies, such as the mobile gaming and mobile video streaming spaces.

These developments present a whole host of new opportunities for advertisers, giving them greater room for creativity, and opening the door for them to deliver high quality interactive ads on mobile devices.

Future

- We predict that 2020 will be a good year for mobile advertising, especially in-app, thanks to ongoing transparency and measurement initiatives. Many have started to adopt IAB standards, app-ads.txt and viewability measurement, particularly those looking to expand their audience base beyond domestic borders and gain access to international demand. Pixalate’s most recent App-ads.txt and Ads.txt Report found that the adoption for app-ads.txt in 2019 has skyrocketed with an increase of more than 5000%.

- The roll out of 5G will also present brands with big opportunities in the coming year.

- Online publishers with their own mobile app will be able to take advantage of first-party data, leveraging it to build audiences. Now is the time for media buyers to start taking advantage of the rich data points that mobile inventories can offer in terms of targeting, ROI, and customer experiences.

- Consumer privacy will play more prominent role in ad targeting that is based on user data collection.

- Advertisers will continue to look for more control; buyers worldwide are already utilising PMPs to help them protect their branding and avoid ad fraud.

- Video ads, which are already outperforming other ad formats, will continue to lead.

How are advertisers changing their approach to working with in-app publishers, and what should the industry expect to see over the next 18 months?

The rise of in-app usage will push the industry to solve mobile's challenges

Digital identity is critical to the future of advertising and is currently being challenged by the demise of the third-party cookie. Considering this radical change, coupled with the fact that 90% of a user’s time on their smartphones/tablets is spent in apps (vs. 10% on web browsing), there's no doubt that advertisers will be shifting large parts of their budgets to in-app advertising. It is no secret that MAIDs (mobile AdIds) are inherently mobile-based and more sustainable and efficient identifiers than cookies — so the industry and publishers specifically now have more reasons to improve on known in-app mobile challenges to drive more demand towards it.

Google’s announcement should help catalyse the industry to improve on these issues and finally drive the deserved demand to in-app advertising

Historically, the migration of marketing spend from web to in-app advertising hasn’t kept pace with the amount of time users spend in apps. This disconnect has mainly been due to viewability issues, brand safety concerns and the fact that audience ratings vendors have been slow to pay attention to the app space. Google’s announcement should help catalyse the industry to improve on these issues and finally drive the deserved demand to in-app advertising.

In broader terms, the industry can expect to see more paywalls and login walls as first-party data becomes a virtual gold mine for both advertisers and publishers, together with the rise of Universal ID solutions in an effort for cookie-reliant vendors to survive and others to simply solve the imminent cookie challenge.

Denis Palmer, Global Director Channel Partnerships, Zeotap

The in-app opportunity is yet to be fully untapped

We’re seeing a huge push within our industry, driven at a client and group level to develop best practice frameworks and guidelines for media buying within the in-app space. As well as a specific focus on brand safety, we are building our own methodologies towards buying, measurement and optimisations tactics. We are starting to see mobile in-app networks getting more traction with agencies and brands directly, looking to dip their toes into this untapped (by many big brands) inventory base. We’re also seeing our more traditional display partners, ad-exchanges and DSP’s come to use with in-app inventory sources. It does seem strange that we spend so much time within in-app environments, yet we are hardly advertised to by the biggest brands we are most familiar with. It’s only a matter of time before this changes and all apps, gaming and non-gaming have monetised their inventory and made it available programmatically for the industry.

Daniel Sichel, Live Planner, Mindshare

Data, insights, and gaming are huge drivers behind in-app's growth

We have noticed that some clients are now approaching in-app with a more robust data-and-insights-driven approach. Publishers with extensive first-party data, or in-app vendors who have their SDK integrated with premium publishers at scale, are in a position to offer up a winning combination of both deterministic and contextual targeting. It’s then about what you do with that data: from what we've seen, full screen or rewarded video seems to compliment the environment well.

"Changing attitudes across the industry with regards to gaming will help drive more investment towards in-app"

We have already witnessed one of our clients double their programmatic investment with a particular in-app vendor YoY, driven by consistent 90%+ viewability and 80%+ VTR. In addition, the changing attitudes across the industry with regards to gaming will help drive more investment towards in-app, as advertisers begin to understand that the gaming audience is far more extensive than first perceived. ‘Core gamers’ can be found in companion apps for games like Fortnite and Overwatch, as well as in apps for e-sports leagues, while almost all audiences can be found across the ‘casual gaming’ ecosystem.

Joe Camp, Senior Media Partnerships Manager, Amnet Global

In-app now a highly premium environment

Our brands's perception of in-app has changed, viewing the channel as a premium environment where they can engage with their target audience at scale and achieve the best outcomes for their campaigns. This shift can be attributed to a number of factors, including the support of some of the industry's biggest players, and the adoption of the Open Measurement SDK by in-app publishers, which has made the environment more measurable via third-party verification companies. This change in particular has helped brands recognise the brand safety and highly viewable nature of in-app. As a result, we're now seeing investment in our in-app publishers grow.

With these trends, and the increasing products and targeting capabilities that in-app publishers can offer, we anticipate in-app buying to grow significantly in the next 18 months, with brands moving traditional desktop and mobile web spends to in-app publishers.

Tara Kilcoyne, Technical Lead, Amnet Global

Programmatic buying potential continues to bloom

Advertisers continue to rely more on measured efforts and increasingly specific KPIs when they make bookings. It’s not a new phenomenon, but publishers are becoming much better at responding to those needs by rapidly advancing their ad-serving technology and building a more complex eco-system.

"The potential of programmatic buying continues to grow"

The advancement among publishers allows for both increased measurability and a better use of first-party data, including inventory segmentation and price points. Even a combination of different deal types allows advertiser to better reach their ROI, because the insights gained from co-operating with publishers results in a much improved bidding strategy.

The potential of programmatic buying continues to grow, and both demand and supply sides are becoming better at structuring detailed partnerships that enable all sorts of strategies, regardless of focus on eCPM, viewability, reach, and conversions.

The open marketplace is pretty much established around first price auction and header bidding (for lack of a better word) at this point. The competitive advantage will lie in designing more detailed programmatic deals to ensure better use of first-party data and better fulfilment of both advertisers' and publishers' targets.

Alexander Qvitzau Lund, Head of Programmatic and Ad Operations, upday.

Rising usage and technological changes will make 2020-21 the era of in-app advertising

I predict that 2021 will be a really great year for mobile advertising, specifically in-app.

Mobile is still trending in a really positive direction overall — screen time on mobile devices and consumption of content is increasing, and so too is ad spend, with CPMs slowly coming back following the fall from COVID-19. This increase in mobile usage presents brands, publishers, and the ad tech ecosystem with big opportunities for the future.

"I find it quite hard to not see 2021 as anything but amazing for mobile in-app advertising"

COVID-19 gave many brands time to re-assess their marketing spend and ascertain where they're achieving the most success. It also provided publishers with an opportunity to address a lot of their inefficiencies, as well as to train their teams up online. Finally, it gave buyers a chance to enhance their digital buying skills, specifically the differences between desktop and mobile in-app.

The requirement for transparency on the buy-side will continue to increase with the growing adoption of third-party verification tools bundled into the IAB’s OM SDK. If you add the plethora of studies on in-app advertising working full funnel, and add the cookie restrictions being brought in by browsers (which increases the value of in-app first-party data significantly), I believe that marketers will increasingly push towards in-app advertising. Apple's announcement at WWDC will certainly hurt the industry, but the biggest impact will likely be a change in buying behaviour. Similar to the elimination of the cookie from modern browsers, the gradual phasing out of the IDFA will increase the value of first-party data significantly for publishers, and we'll see contextual targeting come back strong.

If you combine the increased knowledge of the market, the increase in usage of mobile in-app by consumers, the adoption of improved mobile in-app ad tech, and the increased importance of first-party in-app data in a cookie- and IDFA-free world, I find it quite hard not to see 2021 as anything but an amazing time for mobile in-app advertising.

Jason Parmar, Group Head of Programmatic, Onefootball

Download Report

Download Report

Follow ExchangeWire