IPA Bellwether Report Q4 2016

by Hugh Williams on 20th Jan 2017 in News

Companies dismiss ongoing uncertainty by raising marketing budgets markedly at end of 2016, reveals Q4 2016 IPA Bellwether, released this Wednesday (18 January).

Report highlights

– Growth sustained to extend record run of growth to over four years

– Events and online marketing remain best performing subcategories

– Weaker sterling offers threats and opportunities over coming 12 months

– Ongoing uncertainty continues to weigh on financial prospects

– Ad spend expected to fall in 2017 before recovering in subsequent years

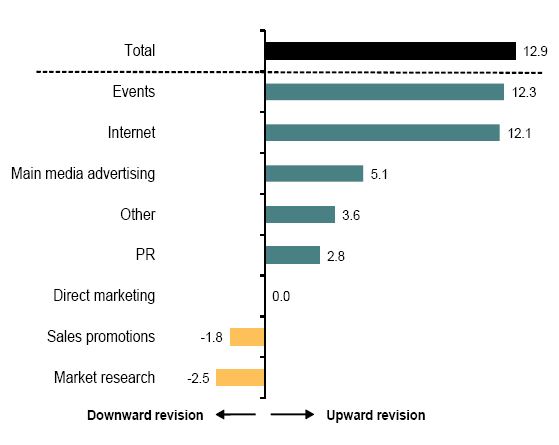

The Report, which has been conducted on a quarterly basis since Q1 2000, revealed a net balance of +12.9% of companies registering an increase to their budgets during Q4 2016, down only fractionally from Q3’s nine-quarter high of +13.4%. (The net balance is calculated by subtracting the percentage reporting a downward revision from the percentage reporting an upward revision.)

Looking ahead to 2017/18 budget plans, UK marketers have indicated a positive outlook, with a net balance of +27.6% of companies signalling growth in their total budgets for the coming year.

Ad spend forecast growth

Following a strong rise in economic activity at the end of 2016, which has resulted in an unexpectedly firm 2.1% increase in GDP, Bellwether is now anticipating adspend to rise by 2.1% in 2016, up from Q3’s estimate of 1.9%; and by 0.7% for 2018, up from Q3’s estimate of 0.2%.

However, punctuating this growth, Bellwether has forecasted a fall during 2017. Uncertainty over the impact of the negotiations of the UK’s terms of EU withdrawal is likely to drag on investment, while consumer spending is forecast to rise at a much slower rate. The result is a projected -0.7% annual fall in ad spend during 2017, unchanged from Q3’s estimate.

Online marketing

Online marketing continued to gain an increasing share in the marketing mix of companies, recording a net balance of +12.1% for Q4 2016. That compared to Q3’s +9.5% and was the best reading for two years. Within internet, mobile advertising increased, recording a net balance of +3.9%, compared to -2.6% in the preceding quarter; while internet search/SEO recorded a net balance of +7.1%, down slightly on Q3’s 7.3%. Panelists widely reported that digital marketing tools continued to offer positive investment returns by providing good opportunities to attract new customers within a manageable cost framework.

Source: IPA

ExchangeWire spoke exclusively to some of the online advertising industry’s top thought leaders about what the latest report means.

Political uncertainty is one issue that will shape the advertising industry in 2017. Ricky Liversidge, CMO and head of product at Sizmek says: "Political changes may have caused temporary uncertainty in the market, but in this environment it’s unsurprising companies are increasing their marketing efforts, particularly in the online and mobile spheres. Recent technological developments in areas such as location targeting, cross-device attribution, native ad capabilities, and large-scale personalisation through Dynamic Creative are making digital advertising an essential part of any revenue growth strategy. These tools help marketers to drive long-term brand loyalty, by delivering targeted, personalised, and pleasing online experiences."

Toby Benjamin, VP platform partnerships, Viant, agrees, and feels that effective targeting will be a key challenge facing marketers in 2017: "It’s encouraging to see marketing budgets predicted to increase yet again, especially with continued uncertainty around Brexit. But, while it’s no surprise to see continued growth in online advertising investment, the question is whether this growth can be sustained when the proliferation of devices makes cross-device targeting harder than ever.

“One ongoing challenge facing marketers is targeting. While today much of online advertising relies on cookies to target consumers, there’s no guarantee you’re reaching the right person with the right message. When you add cross-device to the mix, the cookie-based approach is impossible. A people-based marketing approach that serves relevant, engaging ads to consumers will be vital to guarantee growing online marketing budgets in years to come.”

Dom Carter, chief Commercial Officer, News UK feels that advertisers who can ride out the uncertainty of Brexit will come out the other side stronger: “The Michael Fish moment has been well documented about how wrong the forecasters were about the economy post the referendum decision and it's great to see that the great British public and business have turned a gloomy decision into a positive result. Clearly, there has to be caution as we approach the reality of Brexit, and certainly consumer confidence will be impacted, but the underlying business performance is still apparent. Advertisers need to hold their nerve during this uncertain time and continue to invest in areas that help their brands sustain for the long-term. For those who do, when consumer confidence begins to grow again, they will find a steeper return to growth. This isn't about driving click-throughs and likes, but more about reaching highly influential and engaged consumers in trusted, professionally curated media, that will determine our path to continued growth.”

Irisini Davis, director of marketing, Marin Software EMEA agrees that brands need to hold their nerve: “The gap between the brands that did and didn’t increase mobile ad budgets in Q4 was even wider than in Q3 2016; overall online spend budgets continued on the trajectory of the last seven and a half years – up.

"Brexit Britain might prompt some caution this year but, when consumers do buy, a lot will buy on mobiles, most likely after starting their path-to-conversion on another online device. If brands hold their nerve and focus on accurate ways to follow these consumers across an increasingly complex device landscape there is no reason online spend should experience an economic wobble like other sectors.”

There are differing views over whether the report will represent a strong 2017. Ken Parnham, general manager Europe, Near thinks it will. He says: “The UK may be facing a period of uncertainty, but it comes as welcome news for the advertising industry that internet marketing budgets are at their highest since 2014. Confidence in online channels continues to grow, and it’s also worth mentioning that the IPA Bellwether panelists reported positive investment returns from their digital marketing tools. Do marketers feel better equipped to invest in internet marketing – and mobile advertising, which has also increased – because they have better tools to collect consumer data and attribute campaigns? It’s very likely, and we have also been noticing the upward trend in marketing spend at Near. What’s in the cards for the marketing industry in 2017 remains to be seen; but overall the report implies a very positive and healthy start to the year.”

On the other hand, Jamie Evans-Parker, Founder & CEO, wayve also encourages caution: “It’s no surprise that with so much hesitation in the air, confidence and ad spend have dipped slightly, but the report also reflects the tenacity of the UK ad industry, with both marketing budgets and faith in individual business prospects up in the final quarter.

“We can’t say with any degree of certainty how consumer spending might change in 2017, but we know businesses that stand firm in the face of economic ambiguity and continue investing in marketing, typically come out ahead of those who draw back. The key thing for businesses right now is to keep spending, but carefully. By using advanced measurement solutions and developments in technology such as AI, companies can truly embrace creativity and tackle viewability head-on in real-time.”

Similarly, Antoine de Kermel, TVTY EMEA MD, feels the outlook is not so rosy: “The UK ad industry is facing a gloomy 2017 with the raincloud of Brexit hovering over it. The IPA Bellwether’s latest forecast that ad spend will shrink by 0.7% this year will not shock many in the industry. Coupled with the fact that 96% of marketing managers think the cost of advertising is rising, marketers face a perfect storm whereby they need to become more creative to improve results.

“We expect more brands to launch moment marketing campaigns, as savvy marketers target the precise moments where consumer interest is at its peak to avoid unnecessary ad wastage. In fact, we predict the practice of syncing the launch of digital advertising with a brand’s own television ads, and ad-jacking competitors’ TV advertising, to rocket this year as marketers look to optimise their TV advertising.”

These comments are part of a wider opinion that TV advertising will have a big part to play in 2017. John Lister, managing director, Sky Media commented: “Understandably, advertisers will be more cautious when deciding where their marketing budgets go and will be demanding clearer ROI to prove the worth of the mediums in which they spend. Research has found that assumptions of average TV viewing is 20% less than it actually is, with live viewing assumptions underestimated by nearly 40% (87% of TV is still watched live). Whether it’s I’m A Celeb, Westworld, Bake Off, or Buster the Boxer, TV is still the talk of the town. It’s the collective responsibility of all the TV companies in 2017 to better educate our customers about how strong TV viewing is and how robustly it’s measured relative to other media. I envisage in 2017 the three TV sales houses working ever more closely to market the continued fantastic brand-building capability and trusted environment of Television – this, at a time when other media attempt to take revenue with products of lesser quality and dubious measurement.”

Chris Cardew, head of strategy, Mindshare agrees. He says: “The positive story told by the Q4 Bellwether is a reassuring one and proves that, despite these difficult economic and societal times, business and brands are continuing to weather the storm and maintain consumer confidence, albeit with a level of cautious optimism.

“As a whole, it’s been a good quarter for media and marketing. For the majority of the big retailers, such as M&S, Christmas delivered bumper results. This was supported by high-profile marketing campaigns and investment, demonstrating their confidence in consumer spend. Similarly, Amazon continued to change the game with their service proposition, also supported by significant marketing investment.

“While digital continued to see growth, TV ad spend was sustained, proving the value and importance of the medium in the modern day media mix. On the social side, despite the fake news drama, Facebook continued to sweep up the lion’s share of social budgets.

“This year, it is likely we will see brands sustain marketing investment as they seek to provide a much-needed comfort blanket for the uncertain times that lie ahead.”

Justin Taylor, MD, Teads UK, thinks the report is good news for the wider online advertising industry, and feels Brexit could boost digital video: “From a digital perspective, these figures are telling a familiar story: online advertising, and particularly video, continues to grow its market share and firmly establish itself as a dominant marketing channel. It’s great news, but it also puts even more responsibility on us as an industry to deliver the best context and outcomes for brands’ investment, whilst always respecting the user experience.

“If Brexit worries do put a strain on budgets in 2017, as the Bellwether predicts, I believe digital video is in a great position to demonstrate flexibility and ROI for advertisers. With more and more inventory being traded programmatically, we believe there is a great opportunity to deliver creativity and personalised video advertising more efficiently than ever before. Brands that harness these opportunities, alongside premium and quality environments, will win both the publishers' hearts and the consumers.”

Abi Jacks, director of marketing, Rakuten Marketing UK, says that the real opportunity for 2017 lies in mobile: “It is clear from the IPA report that internet advertising is not slowing down, particularly mobile. Key focuses for mobile spend in 2017 will include marketing to millennials, and those close to them, as this audience becomes increasingly influential for brands. A recent eMarketer study showed that, not only are 52% of millennial mobile users now using devices to compare prices to other retailers whilst in-store, but that millennial mothers use their smartphones as a crucial source to search for products, read reviews, and find the best prices.

“In this environment, a data-driven approach to mobile, alongside strong native social advertising, is critical in getting a brand or product in front of the millennial audience. Only with insight about the role of Facebook in the wider journey can mobile be most effective. Brands must be able to understand the interest that leads the customer to find the right product, compare prices, and buy if they are to create successful campaigns. Brands should be building their mobile strategy with the buyer’s journey front and centre.”

Although budgets are on the up, Bea Patman, head of SEO at Greenlight Digital, questions whether they are being well spent: “The IPA’s Bellwether report shows an increase spend of 12.9% last quarter, which is great to see, but what marketers need to be asking themselves is whether they are using the budget in the most effective manner for their business?

"Greenlight’s research found that almost one-in-three marketers struggle to prove ROI, demonstrating the need for marketers to prove how the increase in budget is improving their campaigns. If digital marketers are to command the attention of C-level executives, and continue to secure a greater proportion of marketing spend to drive growth, the industry must improve measuring investment in tools and talent, particularly when experimenting with new or unproven technologies and platforms."

Follow ExchangeWire