Retail Media: The Retailer Gameplan

by Ciaran O'Kane on 5th May 2022 in News

Retail media is the biggest ‘green field' space in digital advertising. Online retailers and marketplaces are going to be the biggest beneficiaries, as trade budgets migrate online.

Amazon remains the alpha walled garden, making USD$40bn in revenue from serving product ads on its e-commerce sites. But there is room for growth for mid-tier platforms.

What needs to be done to unlock this spend? In this piece, we look at the product innovation and the technology layer that will be crucial for the growth of the retail media segment.

Moving beyond retargeted product display advertising

What we are seeing in the first iteration of retail media is retargeted advertising. This will be a starter for most brands getting to grips with executing campaigns across the burgeoning retail media ecosystem.

Beyond retargeted product display ads, you will see growth in product video ads and live commerce.

Live commerce is already huge in China and Southeast Asia. This new channel will become a key selling tactic for brands - so expect to see new high-priced formats, incorporating these new features.

Product video and live commerce are still very nascent outside the APAC region (just go see for yourself on Amazon). We will see growth in use, as advertisers experiment with new tech to improve both engagement and optimisation.

Innovative creatives like conversational media units and product recommendation will also see a lot of adoption - particularly the former as the advertisers look to engage customers and push them down the funnel.

How retailers need to build a robust ad infrastructure

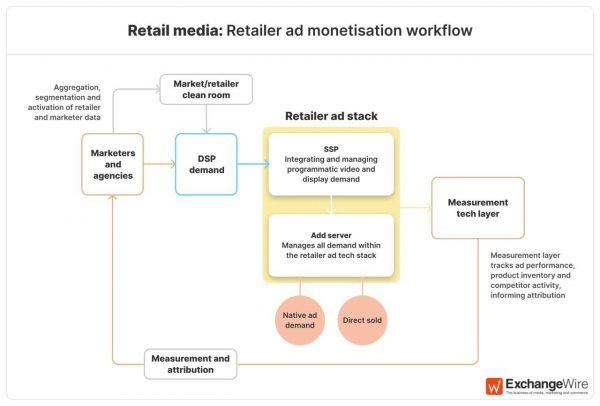

Right now many online retailers are experimenting with basic display ads on sites. Serving targeted ads is an important start, but to scale this opportunity, online retailers will have to invest in ad infrastructure, resources, and proper API access to buyers (all outlined in the graphic below).

Buyers will also look - very quickly - to invest more ad spend on sites that are transacting their product. Linking ad spend with sales performance onsite will be fundamental to the success of retail media.

Source: ExchangeWire

The important components of this workflow include:

Retailer Ad Stack

The ad server will manage all demand within the retailer stack, including keyword buys, direct sold and programmatic. The ad server is the critical piece in the stack, as most big ticket campaigns are likely to be sold directly.

At the heart of the programmatic integration will be the SSP. There are likely to be thousands of online retailers globally, so aggregation of demand will be necessary. The SSP will manage auctions across inventory sources (display, video, native and rich media). The success of the SSP will depend heavily on the type of data made available in the bidstream? And with data so tightly controlled, will we see RMADs (retail media ad networks) emerge to fill this aggregation void?

DSP Demand

The programmatic demand will come from DSPs. At first we will see basic display campaigns. But as the ecosystem grows expect to see performance budgets being shifted across from display ID dead zones, as marketers chase ROI on spend.

Measurement Tech Layer

It is important to note here that attribution is the big draw for buyers in this channel. A bunch of new companies provide that measurement layer, delivering sales data, inventory supply optimisation and campaign performance back to marketers and agencies. It is critical that retailers provide robust APIs to give these independent measurement vendors access to data points.

Clean rooms

There will likely be concerns around privacy and data leakage. Clean rooms will be used by both marketers and retailers to aggregate, segment, and activate data segments.

Clean rooms enable advertisers, retailers, and data providers to match user-level data without actually sharing any PII/raw data with one another.

The biggest issue around clean rooms is activation. You cannot use IDs to activate segments onsite for the obvious reasons; namely platform restrictions, legislation, and user behaviour.

There will need to be interoperability between clean rooms, with segments always being activated on the sell-side.

The retail media supply-side will not mirror online display. Google does not have a foothold in the channel. Nobody on the supply side has a revenue dependency on Adwords, which will restrict Google’s ability to commoditise key areas of infrastructure. Another is the restrictions around supply-side data.

The latter will shape the supply-side ad workflow more than Google dominance. Time to get building.

Follow ExchangeWire