Focused Financials Q2 2023: Retail Media

by Mathew Broughton on 17th Aug 2023 in News

Each and every quarter, fans of numbers and nosy corporate examinations alike are treated to a wealth of data, as public companies open their accountancy doors and tell us how they performed over the previous three months.

In this article, ExchangeWire research lead Mat Broughton sets out to distill what recent financials are telling us about the state of one of the most talked about segments within the ad tech industry: retail media.

Walmart

- Advertising revenue continues to soar

- An experimental approach set to accelerate this further?

Walmart, a crown jewel of the retail media ecosystem (alongside a certain rainforest-themed big tech company), is continuing to grow its advertising business cautiously, but with impressive results.

As of the close of its 2022-2023 financial year in February, Walmart’s global advertising revenue stood at USD$2.7bn (~£2.1bn). While this is undoubtedly a small slither of total USD$164bn (~£129bn) revenue, the segment is continuing to grow at a rapid pace, growing 30% year-over-year over the previous quarter.

In any case, a near-3 billion dollar business is impressive in its own right, but the continued scale of the revenue increase for such an established business is remarkable. Moreover, Walmart executives are looking closely at how its retail media solutions can be leveraged across its physical stores, boosting options available to brands. In-store demos with curated QR codes, and advertising slots within Walmart Radio are two options that have been recently rolled out, while further products are in development.

Walmart has also been foraying into the realm of another industry hot topic: CTV. Specifically, the retailer is partnering with NBCUniversal, which will see sports streaming inventory available to Walmart’s retail media network, alongside its previously announced partnerships with Roku, TikTok, and TalkShopLive. As we discussed on a recent episode of the MadTech Podcast, this is a highly interesting tie-up given the high proportion of food and beverage advertising during these broadcasts, alongside traditional brand-building creatives.

Criteo

- Correct move to be focusing on retail media, but will deprecation of the third party cookie in 2024 give it too small of a run-up?

The headline stat for Criteo’s recent financials is that its combined commerce and retail media revenues are flying, climbing by 30% year-over-year in Q2. The French firm also boasts a high level of market penetration across both sides of the Atlantic, with 210 retailer partners, including 50% of top 25 US retailers and ten of the top 20 EMEA retailers.

The only concern for Criteo is that the majority (53%) of its revenue still comes from its retargeting heartlands. Ignoring the high traffic acquisition costs Criteo is currently incurring, derived from “migrating” clients onto its platform, it predicts both its retail media and commerce media segments to grow by 30% over the course of 2023.

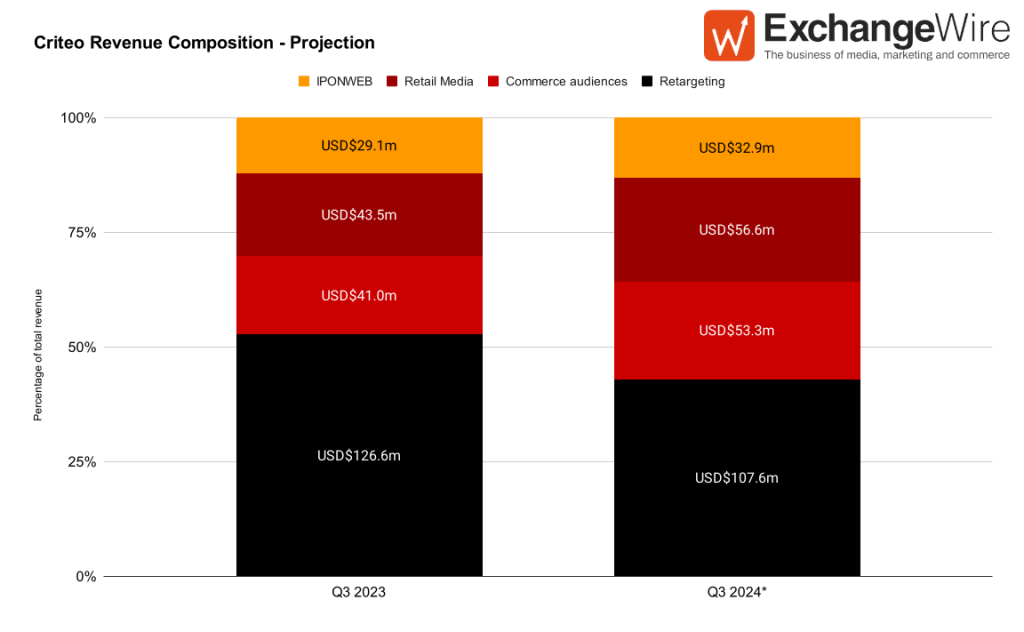

Assuming that holds steady into next year (it actually dipped from 33% to 30% from 2022-2023) and that IPONWEB revenue growth tracks the 13% overall revenue increase, we get to the following projection for Q3 2024, when Google will nix the third-party cookie:

The takeaway here, if these numbers play out in actuality, is simple. Next year, retargeting will no longer drive the majority of revenue for Criteo. Instead, in a closely-run race at 44% versus 43%, retail media and commerce audiences will instead be the most significant driver of revenue for the French firm. The significance of this shift for a publicly-listed mainstay of the ad tech ecosystem, cannot be overstated.

However, while retargeting revenue may no longer be the majority of Criteo’s revenue when the clock strikes midnight on the cookie, nor will that revenue instantly vanish, the firm does expect headwinds. Specifically, a blog post released in April by Criteo’s engineering team shows that they expects some signal loss in Privacy Sandbox, including that under their simulations, for half of all campaigns, over 75% of non-sales conversions, such as a user adding an item to a cart or viewing a product, will be lost to the ether.

Uber

- Reaches profitability for the first time since reporting financials, driven by advertising

- Uber: A USD$7bn (~£5.5bn) advertising business by the end of the decade?

In a standout among tech financials, Uber announced that it has reached a $650m (~£512m) run-rate on its advertising business with 400,000 active advertising merchants, hauling the ride-hailing and food delivery platform to profitability for the first time since it began reporting figures.

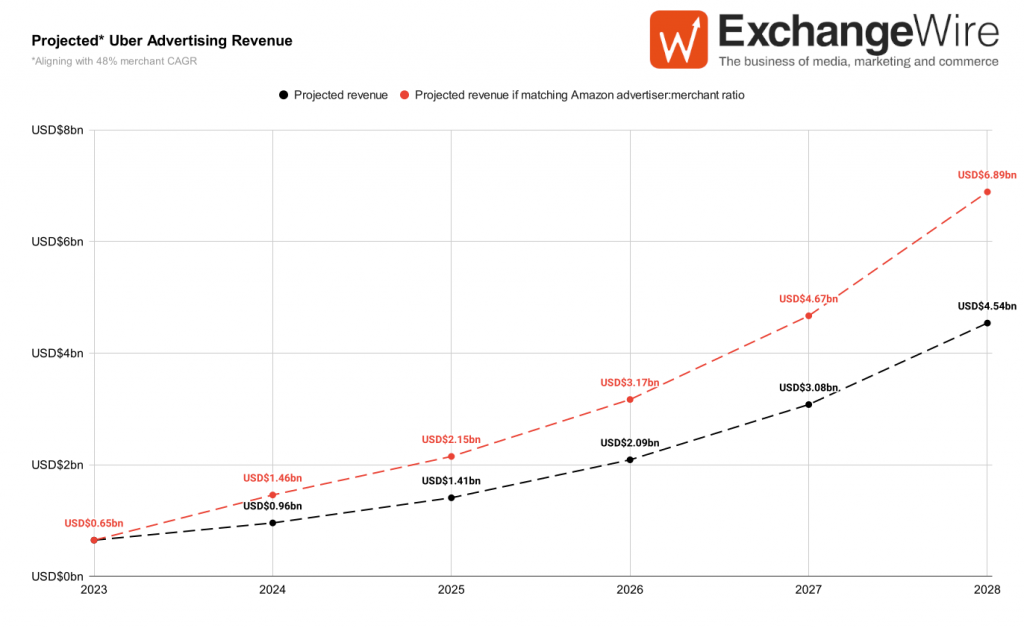

Time for a bit of napkin maths – if Uber ad revenue growth matches the CAGR of 48% it has seen in its merchant numbers, it’d be looking at ad revenues of USD$960m (~£757m) in 2024. This figure is roughly in line with its publicly-stated target of USD$1bn (~£788m) by the close of 2024, and not wholly out of the question given that we have seen a 30% increase in Walmart ad revenue over 2022.

So let’s run with that 48% proxy. Extrapolating that out further, you’re looking at USD$4.5bn (~£3.5bn) revenue from its ads businesses within five years time. Taking a further dip into the crystal ball, if Uber was able to match the ratio of merchants to advertisers that Amazon has (less likely as restaurant/grocery prices aren’t going to match that of premium tech goods), then you’d be looking at just shy of USD$7bn (~£5.5bn) revenue in 2028. Wonga.

Whether or not this proxy plays out in reality, it demonstrates the potential opportunity within retail media, which is why we’ve seen so many flock to release dedicated offerings in recent months.

Conclusions

As with every emerging channel, the key question is “How long can this growth last?” . To that, I would answer that the growth is only just beginning. In a period when consumer spend is tightening, pessimism around the economy is climbing, and technology investment has moved from whimsical dreams to a sharp focus on profitability, look at the growth we are seeing in a segment that’s becoming ever more populous. Thirty percent for Walmart, 30% for Criteo, ~48% for Uber. Even 20% for Amazon, reaching USD$37bn (~£29bn) despite lacking a foothold in a multitude of markets and verticals.

Plus, we haven’t even scratched the surface in terms of unlocking programmatic inventory across platforms to help bolster their scale. Dawn of the era of the PPLA? I wouldn’t bet against it.

Follow ExchangeWire