ExchangeWire Media Pulse Snapshot (H1 2025) - Publisher Monetisation

by Mathew Broughton on 28th Jul 2025 in News

In this Media Pulse H1 2025 snapshot, we examine industry reaction to the Guardian becoming the latest UK publisher to introduce a “pay or consent” model, funding archetypes that may be introduced to deal with modern monetisation challenges, and the role of big tech in influencing publisher monetisation strategies.

In mid-March, The Guardian unveiled its revised access model, in which readers are forced to pay for entry to its website if they refuse tracking underpinned by third-party cookies. In a statement explaining the decision, the publication wrote “Readers choosing to reject personalised advertising make it more difficult for us to generate revenue from online advertising. Put simply, that means that the more people who press ‘reject’, the less money to pay for quality reporting. As a result, we are now asking readers to pay to reject personalised advertising.”

Practice what you preach?

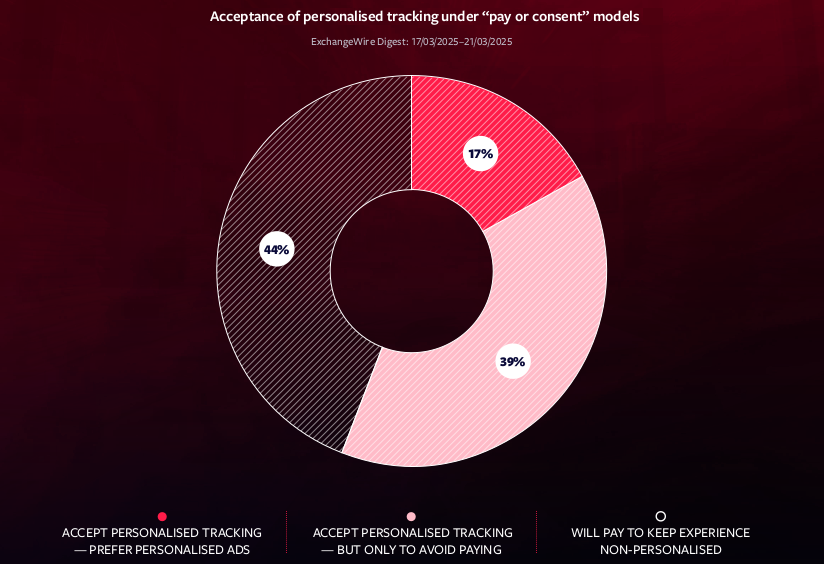

As part of our regular polling of ExchangeWire Digest subscribers, we examined whether industry professionals tend to accept these new models, or would instead prefer to pay in order to minimise tracked advertising. Whilst the majority (56%) of those surveyed stated that they typically accept personalised tracking, only 17% stated that they prefer personalised ads over generic or contextually-targeted campaigns.

Moreover, despite the enduring use of the third-party cookie within advertising systems globally, nearly half (44%) of respondents stated that they would prefer to pay publishers to keep their experience non-personalised.

Perhaps then, it’s no wonder that so many UK publications are using these models, with The Guardian joining the likes of The Sun, Reach PLC (The Mirror, The Express), and The Independent.

Balancing quality with ad revenue, at a time when publishers continue to be constrained by the leading technology platforms, is also contributing to the rapid building of paywalls. Discussing the future of publishing with ExchangeWire, The Trade Desk’s GM of inventory development, EMEA, Sven Hagemeier, wrote, “Big Tech’s monopolies are resulting in the decline of premium publishers, with many outlets forced to clutter pages with a high volume of non-targeted ads driving away frustrated users. To counter, publishers are introducing costly paywalls that exclude many potential readers that can’t afford subscription fees.”

Moreover, whilst big tech platforms are throwing themselves silly into generative AI, serious questions remain as to how publishers can be remunerated when their content, their words, their stories, are used to train these systems, and summarise entire articles without the Pavlovian reward of delicious clicks. Google rolling out AI-generated summaries within its main news feed within its Search mobile app is just the latest in a long line of tales (more on AI within the main Media Pulse H1 2025 report). An olive branch may be extended to publishers, with recent news suggesting Google was at the table with multiple news groups over licensing deals, though no mention of the smaller press houses most likely to be decimated by AI technologies, if not properly remunerated.

Hope remains for the humble publisher however, with opportunities in diversification and community. Much has been made of the New York Times’ success with branching out into gaming and sports news via its acquisitions of Wordle and The Athletic respectively. Large and small publishers alike are also finding success with directly interacting with their audiences via a range of platforms such as WhatsApp, Telegram, and Patreon. Writing for ExchangeWire, Avya Chaudhary details, “Instead of relying on algorithm-driven middlemen, they treat platforms as complementary tools for community building.

“Meanwhile, closed networks like WhatsApp, Discord, and Telegram are becoming go-to channels for direct updates, be it CNN’s 14.5 million followers or BBC News with 9.3 million on closed channels.

“For smaller publishers like Johnny Harris and India’s The Deshbhakt (The Patriot), YouTube and Patreon have become the go-to platforms for building tight-knit communities around the attention economy. They combine subscriber support, ads, and merch sales to foster direct connections. It’s more than just funding: they ask their audience for story feedback, explore what topics they care about, and even dive into who they are and why they’re engaged. With closed platforms gaining traction.”

For more insights on industry developments through the first half of the year, download The ExchangeWire Media Pulse H1 2025 report.

Big TechPublisherSocial MediaTracking

Follow ExchangeWire