Netflix Beats Analyst Predictions & Stock Price Soars

by Rebecca Muir on 20th Jan 2016 in News

Yesterday, (19 January) video streaming company Netflix reported Q4 2015 earnings that exceeded analysts' expectations. In the first of our 2016 earnings reports, we examine the financial highs and lows and explore what the future might look like for Netflix.

Financial Highlights

– Adjusted earnings of USD$0.07 (£0.05) per share, down from 10¢ a share a year earlier, but higher than analysts' estimates of USD$0.02 (£0.01)

– Revenue came in at USD$1.82bn (£1.29bn), compared with USD$1.49bn last year, but lower than analysts' predictions of USD$1.83bn (£1.29bn)

– Netflix added 5.59 million total net subscribers in the quarter, up 29.1% year-on-year

– With 4.04 million (up 66.3% year-on-year) net subscriber additions outside of the US, Netflix easily beat expectations set at 3.51 million

– Average subscriber price grew 4%-5% in the quarter from the previous year

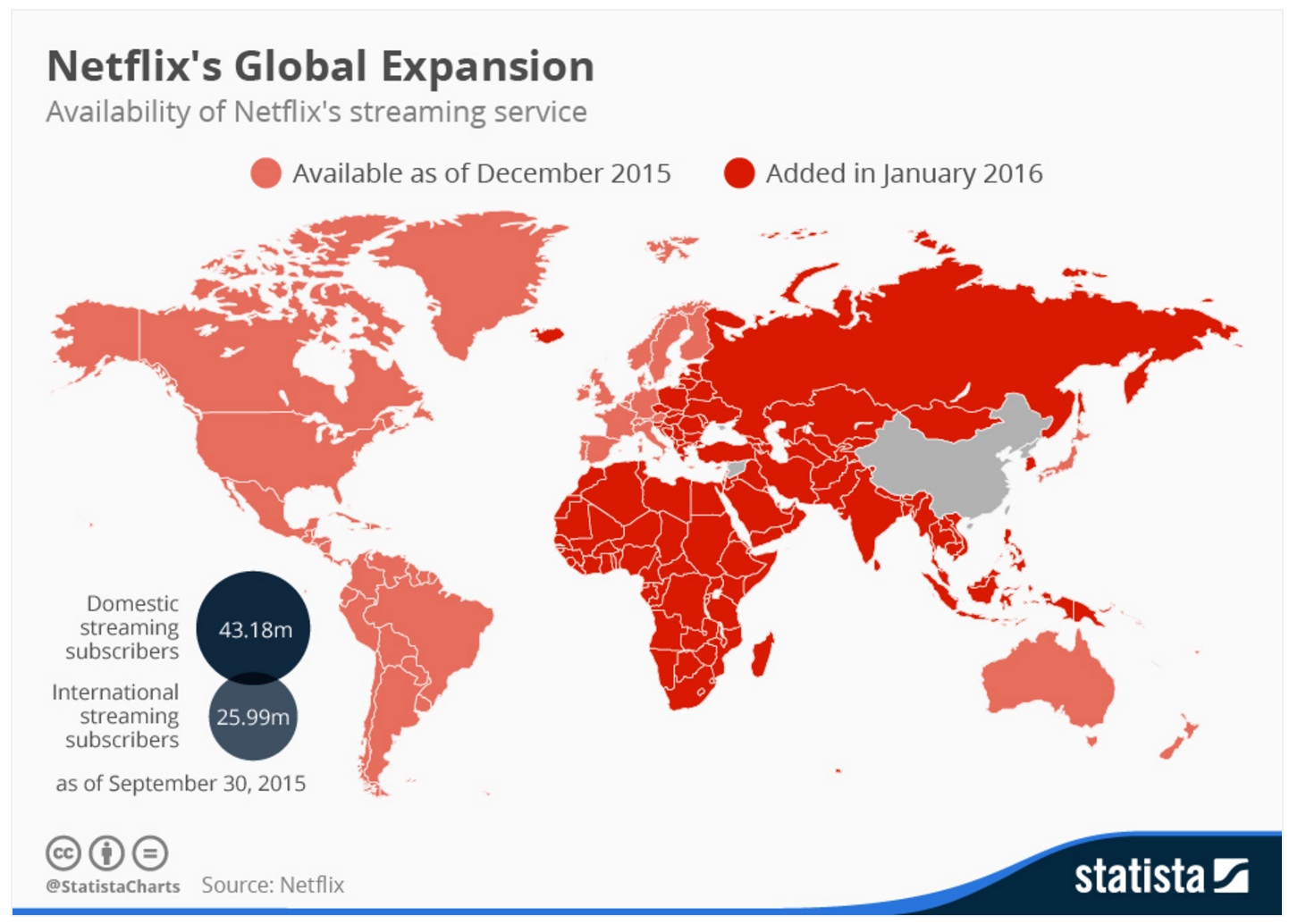

As of early January this year, Netflix's services are available in over 190 countries. International expansion has occurred in parallel with increased spend on original programming, which contributed to a decrease in fourth-quarter net income from the previous year.

The chart below shows Netflix's recent eastward expansion. It should be noted that Netflix is not available in China, due to government restrictions, although Netflix have not ruled out operating in China in the future.

Fourth-quarter domestic net subscriber growth of 1.56 million came in slightly below estimates. Netflix indicated that the transition to chip-based credit and debit cards "continues to be a background issue" and could be to blame for slow subscriber growth in the US.

In absence of ratings figures, we must turn to total streamed hours in order to understand consumer consumption.

In 2015, total streamed hours increased by almost half (46.6%), from 29 billion to 42.5 billion.

The number of subscribers and number of hours streamed are key to Netflix at this stage in their growth, as the company will start to claw back the investments required to offer their services in almost every country in the world.

Netflix have established themselves as the number one video streaming provider, and consumers continue to enjoy streaming more and more video content online, preferring the convenience of on-demand content over traditional broadcast TV.

It remains to be seen whether Netflix will introduce advertising services to boost revenue.

Introducing advertising could be a risky move, get it wrong and users will abandon the service and seek alternative, ad-free offerings. But, get it right and Netflix could realise serious revenue from advertisers looking to serve engaging video content, to a highly targeted audience.

Netflix have demographic data and, as the IoT and connected TV markets grow, data partnerships would allow Netflix to overlay detailed behavioural targeting, meaning that advertisers could serve almost-personalised video advertising to Netflix's users without the problem of scale that has previously prevented advertisers from personalising video advertising in the same way that online display ads are personalised.

USD$107.89 (£76.21)

Follow ExchangeWire