November's Ad Industry Financials - Ad Tech (A-M)

by Mathew Broughton on 7th Dec 2023 in News

In this edition of our ongoing summary of media and marketing financials for November, we go through the A-M of ad tech companies, and how the firms serving, measuring, and verifying inventory across the supply chain are faring in the current market.

AdTheorent - A thorned rose

- Revenue up 9% to USD$40.9m

- Net loss of USD$4.2m, reversed from income of USD$5.7m

- 28% increase in self-service revenue

A rosy quarter for AdTheorent, with self-service a high point. Advertisers here increased by 51%, fuelling platform revenue gains of 28%, which were further bolstered by the performance of its health-specific product, which also saw the number of advertisers climb by 51%.

Though the reversal of income to loss looks bleak on paper, this is attributed to earn-out and warrants liabilities associated with its strong performance. The pains of success.

AppLovin - Once bitten, twice shy

- Revenue up 21% to USD$864m

- Net income up 359% to USD$109m

- Software platform revenue hits record USD$504m, up 64%

One of the brightest notes for this quarter, with revenue and income alike soaring at app monetisation platform AppLovin. According to its executive team, the solid figures were driven by its AI tool AXON 2.0, launched in Q2. Specifically, AXON 2.0 has been accredited with powering growth in user acquisition spend, an area which took an industry-wide hit when Apple rolled out Do Not Track.

Though they were jilted once before, AppLovin executives may move once again to acquire Unity, given the latter’s struggles this quarter (see next edition) and their own positive earnings. Now that it's December, I’ve got a certain Christmas tune by Wham! at the ready…

Criteo - Redefined by retail media

- Revenue up 5% to USD$469m

- Retail media up 29%

- Iponweb revenue up 82%

Make no mistake, this was a momentous quarter for Criteo, and for the whole ad tech industry. One of the powerhouses of retargeting, to many it seemed like an insurmountable goal to pivot the business when governments, Google, and the court of public opinion deemed the third-party cookie should be no more. However, like Hillary and Norgay, they have now climbed that big ol’ hill, as they crossed the 50% threshold for non-retargeting revenues for the first time.

In their previous financials, I hypothesised that this may happen next year, assuming its growth rates remained steady. Indeed, retail media and commerce audiences revenue hovered consistently at the 30% mark it has held at throughout 2023. What saw Criteo cross the magical 50% barrier was a surge in performance for its Iponweb division, which climbed by 84% year-over-year.

Criteo is not fully out of the woods yet, retargeting continues to make up a large chunk of its revenue mix, and, despite being a long-time partner with Google on Privacy Sandbox testing, expect to see a meaningful dip once the traditional cookie signal is lost. They are also implementing a fee structure change to become more SAAS-like, reducing overall contribution forecasts for 2024. This uncertainty has led to a cautious approach when issuing future guidance, which, rather unfairly, has led to a hammering of its share price in the initial earnings aftermath.

Digital Turbine - Still arranging ducks

- Revenue down 18% to USD$143m

- Net income reverse from £11.7m profit to USD$161m loss

- App Growth Solutions (AGP) revenue falls 32%

A shaky quarter for Digital Turbine, with a worryingly harsh decline within its AGP segment which includes app monetisation and advertising. This was “driven largely by the short-term impact of the consolidation and exiting of certain legacy business lines” according to CEO Bill Stone in their earnings call. Though Digital Turbine has been profuse with acquisitions in recent years and time needs to be taken to get ducks in a row, at some point returns need to be made. A non-cash goodwill impairment charge of USD$143.3m, suggesting one or more of its recent four acquisitions are not performing as strongly as originally intended, adds further concern.

What compounds these results further is the excellent performance of fellow mobile-focused player AppLovin. App monetisation is challenging right now with the ongoing barrage of privacy (or self-serving if you’re a cynical sort) actions from Apple, but opportunity clearly remains. The full launch of its next-generation DSP, DT Direct, may help stem the tide through 2024, but work needs to be done to steady the ship.

DoubleVerify - International joy

- Revenue up 28% to USD$144m

- Net income up 29% to USD$13.3m

- Non-US measurement revenue up 62%

Green arrows across the board for DoubleVerify, with strong growth in several key areas including social and CTV. Particularly impressive is the scale of its international growth within its measurement segment, with EMEA rocketing by 75% and APAC up by nearly one half (46%). In a coup for executives, the strength of international growth outpaced that of rival Integral Ad Science, which saw takings outside of the Americas climb by 17%.

The company’s earnings release is a smorgasbord of partnerships and integrations, as it employs a wise strategy of diversifying across multiple sectors. In the words of CEO Mark Zargorski, “That broad footprint gives us a really good opportunity to kind of ride the wave of dollars moving from one place to the other.”

Finally, further efficiencies may yet be found with the continued integration of AI firm Scibids, which it bought at the tailend of July. And indeed from elsewhere, as DoubleVerify retains USD$259m in cash on hand and zero long-term debt, so expect further acquisitions.

Illumin - Breathing and ceilings

- Revenue up 2.4% to CAD$29.6m

- Net income falls by 75% to CAD$762,000

- Self-serve revenue up 348%

Canadian ad tech platform illumin (formerly AcuityAds) had, to use that age-old cliche, a mixed bag this quarter. Positives of a rise in revenue and a more-than-tripling of self-serve revenue to CAD$5.1m were blended with a 75% slashing of net income. The company has gone for the scattergun approach of what to attribute this to, including (deep breath) R&D, sales and marketing spend, lower margin outside of North America, and a weakened dollar.

Breathing out, it’s important to remember that, unlike many of its peers, illumin continues to be profitable (just). Plus, the scale of growth in self-serve revenue suggests it is well away from hitting a ceiling here. An interesting one to watch.

Innovid - Doing CTV-ery well

- Revenue up 5.4% to USD$36.2m

- Net loss shrinks to USD$2.6m from USD$11.8m

- CTV revenue up 9% to USD$14.4m

The gradual but continuing shift from linear to CTV is doing Innovid a heck load of good. Revenue is up, net loss is down, and forecasts for next year are “stable”, which is better than many within the current economic climate.

On the numbers, CTV impressions continue to form a greater component of Innovid’s total inventory, accounting for 55% of video impressions, up from 51% last quarter. Their measurement offering, though a smaller component than their ad serving and personalisation segment, is up 8%.

Zooming out wider than CTV, video is also coming up trumps for mobile, which has climbed 8%, though desktop saw a dip of 12%. Innovid is also looking towards retail media, with CEO Zvika Netter confirming Innovid is exploring options around shoppable ads.

Integral Ad Science - Sugar and spice and all that’s nice

- Revenue up 19% to USD$120.6m

- Measurement, optimisation, publisher, and social revenues all increase

- Net loss of USD$13.7m versus income of USD$800,000 a year prior

To fully Pat Butcher a famous idiom: “There are three certainties in life, death, taxes, and IAS reporting quarterly revenue growth.” No exceptions to the rule this time around, with IAS completing a remarkable 13 consecutive quarters of double-digit revenue gains.

Spoils were shared across the board in measurement, optimisation, publisher, and social takings, though the most remarkable gains were in retail media, with year-to-date revenue here up 1.5x. Things look even sweeter for IAS going forward with the signing of a partnership with Ferrero, and an extension of their collaboration with Mars, alongside BMW as its verification partner (I panicked while looking for a confectionary-based tie for a German auto manufacturer for this stretched analogy, so here I am writing “sweet ride”)

LiveRamp - Sharp CTV growth and friendly cooperation

- Revenue up 9% to USD$160m

- Profit climbs by 13% to USD$119m

LiveRamp has ramped up both takings and profit over the last three months, and is looking well set to further consolidate on these gains once buoyancy returns to the overall market. Its subscription business has seen a small rise in revenue, climbing by 5%, while marketplace revenue has surged by 25% for the second-consecutive Q2 for the company. This was attributed to the strength of the CTV market, with CEO Scott Howe revealing in the earnings call that TV data sales were up 50% year-over-year, prompting the firm to raise its full-year guidance for the “marketplace and other segment” to “low double digits”.

LiveRamp has also been busy bolstering interoperability on identifiers, with new partnerships with Epsilon and Yahoo making its Authenticated Traffic Solution (ATS) and RampID, respectively, compatible. To get all existential, if all identifiers become interoperable, how does IdentityClump (I’m totally trademarking this, no stealing) differ from the cookie? What is dead may never die…

Magnite - At the races

- Revenue up 3% to USD$151m

- Net loss shrinks to USD$17.5m from USD$24.4m

- CTV ad spend up 20%

Like for many horses within the ad tech company stable, CTV is the delicious carrot treat brightening the day for Magnite, fuelling overall revenue growth and shaving a respectable portion off of its quarterly net loss. This was further complemented by a 12% increase in ex-TAC contributions from its DV+ platform (display, video, native, audio, DOOH), and with more growth forecast next year through the US election, there’s plenty of room for further gains.

Generally, firms have presented a picture of open market dynamics, waxing lyrical on partnerships and opportunity for all. Magnite however has taken a refreshingly firm stance on how the sports streaming market will play out, saying they’re adopting a “winner takes most approach” - fingers crossed that Amazon doesn’t hoover up more sports rights and roll out an SSP then...

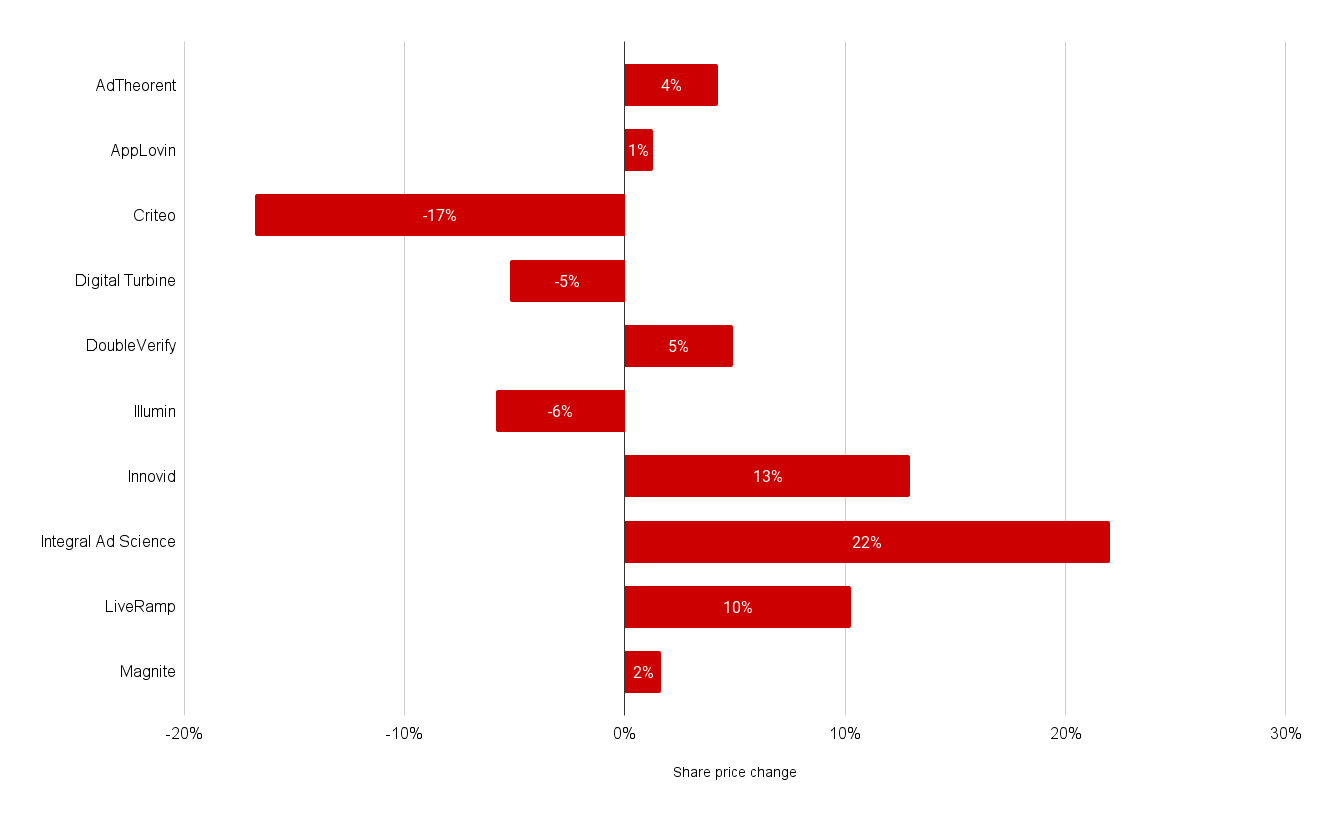

Initial investor reaction

Follow ExchangeWire