November's Ad Industry Financials - Publishers

by Mathew Broughton on 23rd Nov 2023 in News

Round two of our November 2023 industry financials series brings us to the health of publishers, and how their advertising revenue mix is evolving among a global economic slowdown and the proliferation of streaming platforms.

Buzzfeed - Trouble at sea

- Revenue falls 29% to USD$73.3m ▼

- Advertising revenue falls 35% to USD$32.6m ▼

- Engagement down 19% ▼

Buzzfeed’s freefall since going public in 2021 continued, with advertising revenue falling by over one-third. Competitor (and big tech) gains and plummeting engagement were jointly cited as the leading factors, though the scale of the year-over-year decline cannot reasonably be attributed to a soft advertising market as per other publishers in the cohort.

My optimism on Buzzfeed remains low, particularly given the odd approach from founder and CEO Jonah Peretti, who argued in the earnings call that users are set to abandon the likes of TikTok in favour of Buzzfeed’s “generative AI games”, thus, “getting out of that ADHD scrolling behaviour that sometimes can be a bit much for consumers.” A needless dig at the neurodivergent, as well as being complete and utter bollocks judging by the performance of Meta’s short-form video offering. Peretti’s thoughts seem out of sync with other members of the executive team, with CFO Felicia DellaFortuna (who has since jumped ship to Enthusiast Gaming) talking highly of Buzzfeed’s “audience momentum around newer platforms and formats, including YouTube Shorts, Instagram Reels, and TikTok.”

Comcast - Symptomatic

- Revenue up 0.9% to USD$30.1bn ▲

- Video and advertising revenue falls 6% ▼

- Peacock advertising revenue up by 40% ▲

Comcast’s results provided a near-perfect picture of the evolution of media consumption habits, with cable suffering while digital improved markedly. Its advertising revenue fell due to slated softness in the linear market alongside a shortfall due to lack of intensive political advertising, though executives are buoyed by the strong performance of its Peacock streaming service. On the earnings call, they expressed optimism that its Peacock will drive year-over-year growth in the fourth quarter, adding that, now that actor strikes in the US are over, premium content can resume production to bolster both linear and digital efforts.

Fox Corporation - Legal issues to taint early days of Lachlan epoch?

- Revenue up 0.5% to USD$3.2bn ▲

- Advertising revenue down 1.6% ▼

The last quarter of the Rupert Murdoch era at Fox Corp was, as were many of these results, mixed. Advertising revenue was down due to lower audience figures, reduced political ad spend, and “elevated supply in the direct response marketplace”. The results for Fox’s advertising business could have been considerably worse, however they were offset by higher pricing of domestic media, the broadcast of the FIFA Women’s World Cup, and the positive performance of its Tubi streaming service.

Looking forward, we’re set of a bit of a corporate drama side dish, to the main of the rotisserie OpenAI board, with Fox set for a full twelve rounds of legal challenges after the USD$788m defamation settlement to voting technology firm Dominion, which led to the removal of controversial but popular anchor Tucker Carlson.

IAC - Performance performing, programmatic percolating

- Revenue down 15% to USD$1.11bn ▼

- Advertising revenue down 12% ▼

- Programmatic improving sequentially, purportedly outpacing the wider market. ▲

Dotdash Meredith parent IAC recorded double-digit declines in both overall and advertising revenue, though it did see a recovery from a net loss of USD$125m to USD$33m. Baby steps. The fall in digital advertising revenue has been attributed to both a drop in premium-sold inventory and lower programmatic advertising revenue, with the latter caused by reduced traffic. In the letter to shareholders accompanying the results, CEO Joey Levin put an optimistic spin on its programmatic performance, stating it was improving “above the market.”

On a more tangibly positive note for the New York-based firm, its performance marketing segment climbed 22%, driven by its D/Cipher intent-based targeting solution, while it also had a 49% uptick in affiliate commerce takings.

ITV - Dramatic upshot in digital performance

- Revenue up 1% to £2.9bn (nine-month) ▲

- Digital advertising revenue up 25% ▲

- Total advertising revenue down 7% ▼

A mixed bag for the UK’s oldest commercial TV network, with its revamped digital offering ITVX proving highly profitable, while total advertising revenue is down thanks to a “challenging” linear market. The scale of its digital growth is highly encouraging, with users climbing by over one-quarter (27%), and the firm still intends to hit its goal of £750m in digital revenue by the close of 2026. However, should the waters of linear broadcasting remain choppy, ITV may have to go further in its cost-cutting than the £50m it plans to snip, again by 2026.

New York Times - A healthy blend

- Revenue up 5.3% to USD$591m ▲

- Digital subscribers rise 210,000 ▲

- Digital ad revenue up 6.7% to USD$75m ▲

A very positive quarter for the New York Times, with solid gains in both revenue and subscribers. Growth in digital ad revenue was attributed to increases in both direct-sold and open-market programmatic, along with the successful rollout of display advertising on The Athletic’s digital property, more than tripling ad revenue for the subsidiary.

The heavy push to get NYT digital subscribers to bundle-up on multiple products is continuing to bring rewards, forcing ARPU up to its fifth consecutive quarter of growth. Overall, the New York Times is shining as a healthy example of a diversified model of digital and print subscription, alloyed with both open web and direct advertising operations, putting it in good stead to ride out further sluggishness in the wider market.

News Corp. - Dips ‘n’ Spice

- Revenue up 0.85% to USD$2.5bn ▲

- Operating income up 1.74% to USD$1.2bn ▲

- Advertising revenue down 3.7% to USD$391m ▼

A bit of a middling quarter for News Corp, with marginal revenue and income gains concealing a worrying dip in advertising revenue. A surprisingly spicy statement from chief exec Robert Thomson opens their earnings release, “In our view, these results certainly highlight the disparity between the value of our company and our share price, which we believe does not reflect our present profitability, yet alone the potential of our incomparable, growing businesses.” News Corp’s share price fell 4% in the two days following the announcement (see below).

On its advertising performance, ad revenue was down across the board at News Corp Australia, while print advertising revenue fell for News UK. On the positive side, News Corp’s Dow Jones unit showed healthy subscriber (+12% digital, +8% total) and revenue (+14%) growth, though this too saw an advertising dip of 3%.

Now to compare the “incomparable”, News Corp’s results prove an interesting contrast to those of the New York Times above. While News Corp is a more scaled international business, the lack of significant growth in its digital advertising revenue across markets is concerning given that an effectively single-market news business is able to find strong gains whilst simultaneously boosting subscriber figures.

Nexstar Media Group - Digital helps to weather the storm

- Revenue down 11% to USD$1.13bn ▼

- Net income down 97% to USD$8m ▼

- Record third-quarter digital revenue of USD$99m, up 15% ▲

Nexstar Media Group remains highly exposed to political advertising, thus in a fallow year of US electoral horseplay this segment saw a dip of over 85%, driving a year-over-year decrease in total advertising revenue of 22.5%. A near-total elimination of income is sure to draw a sharp breath as we head into the winter months, however green shoots of optimism can be found in the strong performance of its digital efforts, with local digital advertising revenue cited as a contributory factor.

Efforts to diversify continue to centre around The CW Network property, acquired last year. It certainly seems a shrewd move to reposition CW around sports and owned scripted content, as opposed to hand-me-downs from Paramount and WBD, as well as such delights as (checks notes) the Dynasty reboot.

Hatches are certainly battened, but expect dramatic profitability rises as the summer of Octogenarian vs Septuagenarian battle returns.

Warner Bros Discovery - Barbie, elephants, and mammoths

- Revenue up 2% to USD$10bn ▲

- Net loss falls to USD$417m from USD$2.3bn ▲

- TV networks ad revenue falls 12% to USD$1.7bn ▼

- DTC ad revenue climbs 30% to USD$138m ▲

With the highest-grossing film release in its history through Barbie, Warner Bros Discovery results should be a picture of pretty and pink. Instead things are looking more like an elephant made of bread: stodgy and grey.

While a 30% bump in streaming ad revenue, caused by higher engagement and strong uptake of its mid-tier “Ad Lite” package, should be cause for celebration, it’s hard to start blasting Kool & The Gang when more than USD$200m has evaporated from the takings from ads on its TV networks segment. This was primarily due to audience declines, a worrying precedent given that DTC subscribers also fell to the tune of 700,000.

All in all, WBD seems to be somewhat trapped between a content portfolio that is proving unappealing to both linear and streaming audiences, and a mammoth debt portfolio that’s proving difficult to shift.

Zee - A successful balancing act

- Revenue up 20% to INR 20.2bn (£193m) ▲

- Ad revenue falls 2.1% year-over-year ▼

- Net income down 12% to INR 18.6m (£178,000) ▼

Onto Indian media conglomerate Zee, which saw an impressive revenue bump, driven by digital and subscription growth, countered with a drop in net income. The somewhat yin and yang financials continued as the firm took relatively stable domestic advertising revenue, with an increase in spend from FMCG companies balanced out by an ongoing softer advertising market as well as cricket events (Asia Cup and Cricket World Cup) absorbing spend across the country.

Though investors initially reacted slightly negatively to the results, there is certainly cause for optimism. A INR 210bn (£1.1bn) cash injection from Sony India is looming after long-awaited approval for their 51% stake purchase was granted in August, which should allow it to build on its digital efforts and widen its pool of potentially lucrative advertisers.

Summary

Ups and downs as ever on the sell-side, but for many there is cause for optimism in an otherwise turgid market. Digital revenues are generally up for both news and entertainment media, with further room for growth. Streaming platforms are also generally performing well in terms of advertising, with little evidence of market saturation when it comes to ad spend and subscriber figures.

The return of premium content production in the US following the dual strikes, as well as the upcoming election, is set to drive further gains into Q4 and beyond, though publishers need to be cautious in ensuring they do not overcapitalise on content production, as ongoing slothfulness within the wider economy would not be accommodating for heavy debt loads.

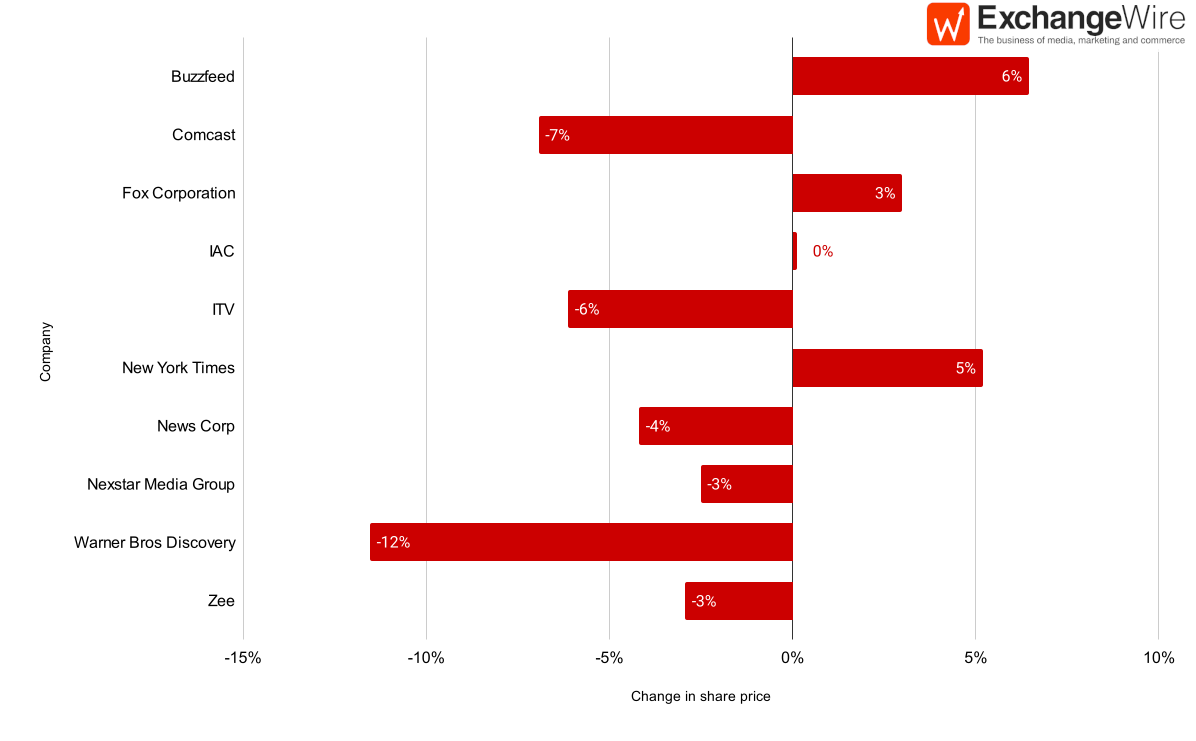

Initial investor reaction

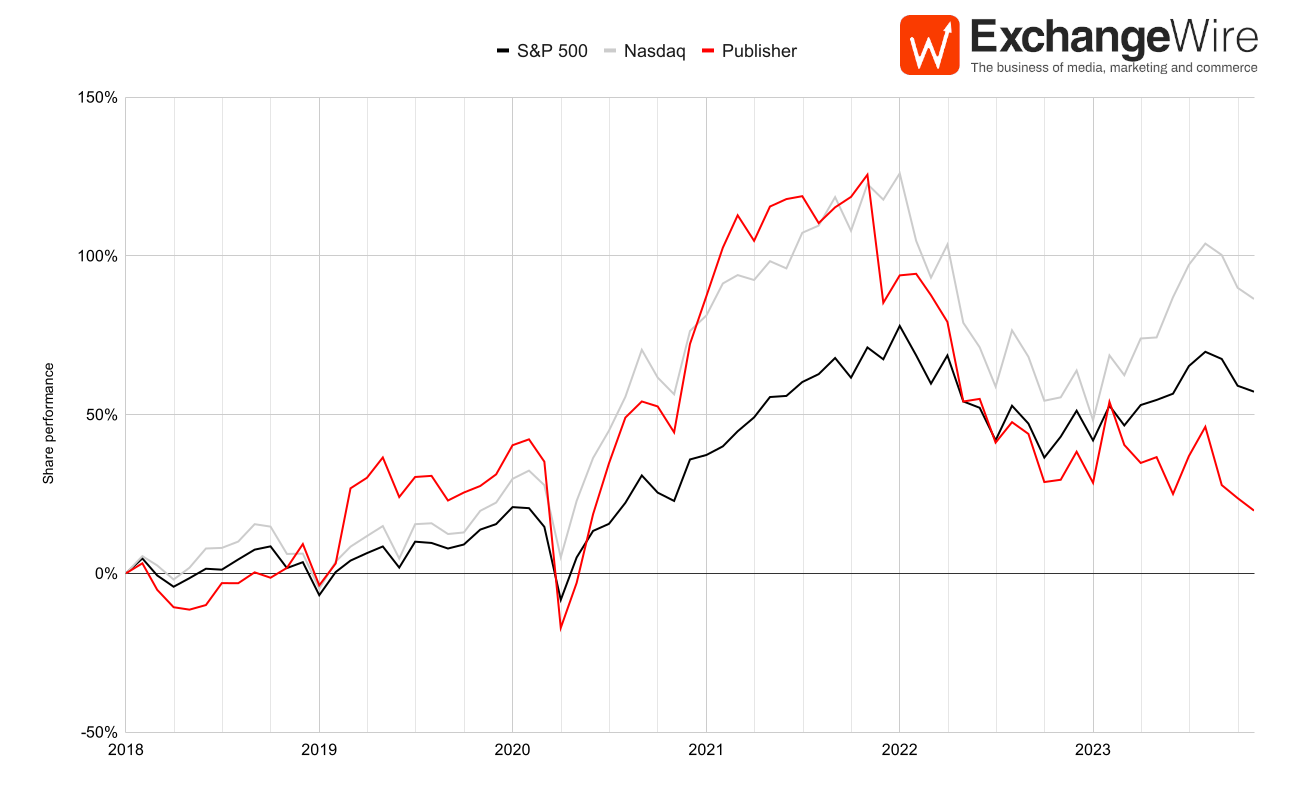

Five-year performance

| Company | Share price change* | |

|---|---|---|

| Buzzfeed | -97% | ▼ |

| Comcast | 2% | ▲ |

| Fox Corporation | -20% | ▼ |

| Future | 146% | ▲ |

| IAC | -37% | ▼ |

| ITV | -62% | ▼ |

| LBG Media | -55% | ▼ |

| New York Times | 114% | ▲ |

| News Corp. | 28% | ▲ |

| Nexstar Media Group | 82% | ▲ |

| Warner Bros. Discovery | -60% | ▼ |

| Zee | -54% | ▼ |

| Publisher† | 20% | ▲ |

| S&P 500 | 57% | ▲ |

| NASDAQ | 86% | ▲ |

†Equal-weighted

Up next: ad tech. Want to have your say on the topics driving industry earnings? Get involved with Industry Review 2024.

Follow ExchangeWire