Media & Marketing Financials - August 2025

by Mathew Broughton on 28th Aug 2025 in News

With Autumn and ATS London on the horizon, ExchangeWire research lead Mat Broughton takes stock (if you'll pardon the pun) of company financials across the media and marketing ecosystem.

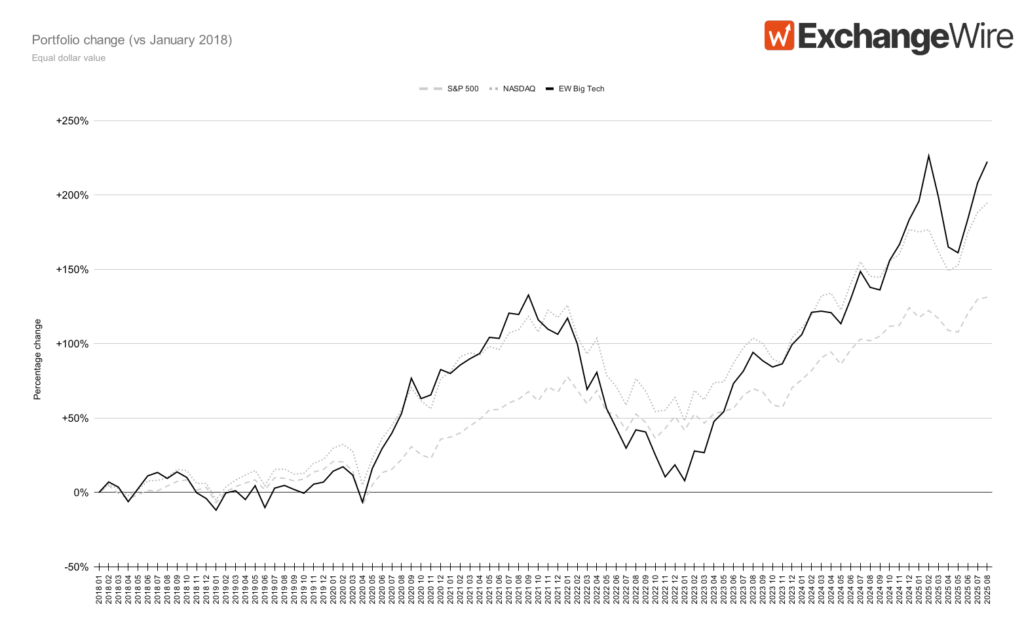

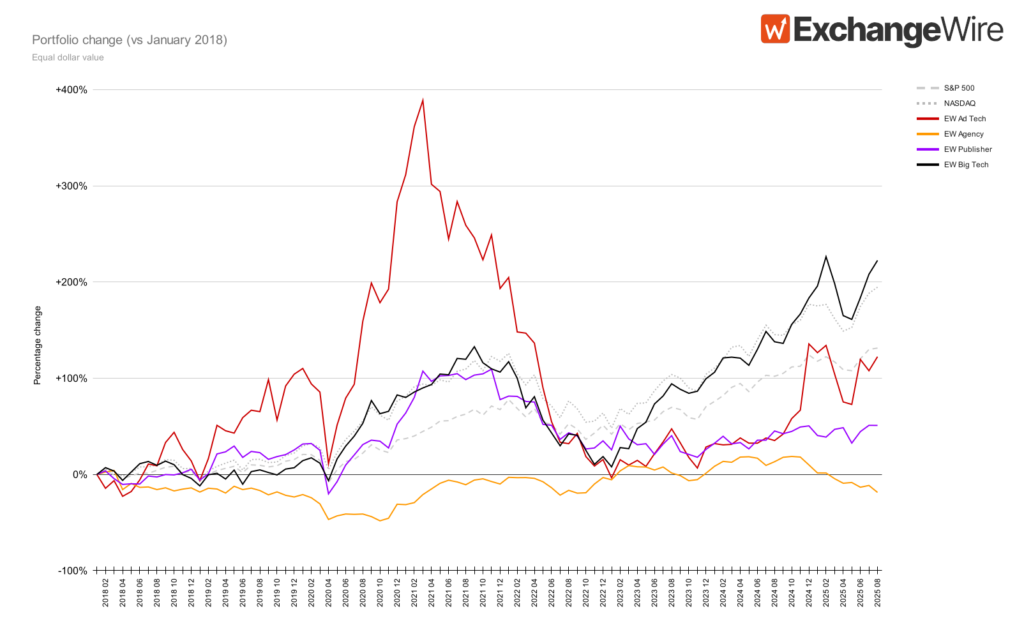

Key themes

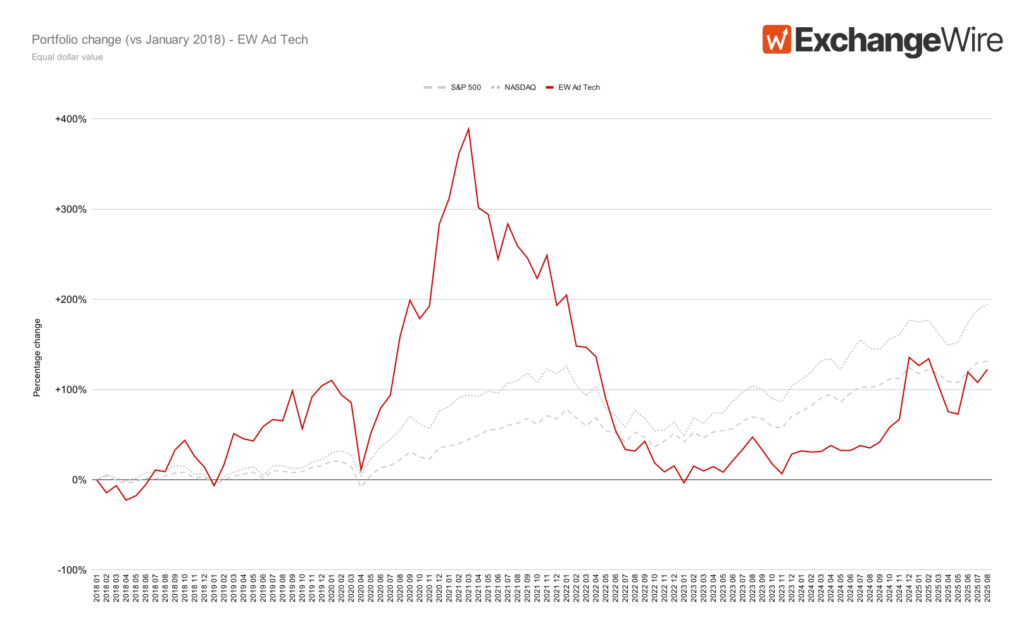

- Ad tech flying up until August, before the falling tide of The Trade Desk sinks many ships

- Big tech soaring off of AI promise, a brave new world or bubble ready to pop?

- Digital-savvy publishers seeing strong gains, whilst legacy cable companies continue to plateau

- WPP flounders, whilst Publicis remains the darling of the agency world

Ad tech

Company highlights

The Trade Desk

- Mixed results created sector-wide concerns.

- Despite nearly hitting 20% year-over-year revenue gains, concerns over future growth emerged, causing a decline in share price of near 40%.

Magnite

- Solid revenue growth driven by CTV.

- Total revenue reached USD$173.3m (£128.3m), a 6% year-over-year increase.

- CTV, a cornerstone of Magnite's strategy, generated USD$71.5m (£53.0m) in Contribution ex-TAC, up 14% YoY.

- Despite this, Magnite stock fell 10% on August 19th, potentially as a result of volatility across the ad tech sector along with increased short activity.

AppLovin

- Exceptional “AI-driven” growth with some volatility. AppLovin's second quarter was marked by a positive market response initially, despite revenue slightly missing Wall Street expectations, however has since fallen ~6% following insider sales.

Roku

- Strong platform growth and profitability surprise.

- Overall, Roku reported Q2 revenue of USD$1.11bn (£822m).

- Roku's Platform segment, which includes ad sales, content sales and subscription-revenue sharing, grew 18% to USD$976m (£723m).

Commentary

A solid quarter overall for our monitored advertising technology companies, however subsequent volatility suggests headwinds for the remainder of the year.

As we track to the start of the calendar month, the chart above does not account for the post-results hit to The Trade Desk, which took a near 40% thumping in terms of its share price off of a deceleration in growth. Despite reaping recent rewards with its continued championing of the open web, investors panicked over competition from the likes of Amazon. As summarised by Madison & Wall, “Long-term optimism around the opportunity from the open web for The Trade Desk continues to seem unfounded to us[...] As well uncertainties abound around the mix of revenue trends for the company from data vs. technology fees.”

Ouch. This had a knock-on effect on the rest of the sector, with Zeta, MNTN, Magnite, PubMatic and Viant, all seeing share price dips despite solid earnings.

Simultaneously, we saw AppLovin continue its meteoric rise, despite ongoing scrutiny as to its practices. If The Trade Desk gets thumped for calling Amazon a potential partner, why does AppLovin avoid the hammer for wholly partnering with Meta whilst simultaneously acting as a parasite?

This is all not to forget the latest flop in the flip-flop-flip-flop saga of Google deprecating third-party cookies across its Chrome browser, now deciding that users will no longer be offered the choice to use, or not use, the cookie. Where one door of uncertainty closes, another opens…

Big tech

Company highlights

Apple

- Rebranded its advertising business from "Apple Search Ads" to "Apple Ads" in April 2025, signalling broader ambitions beyond App Store search results.

- While Apple doesn't separately report advertising revenue, analysts estimate it generates USD$6bn-$8bn (£4.4bn-£5.9bn) annually within the company's USD$27.4bn (£20.3bn) Services segment.

Google (Alphabet)

- Maintained its position as the world's largest digital advertising platform with USD$71.3bn (£52.8bn) in advertising revenue, growing 10.4% year-over-year.

- YouTube generated USD$9.8bn (up 13% year-over-year), with Shorts reaching revenue parity with “traditional” YouTube ads in the US and select international markets.

Snap

- Generated USD$1.17bn (£870m) in advertising revenue with modest 4% year-over-year growth, constrained by platform stability issues that have since been resolved.

- The company grew to 932 million monthly active users (+7% YoY) and 469 million daily active users (+9% YoY), though North America growth remained flat.

- Emerged as the fastest-growing platform across the EW Big Tech bucket, with USD$465m (£346m) in advertising revenue, representing an extraordinary 84% year-over-year increase.

- The company achieved profitability for the first time as a public company while growing to 110.4 million daily active users (+21% YoY).

Commentary

The big tech and social platforms recorded astounding revenue growth across the board, particularly considering the age of some of these firms. Notably, Meta, Reddit, and Apple all exceeded earnings expectations despite Trump's tariffs and economic slowdown.

Twas much of the same for Google parent Alphabet, as its third-party network business continues to stagnate, whilst YouTube goes gangbusters, achieving double-digit growth to reach USD$9.8bn (£7.2bn). Search revenue also continues to climb, bouldering 12% upwards to over USD$54bn (£39.9bn). Google claims that its AI search results monetise at the same rate as traditional search ads, despite these decimating publisher traffic, indicating these generate far fewer clicks, and comparatively showing far fewer ads within its AI Mode. I asked Google AI Mode to clarify:

Righto.

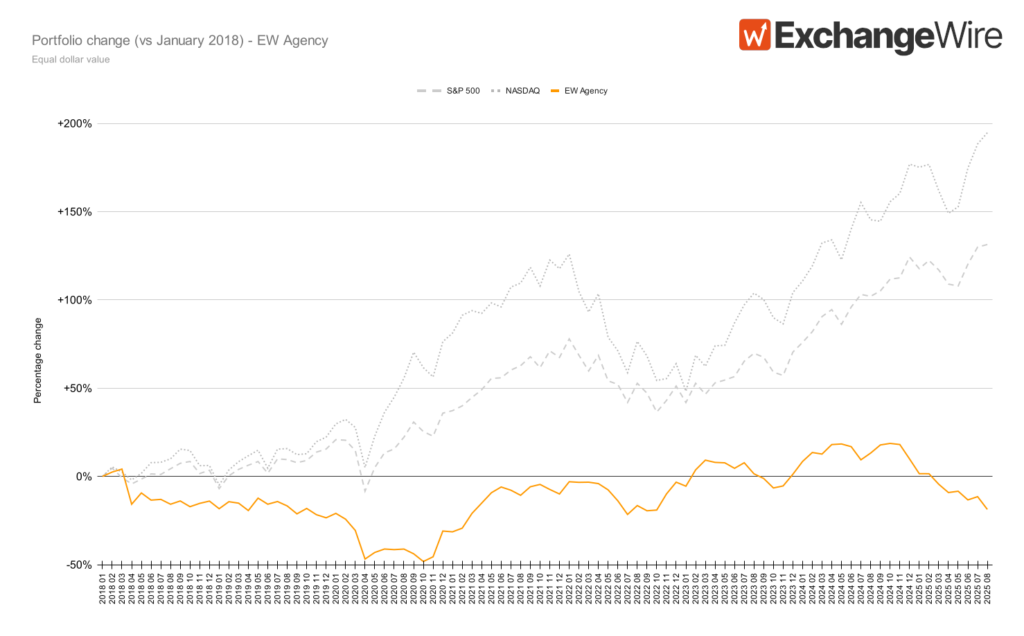

Agency

Company highlights

Publicis

- Clear market leader in 2025.

- Following a record run of new business wins, including nabbing Mars and Paramount's media accounts from WPP and winning Nespresso's creative account from McCann.

WPP

- Struggling significantly with client losses.

- In an unscheduled H1 update, outgoing chief executive (CEO) Mark Read told investors: "Since the start of the year, we have faced a challenging trading environment with macro pressures intensifying and lower net new business".

- The outlook is concerning: -3% to -5%.

Omnicom/IPG

- Stable performance amid industry disruption.

- Omnicom remained stable at 3% growth, while Interpublic shrank 3.5% organically but improved margins.

Commentary

A highly tumultuous time across the agency landscape, with the public-listed holding groups exposed to the joint gales of AI and upstart independents. In recent months, we’ve seen a frankly aggressive period of client switching, with massive brand accounts switching hands nigh-on every week.

Through this turbulence, Omnicom and IPG had a stable quarter ahead of the closure of their blockbuster merger. Further consolidation was seemingly on the cards, with Sir Martin Sorrell’s S4Capital mulling over a merger approach from private equity-backed MSQ Partners, only for the mooted acquirer to come out and say that they had not made an approach, nor would ever do so ever again. Savagery

Publicis continues to fly, nabbing accounts aplenty at the expense of its rivals. I’ve used the phrase “mastering the narrative” a lot in recent months regarding Publicis, and they continue to do so, rightfully highlighting that scrutiny will shift onto Omnicom/IPG following the completion of their merger (much to the delight of beleaguered WPP). As industry expert Barry Dudley observed: "having an enemy, a Goliath to your David, is very commonly what drives people, drives businesses. This has been the environment that Publicis has been playing within."

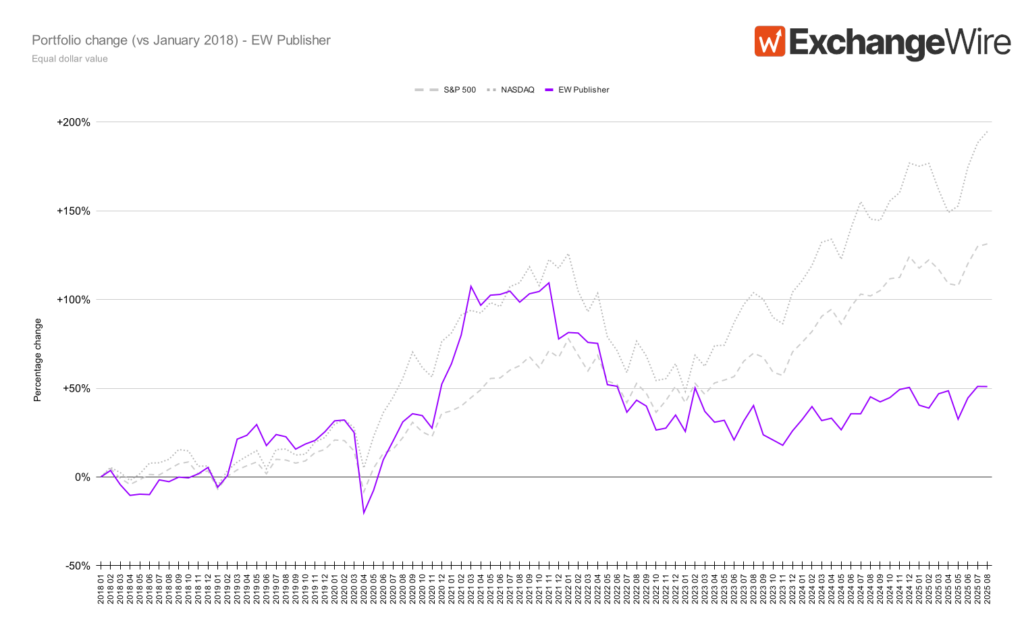

Publisher

Company highlights

Warner Bros Discovery

- Solid turnaround but challenges remain.

- Warner Bros. Discovery announced a modest increase in total revenues to USD$9.8bn (£7.3bn), alongside a significant turnaround in net income to USD$1.6bn (£1.2bn) from a loss in the previous year.

- The quarter was powered by the company's studios business, and to a lesser extent streaming, with studios revenue of USD$2.8bn, up 55% from a year ago.

New York Times

- The New York Times delivered the strongest performance among the publisher set, with total advertising revenue reaching USD$134m (£99.3m) in Q2 2025, up 12.4% year-over-year.

- Digital advertising specifically grew 18.7% to USD$94.4m (£70.2m), representing over 70% of total ad revenue.

Zee Entertainment

- Zee Entertainment's advertising revenue declined 8% to INR ₹9.01bn (£80.3m) in Q2, but the company achieved dramatic profitability improvements with EBITDA margins rising from 9.7% to 16%.

Commentary

A mixed bag among the publisher set, with digital publishers and streaming providers seeing strong gains, whilst traditional linear TV publishers continue to face headwinds. Despite market challenges, UK publishers showed strong momentum, whilst audience targeting, first-party data strategies, and AI integration, all dominated earnings presentations.

Consolidation has cooled in the segment, barring the merger between Nextar and Tegna, which seeks to solidify shaky foundations beneath the house of local TV across the US. Despite rampant speculation earlier in the year, gossip has quietened about a potential divestment of ITV Studios from the parent ITV business, however talks may still be ongoing on that front.

Ad TechAgencyBig TechEarningsPublisher

Follow ExchangeWire