Consolidation in Digital Audio: Now & Next

by Mathew Broughton on 5th Oct 2021 in News

In this feature article, ExchangeWire examines investment within the digital audio space over the course of the last nine months, how programmatic is fuelling funding initiatives, and the effect of consolidation upon the sector.

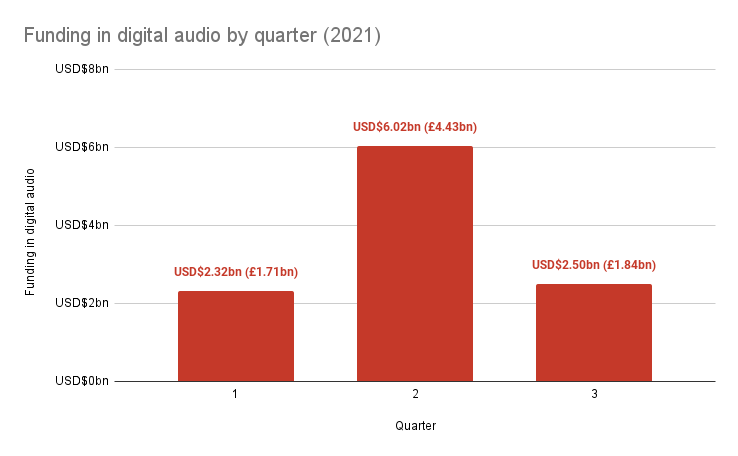

Consolidation in digital audio is booming. As of the start of Q4 2021, ExchangeWire has tracked USD$10.84bn (£7.97bn) in investment within companies offering digital audio products. This is balanced between “pure-play” audio firms, such as Triton Digital, Tidal, Art19, and 99% invisible, and firms offering audio as part of a wider product suite, such as Nielsen Holdings and Verizon Media. This level of funding spread between both specialists and generalists is indicative of the maturation of the audio sector, with many firms recognising the benefits of holding audio assets. By a crude measure of comparison, audio’s fellow “emerging channel” digital out-of-home (DOOH) has garnered only USD$574.5m (£422.9m) over the same period, despite both having been heavily impacted by the coronavirus pandemic.

The benefits of programmatic were cited by Tilly Sheppard, product manager, Xaxis, as fuelling this investment activity. Sheppard writes, “The concern in the early stages of the pandemic that there would be a drop off in audio user consumption hasn’t been borne out. In fact, the growth of podcast listening in particular proves users have continued to appreciate the high quality, screen-less entertainment that digital audio provides. Combined with the growth of programmatic capabilities in podcasts, this user demand has driven brands to the channel in huge numbers over the last year or so.

“Programmatic has opened up exciting new ways to make digital audio ads relevant to users. Creative can be dynamically personalised using behavioural data; location; age; gender; time of day; and weather, to ensure ads truly capture user attention and build brand awareness.

“These greater capabilities open up opportunities for bringing together audio with other formats, such as video, with the same data points being used to deliver consistent personalisation and increase relevance and effectiveness across a campaign. We’re also seeing how audio personalisation can work within the high growth area of voice enabled devices, with ads tailored to both the device and what the user indicates they are interested in.”

One worrying caveat to audio’s promise is the relative ease with which major tech firms under antitrust scrutiny, such as Apple and Amazon, have been able to snap up audio firms without so much as a hiccough. Apple’s recent purchase of classical music platform Primephonic, which was then be dismantled with vague promises to relaunch next year, hardly signifies that it is overly concerned with regulatory forces.

Content is king - not everyone wears a crown

While the fervent condition of the wider M&A and public markets cannot be ignored, the groundwork for this year’s surge in audio investment was laid by a steady stream of acquisitions, most notably within the podcasting space, prior to 2021. Examples in recent years include:

- Gimlet Media (Spotify) - USD$200m (£147m)

- Anchor (Spotify) - USD$140m (£103m)

- Megaphone (Spotify) - USD$235m (£173m)

- Stitcher (SiriusXM) - USD$325m (£239m)

- Pocket Casts (Automattic) - undisclosed

- Podnods (Sounder) - undisclosed

- Wondery (Amazon) - USD$300m (£221m)

Further purchases within the space have branched away from company acquisitions towards content-based growth, with multi-million dollar licensing agreements increasingly coming to the fore. Larger players have again dominated here. A prominent example includes Spotify snaffling Bill Simmons’ The Ringer for up to €180m (£154m), while also landing a USD$100m (£73.6m) licensing agreement for The Joe Rogan Experience.

Chirs Shuptrine, VP marketing at Kevel, believes that this level of consolidation could harm the prospects of podcast advertising in the long run, writing, “There’s no denying that podcasting has grown in popularity. And ad tech innovation invariably follows audience shifts. That said, I think podcast advertising is a very different beast from traditional digital advertising and that the space will be dominated by a few players, versus the thriving swath of display vendors.”

“For one, ad unit creativity is limited. With display you have standard programmatic banners of course, but also skin ads, native ads, rich media, sponsored listings, and so on — each with its own set of enablers. With podcasts, you have pre-recorded messages (whether sponsor or host read) and...an audio ad. Is there much room for tech differentiation here?

“Two, podcasting is not as open as the Internet; a couple of platforms have a monopoly over distribution, and we can expect consolidation and a walled ad garden approach. This further limits room for ad tech vendors.

“Finally, audio targeting leaves much to be desired. While you do receive IP address (allowing for some data augmentation), this is an imperfect approach. And are episode genre, content, and name complex enough to justify the growth of many competing DSPs/SSPs? I think there will still be much innovation here, but podcasting ad tech is unlikely to be a breeding ground for new vendors, and I expect a few players will own the space outright.”

Follow ExchangeWire