Adform Q2 2013 Report

by Romany Reagan on 26th Sep 2013 in News

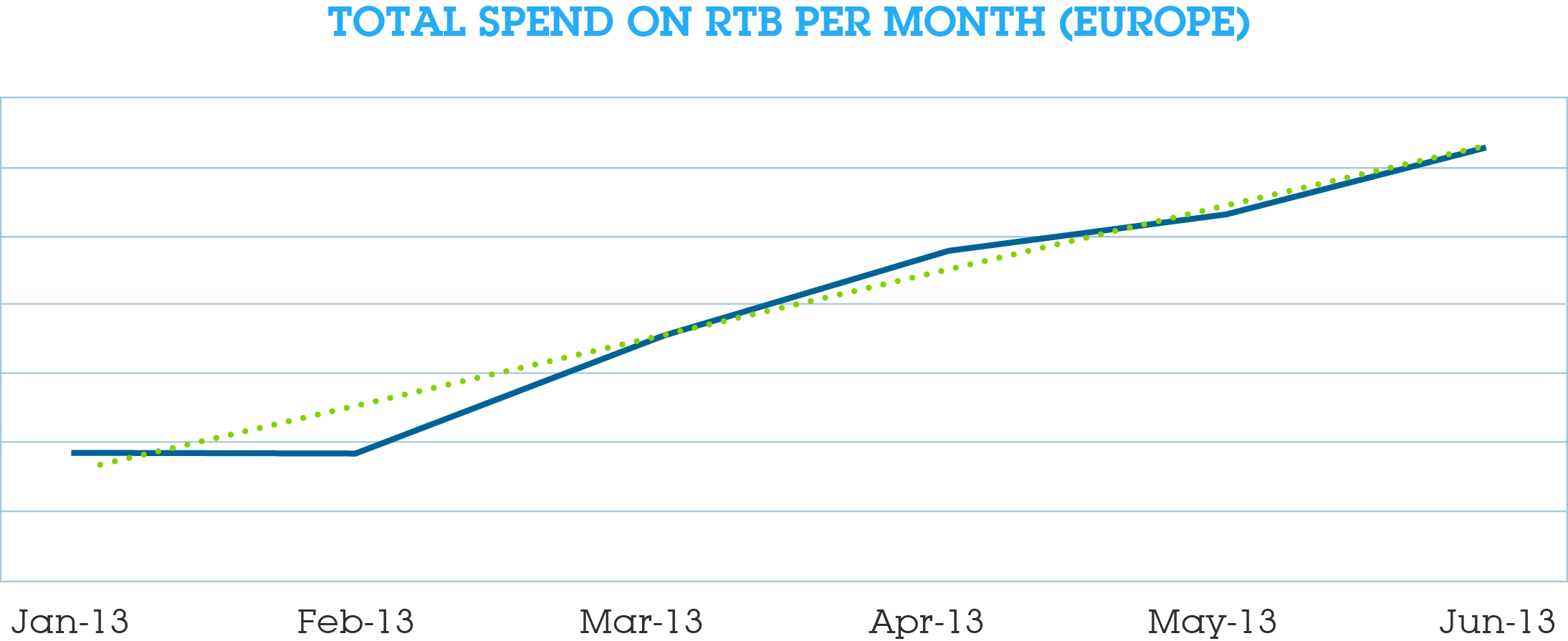

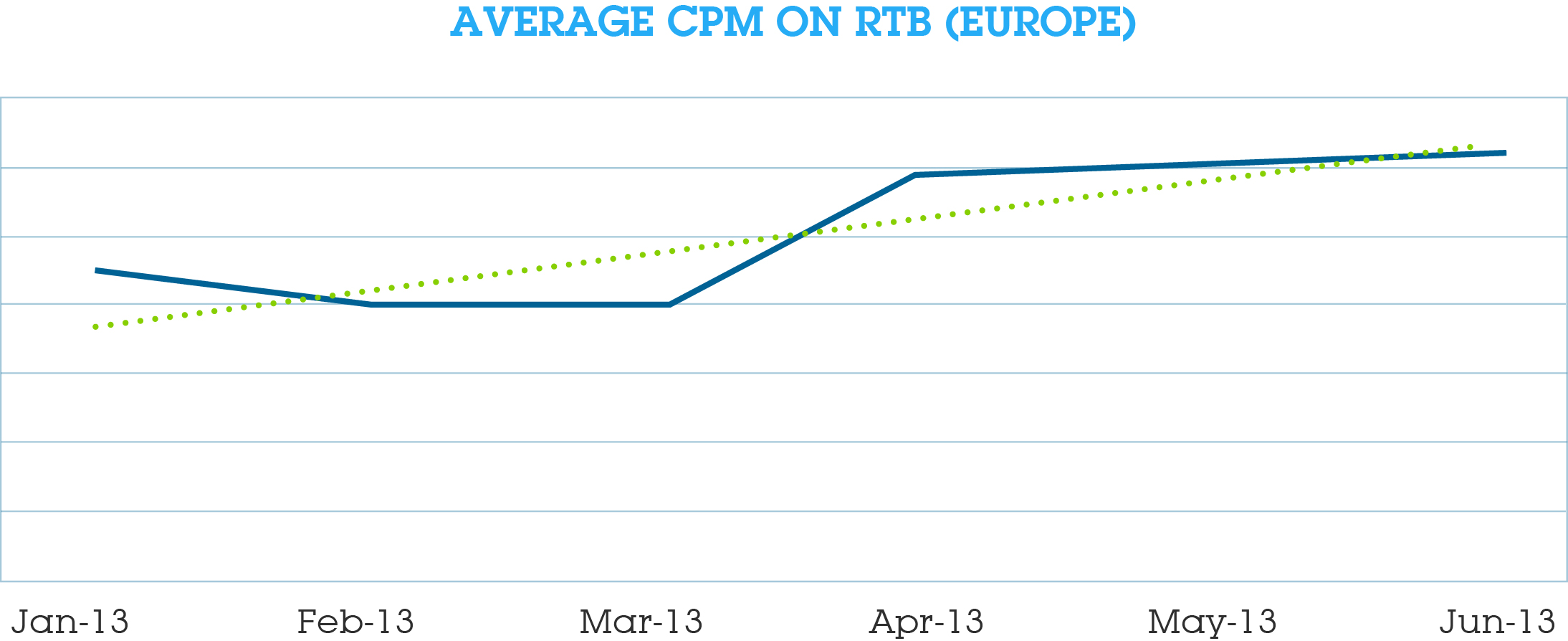

Real Time Bidding (RTB) and programmatic as a means for purchasing digital inventory continued its exceptional growth in the second quarter of 2013, boding well for the industry as a whole. Across Europe, advertisers increased spend by 92%; and publishers saw their CPMs increase by 30%.

Regional variations reflect each market’s experience level with RTB. For example, CPMs are high in the Nordics and Netherlands. Publishers are familiar and comfortable with the technology and are willing to offer premium inventory in private marketplaces driving higher prices, but the potential is still big. Likewise, both advertisers and publishers are slowly embracing RTB-traded video and Rich Media inventory, all of which command higher CPMs. This contrasts with Germany, a relatively latecomer to RTB. Demand for RTB in that country stems mainly from retargeting initiatives, not the premium-level services as we see in the more mature regions.

The rise in CPMs is particularly welcome news to the industry. Simply put, publishers need to realise higher CPMs from programmatic in order to justify their participation in the market. We continue to see inventory constraints in the market, with demand for RTB impressions outpacing availability.

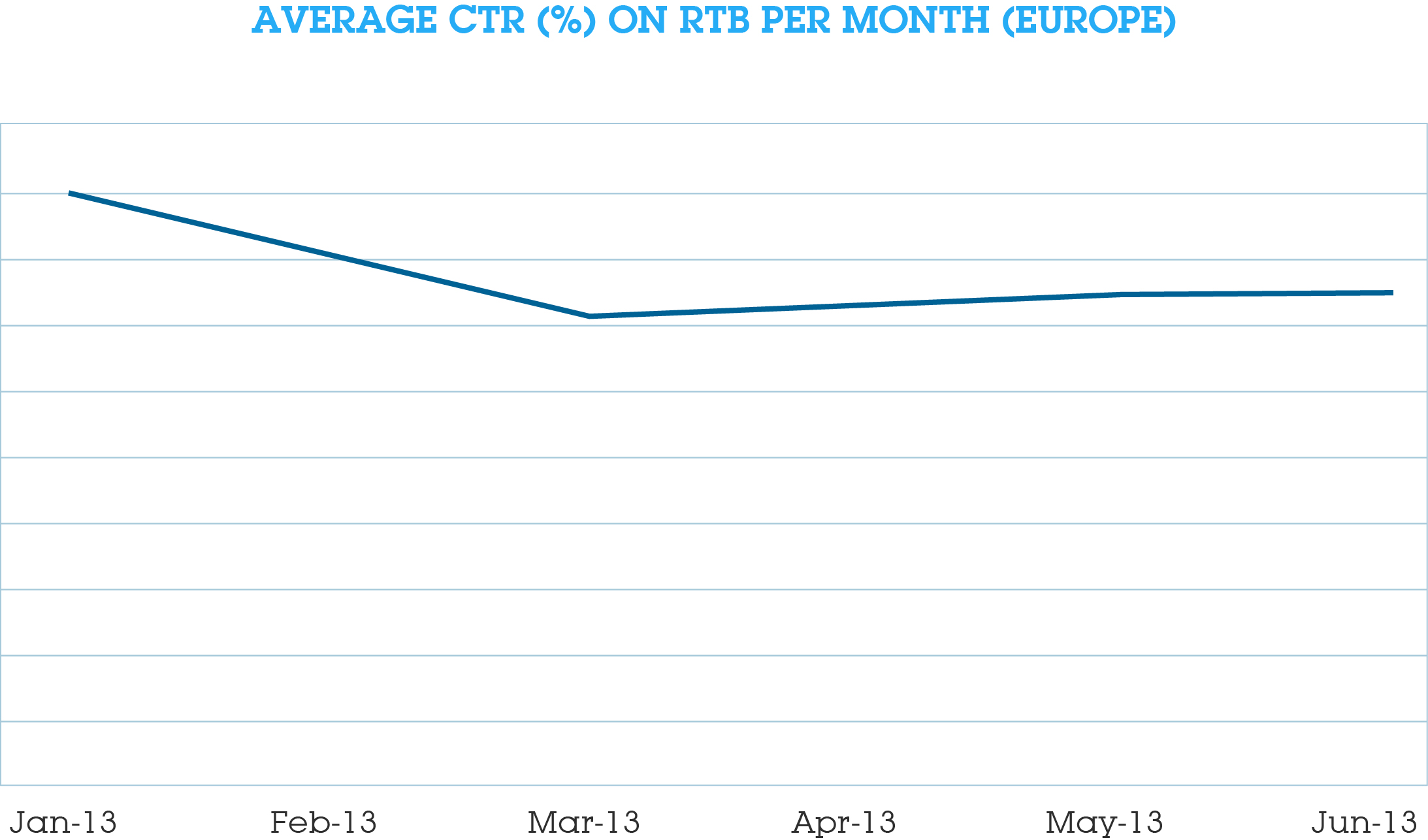

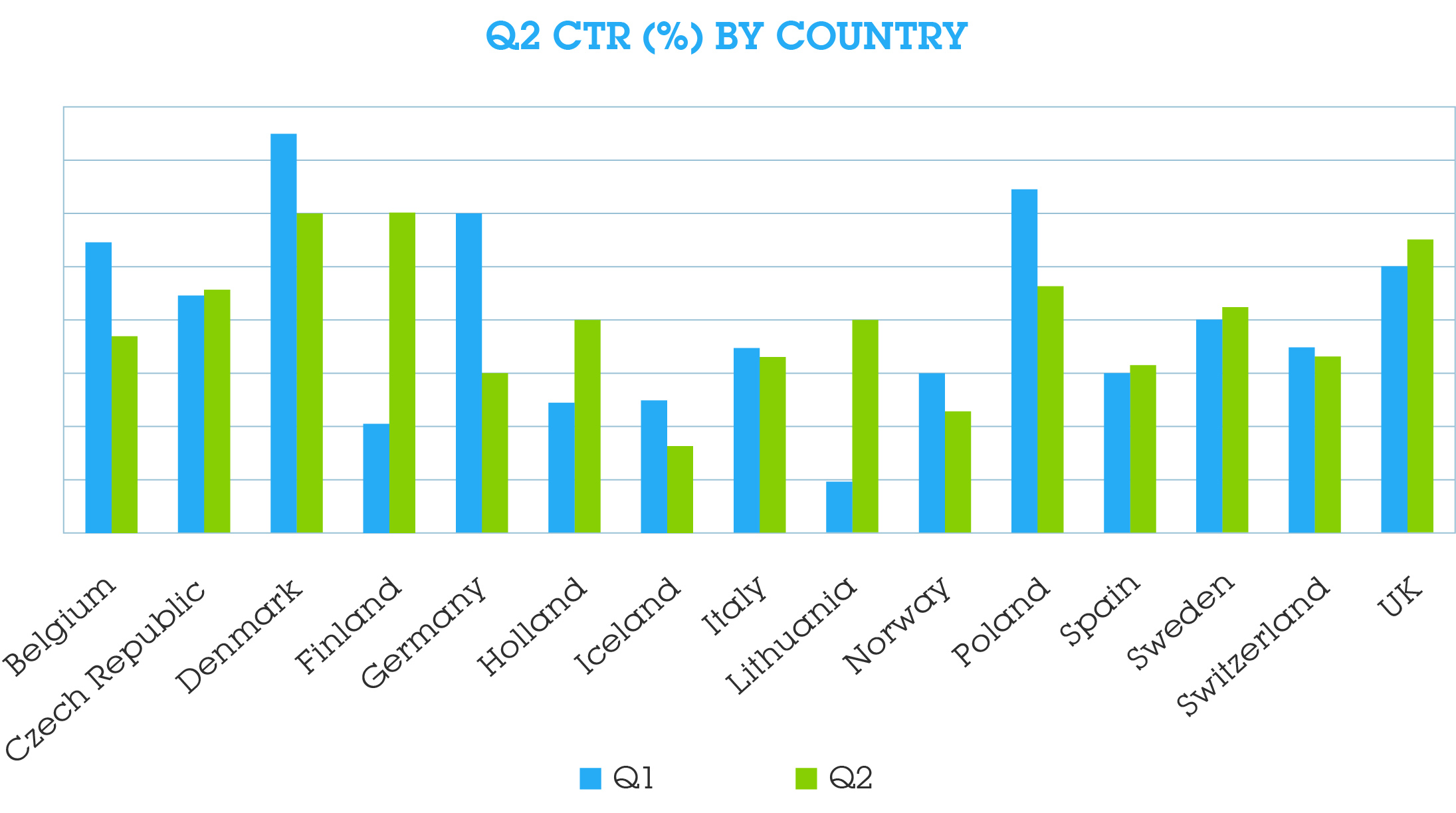

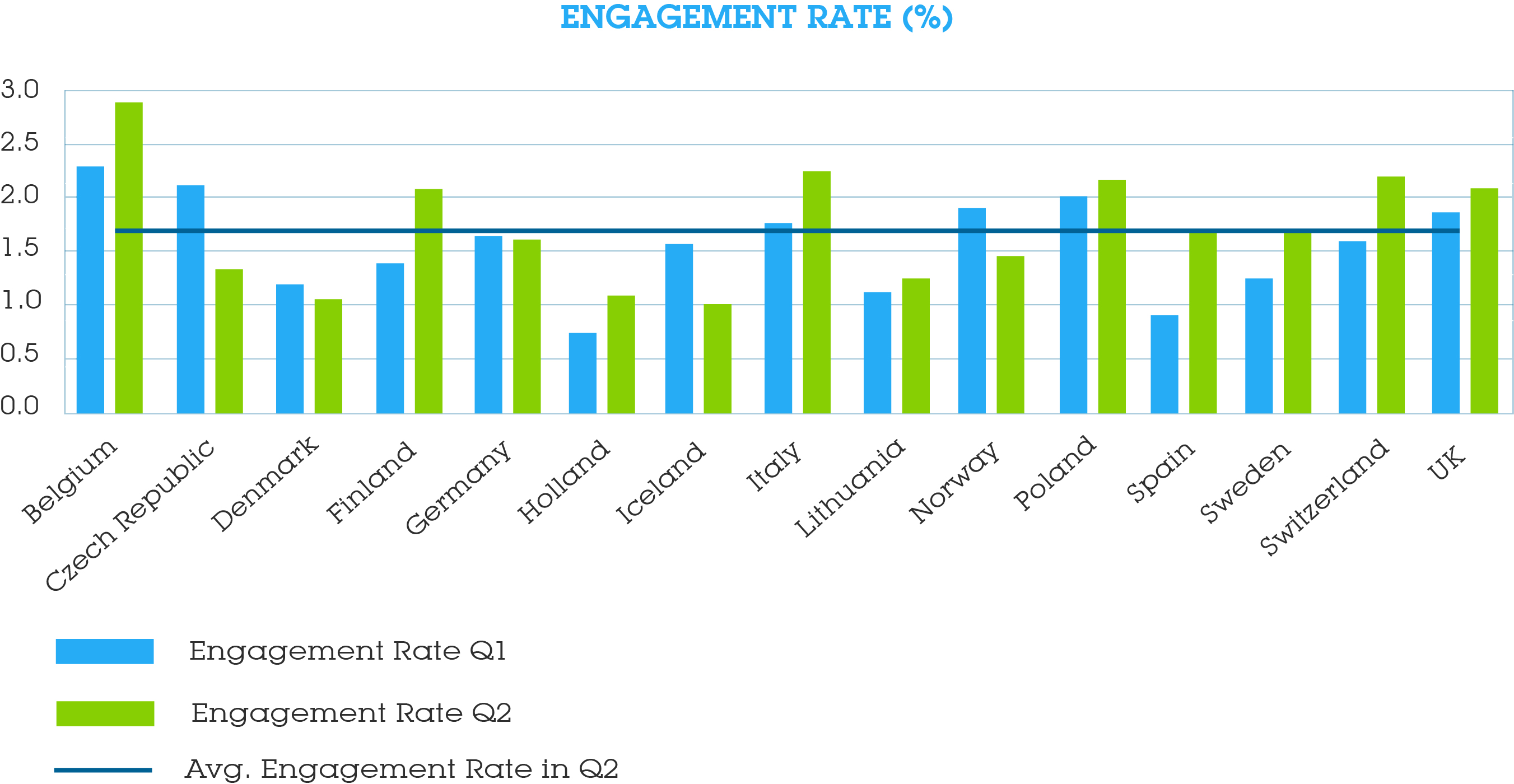

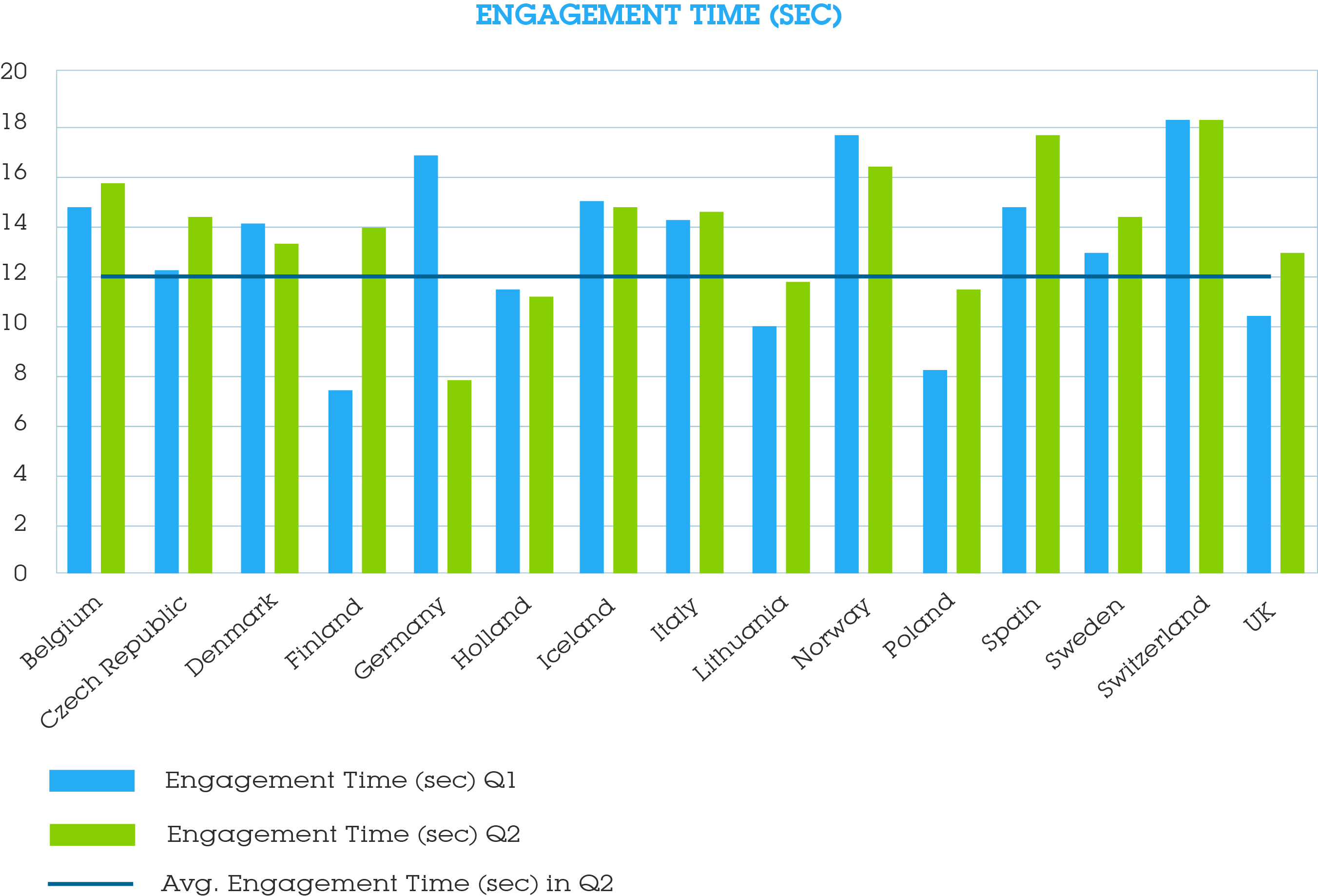

This quarter, we’ve seen an interesting development in the mature markets. Click-through-rates (CTR) are declining, even as CPMs rise. A possible reason for this may be the number of brand campaigns that are now executed programmatically. Supporting this theory is the strong showing of the metrics that typically measure performance of brand campaigns, including engagement rate and engagement time. Across Europe, the average engagement rate jumped 14%, and engagement time held steady at impressive 12 seconds – a clear indication that users are engaging with ads.

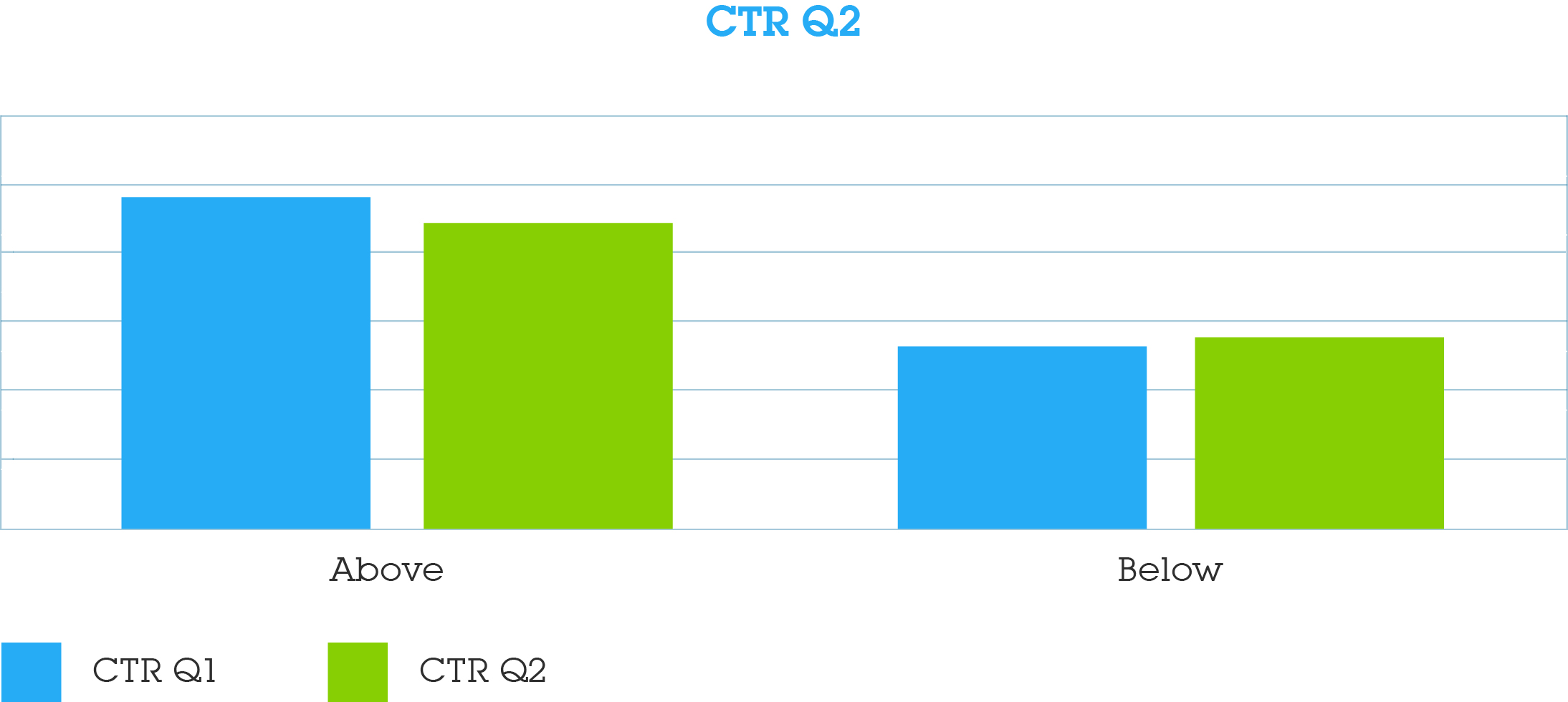

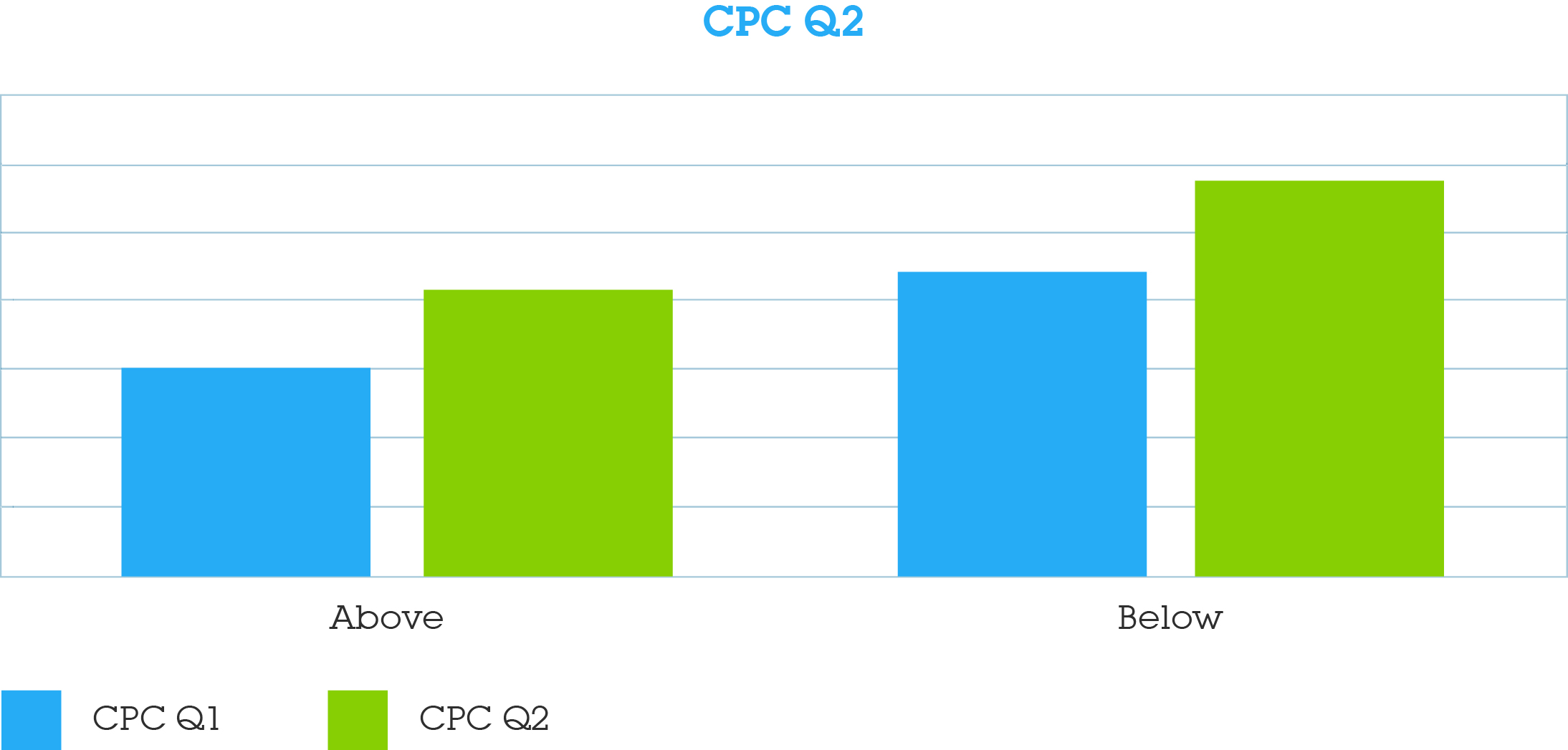

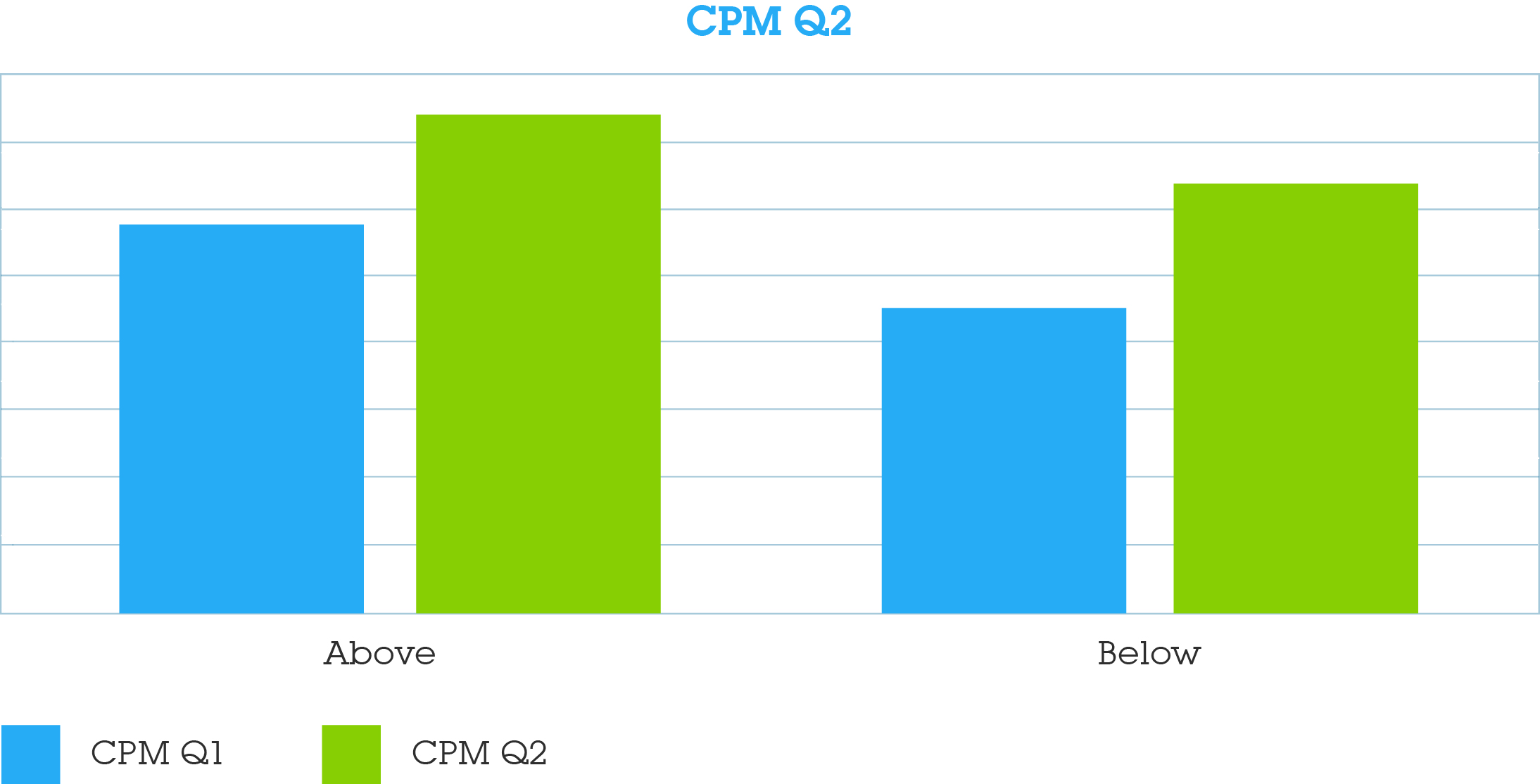

The CTR of above- and below-the-fold banner ads narrowed somewhat this quarter, as did the CPM for buying them. However, the cost-per-click (CPC) for below-the-fold ads is 33% higher than those above-the-fold, providing ample justification to opt for ads that users can see without scrolling.

The Big Three banner formats (top, article and skyscraper) still account for most of RTB ad spend, no doubt due to their relatively high CTR and low CPMs. At the same time, the higher-priced banner formats consistently deliver the highest CTRs. In fact, there is a tight correlation between banner CPM and banner CTR, indicating that performance is driving the media acquisition costs. Publishers interested in boosting their CPMs further would be wise to offer more attention-grabbing formats to RTB markets.

Going forward, we anticipate further growth in RTB spending as the holiday shopping season gets underway in Q4. And given that many holiday campaigns will be performance-based, the average CTR may recover, as marketers seek to drive consumers to their sites and stores with offers.

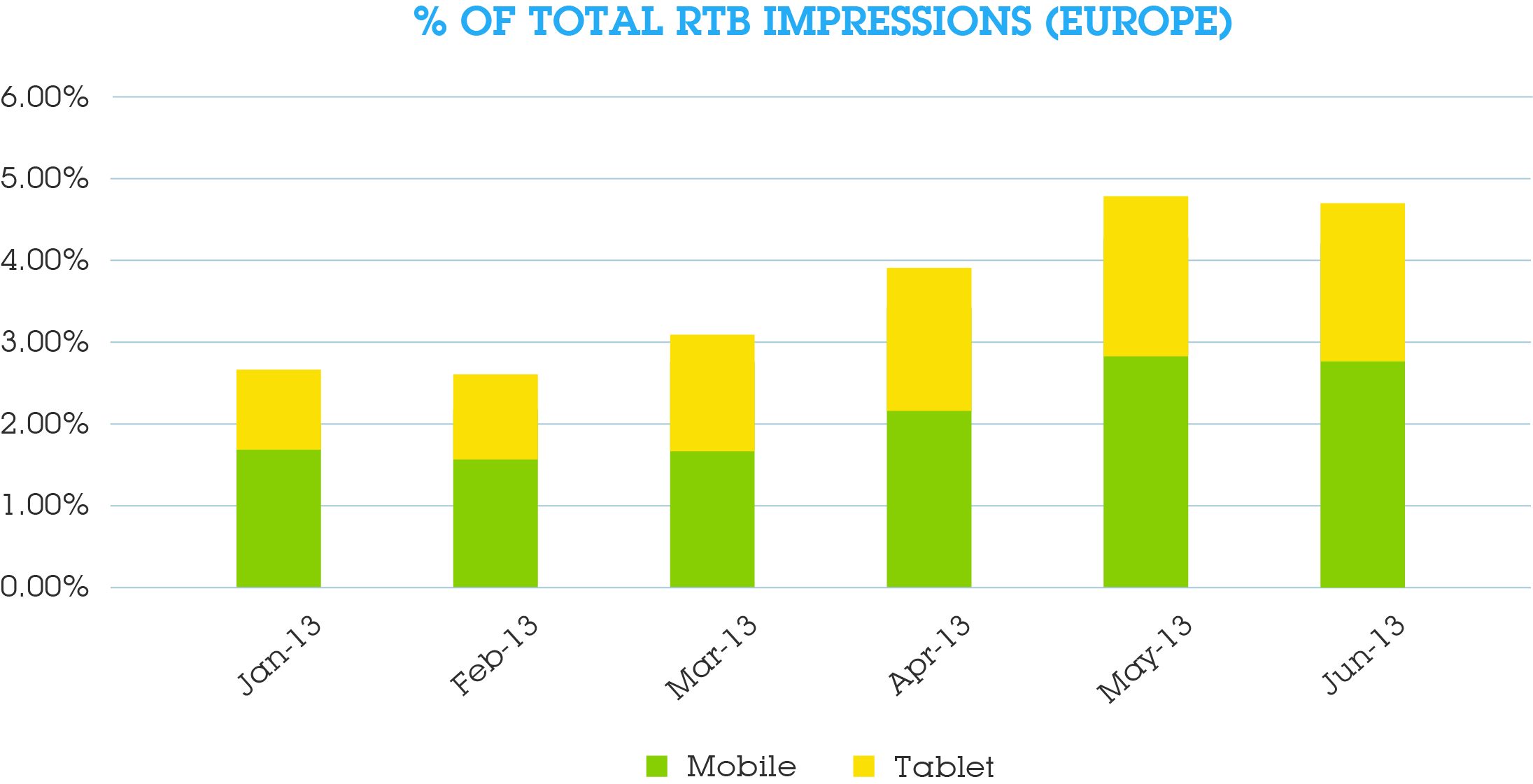

Mobile RTB spending grew from three to five percent in Q2, a 67% increase, but still a far cry from what it should be given consumer migration from laptops and PCs to smartphones and tablets. Advertisers need to meet the consumer where they spend the most time, and increasingly that is the mobile web.

New in this Report

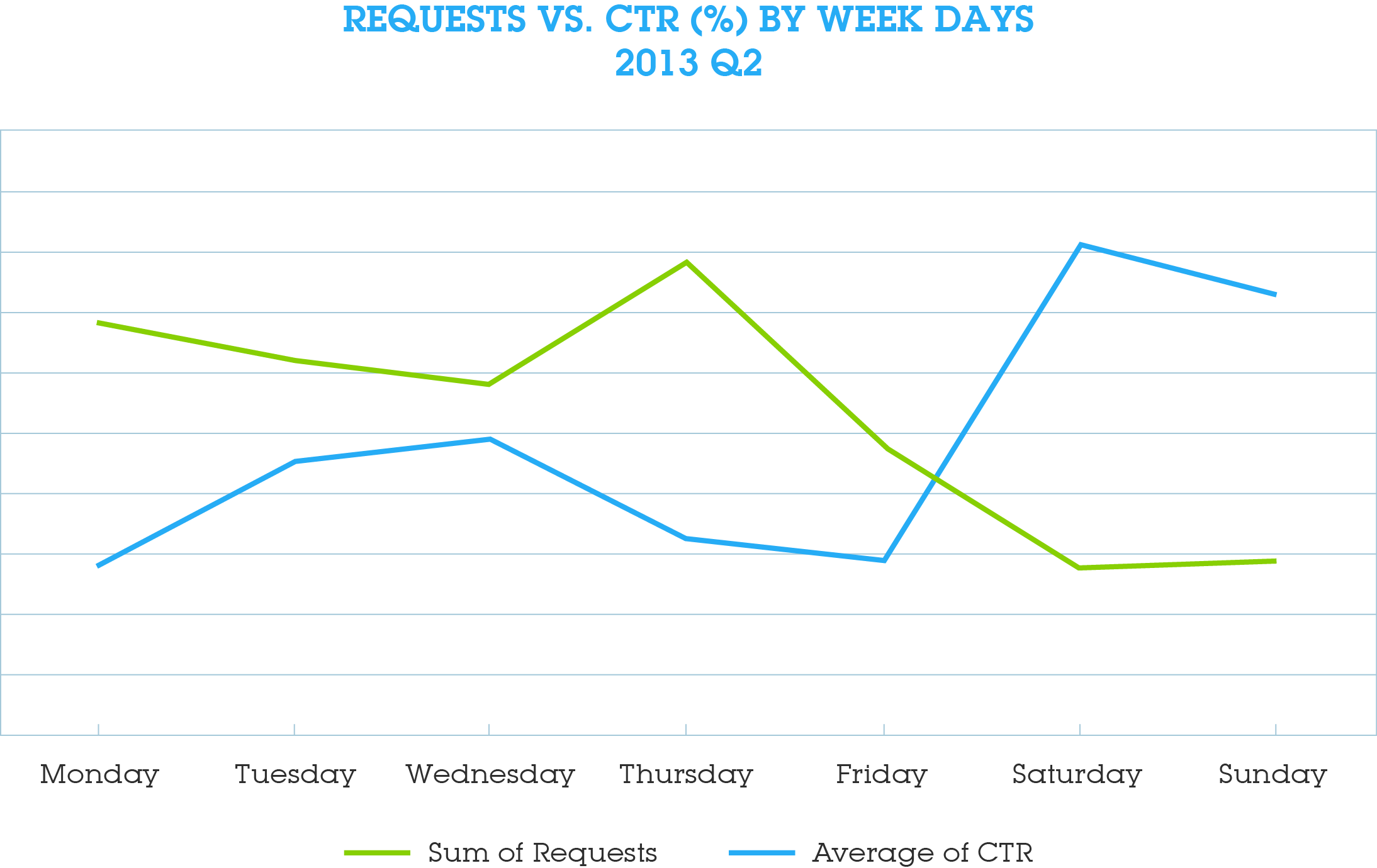

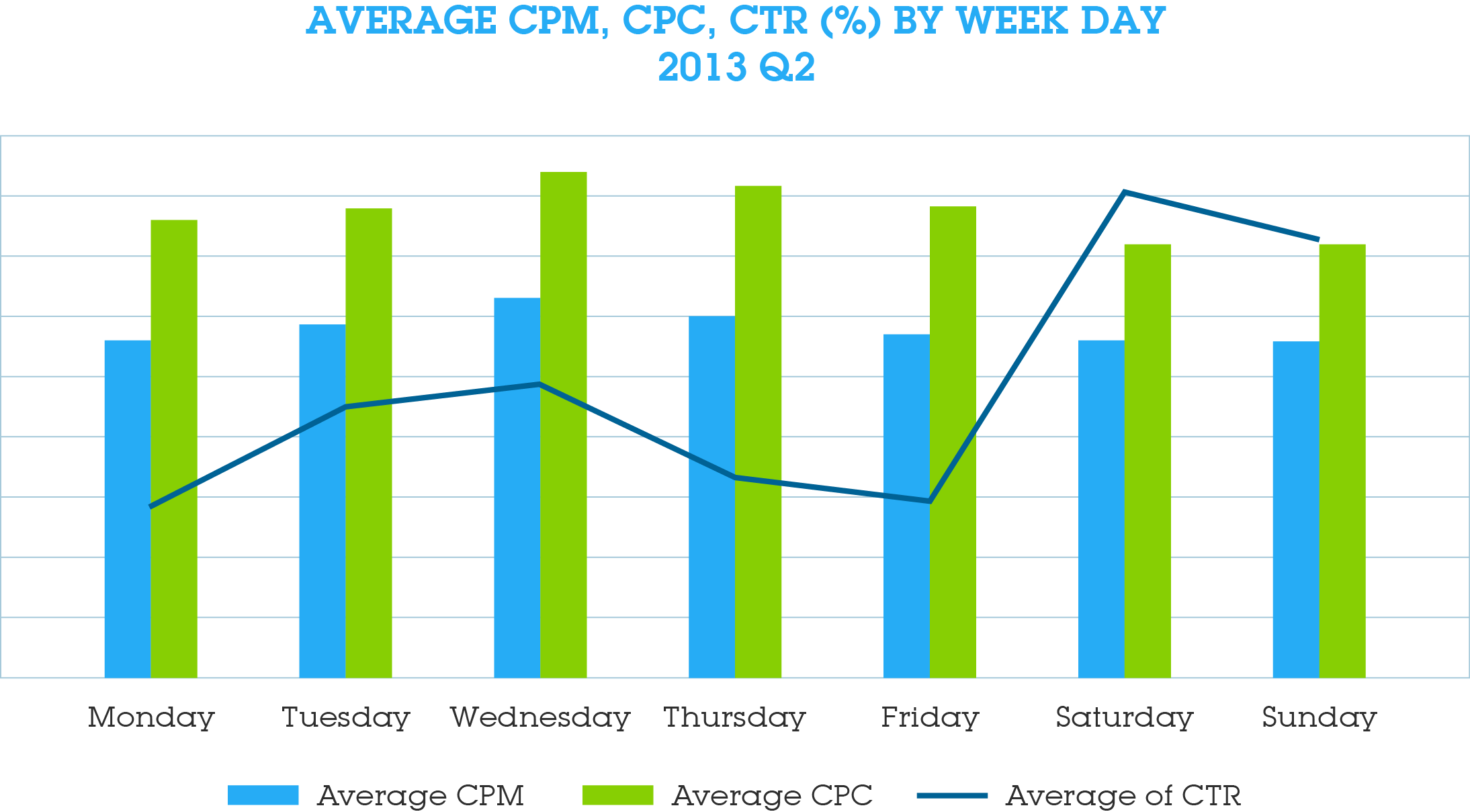

Finally, weekends are proving to be ideal times for marketers to reach and engage consumers. CTR increases on Saturday and Sunday, while the number of bid requests decline. The result is a more receptive audience available at a lower cost. Perhaps it’s time for brands to reconsider how they split their media across the days of the week.

GENERAL TRENDS – RTB in Europe Q2 2013

General Growth in Spend

Though RTB spend was flat in the first month and a half of 2013, by the end of June it had risen by a dramatic 92%. Much of the growth stems from new advertisers and agencies that have jumped into the RTB game. As these newcomers move out of the testing phase, we can expect to see further increases in RTB spending. To sustain healthy growth, however, publishers will need to keep up with the growing demand.

Possible Reasons

-- Demand is growing. An increasing number of advertisers and agencies are buying RTB inventory their campaigns, and existing RTB buyers are dedicating more of the budget to programmatic campaigns.

-- More premium publishers are beginning to see advantages of RTB and are offering inventory to real-time markets.

-- Many of players within the RTB ecosystem are gaining expertise, enabling them to provide personalised services to advertisers and agencies; better targeting and data capabilities (including geo, demographics, browsing history, income, internet provider); and enhanced Rich Media ad formats. As a result, today’s RTB campaigns are more sophisticated, with many on par with direct-buy campaigns.

-- Although still in its early stages, programmatic video and Rich Media ads are on the rise. These premium ad units deliver higher CPMs than traditional formats.

Average CPM Increases

After a relatively flat overall CPM in the first quarter of 2013, RTB prices rose significantly between March and April, and leveled off through June with 30% increase quarter to quarter. We expect CPMs to continue increasing, particularly as demand grows, publishers offer more premium inventory to the markets, and the back-to-school and holiday shopping seasons kick into high gear, increasing competition for impression.

Although RTB is still relatively young, the RTB ecosystem is showing signs of stabilisation, with buyers and sellers reaping equal rewards. Healthy CPMs are vital for publishers, and for the market as a whole.

Possible Reasons

-- Strong personalisation capabilities and services are giving rise to more sophisticated, higher-cost campaigns.

-- Programmatic video and Rich Media ad formats are premium impressions that command higher prices.

-- New technologies such as private marketplaces allow premium publishers to enter into private deals in tightly controlled selling environments with selected advertisers. Private marketplaces deliver higher CPMs compared to SSPs and retargeting networks.

-- Early adopters are beyond the testing phase and are now allocating significant budget to programmatic campaigns.

-- RTB supply hasn’t quite caught up to demand in most regions

Average CTR Declines

The average click-through-rate declined in the quarter, and has remained relatively flat through June 2013.

Possible Reasons

Thanks to rich-ad formats, enhanced targeting, and personalised service, brand managers are relying on RTB for their branding campaigns, which typically rely on – and are optimised for – metrics other than CTR as they are focusing on more upper funnel objectives. Thus, fewer campaigns overall rely on clicks.

Performance/Branding

The CTR for banners above-the-fold declined slightly from Q1 to Q2, while the CTR for banners below-the-fold saw a modest increase. Meanwhile, the difference in CPMs narrowed 6% from Q1 to Q2. These trends would appear to indicate that banners below-the-fold are beginning to catch up to those above-the-fold in terms of value delivered, however, the substantial difference in cost-per-click (CPC) proves otherwise. The CPC for banners below-the-fold jumped by 76% from Q1 to Q2, and are 70% higher than those above-the-fold.

The data for this analysis came directly from the ad exchanges and publishers that sold inventory via the Adform DSP. It’s interesting to note that above/below data was reported for only 35% of all impressions that passed through the DSP. Put another way, the ad exchanges and publishers don’t collect and report on above/below the fold data in 65% of all impressions sold.

RTB Performance by Country

Country Comparison

To get a sense of in-market variations, Adform compared data for key campaign metrics (CTR, engagement rate and engagement time) on a country-by-country basis.

Some of the countries are quite new to RTB, which can lead to spikes in CTR, such as those seen in Poland in Q1. As noted earlier in the report, CTR in Europe declined by 20% from Q1 to Q2 2013 due to a variety of factors, including influx of brand campaigns into the RTB market.

On the flip side, engagement rate across Europe is up 14%, which is good news for brand campaigns. Engagement time saw little change from Q1 to Q2; however, the 12-second average is extremely high, and a clear indication that users are truly engaged with an ad.

Devices

The industry is abuzz with talk about mobile, and for good reason: sales of smartphone and tablet devices far outweigh those of laptops and PCs. In some regions and demographics, mobile is the primary way to access the internet. While the consumer has clearly embraced mobile, advertisers have been slow to catch up. From Q1 to Q2, mobile grew from 3% to 5% of all RTB ad spend – a 67% increase to be sure, but still a far cry from what it should be.

Possible Reasons

-- Publishers, unsure of how to fully optimise their sites for mobile or to build mobile versions of the site, aren’t offering enough mobile inventory to the RTB markets.

-- Although publishers are eager to monetise mobile inventory, their enthusiasm is tempered by a concern for their readers’ brand experience. They don’t want users to confront highly intrusive ads.

-- While advertisers have tremendous expertise in developing engaging display ads, mobile creatives and formats are still relatively new to them.

-- Advertisers and agencies are reticent to invest heavily into mobile performance campaigns until they feel comfortable that the industry has solved the problem of accidental clicks.

Time

Are consumers more likely to click your banner on the weekend? Across Europe we noticed a strong correlation between CTR and bid requests across the days of the week. In general, we receive more requests for bids on work days than we do on weekends, which means the competition – and CPMs – for inventory is highest Monday through Friday. Consumers, on the other hand, are more apt to click on an ad during the weekend. In fact, CTRs rise significantly on Saturday and Sunday. Saturdays see the lowest CPMs and CPCs and the highest CTR, making it a prime opportunity to target consumers.

Possible Reasons

-- Consumers have more time on the weekends for recreational browsing, and are more apt to research products and services by clicking on ads.

-- Consumers are reluctant to click on ads while at the office.

-- Planners don´t allocate enough budgets for the weekends

A Look Forward

-- RTB spend will continue its upward trajectory as both publishers and advertisers gain more experience and confidence with programmatic trading. Publishers will offer more premium inventory to the programmatic market, and advertisers will allocate more of their media budgets to RTB campaigns. Additionally, more advertisers and publishers will begin testing, leading to an increase in the number of players participating in the market.

-- CPMs will continue to rise, particularly as publishers adopt the private marketplace model for RTB. Direct buys will include private deals that are executed via programmatic pipes.

-- An increase in attention-grabbing inventory, including the mega-format banner, will result in higher CPMs as well as overall spending.

-- Although overall CTR in Europe has declined slightly due to the influx of brand campaigns into the RTB market, the holiday season may drive clicks back up as advertisers vie for consumers’ attention.

-- In the coming months we expect to see more brand managers launch programmatic digital campaigns due to a combination of factors, including:

*The ability to track brand-centric campaign metrics, such as engagement rate, engagement time and banner visibility

*The availability of new and innovative Rich Media ad formats that can support the level of creativity that brand managers favour

*A growing abundance of Rich Media and video inventory to support large-scale brand campaigns

*New fully integrated page-content analysis technologies that ensure ads appear in brand-safe, uncluttered pages

-- Mobile and tablet RTB campaigns will increase in the second half of the year, driven by holiday campaigns seeking to target users in the vicinity of stores.

You can download the full report from Adform here.

AdvertiserCreativeProgrammaticPublisherVideo

Follow ExchangeWire