Surge in Marketing Automation Deals Reflects Marketers' Business Needs

by Lindsay Rowntree on 5th Feb 2016 in News

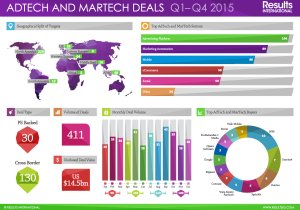

Around three-in-ten ad tech/martech deals in Q4 2015 involved ad platforms, rising significantly from the previous quarter, where such deals only accounted for 7% of all transactions. This research from specialist M&A advisor Results International showed that data-driven and marketing automation software platforms are playing an ever-increasing role in the mergers and acquisitions arena; but is this a sustainable trend?

If you look at 2015 as a whole, deals across the ad tech and martech landscape offered a combined value of USD$14.5bn (£9.9bn) which was a whopping 59% down from the previous year. When you account for Facebook’s multi-billion-dollar acquisition of WhatsApp in 2014, that equates to a more acceptable drop of 8% year-on-year. The surge in Q4 2014 was positive, but it wasn’t enough to overturn the full year trend.

The big growth last year occurred within marketing automation; capturing 22% of all market deals, versus 10% in the previous year. So, where has this trend for marketing automation come from?

When looking at the M&A activity of the so-called ad tech hubs in 2015, you begin to get a clearer picture of the direction the market is heading.

As channels, devices and communications became more convergent in 2015 than ever before, marketers began to realise that integration and coordination were the order of the day, to allow them to deliver tailored communication in a standardised way. It became clear to tech platforms what needed to happen; they needed to be able to meet all of their clients’ needs. This meant one of two things: either create a fully operational, full-service stack, or an open ecosystem, to allow the missing pieces of the puzzle to be able to plug into your platform.

Neustar’s purchase of MarketShare, an analytics and attribution tool, in November 2015 showed that it was looking to bolster its already advanced analytics capabilities, to be able to address this cross-channel and cross-device; hugely beneficial and necessary in the telco environment in which Neustar plays.

Similarly, Nielsen’s purchase of Exelate in March enables it to expand beyond measurement and analytics and enter into the world of data and execution, to deliver improved, effective targeting.

Sizmek, known for being an open, customisable tech stack that can operate alongside other vendor platforms, is moving into ad customisation with it’s purchase of Pointroll last year, to allow for more targeted ad creative and delivery; again, a big want on the list of marketers’ needs.

Sticking to the targeted creative theme, in August, Oracle purchased Maxymiser, a cloud-based software allowing marketers to test, target and personalise web pages and apps – a move that will ensure Oracle’s clients can put their data to relevant use and automate highly targeted on-site/in-app content for their consumers.

There is a fine line between becoming ‘jack of all trades, master of none’ and delivering the tools that marketers need to be able to achieve their goals. Looking at the acquisition trends among major technology hub platforms, this clearly indicates a need for targeted content and using data to inform creative, as well as investing in a platform that delivers more than one element of a marketing ecosystem in one place.

Even Adobe’s purchase of Fotolia, a stock photography agency, to be integrated into the Adobe Creative Cloud in January last year was sending a clear message: tailored messaging via dynamic content made easy. With access to all this creative inventory as part of their cloud offering, marketers will be able to significantly speed up their design process and actually deliver specific creative that will engage the consumer.

So, what’s next? We’re only into February, but already it seems that the race for data and targeted delivery will continue to drive a flurry of acquisitions within ad tech and martech in 2016. They have always remained quite separate entities; but last year showed convergence and that trend is continuing this year, with the recent announcement of TeleNor acquiring Tapad being a great example of this.

The digital ecosystem is merging and it is becoming harder to differentiate between tech platforms, marketing automation software or data, as many businesses are setting out to excel across all of them. They have to if they want to keep up. Many standalone tech businesses, such as DSPs, are homogenous; so it is much harder to extract the point of difference. Tech hubs being able to integrate these into their offering enables them to tell a better story to marketers about where development investment is required and drive better results.

Equally, as long as there are threats posed by challenges, such as ad blocking or viewability, businesses will launch to try to combat them. Invariably those businesses will eventually get bought by a larger business, looking to diversify its offering.

As long as technology keeps evolving at its current hyper speed, new tech platforms will emerge to solve a marketer’s problem or even create problems marketers didn’t know they had. The number of deals may be down marginally versus last year; but it is still significantly higher than 2013, and this year already looks to be very active, so nobody needs to be worried.

M&AMartechMedia SpendNorth AmericaTechnologyUK

Follow ExchangeWire