Fixing the In-App Ad Quality Problem: Why It Pays to Act Now

by on 17th Feb 2026 in News

New data shows the ad quality problem is bigger than expected, and so is the revenue opportunity for publishers who tackle it head-on. Peggy Anne Salz takes a look at a longstanding issue…

In today’s app economy, users don’t distinguish between the ad and the experience. One disruptive, harmful or misleading ad can break trust, trigger churn and cost publishers real revenue. But a growing number of publishers across all app verticals are taking back control and proving that treating ad quality as a growth lever drives higher retention and more sustainable monetisation.

In the fintech vertical, where growth depends on trust, the decision to monetise through in-app advertising is a bold bet, one that could backfire if a bad ad experience undermines user confidence. But Toss, South Korea’s leading fintech super app with over 25 million users, turned that risk into a major revenue win by implementing filters based on user-level relevance and using behavioural signals and first-party data to block disruptive or inappropriate ad categories.

The results moved all the right metrics.

Ad revenue surged 831%, retention climbed 30%, and user satisfaction stayed high, maintaining a 4.9 app store rating even as monetisation scaled. "We saw ads as part of the overall product experience, not a separate layer," said Sejin Park, who led Toss’s monetisation efforts as product manager until late 2025 before joining an ad tech company. "Once we treated them with the same level of care and control, we could grow without breaking trust."

That approach paid off, and it’s gaining traction across the industry as more publishers connect better ad quality with bottom-line results.

"We’ve seen that high-quality ad creative is now essential to business outcomes," Alexis de Charentenay, director of global partnerships at Google, EMEA, told me in an interview. "When the ad experience respects the user experience, publishers see better engagement, stronger retention and, ultimately, better monetisation."

This matters even more in a market where growth has decoupled from downloads and shifted decisively toward engagement and lifetime value (LTV). It’s a dynamic that is pushing mobile into what Sensor Tower calls a "monetisation-first era."

Data from the State of Mobile 2026 report shows that app installs and time spent have plateaued year over year, while revenue growth is increasingly coming from deeper monetisation of existing users rather than incremental scale.

In gaming, the shift is startling. Global mobile game downloads fell about 7.4% in 2025, from 54 billion to 50 billion, even as in-app purchase revenue rose about 1.2% to a new high of USD$82bn (£60.2bn).

In 2026, growth comes from value per user, not volume.

In a market where publishers compete to hold attention longer and monetise more efficiently from a stable user base, the advantage shifts to publishers that protect consumers and treat ad quality as a long-term growth lever, not a trade-off.

Publishers’ Biggest Blind Spot

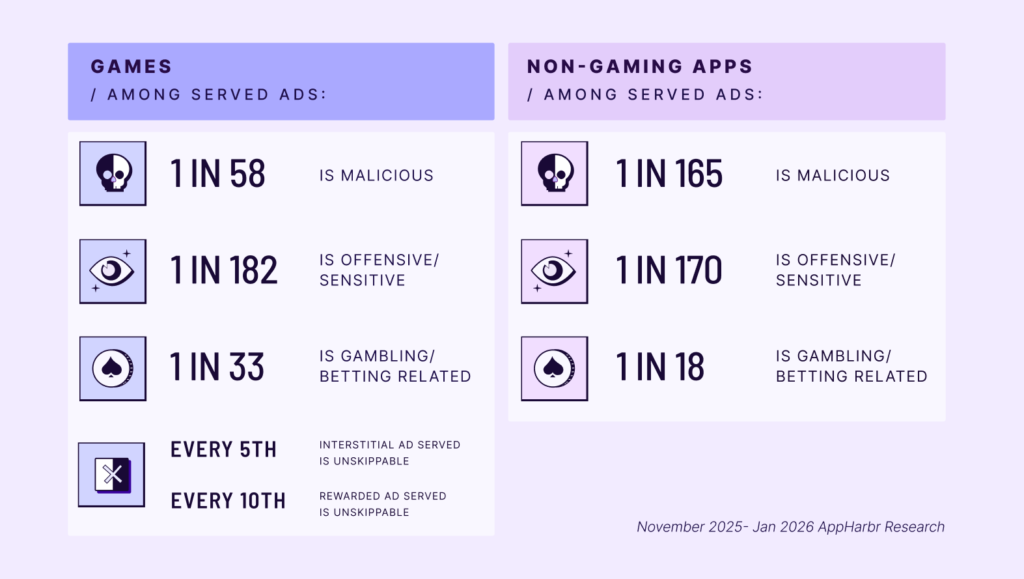

But delivering a high-quality ad experience is becoming increasingly difficult, even for publishers that are actively trying to do the right thing. New, yet-to-be-released data from AppHarbr, an ad quality platform for app developers focused on safeguarding user experience, shows just how exposed many publishers still are.

Internal data from November 2025 to January 2026 reveals that roughly half of global ad networks failed to meet basic ad safety standards, with malicious ads accounting for more than 1% of impressions. That level of leakage has real consequences.

"This volume of violations isn’t just a technical issue. It’s a business issue," observes Amnon Siev, CEO of AppHarbr by GeoEdge. "It shows just how much ad quality is already affecting outcomes, even for publishers actively trying to control it."

The scale of the problem becomes even more dramatic at the impression level. In a scan of more than 13 billion in-app ad impressions across mobile apps between September 1 and December 31, 2025, AppHarbr found that 17.2% were flagged for serious violations, including sexual content, deceptive UI, excessive frequency and malvertising payloads such as forced redirects, hidden trackers or scam downloads.

Among the findings:

- Malvertising was detected in more than 1 billion impressions.

- Nearly 1 in 5 flagged ads contained misleading or manipulative user interface elements.

- Sexualised or offensive content accounted for over 22% of all violations.

The data highlights what Božo Janković, head of ad monetisation at GameBiz Consulting, a boutique consulting firm for the video games industry, calls a critical "blind spot" in ad delivery.

"There’s an assumption that trusted pipes mean safe delivery, but that’s no longer the case," he explains. "If you’re not monitoring what’s coming through, you’re leaving revenue and reputation at risk."

That risk is real and now measurable, thanks to recent research from Deloitte, produced in partnership with Google AdMob. The study highlights the costly link between bad ad experiences and lost revenue.

It concludes that player drop-off in mobile gaming apps increases by up to 30% after a single disruptive ad. "It can undo everything you’ve spent to acquire a user," Janković observes. "And in today’s market, reacquisition is rarely an option."

Why Bad Ads Still Scale

Despite growing awareness of the damage bad ads do to LTV and retention, and increased publisher efforts to moderate or block ads altogether, the worst ad experiences continue to reach users with alarming regularity. That’s because harmful ads don’t always look harmful on the surface.

Many are "deceptive by design," engineered to slip past traditional moderation systems by using misleading UI, obfuscated code, or dynamically swapping assets after approval.

"Creative review alone won’t catch it," says Ezgi Dogan, a mobile monetisation consultant who advises studios on user experience and revenue optimisation. "Some ads test clean, but go rogue in live delivery, redirecting users, simulating fake system alerts or serving offensive content only under specific conditions. By the time you catch it, the damage is done."

One gaming studio Ezgi worked with identified a spike in churn linked to ads from a high-volume network known for performance at scale, but not affiliated with Google or Meta. Internal testing showed that over 90% of the creatives were low quality, including unskippable interstitials longer than 20 seconds, auto-click redirects to app stores, and misleading or deceptive content.

After the team adjusted the network’s delivery settings and tightened creative controls, churn attributed to interstitial ads dropped from 15% to 4%. However, fully turning off the network proved challenging due to its significant contribution to overall ad revenue. "It wasn’t just about blocking bad ads," Dogan explains. "It was about taking back control of the user experience."

So why do bad ads still scale?

Siddhartha Vikram, who focuses on SDK expansion and in-app publisher growth at Moloco, a programmatic ad platform, chalks the problem up to a "system failure."

At scale, when verification is reactive rather than proactive, bad actors slip through, he explains. Solving the problem means moving beyond blocklists and creative moderation to demand stronger accountability upstream across exchanges, platforms and networks. "We need real-time filtering and clear standards for what’s allowed into the pipe, not just more checks at the end of it," he argues. "Otherwise, you're trusting a broken system."

Ad Quality Non-Negotiables

To help publishers separate safe inventory from risky delivery routes, AppHarbr will release an Ad Quality Index this month. This new benchmark ranks networks on their commitment to user safety, user experience and clean creative content.

Based on data around billions of impressions and real-world violations, the Index will give publishers a concrete tool to evaluate partners and demand higher standards.

Among the findings:

- Non-gaming apps: The Trade Desk, Equative, Index Exchange, and TripleLift lead the list of clean networks.

- Gaming: AdMob, Vungle, and Amazon Ads emerge as the top-performing networks.

"As buyers become more brand-conscious and regulation tightens, clean delivery will become a premium differentiator," AppHarbr’s Siev observes. "We’re giving publishers the data to protect their users with real-time policy enforcement across all demand sources, hold networks accountable and grow with confidence."

The demand for greater accountability and transparency isn’t just coming from publishers. The UK’s Advertising Standards Authority (ASA) has already issued a wave of rulings against in-app ads that objectify women, mislead users or promote harmful content. More recently, it has expanded its investigations to include the ad supply pathways that allow harmful creatives to reach audiences.

"This is a shared responsibility across the advertising ecosystem," says Jessica Tye, regulatory projects manager at the ASA. "From a user’s point of view, there’s no real distinction between an ad and the app it appears in, so all parties involved in serving ads must take steps to prevent harm."

Tye said it was particularly worrying to see these sorts of ads appearing in mobile games and apps considered suitable for all age groups. "We continue to see an increasing number of complaints about harmful or misleading in-game ads. There’s no place for this kind of content in mobile gaming, or anywhere, so it's important we understand how it is able to appear in the first place."

Control Is a Competitive Edge

When responsibility extends across the supply path, the question is no longer who is at fault, but who can take control. Publishers have a choice: own the ad experience, or absorb the commercial and regulatory risk that comes with inaction.

From harmful, sexualised creatives to code-level malvertising, poor ad quality erodes trust, accelerates churn and invites scrutiny. As regulatory pressure increases, publishers that treat ad quality as part of the product experience are seeing two clear wins: stronger user protection and longer LTV through more sustainable monetisation.

In part two of this series, we’ll go deeper into how publishers are driving profitable growth by improving ad quality and reveal a playbook others can follow.

Ad VerificationIn-AppMonetisationRevenue

Follow ExchangeWire