Alphabet's Earnings Beat Analyst Forecasts

by Hugh Williams on 28th Oct 2016 in News

Alphabet Inc. (NASDAQ: GOOG, GOOGL) yesterday (27 October), announced financial results for the quarter ended 30 September, 2016. Google remains the company’s strongest business, while there were also increases in revenue for its ‘Other Bets’ segment.

Financial Highlights

“We had a great third quarter, with 20% revenue growth year-on-year, and 23% on a constant currency basis. Mobile search and video are powering our core advertising business and we’re excited about the progress of newer businesses in Google and Other Bets”, said Ruth Porat, CFO of Alphabet.

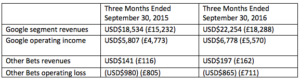

The following summarises results for Google compared to all other Alphabet businesses (Other Bets) (in millions; unaudited):

The company’s net revenue is USD$18.3bn (£15bn), up 21% year-on-year. Earnings per share stand at USD$9.06 (£7.42), beating analyst expectations of USD$8.64 (£7.07) per share. Revenue from ‘Other Bets’ was also up to USD$197m (£171m), a year-on-year rise from USD$141m (£115m).

Google's mobile and video ad businesses helped it top Wall Street financial targets in the third quarter and the company authorised a new, USD$7bn (£5.75bn) stock repurchase.

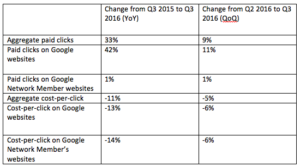

Google's online ad business continued to thrive during the third quarter. Its dominance has been solidified in the transition from web to mobile, and the growth of the Android operating system, YouTube, and investments in smartphone apps for maps, email, and photo storage.

Despite the fact that cheaper mobile adverts (relative to desktop) mean the amount Google gets once users click on ads has fallen, these results show mobile-ad prices are catching up as the smartphone becomes the primary computer for many users.

Twitter's third quarter results

Twitter posted quarterly revenue of USD$616m (£506m), up 8% year-on-year. Quarterly GAAP net loss was USD$103m (£84m), with quarterly non-GAAP net income of USD$92m (£76m).

Average monthly active users (MAUs) were 317 million for the quarter, up 3% year-on-year and compared to 313 million in the previous quarter. Average daily active usage (DAU) grew 7% year-on-year, an acceleration from 5% in Q2 and 3% in Q1.

Advertising revenue totalled $545m (£448m), an increase of 6% year-on-year. Mobile advertising revenue was 90% of total advertising revenue. Data licensing and other revenue totalled USD$71m (£58m), an increase of 26% year-on-year. US revenue totalled USD$374m (£307), an increase of 1% year-on-year. International revenue totalled USD$242m (£199m), an increase of 21% year-on-year.

Twitter also announced a restructuring and reduction in headcount of approximately 9% of its global workforce. The restructuring, which focuses primarily on reorganising the company’s sales, partnerships, and marketing efforts, is intended to create greater focus and efficiency to enable Twitter’s goal of driving toward GAAP profitability in 2017.

“Our strategy is directly driving growth in audience and engagement, with an acceleration in year-on-year growth for daily active usage, Tweet impressions, and time spent for the second consecutive quarter”, said Jack Dorsey, Twitter’s CEO. “We see a significant opportunity to increase growth as we continue to improve the core service. We have a clear plan, and we’re making the necessary changes to ensure Twitter is positioned for long-term growth. The key drivers of future revenue growth are trending positive, and we remain confident in Twitter’s future.”

In response to Twitter’s Q3 earnings Tom Bailey, regional vice president at Marin Software, said: “The surprise decision to move the earnings call has placed further scrutiny on Twitter. This quarter has not been the horror show some expected.

"The platform has been in an on-going battle to monetise its platform without alienating its loyal user base; Jack Dorsey even came back to turn things around. Dorsey is working hard to attract advertising budgets by broadening its advertising options, opening up more audience data and launching new capabilities to reach users, but, ultimately, as the share price has shown, it has been a struggle.

"With a buyer on the horizon, the future looked positive. But without a suitor, and the necessary financial backing and expertise to invest in tools that support marketers in reaching their target audience, the next quarter could present more challenges rather than answers.”

Follow ExchangeWire