Transparency in a Complex Ecosystem

by Grace Dillon on 26th Nov 2020 in Deep Dive

Most of us today have experienced that unexpected, high priced mobile phone or cable bill. That one where when you really dig into you find the hidden fees, hardware tax, or extra service you don’t remember signing up for. It took a while for many to realise that there are more efficient ways to get the service we want and understand exactly where our money is going. This concept of greater transparency has certainly made its way to programmatic advertising as of late, but many in the industry have realised the path to more efficient supply paths is much more complex than just calling up to cancel your cable service.

No one would disagree that programmatic has revolutionised the industry, bringing a new level of automation and value bearing intermediaries to more quickly and efficiently facilitate the buying and selling of ads. Now with the addition of video, audio, and the multiple channels of desktop and mobile, optimising the buying process in real-time is a must. Transparency to the same effect now appears to be the driving force for change in a world where privacy, user control, and the bottom line are more important than ever.

As many players in the industry, from brands to publishers, have started to seek out more efficient supply paths, Criteo has been successful at implementing various strategies aimed to reduce inefficiencies, trim unnecessary fees, and shift spend towards channels that bring in the most value. Like many of the challenges we face in our industry, no one person or organisation has the answers, but there are ways that can help to grow transparency and establish clear industry benchmarks. In the following we will share how we approach this challenge at Criteo and talk about some of the initiatives happening within the industry.

Criteo has produced this Deep Dive special in partnership with ExchangeWire. Criteo is the global technology company powering the world’s marketers with trusted and impactful advertising. 2,600 Criteo team members partner with over 20,000 customers and thousands of publishers around the globe to deliver effective advertising across all channels, by applying advanced machine learning to unparalleled data sets. Criteo empowers companies of all sizes with the technology they need to better know and serve their customers

This Deep Dive special is written by Franziska Ferraz (pictured below), managing director, publisher partnerships EMEA. Franziska is leading Criteo’s Publisher Partnerships team for EMEA and joined Criteo in 2009. In her first years with the company, Franziska opened and implemented Criteo’s supply business first in Germany and later in Brazil. Over the last six years, Franziska has held several supply

leadership roles within Europe. This Deep Dive covers:

– The evolution of media buying

– How SPO can provide better transparency

– How Criteo is approaching SPO, particularly in conjunction with IAB guidelines

– The publisher perspective on how SPO can help resolve current challenges

The evolution of media buying

Franziska Ferraz, managing director, publisher partnerships EMEA at Criteo

In a completely transparent environment advertisers can see exactly where their ads are running, what type of audiences are seeing the ad, and what they are getting back from their ad spend. While at the same time publishers would have the ability to fully understand their demand paths — which brand, agency or client is spending how much and for which price through which pipe.

Over the last 10 years at Criteo, we have seen a rapid change in media buying, from a much more direct approach, where historically all Criteo spending went directly to our publishers, to a surge of intermediaries, some of which provide unique value, but many that do not. As programmatic adoption started to grow, so did the number of Supply Side Partners (SSPs) that publishers began to work with. While that number was only few to start, header bidding brought on the opportunity to include multiple SSPs (up to 10 or even more) . These additional intermediaries have led to a take rate which eMarketer calls the Ad Tech Tax: Each intermediary takes a fee and what that adds up to is about 1/3 of advertiser dollars. In 2019, that equated to around USD$11.5bn (£8.71bn), with an estimated USD$25bn (£19bn) making its way to publishers.

If this number seems a bit daunting, that’s because it is, and the industry has taken notice. Publishers and advertisers have an opportunity to take a more strategic approach and leverage their programmatic partners that bring the most value to their supply path, whether that be engaging in more private marketplaces, entering into more guaranteed deals or outright reducing the number of partners they work with.

Now with the addition of video, audio, and the multiple channels of desktop and mobile, optimising the buying process in real-time is a must.

Supply Path Optimisation — a direct path to better transparency

Supply Path Optimisation, or SPO, while loosely defined by many, is a collection of techniques that enable marketers and publishers to make intentional choices about programmatic platforms that power trades. In other words, how can we reduce the number of intermediaries that publishers and buyers choose to work with in order to gain the maximum value from the few as opposed to marginal value from the many?

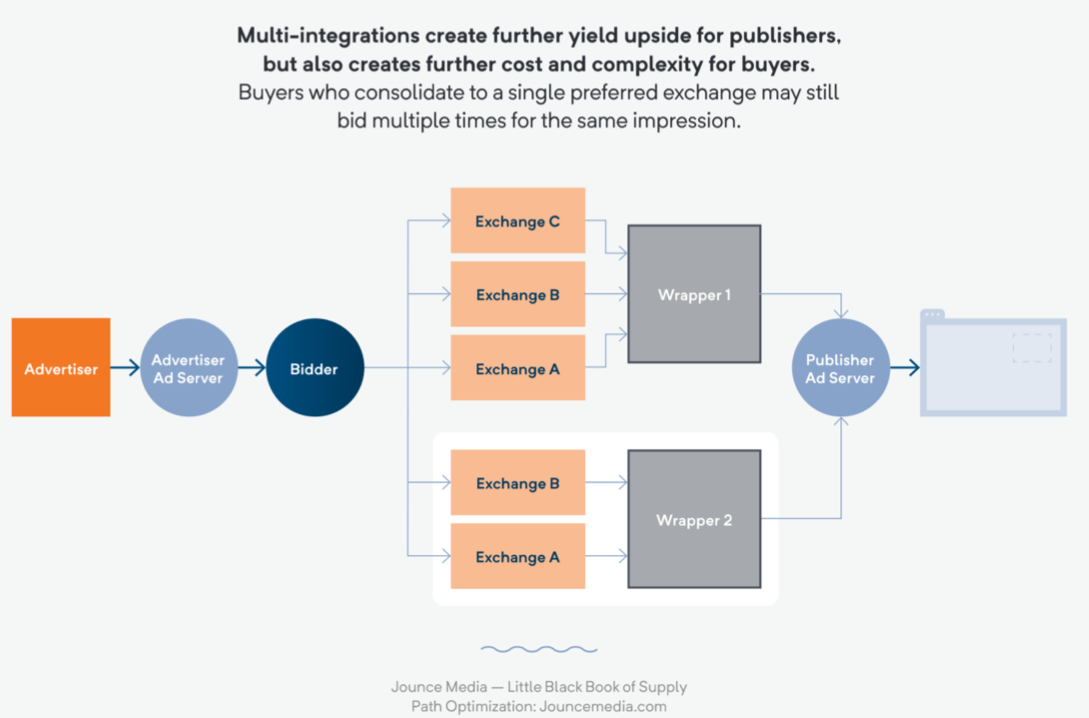

In light of header bidding, publishers are working with far more SSPs than in the past. As such we have seen a rise in duplicate bid requests to Demand Side Partners (DSPs), which leads them to bid into multiple auctions for a single impression. While on the one hand this causes publisher yield to improve, it also introduces increased costs and fees into the programmatic market. Along with auction duplication comes the many integration types publishers have leveraged to maximise fill rates and increased CPMs. One example here is multi-integrations where publishers use multiple wrappers which execute multiple auctions for a single ad impression, adding even more complexities to an already crowded system. We can see very quickly that with the addition of more and more partners comes the dilution of advertiser spend and publisher revenue.

Publishers and advertisers have an opportunity to take a more strategic approach

SPO in practice - Criteo's approach

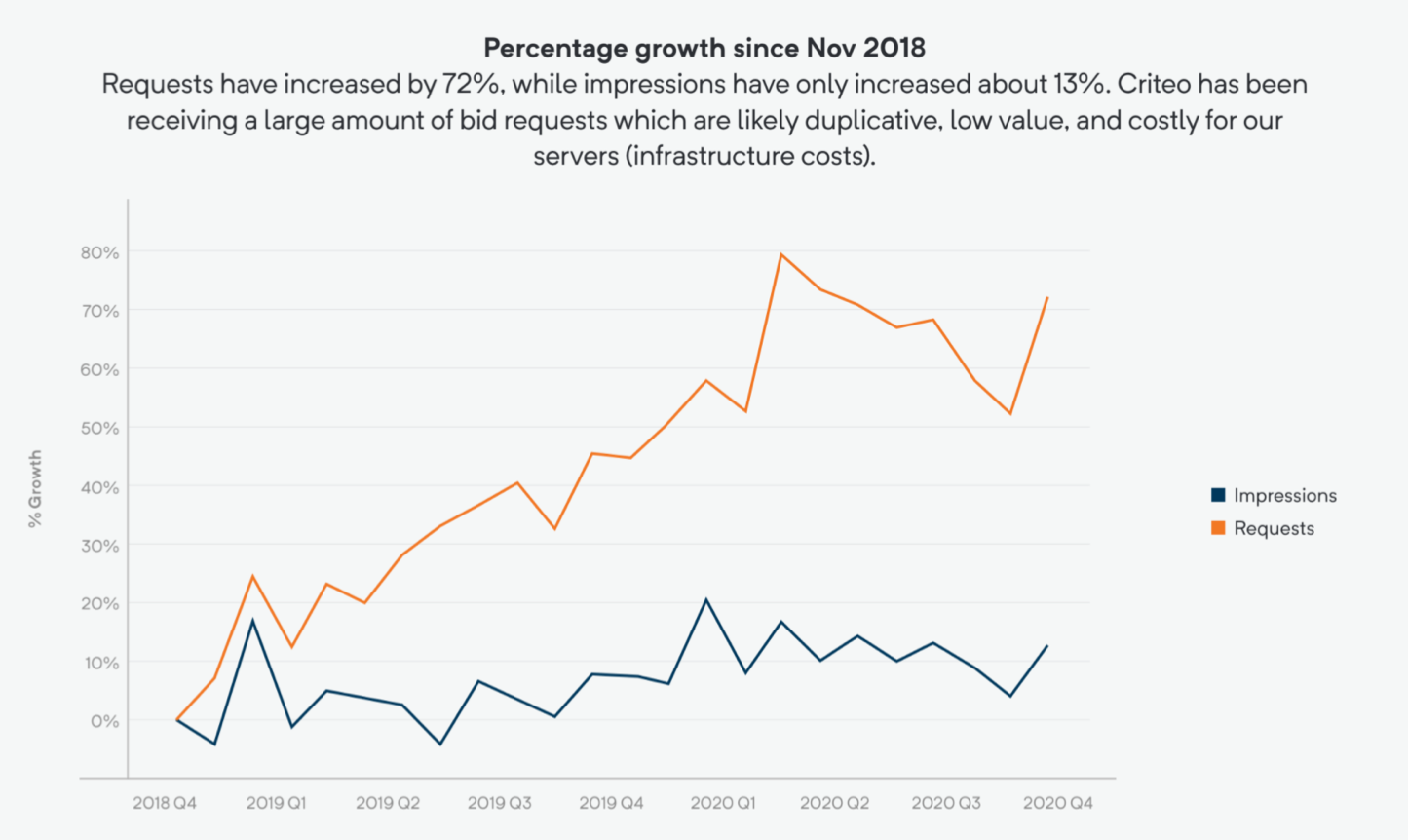

A recent internal study from Criteo revealed that on average there are 10+ distinct channels per publisher on web inventory. This translates to Criteo receiving many duplicative bid requests that generate very little value or our advertisers, or another way to look at it — 7% of requests generate less than 1% of Return On Advertising Spend (ROAS) for advertisers. By first focusing on keeping only the most profitable supply sources, and reducing from 10+ to no more than 4 channels per publisher, Criteo was able to realise the same performance for our advertisers by removing unnecessary requests to reduce infrastructure costs by up to 10%.

Criteo was able to realise the same performance for our advertisers by removing unnecessary requests to reduce infrastructure costs by up to 10%

These favourable results signify there is a strong argument to be had for focusing on fewer, but more value driven partnerships. As a result, moving to consolidate and increase spend on the most efficient channels is the clear next step in Criteo’s SPO strategy, especially with a strong focus on direct connections with publishers. Advertisers reap the benefits here as well, since this approach will enable them to reduce their acquisition cost, and gained budgets can be more efficiently reallocated to inventory sources with higher ROAS without incurring extra fees.

Leveraging IAB guidelines

Both advertisers and publishers gain transparency of the entire supply chain by simplifying and consolidating partnerships. To further improve supply chain transparency, Criteo will also look to adhere to IAB guidelines around inventory quality including use of tools such as: ads.txt, sellers.json, and s-chain (supply chain object). Criteo will be able to action using these to further ensure that only approved, safe inventory is purchased from trusted sellers, and to mitigate the impact of “middle-man” partners who only serve to increase fees per transaction.

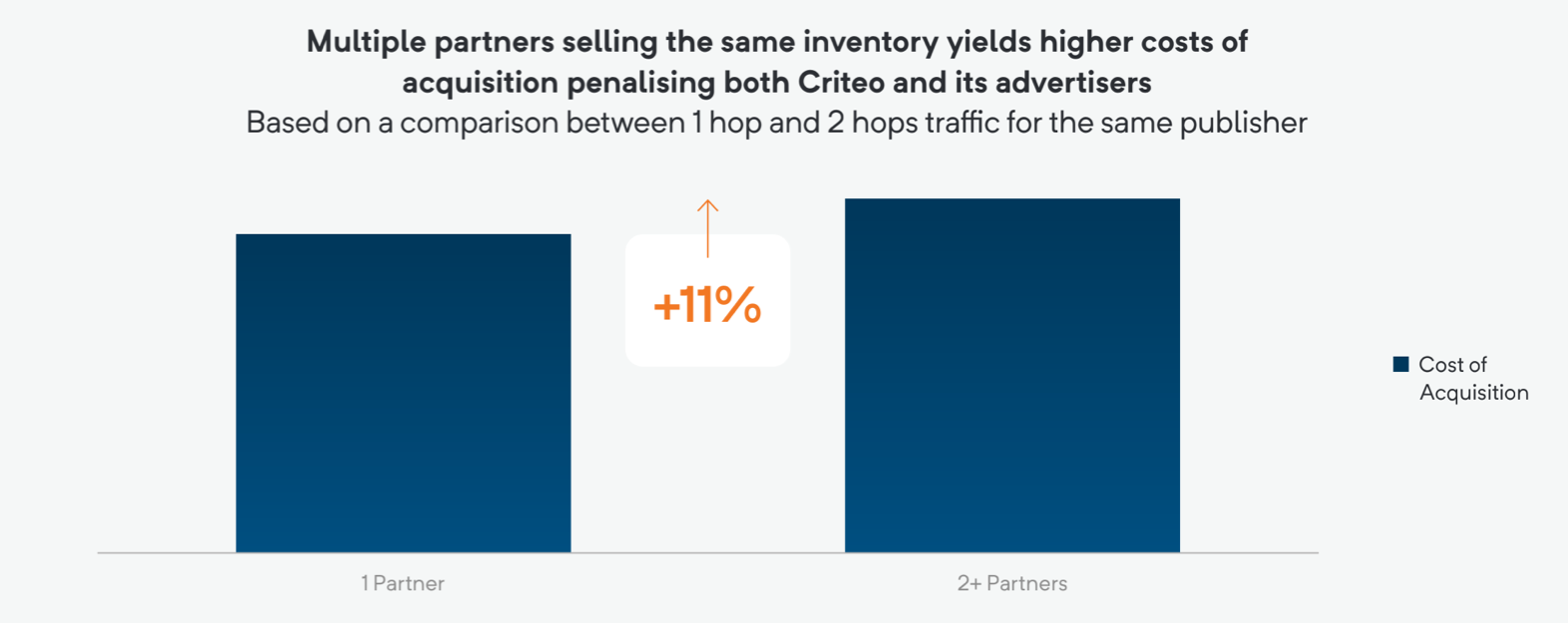

By requiring partners to pass us the s-chain object, Criteo is able to identify what traffic or impressions have gone through multiple intermediaries and only channels with direct access. Criteo can then cut this multi-hop traffic in order to generate the same yield without having to pay a higher cost of acquisition coming from multiple intermediary fees.

Based on the various strategies we have implemented at Criteo, we accept traffic under the following conditions:

→ Traffic needs to be profitable:

• The incremental revenue generated by the traffic must be greater than the cost necessary to process the traffic. Today, this allows us to cut 20-25% of our traffic. Cut unnecessarily intermediary fees.

→ Traffic needs to be 100% iAB tech Lab anti-ad fraud compliant leveraging ads.txt, sellers.json and s-chain

• These guidelines allow us to select the most direct and transparent channels to our advertisers.

• Ads.txt is a widely-adopted mechanism for publishers to authorise specific supply paths to transact inventory. It is the publisher’s way of signalling to buyers “this is really us.”

SPO remains loosely defined, and that’s mainly due to the fact that there are many ways to go about execution to achieve the same end goal: get buyers closer to sellers, increase performance, reduce costs, and maintain a safe and compliant environment.

The publisher perspective

As stated above, SPO remains loosely defined, and that’s mainly due to the fact that there are many ways to achieve the same end goal: get buyers closer to sellers, increase performance, reduce costs, and maintain a safe and compliant environment. Like many of the challenges we face in our industry, sometimes it may feel like finding the right solution is like hitting a moving target. As we have seen, there are many strategies that can help to grow transparency and deliver highly-customised SPO designs.

Optimising the supply path is no simple feat. However, making a concerted effort to increase the efficiency of the buying process will undoubtedly elevate programmatic for everyone involved. In order to lend additional perspectives on the current challenges facing the supply chain and how SPO can help us to address them, we spoke with Ollie Steele, advertising yield manager at eBay; Nicole Mortier, SVP account management and platform solutions at Yieldlab; Carmine Laltrelli, Programmatic Advertising Director at Italiaonline; Adrien Etienne, programmatic manager at relevanC Advertising; and Alex Simpson, head of programmatic activation at News UK.

1. From your perspective, what are the biggest issues or problems with the current ad tech supply chain?

Unfortunately, one of the biggest issues that still remains is the number of paths that exist between advertisers and publishers — often in conflict. This results in huge inefficiencies that are created by the lack of an optimal route for advertisers to buy through.

While this has started being addressed, it’s still a far cry from being perfect. As long as this inefficiency still exists, advertisers will continue receiving suboptimal bang for their buck which will be damaging for the industry in the long run. Ultimately, price should depend on performance, not ad stack setup and ecosystem complexity.

Ollie Steele

"Hidden algorithms" from 'One Stack' technology providers who optimise for their own good is a serious issue. The activities of these players cause publishers to lose transparency and insights into their own yield and sales strategy. Another significant problem is the complexity of the current ecosystem itself. To handle and optimise Demand via Open Bidding whilst juggling a diverse group of partners through multiple Wrapper Integration is getting more and more opaque.

Nicole Mortier

From a Publisher perspective, the main issues are the complexity of the advertising monetisation model and developing cookie-less solutions.

To address the first issue, the industry needs to review the current monetisation model, because the competition of several SSP on several platforms (Prebid, EBDA, TAM) is no longer fit for purpose. There is neither efficacy (no better monetisation) nor efficiency (too complex, with dedicated teams focused on data collection and analysis). We believe in a new era based on “ecology”, where the complexity will be reduced further and further, while Publishers will have better and more direct control over their own inventory. We believe that a model which enables Publishers to achieve everything using just one SSP will be a big step forward in optimising the supply chain.

For the second issue, the priority will be the development of services and content for the enjoyment of only logged-in users. Publishers would do well to differentiate business perspectives and not tune them solely towards the flow of advertising revenues.

Carmine Laltrelli

The monopolistic market structure will get stronger in the long-term, meaning that size will become imperative to existence on the market. This can create a notable hurdle to newcomers in the market. On top of this, there is a lack of transparency and efficiency, as well as a far too common acceptance of excessive levels of “natural” performance loss. For instance, a number of tech partners and providers are currently blocking the industry’s ability to gain visibility on recurrent technical issues, resulting in an average of 10% of technical impressions being lost. Yet no tangible effort has been made to address this.

Another key issue currently dogging the industry is a lack of communication, both within tech providers, and between these providers and advertisers and sellers. Poor communication within tech providers’ operations slows the resolution of market issues, and a lack of interaction between the different industry players plants distrust in advertisers and conservativism in publishers.

Adrien Etienne

2. How will SPO address these issues?

It’s simple: deals or specific pipes between demand and supply will help drive efficiency and avoid self- competition. Close, direct relationships between advertisers and publishers will help to foster this.

Ollie Steele

We have to start somewhere in order to untangle the programmatic web, and SPO is the process of doing just this. If you are trying to go from London to Manchester, you don't go via Exeter and Aberdeen. Likewise, SPO is the industry’s attempt to forge as direct a path as possible for the programmatic buying process.

Alex Simpson

SPO should create a better and more direct connection between the seller and the advertiser, which will have a number of long-term benefits for the industry. Firstly, it will allow the industry to be more efficient from a tech perspective by dramatically reducing the number of ad calls and lost impressions.

Secondly, it’ll improve transparency for both buyers and sellers, giving the former a clear picture of where their ad spend is going and the latter insight into which advertisers are buying their inventory. And it’ll provide more transparency on the fees taken by each actor within the RTB process and enable both buyers and sellers to select their partners on objective financial criteria.

Adrien Etienne

3. How far would you say that changes that have already been made to the supply path, such as introducing industry standards like ads.txt and sellers.json, have contributed to increased optimisation?

The initiatives we’ve seen so far have helped to minimise fraud and reselling/arbitraging in the supply chain — so, in theory, they should have had a significant impact on buying optimisation. That being said, there’s clearly still room for improvement.

Ollie Steele

These two actions are definitely a first step towards greater security and transparency, especially for buyers. However, from our perspective as a publisher, they have not led to a dramatic change for the market. To date, it’s still unclear whether the buy-side is really aware of these industry standards their respective purposes, but their adopting them is a good start that will encourage the industry to take more ambitious action.

Adrien Etienne

We consider these changes important steps, but not “game changers”. The critical point has been that Programmatic has switched the investment planning strategy from a “site targeting” one to a “data based” one. Now that we’ve discovered all the quality topics, we need to redefine a direct relationship between advertiser and publishers.

Carmine Laltrelli

4. What impact do you think that a continued focus on SPO will have on the industry, and particularly on SSPs?

It’s inevitable that there will be further consolidation in the middle ground between advertisers and publishers. I believe that the SSPs who come out of this the winners will be those that focus on building relationships with advertisers, agencies, and publishers, and act as a mutual tech partner for them.

Ollie Steele

The impact will be very strong, and I believe we will see a massive streamlining of the SSP industry with the rise of national champions for each geographic area which will come into competition with the main international OTT services. Thanks to the strong relationship with media agencies and advertisers consolidated throughout the years, there will no longer be several SSPs, OTT, and ad networks; instead, there will be a few companies in each country responsible for aggregating the market’s demand side.

Carmine Laltrelli

I predict that the continued focus on SPO will lead to a consolidation of SSPs and marketplaces of pure resellers who do not offer any additional value to the buying side (such as data enrichment or visibility guarantees).

Nicole Mortier

Good players have little to fear from this. SSPs will still continue to represent publishers, but will also be asked to ensure that they are working with reputable supply and down-stream partners. This should winnow out arbitrage players, and hopefully reduce overall QPS and impression volumes as resold inventory is reduced.

Alex Simpson

Continued optimisation of the supply chain will likely cause SSP fees to decrease and some smaller, less valuable SSPs and partners to close. This will result in the creation of direct connections between DSPs and publisher mediation tools. The SSPs that survive will need to be able to demonstrate the specific value and features they provide (such as an ability to ease sales processing, being able to strengthen the links between buyers and sellers, or having onboarding features that make it easier for publishers to provide optimal inventory). The change will also require SSPs to reinforce communication with their peers and competitors in order to facilitate solutions that will foster transparency, such as by adopting the same sellers and buyers, blocklisting, or using advertiser IDs to make reporting more efficient. Optimising the supply chain will create a more mature market in which the actors who offer just a buy-side and sell-side solution will struggle to survive.

Adrien Etienne

The hope is to create a more transparent, innovative digital environment, and in order to achieve this, there must be sufficient education on how the entire programmatic process works. Many buyers in our ecosystem are contacting SSPs for the first time, and not having that knowledge will only entrench the opacity that currently plagues the system. That said, it’s encouraging to see that advertisers and buyers are beginning to build more trusting relationships with programmatic players on the supply side, especially with partners who are truly transparent.

Nicole Mortier

5. Transparency is a topical issue in ad tech, and one that is closely entwined with SPO. Do you think that enough is being done to address current flaws in the supply chain?

Improving transparency across the supply chain requires every company to play their part and open up — and, unfortunately, this isn’t happening yet. That’s not to say that companies are being intentionally opaque. The inherent complexity of the supply chain simply makes it very difficult for everyone to truly understand how it operates — so, it’s as important for people to upskill and equip themselves with the knowledge to understand it as it is for companies to disclose their ways of working.

Ollie Steele

No, it’s not enough. From a publisher point of view, it’s unacceptable that we have such little control over how advertisers spend money on our web pages. From an advertiser perspective, not having complete control over where your ad spend goes creates a major brand safety issue.

Publishers and advertisers must take initiative and join forces with the leading tech partners in order to elevate the industry to new transparency standards. Some have already launched projects to address the issue, but many are still confidential or at a POC stage. In order for the industry’s actions to have a real impact, it is essential that the biggest tech monetisation providers make a more concerted effort to address these issues.

Adrien Etienne

Ironically, many actions taken for the sake of transparency end up creating more opacity within the system. From my point of view, the most important thing is simplicity. By prioritising simplicity, we will be sure to see transparency follow.

Carmine Laltrelli

Since we still have an issue with transparency, the answer would have to be ‘no’. That being said, people within the industry are keen to resolve the issue and are actively attempting to do this, which is certainly encouraging. I believe that the next year will see a lot of positive news stories and case studies about the improvements people have achieved.

Alex Simpson

6. What other areas do you think the industry should focus on to improve transparency?

Transparency shouldn’t be limited to the supply chain. At eBay, we believe that transparency should exist in all areas — from who we all partner with to how custom audience segments are built — because we don’t believe in black boxes. If brands and agencies are spending money with us, they deserve to know exactly how that money is being spent.

Ollie Steele

We need more audacity. The two extremities of the chain – advertisers and publishers – have taken advantage of this complexity and opacity for too long. Now, we need industry figures to step up and put the clarity and security of the supply value chain first.

Carmine Laltrelli

There are a variety of tools available for publishers to improve transparency. We’ve observed that more publishers are already using standards such as "ads.txt" to declare which companies are allowed to sell their inventory, reducing the risk of counterfeit inventory and contributing to a cleaner digital programmatic supply chain. However, only once the entire ecosystem is completely open will programmatic advertising be able to deliver on its promise of unlimited potential, and publishers will finally be able to monetise their inventory at rates that they deserve.

Nicole Mortier

7. What else can the industry do to maximise SPO?

Header bidding has resulted in an explosion of data volumes. Inventory is now offered multiple times in the same auction, meaning that the buy-side has to process information from an excessive number of bid requests. This generates enormous costs for all participating parties and consumes excessive amounts of energy unnecessarily. In order to solve this, I suggest that buyers carefully scrutinise their tech stack in order to determine which technology adds value and has unique demand and to reconsider their relationships with those that do neither.

Nicole Mortier

For us, it’s about keeping the supply chain short and efficient, while also being flexible to accommodate clients’ needs. Every link in the chain should add defined value to the advertiser for the slice of spend they take, and be fully transparent. We’re channel-neutral and tech-agnostic, but where we can, we’ll actively avoid bringing too many different partners into the mix. Complexity doesn’t necessarily equate to campaign success.

Ollie Steele

Publishers and advertisers should educate themselves on the issues surrounding fees and the bidding mechanism, and should make use of expertise, sales agreements, and tech knowledge to manually optimise the impression journey. Buyers and publishers should also run ad hoc studies to identify the most cost- and technology-efficient path to ad transactions.

To make greater transparency a reality, it should become mandatory for publisher IDs to be included in ad requests, and for advertiser IDs to be included in bid responses. This will cut down on the amount of unattributed spend. In an ideal world, we’d also want different actors within the programmatic chain to declare their fees on an impression-to-impression level of granularity (although this would take time!).

Adrien Etienne

Check where your inventory is being bought and sold, find what works best for you and where measurement is not good enough, cut the supply path. Talk to publishers – if you think you are getting pre roll on The Times for £1.20, then we can assure you that it is fraud. Publishers need to know what is on their site and how they are being represented in market.

Alex Simpson

Download Report

Download Report

Follow ExchangeWire