TGE Index Investment Report - Q4 & Year-End 2020

by Mathew Broughton on 28th Jan 2021 in News

2020 highlights

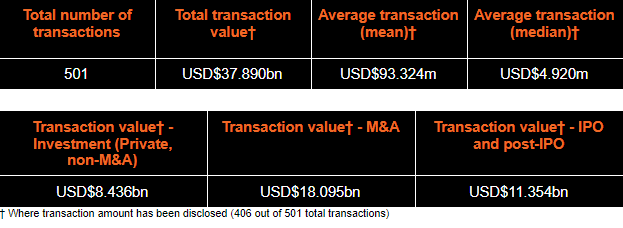

- Total investment and M&A activity across the video games industry tracked by the TGE Index through April-December 2020 reached USD$37.890bn from 406 disclosed transactions (501 total). Adding averaged publicly-available data for Q1 gives a full-year approximation of USD$40.572bn from 642 transactions.

- The shift in consumer attention to gaming through the disruption of other forms of entertainment offered a previously-unrealised level of financial freedom to scaled public firms, leading to an eruption of acquisition activity, with M&A transactions totalling in excess of USD$18bn since April, representing close to 50% of the total recorded value.

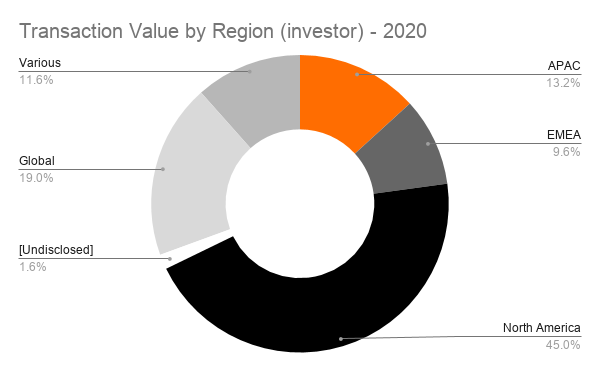

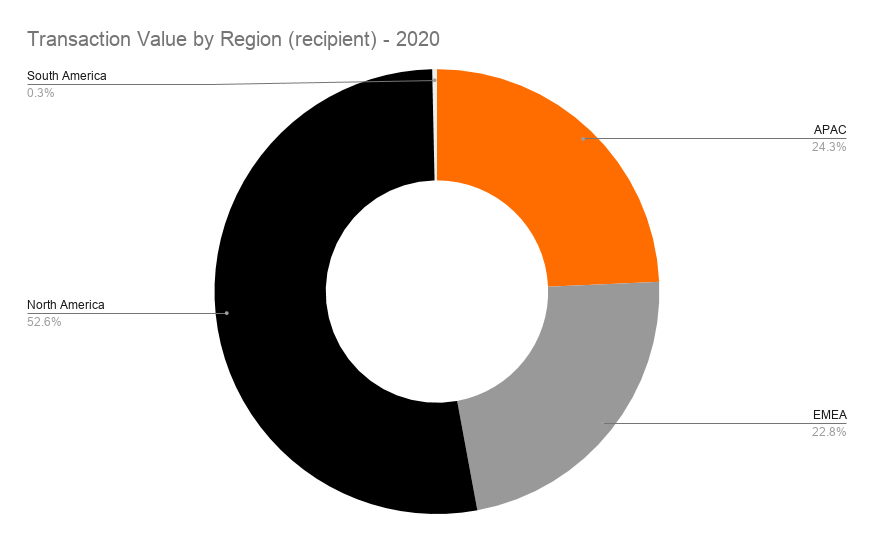

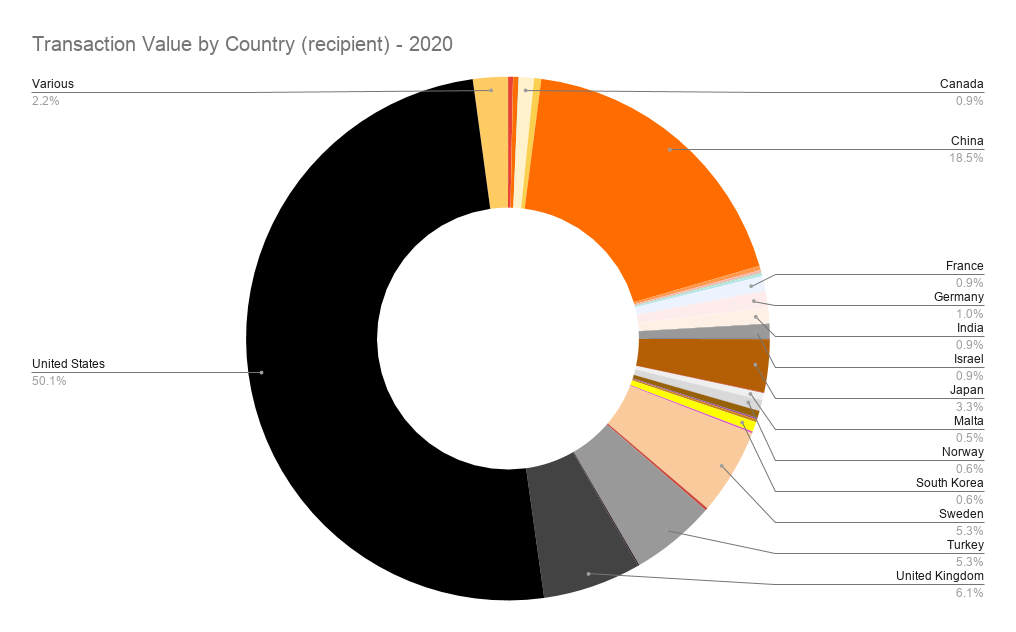

- The majority (51.43%) of investment tracked from April to December 2020 was channelled towards North American firms garner the majority of investment in terms of value, followed by the EMEA and APAC regions. No single national market dominated the EMEA region, while the United States and China claimed the lion's share of investment receipts through April-December in their respective regions.

- Esports companies received in excess of USD$1.3bn over April-December, as streaming audience figures surged in the wake of suspensions to traditional sporting activities.

- IPO activity recovered in H2 2020 and is set to climb further into 2021, driven by the strong performance of Q3 listings and non-traditional methods of public offerings, including auction-based listings and SPAC mergers.

Key statistics - Q2-Q4 2020

Q4 highlights

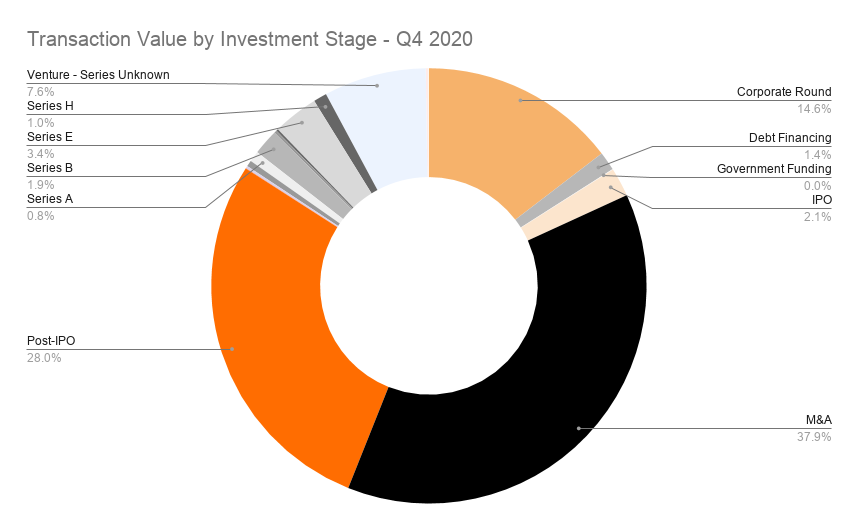

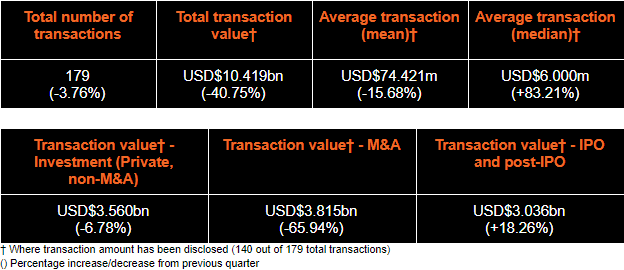

- Total investment and M&A activity through Q4 2020 remained strong after an extraordinarily vibrant Q3, with recorded transaction value totalling USD$10.419bn from 140 disclosed transactions (179 total). This represents a 5.4% increase over Q2 and a 3.3% climb over Q3, excluding Microsoft's USD$7.5bn acquisition of Zenimax.

- Post-IPO activity rocketed by nearly 3000% due to a flurry of nine-figure raises in December, primarily by companies active in M&A through 2020, suggesting another strong period of consolidation is due through Q1-Q3 2021. By contrast, sums raised through IPOs declined by over 90%, though confidence in public markets remains considerably higher than levels seen in Q1.

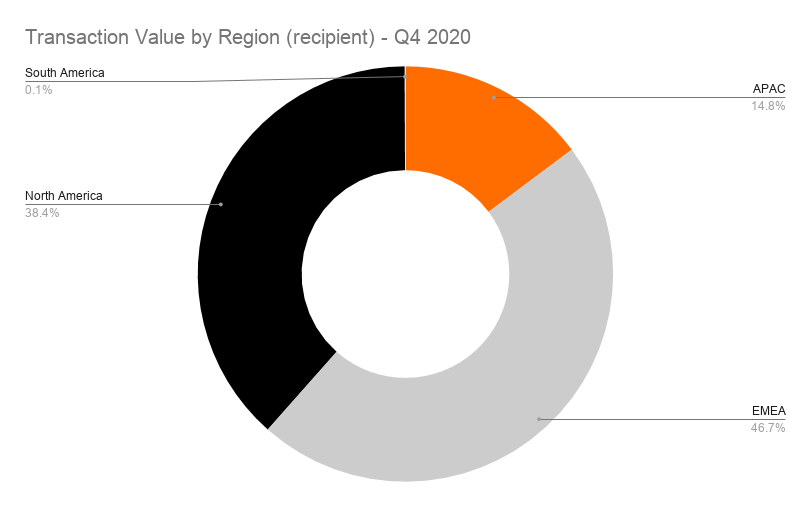

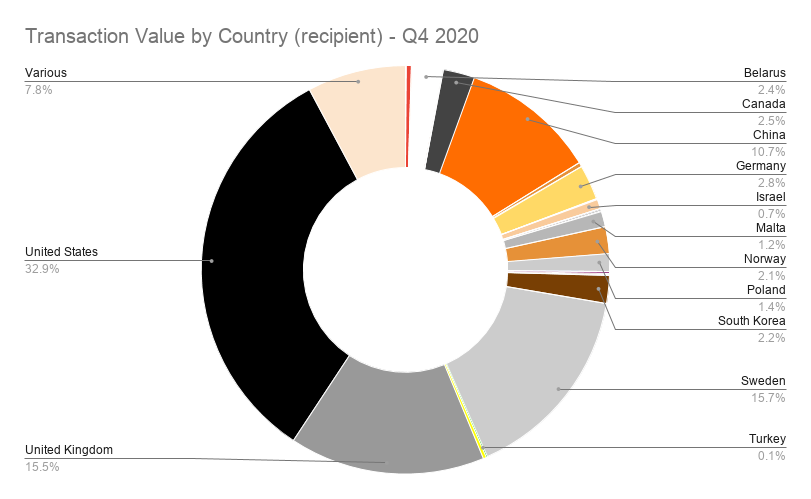

- Investment towards EMEA-based video game companies increased by 310% to USD$4.489bn, contrasting with previous quarters in which North American (Q3) and APAC (Q2) firms saw the majority of transaction value.

Key statistics - Q4

Investment

2020

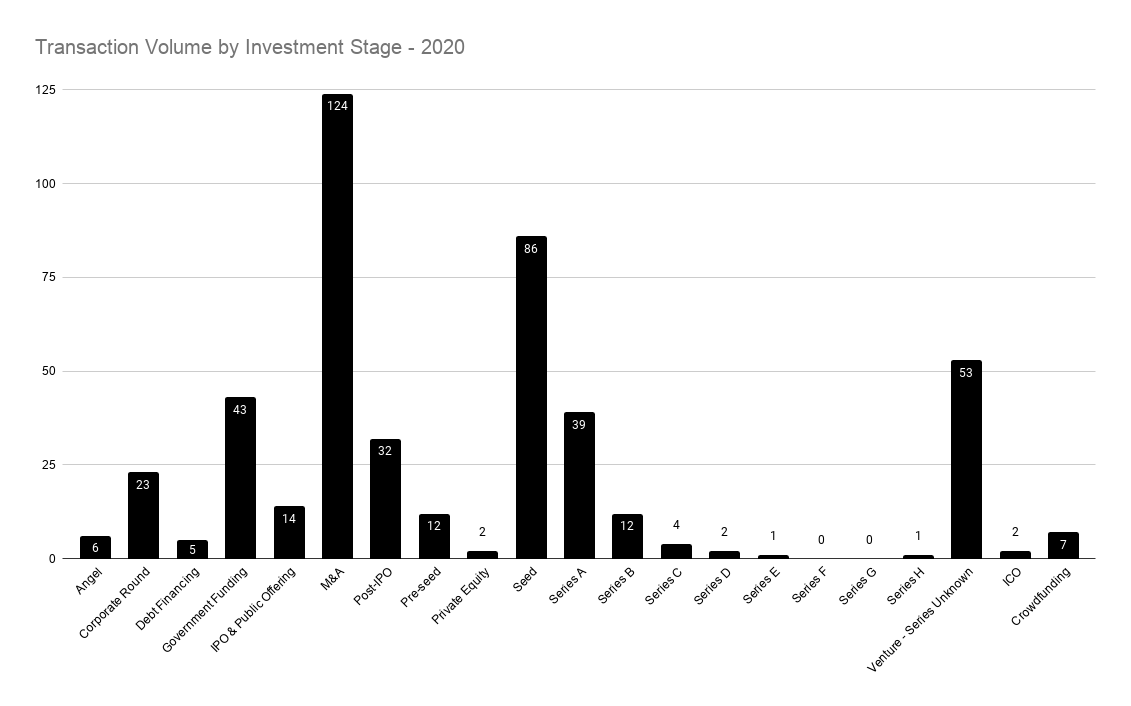

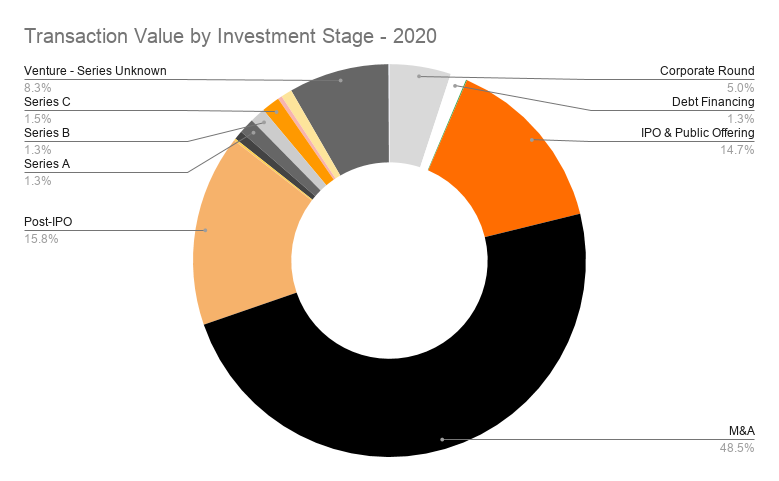

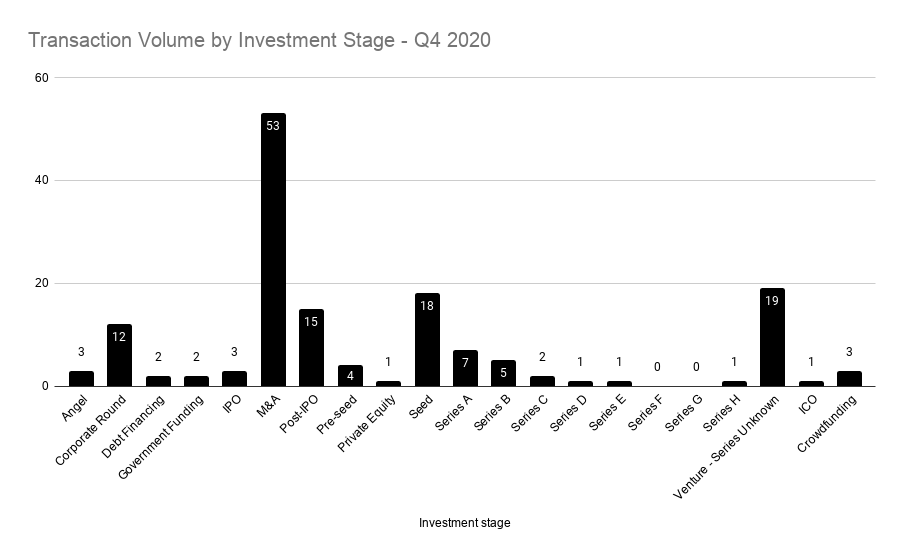

Investment in private video game companies (excluding M&A activity) reached USD$8.436bn over the course of Q2-Q4 2020, representing 22.3% of total transaction value. As is typically observed, investment volume was predominantly concentrated towards seed and Series A tranches, with a sharp drop-off on subsequent rounds, though it should be noted that 53 venture rounds out of the recorded 264 were supplied at an unknown stage. A highly buoyant M&A market, coupled with rebounding confidence in public offerings, as discussed below, served to further sway directors away from minority equity investments at post-Series B stages. However, firms able to secure financing at the Series C stage and beyond were able to command impressive sums, with all eight breaching the USD$100m barrier.

The most significant investment in a private gaming company, by far, was the USD$1.78bn in primary capital and secondary purchases funnelled to Epic Games, best known for its Unreal Engine platform; Fortnite title; and eponymous retail store, in August. The tranche included a USD$250m strategic investment from Sony, with the two firms working together since to launch an immersive music division, and support from Baillie Gifford; BlackRock; Lightspeed Venture Partners; T. Rowe Price Associates; and returning partners KKR and Smash Ventures.

Aside from Epic Games, the most substantial investment per stage is as follows:

- Angel: USD$5.233m (Veloce)

- Pre-seed: USD$1.942m (Sugar)

- Seed: USD$26.20m (Subspace)

- Series A: USD$100m (Playco)

- Series B: USD$120m (Wildlife)

- Series C: USD$450m (Zwift)

- Series D: USD$113m (Caffeine.tv)

- Series E: USD$340m (Scopely)

- Series H: USD$100m (Discord)

Note: There were no recorded transactions confirmed to be made at the Series F and Series G stages

Q4

Overall, investment in private video game firms remained relatively steady in Q4 having boomed by 247% in Q3, falling by 6.78% to USD$3.560bn. However, within the transaction group there were marked differences from July-September. Firstly, Q4 saw a near-60% decrease in early-stage venture investment, with angel, pre-seed, seed and Series A rounds falling to USD$128.66m from 32 transactions, compared to USD$319.27m from 56 transactions in July-September. As noted above, this decrease was likely fuelled by the lucrative market conditions for exits, though this trend will have to be monitored going forward to ensure sufficient capital is available for independent studio owners looking to scale their firms without exiting. The decline in early stage investments was balanced out by a profligate increase in minority rounds led by corporate investors, up 292% in terms of value to USD$1.469bn, largely centred towards mobile gaming and advertising technology operators. Indeed, the three most valuable corporate rounds over October-December were directed to mobile-focused firms, namely Guangzhou Sanqi Network (USD$440.65m from 37Games), Liftoff (USD$400m from Blackstone); and Scopely (USD$340m from multiple investors).

M&A

2020

If the financial landscape of the video games industry in 2020 had to be summed up in a single word, that word would be "consolidation". Acquisitions accounted for just under half (47.8%) of all recorded transaction value from April-December, equating to USD$18.095bn, dwarfing both non-public company investment (USD$8.4bn) and public market activity (USD$11.3bn). The rise in consumer attention upon the video games industry in the absence of other forms of entertainment streams, such as live music concerts; sporting events; and cinema film releases, as a result of the ongoing coronavirus pandemic, fuelled corporate and investor confidence in the sector. The anticipation in the run-up to the release of the next-generation Microsoft (Xbox Series X, Xbox Series S) and Sony (PlayStation5) consoles further heightened company valuations, giving buyers greater financial freedom to secure credit facilities and incentivising sellers looking for an exit.

A total of twenty acquisitions breached the USD$100m mark, four of which topped USD$1bn, while 57 comparatively smaller firms were snapped up at a rate reminiscent of early-lockdown toilet roll hoarding, or a particularly frenetic 1993 episode of Dale Winton's Supermarket Sweep. Ahead of its latest Xbox debuts, Microsoft topped an already highly active M&A market in Q3 with its USD$7.5bn cash acquisition of ZeniMax Media, the second-largest company purchase on record in the industry, behind only Tencent's USD$8.6bn purchase of Clash of Clans developer Supercell in 2016. The purchase brings leading IP such as The Elder Scrolls; Fallout (Bethesda Softworks); DOOM; Quake (id Software); Wolfenstein (MachineGames); and The Evil Within (Tango Gameworks) under the wing of the Washington-based tech giant, as it seeks to grow its Xbox Game Pass subscription platform.

Elsewhere in Q3, Tencent agreed to the long-rumoured acquisition of Leyou Technologies for USD$1.498bn, beating an extensive list of previously-implicated suitors including Sony; iDreamSky; CVC Capital Partners; and Zhejiang Century Huatong Group Co., Ltd. Though the Shenzhen-based firm was again prolific in both minority investment and M&A activity through 2020 via its deep network of subsidiaries, there was a notable shift away from US-based companies in the wake of ongoing trade hostilities with the Trump administration, towards both European and domestic firms.

Aside from EA's acquisition of Codemasters (see "Q4" below), the remaining company purchase over USD$1bn was the USD$1.8bn acquisition of Istanbul-based studio Peak Games, best known for its match-three titles Toy Blast and Toon Blast, by Zynga. The acquisition set multiple precedents on both a corporate and regional level, namely the confirmation of Peak as the first Turkish unicorn (valuation north of USD$1bn); the most valuable exit of a Turkish startup, and the second largest acquisition recorded in the MENA region. You can read further analysis of the Peak-Zynga deal from TheGamingEconomy here.

Q4

The video game M&A market slowed by 65% in the final quarter of 2020 to USD$3.814bn, though this is more of a measure of the strength of the market in Q3 than an indication of a long-term decline, given that Q4 activity stood 23.8% higher than in Q2.

The most substantial acquisition deal penned in Q4 was that of British racing game studio Codemasters by Electronic Arts (EA) for USD$1.2bn in cash. EA was selected ahead of fellow US giant Take-Two Interactive, which earlier submitted a bid worth USD$986m, given the higher selling premium and lack of volatile equity component in the offer. Sadly for lovers of an old fashioned bidding war, Take-Two has since withdrawn from proceedings to acquire the Dirt and Formula One series developer. Elsewhere, transactions topping the USD$200m mark primarily concerned mobile and MMORPG studios, namely Daybreak Games (EG7) for USD$300m; Hutch (MTG) for USD$275m; and Melsoft (Moon Active) for an estimated USD$250m. A noteworthy exception to this was the USD$340m acquisition of console controller manufacturer PowerA by corporate product provider ACCO Brands, marking the US brand's entry into the gaming market as the third-party console hardware market is set to accelerate following the release of the next-generation console devices.

IPO & post-IPO

2020

After a particularly slow start to the year, in which just two firms went public in Q1 at a combined value of USD$8.08m, public offering activity boomed throughout Q2 and Q3, with proceeds reaching USD$5.478bn from 14 listings. In terms of value, the most substantial of these was the USD$2.681bn secondary listing on the Hong Kong Stock Exchange filed by Chinese online gaming firm NetEase Inc., which was driven by proposed changes in US legislation which would see Chinese companies forced to de-list from US exchanges if they fail to comply with audit oversight for a period of three years. Anti-China sentiment in the US drove a number of proposed measures which could affect the gaming industry, including the launch of an investigation by the Committee on Foreign Investment in the United States (CFIUS) into Tencent's investments in American companies, including Activision Blizzard, Discord, Epic Games, Glu Mobile, Riot Games, and Roblox Corporation.

Perhaps more significantly, in terms of driving confidence among video game executives exploring IPOs, was Unity Software's USD$1.3bn listing on the New York Stock Exchange. The shares launched beyond the upper forecast price bounds at USD$52, and have since climbed to approximately USD$150 at the time of writing. Since then, a whole host of gaming companies have either filed listings or been heavily rumoured to list in 2021 (see "Forecast" below"), heartened by Unity's demonstrated success as well as the general strength of public gaming stocks. As examples of the latter, the The Global X Video Games & Esports ETF (NASDAQ:HERO) climbed by close to 86% over 2020, while the Roundhill BITKRAFT Esports & Digital Entertainment ETF (NERD) closed the year up over 106%.

The Unity IPO was also notable in that it took place via an auction hybrid model in which prospective investors could submit multiple bids at specific price values, rather than a traditional telephone-based approach where interested parties could purchase blocks of unpriced shares. This demand for alternatives to the traditional IPO process, often criticised for favouring new investors in a given company, is one of the reasons for the prolific rise of special purpose acquisition companies (SPACs) through 2020. Mobile game and esports company Skillz became the first gaming company to list via a so-called "blank-cheque" company in December, having agreed to merge with the Flying Eagle Acquisition Corp. for USD$690m, raising addition PIPE investment worth USD$159m from institutional investors.

Non-M&A investment activity in publicly-listed companies closely matched IPOs in terms of value, with USD$5.876bn generated from 32 recorded transactions in April-December 2020. The overriding majority of this activity, USD$5.692bn, was generated through Q2 and Q4, with a marked lull in Q3 as scaled public firms prioritised using previously-raised funds for acquisitions for the following quarter and for 2021. By value, the most significant post-IPO investments were the USD$1.151bn debt financing secured by Zynga (see "Q4" below); ValueAct's accumulated USD$1.11bn holding in Nintendo, and a USD$650m convertible bond issuance by Bilibili, which also raised a USD$400m cash investment from Sony.

Q4

After a spike in activity through Q3 driven by the listings of Unity, Corsair, and Archosaur Games, the IPO market lulled considerably in terms of value as the three recorded listings netted a combined £214.4m, down 91.34% from Q4. However, this figure represents a marked improvement for public gaming listings from Q1 as aforementioned, and with multiple firms set to go public over the course of 2021 there is a certain element of excitement and opportunity in the IPO market not seen at this stage last year.

Through Q4, by far the most lucrative IPO was that of Gothenburg-based holding co. Thunderful Group AB, which went live on the Nasdaq First North Premier Growth Market in December at USD$177.21m, hot on the heels of its acquisitions of Coatsink Software and Station Interactive during the quarter. Though less substantial in terms of sums raised, the remaining two IPOs provided notable firsts for their respective markets. Firstly, Guild Esports, a fledgling firm which attracted headlines due to the involvement of former footballer David Beckham, became the first esports organisation to be admitted to the London Stock Exchange through its USD$25.85m listing in October. Subsequently in December, Melbourne-based Playside Studios became the first Australian video games company to list publicly, debuting on the ASX in a USD$11.43m IPO.

In a reversal of the overall trend observed in Q3, in which post-IPO activity plummeted by 91%, investment in public companies recovered to Q2 levels, increasing by 2966% to USD$2.822bn. This was primarily driven by private share issuances and the reorganisation of credit facilities by firms active in the M&A market over 2020, as they recovered cash holdings for general corporate purposes and for likely further purchases through 2021. After the dual acquisitions of Peak Games and Rollic, Zynga raised USD$1.151bn through a USD$726m private offering of convertible notes and a USD$425m three-year revolving credit facility. Meanwhile, shortly before forking out USD$310m for Sandbox Interactive and Super Free Games, Stillfront Group secured its own credit facility worth USD$442.77m, joining fellow Swedish holding groups Embracer (USD$358.5m); MTG (USD$298.7m); and EG7 (USD$187.6m) in securing capital raises or novel debt financing during the quarter. The APAC region saw a single post-IPO transaction topping the USD$100m mark, namely the purchase of a 33.3% stake in Japanese gaming hardware and software firm SNK Corporation by the Electronic Gaming Development Company (EGDC), held by the Saudi Crown Prince's Mohamed bin Salman bin Abdulaziz Al-Saud (MiSK) Foundation. EGDC is set to acquire a further 17.7% in SNK at an undisclosed date, giving it majority control, in a move seen as both a boost to the Middle Eastern video game market and controversial given outstanding allegations against the Crown Prince in the killing of journalist Jamal Khashoggi in 2018.

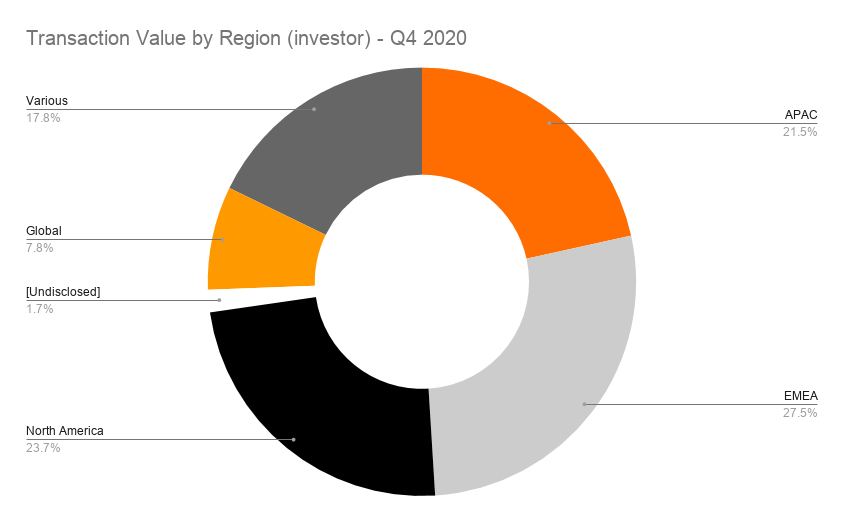

Funded company - location

2020

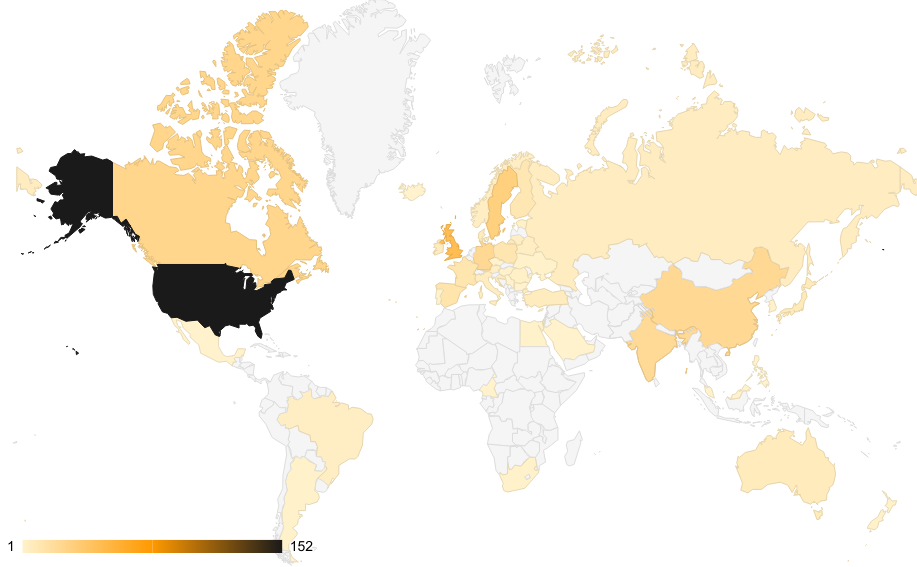

The majority (51.43% of total, USD$19.489bn) of investment tracked from April to December 2020 was channelled towards North American firms, with investment elsewhere split fairly evenly between companies in the EMEA (22.8%, USD$8.448bn) and APAC (24.3%, USD$9.009bn) regions in terms of value. However, investment volume between EMEA- (233 transactions) and APAC-based (71 transactions) firms differed significantly, as did the type of company invested in. In APAC, multiplatform developers and publishers commanded the majority (63.8%) of total investment in the region, followed by streaming platforms (20.3%) as Tencent consolidated its Huya and DouYu properties, while Bilibili secured a combined USD$1.05bn through a convertible note issuance and a Sony-led corporate equity investment.

In EMEA, unlike in both North America and APAC, mobile-focused video game companies were in the leading segment rather than multiplatform studios (39.3% versus 35.9% of total investment), driven by Zynga's acquisitions of Turkish studios Peak (USD$1.8bn) and Rollic (USD$180m); Tencent's ~USD$315m support of Voodoo; and the acquisitions of Hutch by MTG for USD$275m and Moon Active by Melsoft for USD$250m.

Nationally, the United States (USD$18.967bn) and China (USD$7.002bn) commanded the majority of gaming investments, dominating their respective regions with market shares of 98.51% and 77.7%. However, no single market within EMEA dominated investment receipts, reflecting the more fragmented corporate landscape of the region, though companies across the United Kingdom, Turkey, and Sweden saw a combined share of 74.7% of total funding across the region.

Q4

While APAC and North America-based gaming companies saw the lion's share of investment through Q2 and Q3 respectively, firms operating out of EMEA garnered the most significant proportion of investment in Q4. The aforementioned acquisition of Codemasters by EA for USD$1.2bn, along with post-IPO debt financing/rights issuance by Swedish video game holding groups Stillfront Group (USD$442.8m); Embracer Group (USD$358.5m); and Modern Times Group (USD$298.8m) drove a significant proportion of EMEA video game investment in the quarter. While these were the marquee transactions in October-December, an impressive 27 transactions were recorded at or above the USD$10m figure, indicating that the EMEA gaming ecosystem is in rude health going into 2021.

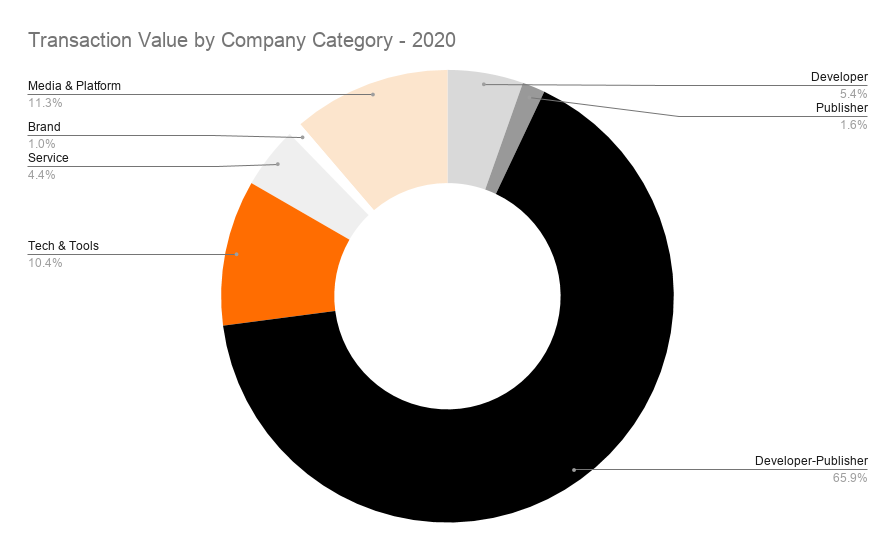

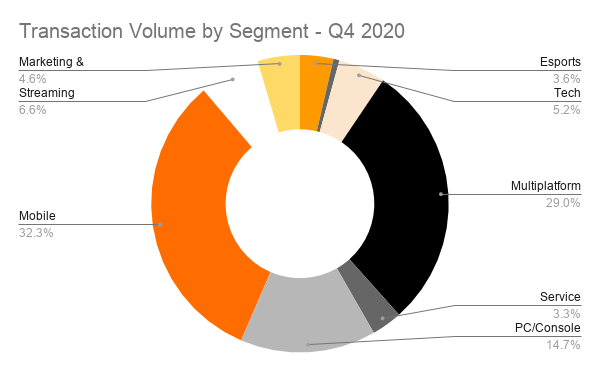

Funded company - type

2020

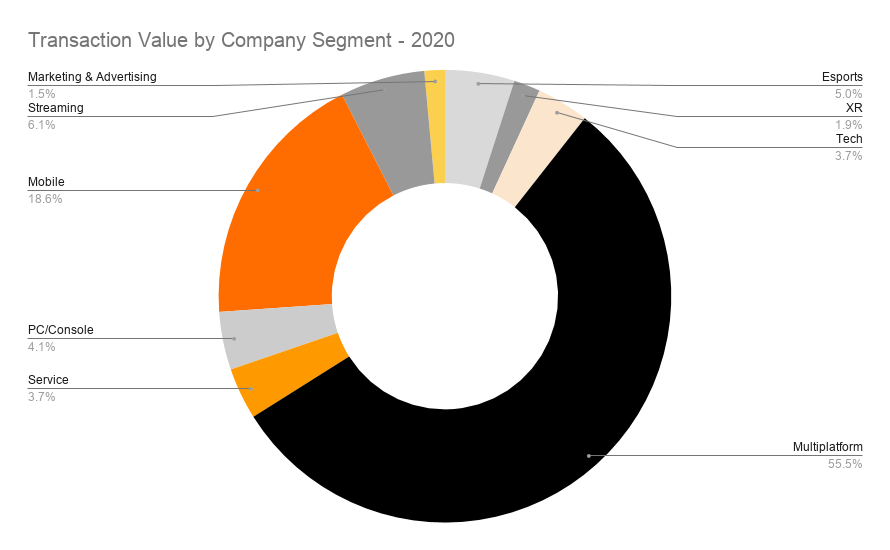

Scaled video game studios with both development and publishing capabilities across multiple platforms unsurprisingly commanded the majority of investment through April-December, more so than in previous years given the optimal market conditions for exits over private funding rounds, which tend to be comparatively rarer and lower in value. As the industry continues its maturation it is encouraging to see close to USD$5.5bn in investment towards technology vendors and service providers over the last nine months, underpinning the expansion of the industry in both breadth and depth. This is perhaps demonstrated by the three most valuable transactions recorded in the technology category, namely Unity's USD$1.3bn IPO; Zwift's USD$450m Series C; and Liftoff's USD$400m venture tranche, which demonstrates support for independent game development; the expansion of gaming into sectors such as health and fitness; and in-game advertising.

Despite early concerns that the sector would be impaired by a fall in commuting hours, mobile gaming remained strong, reflected by the USD$6.888bn funnelled towards mobile-focused video game companies through Q2-Q4 2020. Over 79% of this figure is accountable to acquisition and post-IPO activity, as sector-leading firms strove to both solidify their position within current genres such as Zygna bolstering its match-three presence through Peak, as well as expanding into new sub-categories, demonstrated by AppLovin (traditionally a marketing technology vendor) purchasing Machine Zone for an estimated USD$500m.

While the video games industry as a whole benefitted from greater consumer engagement in the wake of Covid-mandated sports and film suspensions, Esports was perhaps the sector which benefitted most strongly from these in terms of consumer and investor attention. Esports technology vendors and competitive platforms saw a spike in funding over the course of the year, as did the streaming landscape, particularly in China (Bilibili, DouYu/Huya) and the United States (Caffeine.tv, Discord, Restream, Parsec). Competitive esports teams also reaped the financial rewards of consumer engagements in terms of both sponsorship deals and funding rounds, with FaZe Clan (USD$39.4m Series A); ReKT Global (USD$35m debt financing); Immortals Gaming Club (USD$26m Series B); Guild Esports (USD$25.8m IPO) Reciprocity (USD$21.9m acquisition by GameSquare); EVOS Esports (USD$20m Series B); and Fnatic (USD$10m venture financing) all securing eight-figure raises. An obvious caveat to this is the challenging market conditions facing in-person esports tournament operators, which have faced extensive revenue shortfalls through 2020 and into 2021. However, significantly increased fanbases, coupled with favourable opportunities in commercial real estate, are likely to power a strong rebound when such events can be resumed.

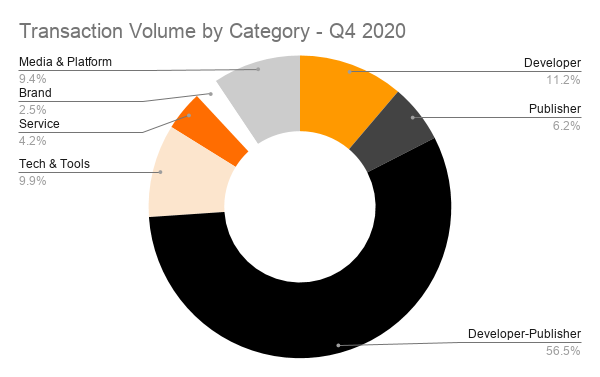

Q4

Unlike the case in the two previous quarters, video game investment was not dominated by multiplatform developer-publishers, with mobile gaming companies forming the leading segment as their funding rose by 146% to USD$3.100bn. This increase is particularly remarkable given the uncertainty around mobile app platforms and monetisation caused by the looming deprecation of Apple's Identifier for Advertisers (IDFA) and multiple antitrust cases against both Apple and Google from the likes of the US Justice Department, European Commission, and Epic Games.

Q4 also saw a 1107% increase in funding for PC/console-dedicated studios to USD$1.414bn, though this is largely attributable to a single transaction - the USD$1.2bn acquisition of Codemasters by EA. Given that both Microsoft and Sony launched their next generation devices during the quarter, it is perhaps surprising that console-focused studios did not attract significant sums of investment. However, as development costs for polished console titles have been increasing rapidly (a 2018 study by Ralph Koster estimated that such costs for AAA titles was increasing at a rate of 10x every ten years), even more so in the run-up to new console releases, there are significantly fewer operators in the console market than in mobile, less still that focus exclusively on the market. Therefore a more nuanced approach to the "multiplatform" category, including sub-groups such as "console-specialist" may need to be implemented going forwards.

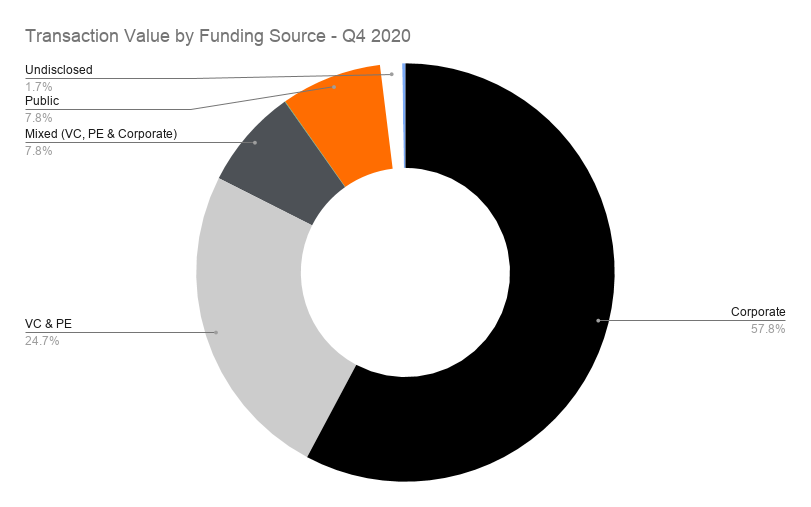

Investment source

2020

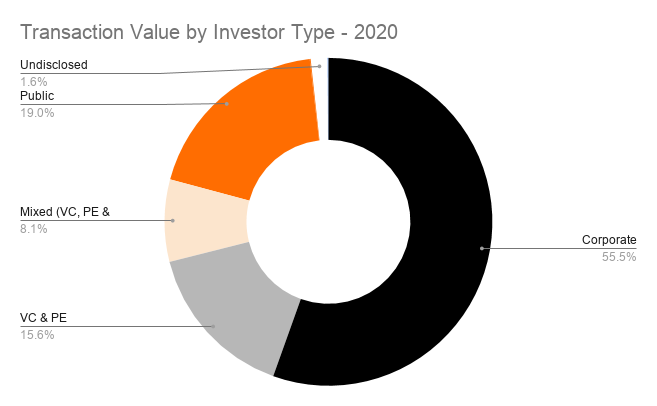

For the nine months ended 31st December 2020, over half (USD$21.017bn) of the total recorded transaction value within the video games industry can be attributed to rounds led by a corporate investors, attributable to the strength of M&A activity and the USD$1.879bn in minority corporate investments, which represents almost 5% of total value. The actual amount invested by corporate sources in the gaming industry is likely to be significantly higher still, as nearly one third (57) of the total 176 transactions led by non-financial companies were for undisclosed sums.

While the USD$5.860bn total investment led by venture capital and private equity investors was dwarfed by corporate-led rounds, the two groups were remarkably similar in terms of deal volume, as 173 transactions were led by VC & PE firms compared to 176 for corporate investments. Greater focus on the gaming industry turned the heads of several sector-generic VCs, while the broadening of the sector to other industrial applications such as health, fitness, and digital entertainment, will likely lead to further activity led by non-sector-endemic VCs in 2021. Indeed several firms are expanding their operations into the video games industry, such as Telstra Ventures and Grishin Robotics, with the latter raising a USD$100m fund to support its nascent involvement in the space. Meanwhile. established gaming VCs such as BITKRAFT and Galaxy Interactive were once again at the forefront in 2020, between them leading rounds worth USD$98.06m at the seed and Series A stage, over 14% of the total recorded at those growth phases.

Q4

Despite a decrease in acquisition activity, minority corporate investments saw a strong strong Q4. USD$1.469bn was supplied through such rounds, up 292% from Q3, at an average of USD$163.23m over the nine disclosed transactions (four were for unknown sums). This in turn ensured corporate investments remained the leading investor type, contributing in excess of USD$6.02bn.

Video game investment led by venture capital and private equity companies more than doubled to USD$2.569bn, representing nearly a quarter of all investment activity during the quarter, compared with just 6.6% of transaction value recorded in Q3.

Concerningly, government funding decreased further in terms of value by 10.08% to USD$4m, having fallen by 69% through Q3. The volume of government support of the video games industry also plummeted, with only two transactions recorded during the quarter compared with 32 over July-September, namely the UK government's COVID grant allocated to the National Video Games Museum and the allocation of USD$3.6m by the Malaysian executive towards companies operating within esports. It is important to note that national funding of the video games industry is highly cyclical, and excludes both indirect programmes such as the UK's Video Game Tax Relief (VGTR) scheme and non-financial incentives, the fall is still perturbing when coupled with the decline in early-stage funding.

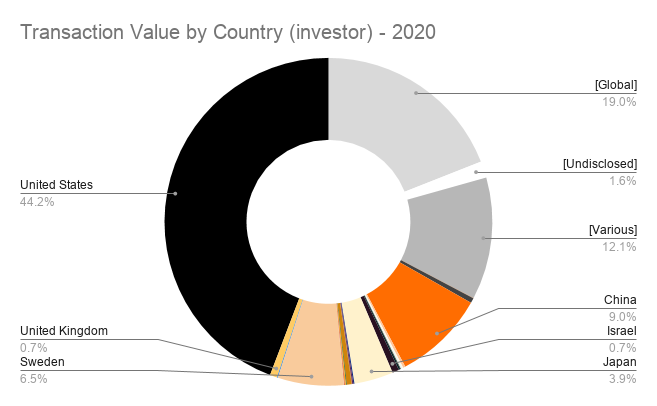

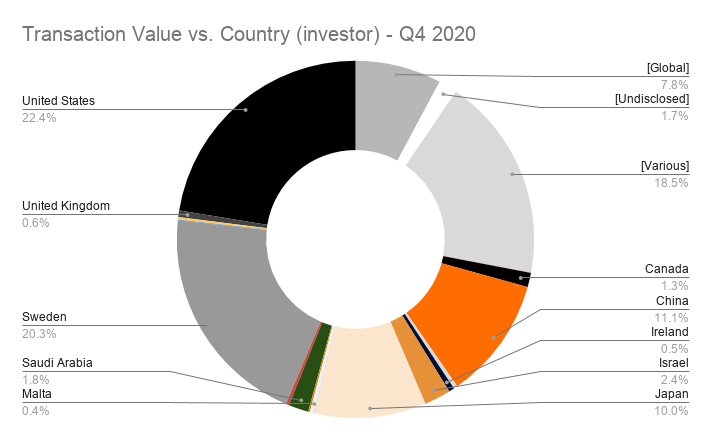

Investor location

2020

In a similar pattern to funded company location, investors situated in the United States and China led the way in terms of transaction volume through multi-billion dollar purchases and investments, leading total transaction value of USD$16.739bn and USD$3.415bn respectively. However, investors based in EMEA drove the majority of investment rounds in terms of volume, supporting 186 rounds compared to APAC (71) and North America (141). Within Europe, Swedish companies funnelled USD$2.466bn into the gaming industry, close to 7% of the total, while investors based in the United Kingdom led 36 transactions, primarily at Seed-Series A stage.

Q4

Investor location through Q4 again mirrored investment recipient location, with EMEA-based firms supplying more funding (USD$2.862bn) than North American (USD$2.468bn) and APAC-based (USD$2.244bn) investors. The injection of USD$815.6m into public companies by Tokyo-based Nexon, just over half of its previously-announced fund, accounts for Japanese investment through the quarter, while China-based investors has a comparatively quiet quarter at USD$1.151bn, though this is still significantly more active than the USD$394m recorded in Q2.

Forecast

I. As the coronavirus pandemic lumbers on, coupled with early indications that gaming is retaining the users engaging with the medium more often through stay-at-home measures, scaled studios and holding groups are likely to see continued access to generous credit facilities over the course of 2021, supporting further M&A activity. Exit-thirsty backers will also be buoyed by the strength in game company valuations over 2020, and will seek to capitalise on the current market conditions. We expect M&A to be strong over the course of the full year, however this may begin to tail off towards Q4 and early 2022, as firms shift priorities to bedding in their previous purchases.

II. IPO

IPO activity is set to proliferate through 2021 after a comparatively fallow year, as directors capitalise on the recent strength of video game company performances on public markets, as well as the attraction of non-conventional methods of public offering such as direct listings and SPAC mergers. Already in January we have seen Playtika net USD$1.88bn via its Nasdaq IPO, a record for an Israel-based company, and Roblox raising USD$520m ahead of a proposed direct listing to take place in February. Other notable companies either confirmed to be, or exploring the possibility of, pursuing IPOs this year include Krafton; Scopely; Huuuge Games; People Can Fly; tinyBuild; and G-Loot. Moreover, the advertising technology sector is seeing a boom as marketers turn to scaled privacy-focused solutions through the dual headwinds of IDFA and third-party cookie deprecation, with several notable mobile marketing platforms, including ironSource and AppLovin, reportedly planning IPOs for H1 2021.

III. Private investment to remain slow in H1 as market conditions favour IPOs and M&As, reducing follow-on funding, which is traditionally low for the sector in any case. However, while the attention of generalist VCs may be on scaled firms and other sectors, we expect to see a greater proportion of early-stage investment in gaming being provided by specialist firms, as seen with BITKRAFT and Galaxy Interactive (see "Investment source - 2020). The launch of new geography-focused gaming VCs, such as Lumikai Fund and VGames, and a USD$235 fund secured by Griffin Gaming Partners, further point to a greater proportion of early-stage investment stemming from investment bodies with extensive sector-specific experience, surely a positive for funding recipients.

IV. Much of China's international investment in the industry will depend on actions taken by the new Biden administration in the United States. Any action, whether this is directly against Chinese firms, as has been demonstrated in the latter days of the Trump presidency, or by taking a harsher look at monopolisation in general, will likely lead to a continuation of Tencent and other China-based giants' recent investment focus on European and SEA markets. At this early stage it appears that the Shenzhen colossus' directors are highly optimistic about its US operations, with rumours suggesting the firm is considering a multi-billion dollar debt financing round in order to support a US or South Korean acquisition. Electronic Arts (market cap: USD$42.406bn); Take-Two Interactive Software (market cap: USD$23.481bn) and Zynga (market cap: USD$11.135bn) have been touted as potential targets, though it is important to stress that this information is uncorroborated at this stage.

Domestically, a marked rise in anti-monopolisation sentiment purveyed by the CCP, most notably towards technology and ecommerce colossus Alibaba, will likely hinder any internal M&A efforts, such as October's long-mooted merger of the Huya and DouYu streaming platforms.

V. The momentum behind mobile gaming may slow due to upcoming deprecation of Apple's Identifier for Advertisers (IDFA). Despite the updates looming ever-closer on the horizon, there is still a substantial level of market uncertainty as to what effect the changes may have on the ecosystem, and indeed how they will even be implemented. In recent years, in-app advertising (IAA) has been as important a revenue stream as in-app purchasing (IAP) for mobile gaming companies, thus any effect on campaign effectiveness caused by the IDFA deprecation is likely to see a return of greater focus on IAP. However, user acquisition (UA) is where the changes are likely to have their most substantial effect. Earlier in the year, AppsFlyer forecast that £37bn would be spent on UA by gaming firms by 2022, with the sector responsible for an estimated 40% of all paid media spend for app installations. Any deprecation of user-level tracking is likely to hinder these efforts, particularly on the Apple ecosystem with traditionally higher per-user spend, meaning a tougher 2021 could be in store for operators in highly-competitive mobile sectors such as casual and hyper-casual. However, the various antitrust cases progressing against Apple from private companies as well as governments may force Apple to pare back its plans, which were initially due to be implemented in September 2020.

Given the current strength of the advertising technology market, with several IPOs and investment rounds, and the necessity for ad-reliant studios to explore alternative measurement and attribution solutions, it would be unsurprising to see further investment activity in the space, akin to Blackstone's recent support of Liftoff, as well as acquisitions, alongside the aforementioned IPOs of the likes of AppLovin and ironSource.

VI. Esports to continue audience growth and advertiser interest through 2021, in turn fuelling further investment. A multitude of sponsorship deals recently brokered between esports organisations and leading non-endemic brands, including KFC; Adidas; BS2; Nestle (KitKat); MasterCard; PayPal; and Red Bull, displays increasing confidence from marketers across the globe that esports can retain the increased attention from consumers brought about through Covid. The eventual resumption on in-person tournaments and stadium events is set to further bolster the sector.

While we forecast esports investment to increase globally, it is likely that we will see faster growth within APAC markets in comparison to the North American and EMEA markets. The sustained development of multi-billion yuan stadiums in China; the legitimisation of esports as a medalled event at the 2022 Asian Games; and a notable degree of government support as demonstrated by the aforementioned direct funding by the Malaysian executive, are all symptomatic of a healthy esports landscape in the region.

About the TGE Index

The TGE Index lists over 2000 companies, across 18 industry categories, operating within the rapid growth video games ecosystem.

The Index is a detailed record of game developers, publishers, technology vendors, service providers, and investors. Business profiles include up-to-date information on funding level, investment activity, M&A status, and titles produced. The data within the index is updated on a regular basis, with a minimum of 300 companies to be added each month throughout 2021.

From surveying the state of investment in the video games market, to identifying the right publisher, technology solution, or games service, the TGE Index offers an unparalleled viewpoint across the full breadth of the industry. Further functionality will be brought to the platform through 2020 and beyond.

To subscribe to the TGE Index, please click here.

Follow ExchangeWire