Google Report 17% Increase in Ad Revenue, But Fail to Break Out Programmatic

by Rebecca Muir on 2nd Feb 2016 in News

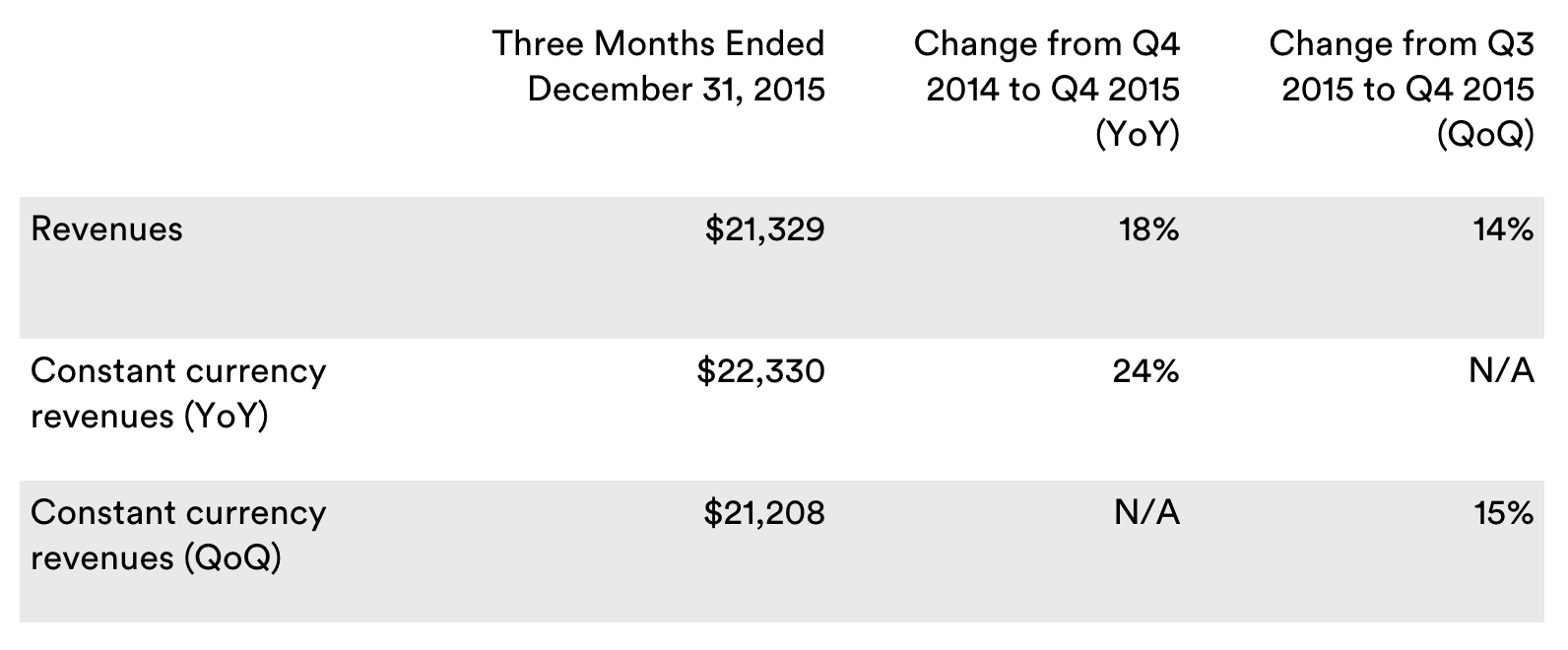

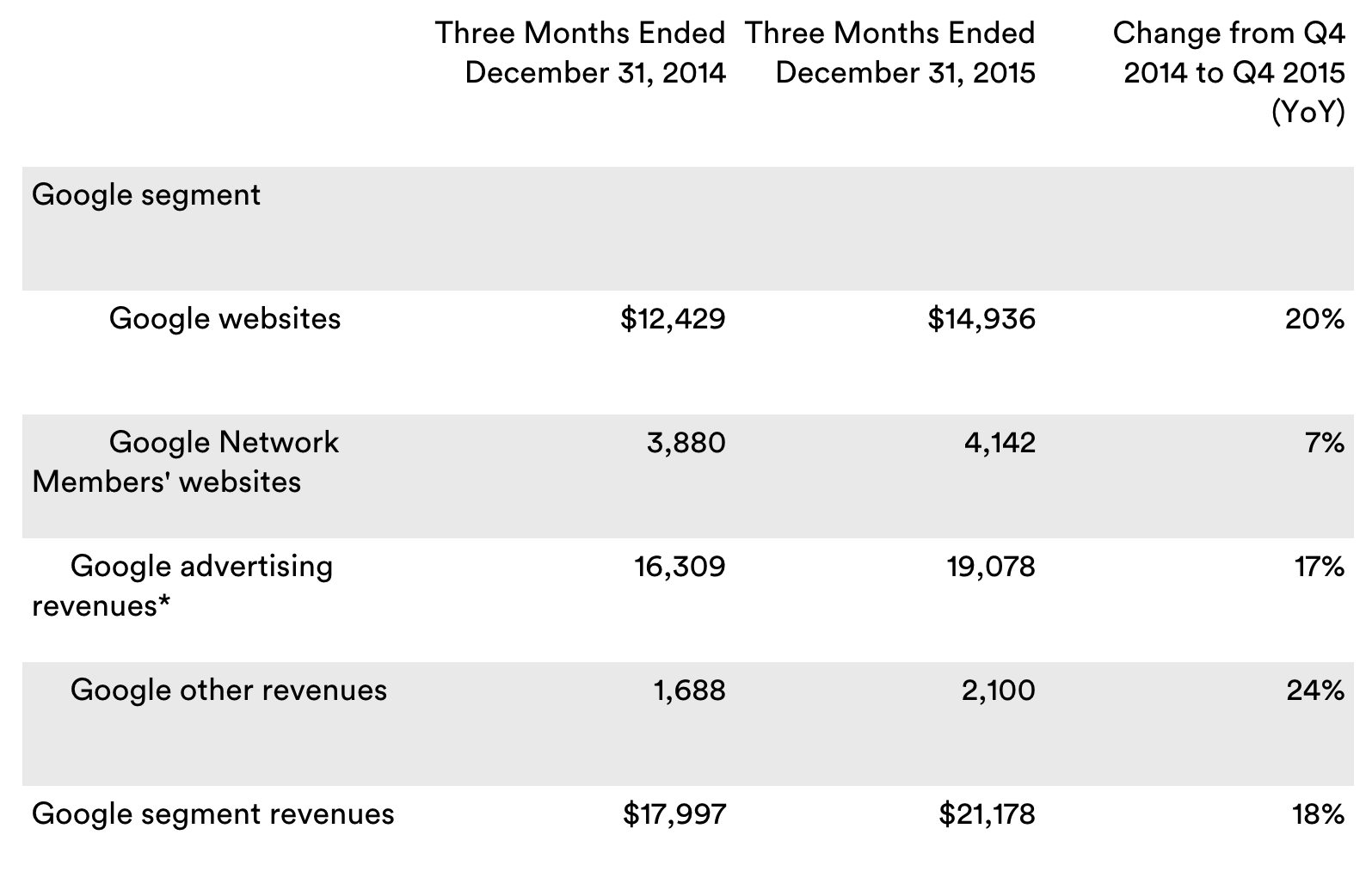

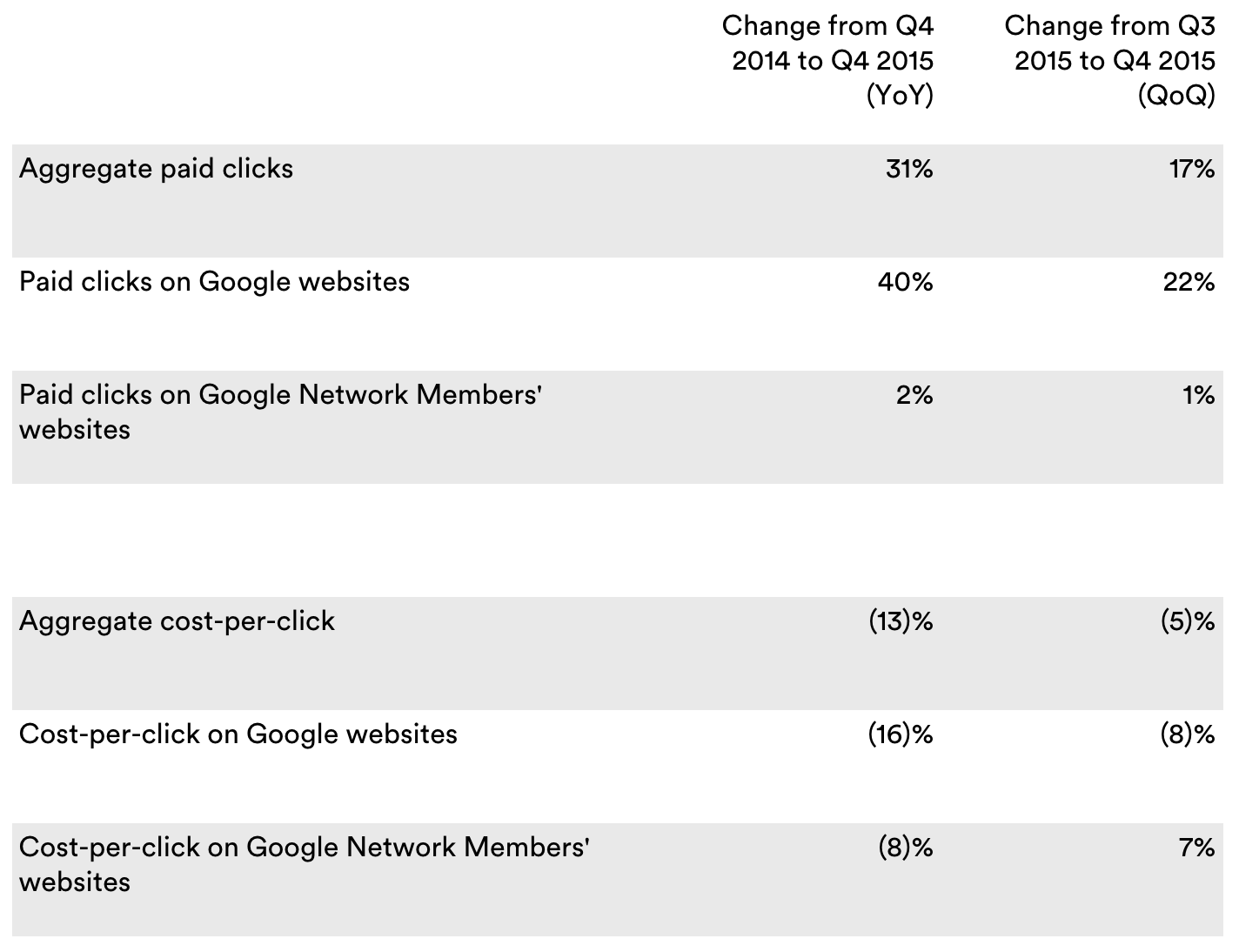

Alphabet, yesterday (1 February), announced financial results for the quarter and fiscal year ended 31 December, 2015. The company reported a year-on-year increase in revenue of 18%, and a 17% increase in advertising revenue. Paid clicks on Google websites increased by 40% year-on-year, compared to just 2% growth in paid clicks on Google Network Members' websites.

Q4 2015 financial highlights

In millions.

Source: Alphabet

Source: Alphabet

Summarising Alphabet results, Ruth Porat, CFO, Alphabet said: "Our very strong revenue growth in Q4 reflects the vibrancy of our business, driven by mobile search, as well as YouTube and programmatic advertising, all areas in which we've been investing for many years. We're excited about the opportunities we have across Google and Other Bets to use technology to improve the lives of billions of people."

Advertising revenue

Source: Alphabet

The question on the ad industry's lips was just how much revenue Alphabet made from programmatic advertising. Disappointingly, the only mention was as follows: "The primary driver was the increased use of mobile search by consumers, benefiting from our ongoing efforts to enhance the efficacy of mobile search, as well as from the holiday season. In addition, results reflect ongoing momentum in YouTube and programmatic advertising", according to Ruth Porat.

What we do know is that the number of clicks is increasing, but that the revenue per click is declining. Overall, the increase in click volume is enough to mean that revenue from advertising is still on the rise.

Whether that is a sustainable model is debatable.

Generally, declining CPMs & CPCs means one of two things: either there are fewer advertisers competing for those clicks, thus the auction model does not become as inflated and the cost declines, or the advertisers taking part in the auction see the value of the clicks they get declining; therefore, they bid less for them.

Either way, Google may have a problem with advertisers' perceived value of clicks.

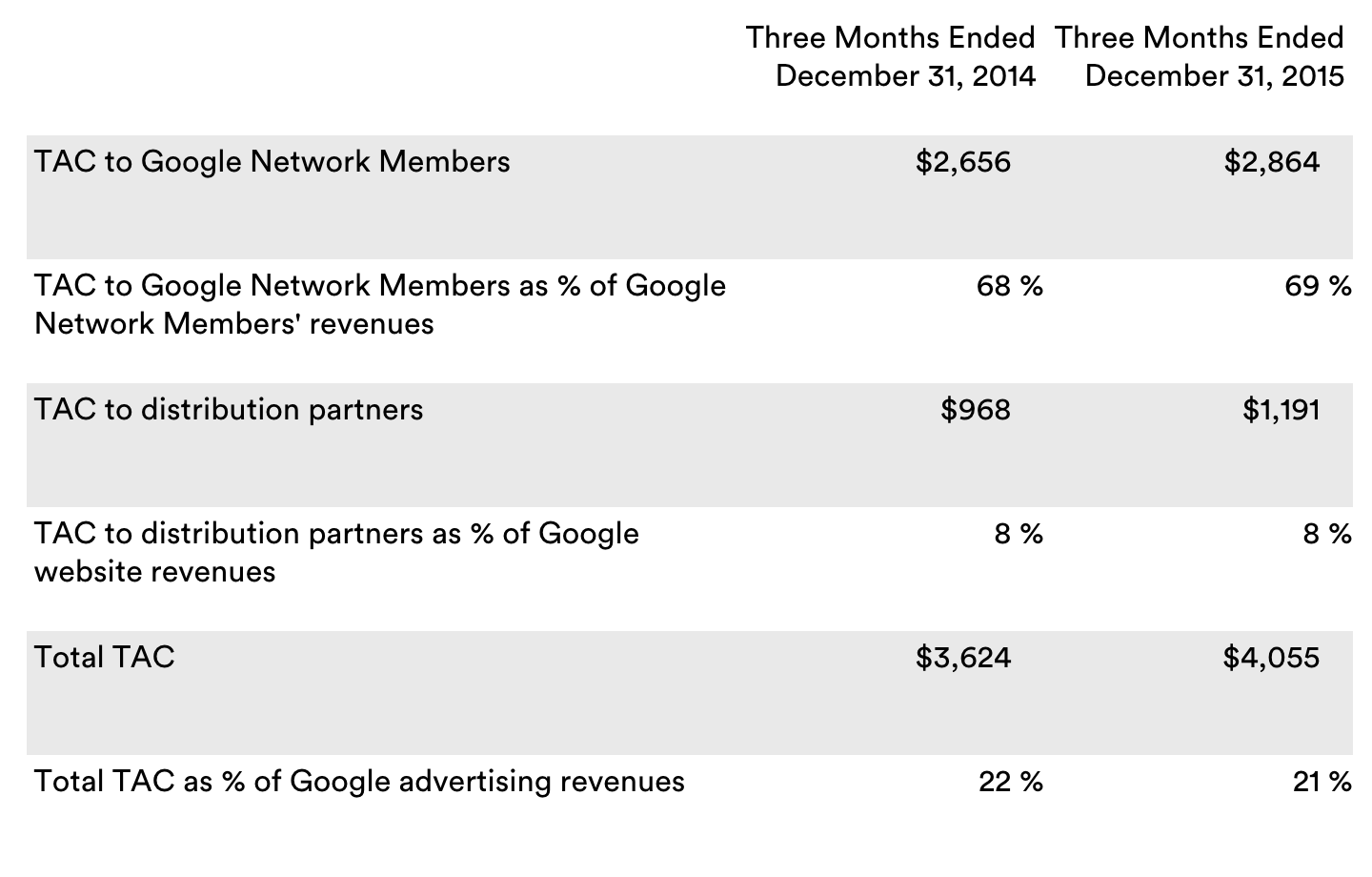

Source: Alphabet

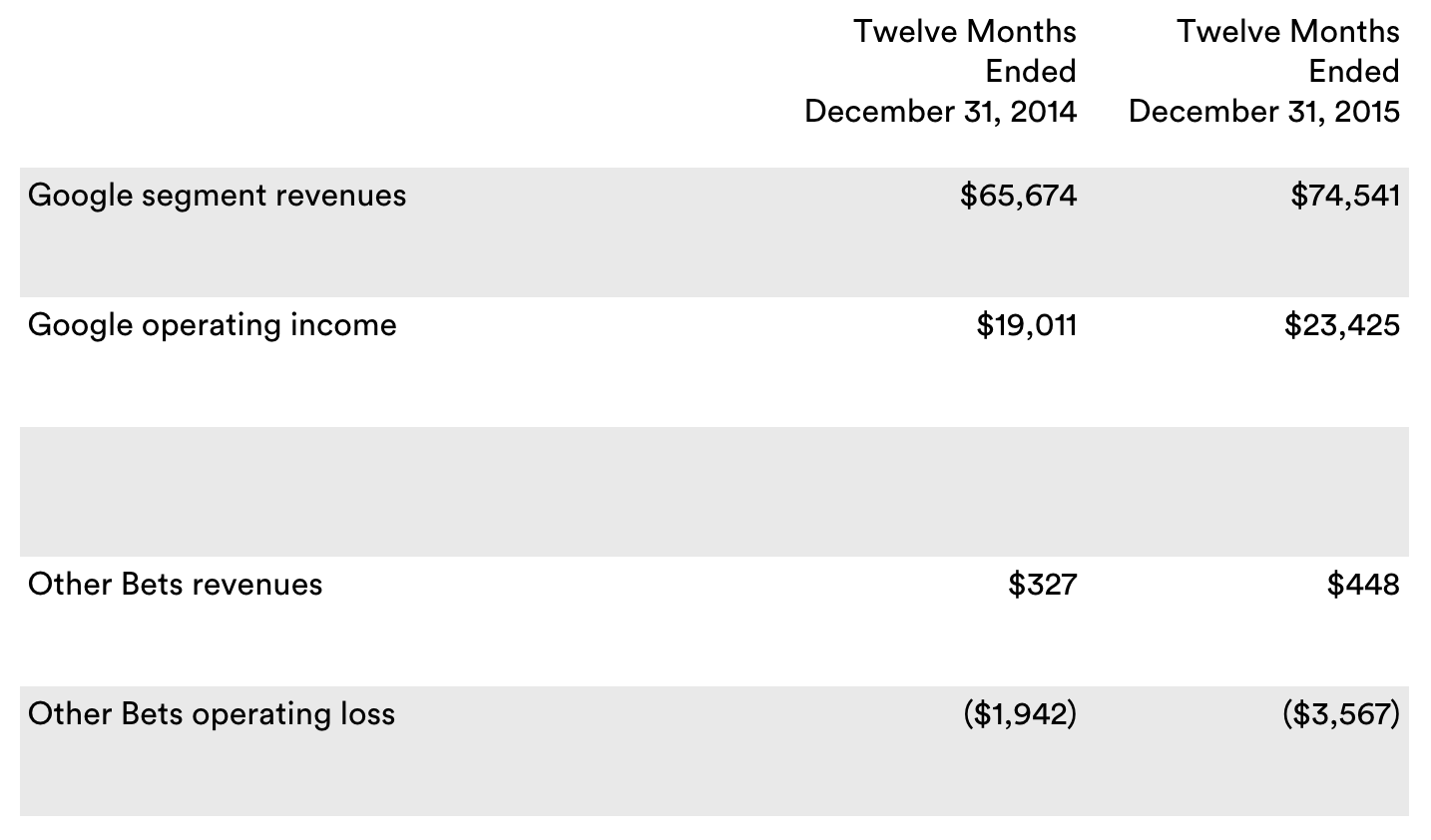

Alphabet broke out earnings from Google and Other Bets. The results show that Google is propping up the overall numbers. In previous earnings reports, there was no visibility into the performance of the different segments of the business, everything was lumped under 'Google'. The new company structure provides some clarity into what's working and what isn't at Alphabet.

In summary, Google is making vast amounts of revenue and Other Bets are not. In 2015, Google earned USD$74.5bn (£51.76bn) in revenue with USD$23.4bn (£16.26bn) of operating income, both up compared to 2014.

However, the Other Bets made a much smaller USD$448m (£311m) in revenue over the course of the year, and failed to make a profit. Those companies lost USD$3.6bn (£2.5bn) in 2015. Alphabet CFO Ruth Porat said on yesterday's earnings call that the majority of the revenue pulled in by Other Bets came from Nest, Google Fiber and Verily (formerly known as Google Life Sciences).

Alphabet revenues by geography highlight the strength of the business around the world as well as the impact the currency headwinds continue to have on non-US business. US revenue was up 24% year-on-year to USD$10.3bn (£7.16bn) and up 18% versus Q3.

UK revenue was up 16% year-on-year to USD$1.9bn (£1.32bn) and up 7% sequentially. In fixed FX terms, the UK grew 20% year-on-year and 9% quarter-on-quarter.

Rest of world revenue was up 12%, versus last year, to USD$9.1bn (£6.32bn) and up 12%, versus Q3.

Follow ExchangeWire