M&C Saatchi Performance's Lavinea Morris on Netflix-Roku, Agencies, and Online Shopping

by Grace Dillon on 17th Jun 2022 in Podcast

On this week's MadTech Podcast, Lavinea Morris, Head of Performance, EMEA, joins Mat Broughton and John Still to discuss the rumoured plans for Netflix to buy Roku, advertisers' growing reliance on their agency partners, and the rise of online grocery shopping.

Netflix reportedly considering buying Roku

How would a Netflix-Roku tie up impact the streaming and CTV markets?

Netflix are reportedly contemplating acquiring ad-supported CTV platform Roku. The rumoured purchase could stand to remedy the Reed Hastings-led company’s recent woes by providing access to a pre-built ad tech stack — Roku’s OneView ad platform — potentially promising a faster implementation of their recently-announced ad-supported tier. For Roku, meanwhile, the takeover could give a competitive edge over CTV rivals when it comes to drawing eyeballs by giving them a share of Netflix’s extensive and in-demand catalogue of content.

Whilst some analysts are sceptical that the deal will come to fruition due to Netflix’s device-agnostic approach, others point out that most of Roku’s revenue comes from advertising rather than devices (USD $646m versus $86m respectively in Q1 2022). Furthermore, Amazon’s offering of both a device (Firestick) and streaming platforms (Prime and IMDb’s Freevee) indicates that adopting hardware wouldn’t necessarily damage Netflix’s brand.

Advertiser reliance on agency partners grows as recession fears loom

How are agencies helping their clients deal with current uncertainty?

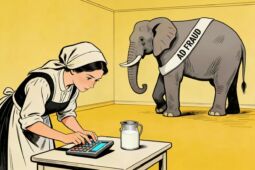

The threat of a recession sparked by rising inflation and other macroeconomic factors is seeing some marketers re-evaluating their plans and seeking greater reassurance from their agency partners, according to a report from Digiday. This is unsurprising, the report notes, as marketing is often the first area to face cuts in response to hardship – now, during a time of crisis, proving that media spend is delivering ROI is vital.

While some marketers have become fixated on making spend more efficient by restricting their budgets and limiting investment to media partners that offer greater flexibility and channels with easier cancellation processes, others have not cut back on spend but are frequently revising their strategies, creating a great operational burden for their agency partners. Some agency executives speculate that these advertisers are afraid that missing their revenue targets will make them more vulnerable to the fallout of a recession. In both cases, agencies have found themselves spending more time trying to address their clients’ anxieties and manage their expectations for an anticipated and much-feared economic downturn.

More than half of UK shoppers buy groceries online

What could this shift in shopping behaviour mean for the evolving retail media space?

A new survey of 2,500 UK consumers has found that 60% now buy at least some of their groceries online, with 16% ordering most or all of their food and household goods via the internet. The UK Online Grocery Report 2022 from Spryker found that, if provided with a better experience, 80% of respondents would buy more groceries online, and that 28% plan to migrate to online for the majority of their shopping within the next two years.

With 23% of consumers preferring delivery to in-store pick up, introducing an online shopping and delivery service could be key to lower-cost supermarkets staying competitive, says Spryker CEO Boris Lokschin. As digital shopping continues to grow in popularity, retailers should “invest in technology infrastructure that seamlessly links on- and offline channels” to ensure that their physical outlets remain profitable and to win repeat business, he adds.

Ad SpendAgenciesNetflixPodcastRetailStreamingVOD

Follow ExchangeWire