Ad Tech Companies Pushing EU to Investigate Google Dominance; Nikkei Buys FT for $1.3bn

by Ciaran O'Kane on 24th Jul 2015 in News

In this week’s ExchangeWire European Weekly Roundup: ad tech companies push EU to investigate Google dominance; Nikkei buys FT for $1.2bn; ad tech is killing the online experience, allegedly; and ATS London, more speakers announced and tickets selling fast.

Ad tech companies push EU to investigate Google dominance

The FT reports this week that several ad tech companies, including AppNexus and OpenX, are pushing the EU to investigate Google's dominance in the ad tech space.

The report points to Google's leveraging of its dominant position in the market. There remains a lack of hard data around Google's share of the ad tech market to support the claim. The FT outlines the following high-level numbers around Google's revenue:

- $49bn from search

- $3.6bn from YouTube

- $2.1bn from DoubleClick

- $6.9bn from Google Display Network and other display ad products

The real problem here is how you quantify it. Google owns so much of the digital ad eco-system (technology and media) that it is difficult to ascertain (from current sources) where and when it makes money, and for obvious competitive reasons Google will never break out those numbers.

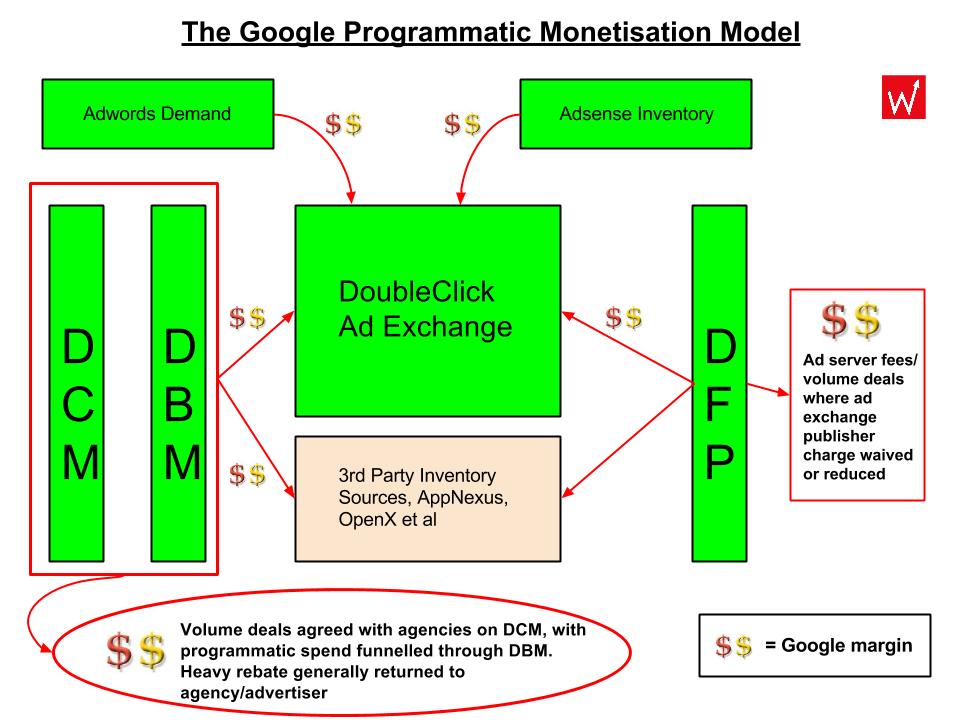

You only have to look at the graphic below to understand the pure genius - as well as the complexity - of the Google programmatic monetisation model:

As you can see from this rudimentary visual, Google is picking off margins everywhere in the programmatic monetisation chain. EU regulators will have a difficult time figuring out Google's market share.

Those pushing the case against Google also point to software bundling, such as full Google Analytics access via volume commitments on DBM. Again, many of those deals are probably done an ad hoc basis - and will be difficult to prove.

Such is the scattergun nature of ad tech, reliable data on market share is almost impossible to find. The ExchangeWire Research portal, launching in September, will help to fill some of these glaring gaps on specific vendor dominance in ad tech, marketing technology and programmatic advertising.

Google might be dominant, but challengers on the buy sell (particularly Facebook) and the sell side (spearheaded by AppNexus) will emerge and challenge the current controlling influence of Google in the European programmatic marketplace.

Latest research and ATS London agenda

It is now only seven weeks until our flagship event, ATS London, on Monday September 14. It is the largest programmatic event globally - and is the only major digital media event that contains only unsponsored content.

Confirmed speakers:

- Caspar Schlickum, CEO, Xaxis EMEA

- Damien Blackden, global chief strategy officer, Maxus

- Boris Mouzykantskii, founder, chief scientist & CEO, IPONWEB

- James Patterson, Client Services Director, EMEA, The Trade Desk

- Roi Carthy, CMO, Shine Technologies Corp

- Ben Barokas, CEO & founder, Sourcepoint Technologies

- Dan Smith, Director & head of advertising & marketing law, Wragge Lawrence Graham & Co

- Michael Blais, head of display marketing & operations at Ebay

- Mike Thornhill, CEO, ActiveInstinct

- Pippa Glucklish, Co CEO, Starcom MediaVest Group

- Paul Frampton, CEO, Havas Media

We will be announcing our full agenda and additional speakers next week.

Oracle Marketing Cloud have partnered with ExchangeWire Research to produce a piece of research looking into the global DMP market. We invite our readers to complete the survey and receive a copy of the report prior to publication at ATS London.

Click here to take the survey.

Nikkei picks up FT in $1.3bn deal

Flush with cash and eager to move beyond the Japanese market, Nikkei, international publisher of financial, business and industry news, acquired the Financial Times in a deal worth over £800 million ($1.3 billion).

The acquisition comes amid recent speculation in the financial press that Pearson was looking to unload the "pink 'un". It was reported that Axel Springer was interested in acquiring the FT, but looks like Japanese media giant Nikkei was the favoured suitor after it came in with a last minute, all cash bid.

The deal does not include Pearson's 50% stake in the Economist or the the FT’s head office building on the river Thames in London.

This signals further consolidation in the financial media press.

Nikkei is not a DFP shop - and is thought to be ambivalent towards Google - so could there be an opportunity for an independent to own this global relationship? From an ad tech perspective, Nikkei could trim its vendor list globally within one of the most lucrative publisher niches. It must be noted though that Japanese companies are notoriously slow at integrations.

Ad tech, the fall guy for everyone

Felix Salmon had a proper moan about ad tech companies this week blaming them for long page load times.

The premise of the article is that ad tech has ruined the user experience. Latency issues are causing frustration among users - with slow page loads being blamed on third party ad tech vendors.

Granted there is a lot of javaScript loading on a typical digital publisher's web page - and yes ad tech is eating bandwidth. But you can't escape the fact that publishers are not managing this very well.

Ad tech provides the tools, it is up to publishers to establish the right balance between user experience and monetisation. There should be little sympathy afforded to moronic publishers loading up their pages with ten or more ads and fifty plus ad tags on page. It is no wonder your content won't load.

Ad tech is the monetisation engine of digital media - and it should be used responsibility.

Salmon notes that Apple will introduce its ad blocking tool later this year. Instead of playing into the hands of monopolistic distribution solutions with a piece like this, he should be supporting an independent ad tech sector - where publishers are not the content drones for a handful of modern day digital overlords.

Apple is being duplicitous around how it is approaching this very area: on the one hand it supports the blocking of third party ads thus improving user experience; on the other it covets publishers with its own content reader.

But how long before Apple starts selling ads on behalf of publishers? Answer: not very long. Apple needs to feed on everyone else's revenue.

The industry should be massively wary of Apple. It is the most powerful digital media company globally. It wields an unhealthy monopolistic control over a significant chunk of the mobile eco-system. It is trying to kill the open web, and it is now declaring open war on the independent ad tech industry.

If anything Salmon's ill-informed piece just once again re-affirms why, as an industry, we should keep the smiling assassins of Silicon Valley at a comfortable distance.

Follow ExchangeWire