ATS London: Seeking the Truth in Data

by on 16th Sep 2015 in News

Earlier this week, at ATS London, AppNexus created a stir within the digital advertising industry when Catherine Williams, chief data scientist (pictured) shared results of their ongoing Inventory Quality (IQ) initiative. Through a combination of aggressive policy enforcement and sophisticated data science measures, AppNexus have cleaned their platform of invalid traffic and established a new industry standard for transparency – transparency in how the platform operates and in how they share results and insights with the broader ad tech community. In this piece, Catherine Williams and Brian O’Kelley, co-founder and CEO at AppNexus (pictured), discuss this evolution and the impact it will have on the, sometimes secretive, online advertising industry.

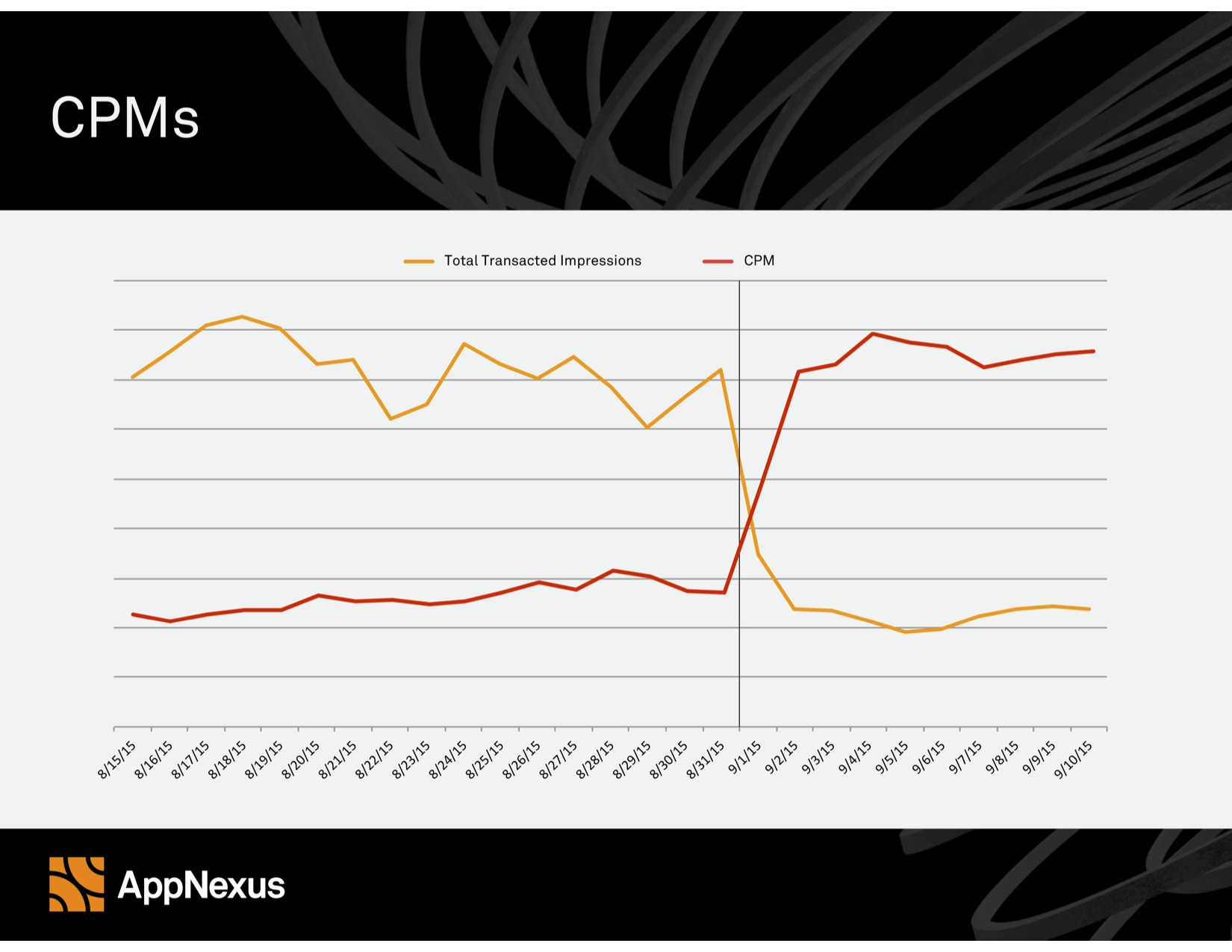

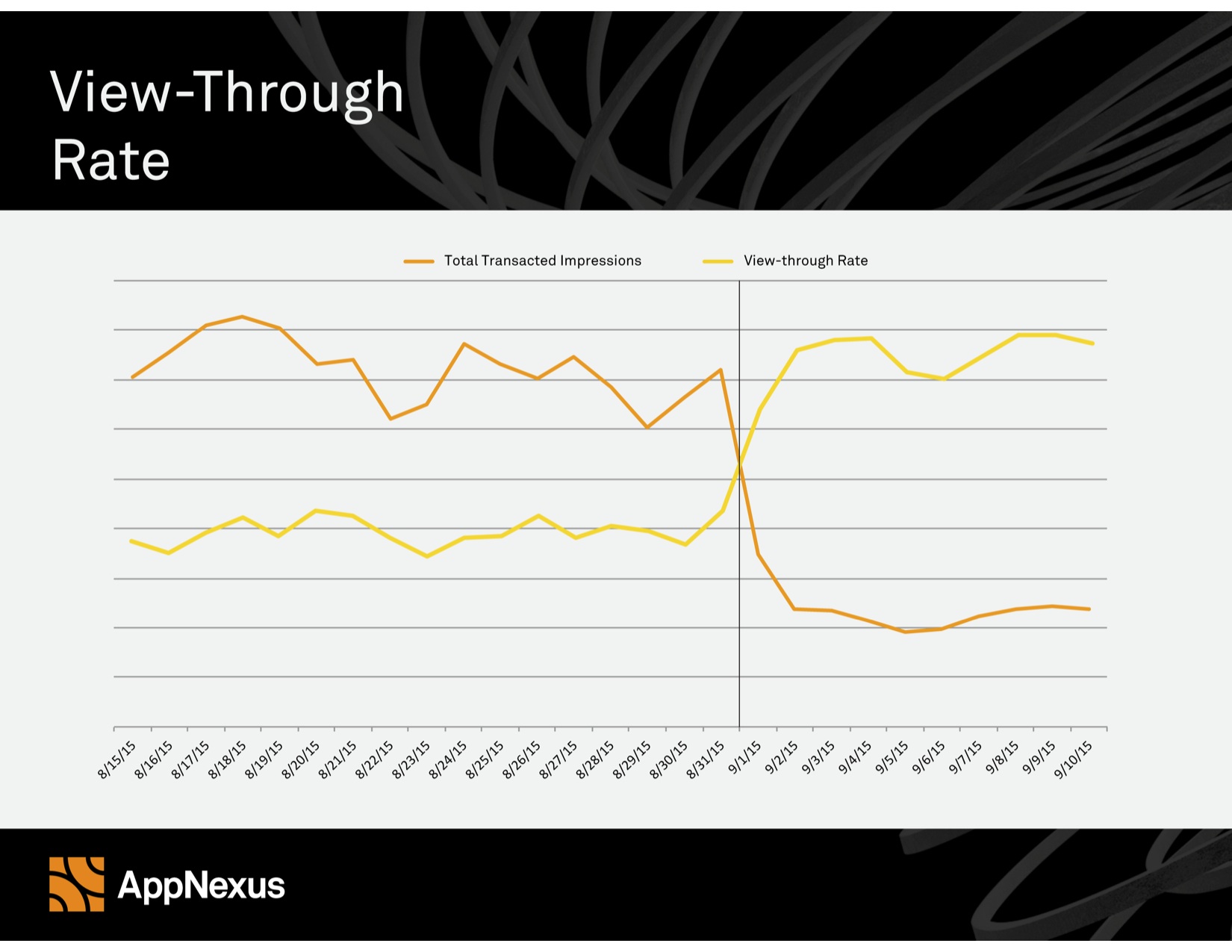

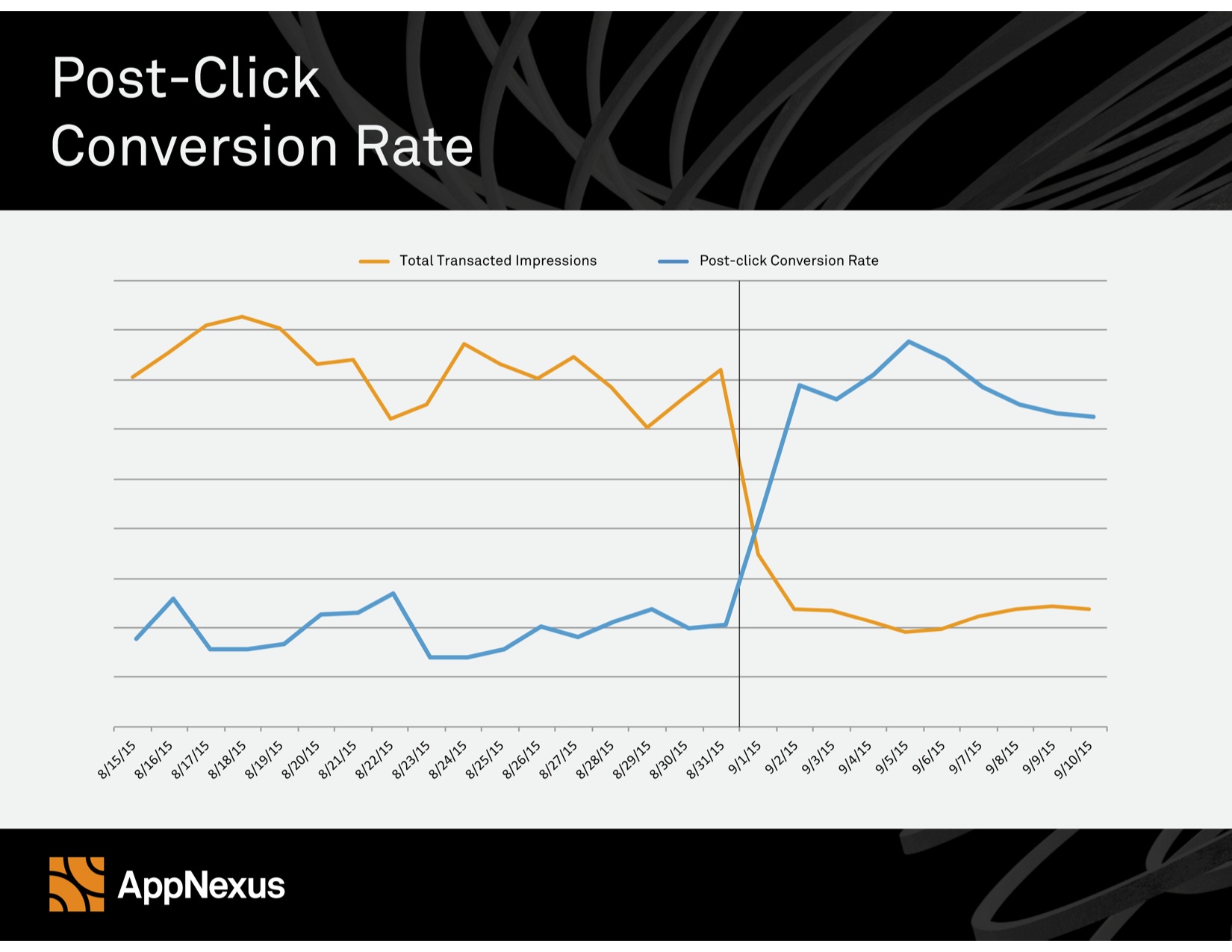

Above all, we have secured our evolution as a premium marketplace. We are transacting fewer impressions each day, but still powering the same amount of spend – a fact that suggests that the invalid traffic we moved off our platform was significant in volume, but commanded fractions of pennies in demand.

Going forward, it won’t be enough for ad tech platforms to claim they have solved for the problem of invalid traffic and inventory – they will have to show it. That means providing ongoing visibility into hard numbers, but also into their understanding of how invalid traffic operates within the complicated digital advertising ecosystem; and what they’re doing to prevent it.

In the case of AppNexus, our thesis is informed by the example of the financial services market. Where there is too much intermediation and complexity it is easier for invalid inventory to enter the system; where there is insufficient visibility, performance and pricing suffer.

The results have been profound. The number of daily transacted impressions on the AppNexus platform has declined significantly, yet the amount of spend on the platform remains unchanged. Strikingly, publishers have experienced a rise in CPMs of 175%, while advertisers have seen view-through rates increase 75% and post-click conversions, 130%. In other words, our customers – be they buyers or sellers of digital advertising – are winning.

Notably, much of the inventory that we eliminated from our platform was selling for fractions of a penny. Total platform spend – which has held steady – was always concentrated on premium inventory. That explains why we’ve grown our revenue year-over-year while transacting fewer impressions. In effect, AppNexus has completed its evolution into a de facto premium marketplace.

In approaching inventory quality (IQ), our thesis was informed by the example of the financial services sector.

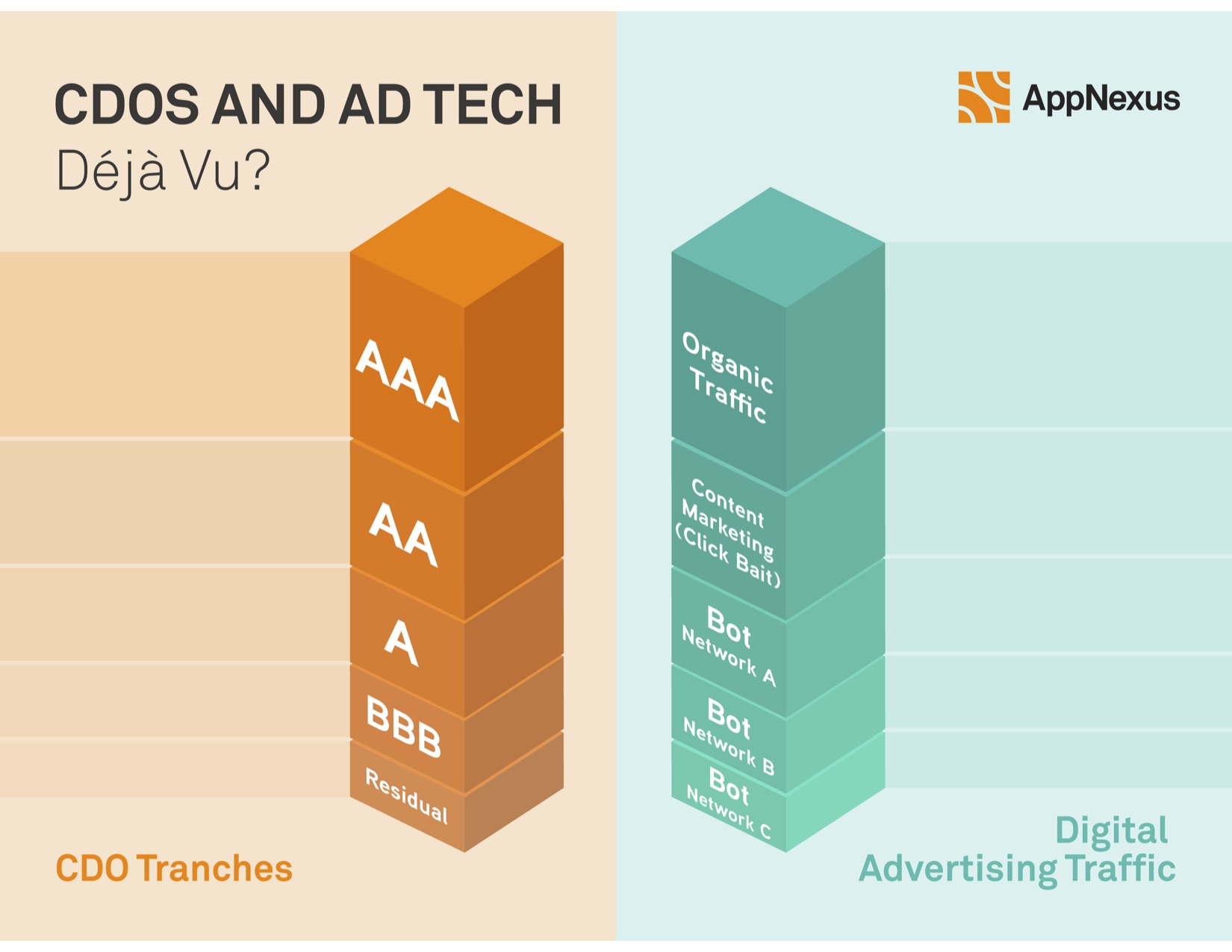

Fifty years ago, if you needed a mortgage, you’d go to a local bank. You knew the bankers, and they knew you. Business was conducted on a handshake. The downside was that banks were constrained by their individual capital limits and assumed 100% of the risk for the loans they issued. Eventually, the industry learned how to securitise and re-sell loans, which mitigated risk for originators and generated greater liquidity. But extra layers of intermediation reduced overall visibility into the quality of the loans. The same is true of digital advertising: in its infancy, the ecosystem spawned a multitude of intermediaries that packaged and resold inventory. The impact was both positive (more liquidity) and problematic (more intermediation, less visibility).

The comparison yields several insights.

Intermediation diminishes transparency

As with the mortgage market, complexity and intermediation open the door to invalid traffic. When Network A buys inventory from Network B, which in turn bought that inventory from Network C, the end customer enjoys very little visibility into the quality of the transacted impressions. Well-intentioned market participants might find themselves passing along invalid inventory without knowing it. When our industry was younger, it needed a great deal of intermediation to facilitate liquidity. That was then. According to Magna Global, programmatic digital advertising is currently a USD$29bn industry and, by 2019, will be a USD$61.9 bn industry. Simply put, we’ve achieved a sufficient network effect to make the intermediation of the past unnecessary.

Tranches implicate many actors

In the years leading up to the global financial crisis, originators issued increasingly shaky loans. They could do so with impunity, because they knew they could pass low-quality mortgages along to third parties who would package risky and high-quality loans together. Thus, residential mortgage backed securities (RMBS) were packaged and diced into tranches that delivered varying risk and returns. We now understand that this practice was perilous. Intermediaries could package, say, 950 AAA mortgages together with 50 BB mortgages, and the bundle itself was still a AAA security. Remarkably, the lowest tranches of these RMBS also got resold and repackaged into collateralised debt obligations (CDOs). With so little understanding of origination, BB and B tranches sometimes got rolled into CDOs that were classified as AAA securities. We don’t need to tell you how that movie ended.

The same dynamic has been at play in the ad tech sector. Our data science team created sophisticated measures to study traffic patterns. Ultimately, they found that intermediaries sometimes packaged invalid and valid inventory and passed it along in a complicated chain. As with residential mortgages, the further that inventory traveled from its point of origination, the more opaque the market became.

Ultimately, we addressed the problem by filtering out invalid inventory – a process that required sophisticated data science to detect non-human traffic. We also removed actors from the platform who were not able, sometimes despite their best efforts, to modify their technologies to prevent invalid inventory from entering the system. The combination of these efforts goes a long way in explaining why we transact fewer impressions today than a year ago.

As the industry landscape shifts, and as intermediaries and point solutions get integrated into the small number of end-to-end platforms that are expected to dominate ad tech, we expect that the new norm will be greater transparency. That will benefit us all.

That’s our thesis. It’s how we’ve stayed ahead of invalid traffic, a highly adaptive problem that challenges the entire ad tech ecosystem. And it’s how we effected our transformation into a global premium marketplace for digital advertising.

Ad FraudAd NetworkAd VerificationDataDisplayInventoryProgrammaticTargeting

Follow ExchangeWire