£416.2m Digital Revenues in 2015 for Publishers; Use of Ad Blockers Rises

by Sonja Kroll on 3rd Mar 2016 in News

ExchangeWire Research’s weekly roundup brings you up-to-date research findings from around the world, with additional insight provided by Rebecca Muir, head of research and analysis, ExchangeWire. In this week’s edition: £416.2m digital revenues in 2015 for UK publishers; use of ad blockers rises to 22%; and users linger 90% longer on sites with video content.

UK publishers raked in £416.2m digital revenues in 2015

The latest Digital Publishers Revenue Index, compiled by the industry body AOP, shows that UK publishers enjoyed a revenue increase of 5.3% in 2015, adding up to a total of £416.2m in digital revenues in 2015.

The report highlights display advertising as the largest single revenue category, with a 46% share in total revenue. However, growth is slowing in this category. The drivers of growth are online video, which increased 27%, sponsorship (19% growth), and mobile, which has risen by 11%.

“Sustained growth over a seven-year period demonstrates how online publishers have continued to adapt to a rapidly changing online environment; this can be seen from the rise of video ad formats in 2015”, commented Richard Reeves, managing director at AOP. "In addition, the sharp increase in sponsorship revenue demonstrates publishers’ desire to introduce more dynamic and meaningful formats, in response to advertiser demands.”

For the first time, mobile advertising revenue has surpassed the £50m mark, representing 10.2% of total revenue, up from 9.6% in 2014.

Use of ad blockers rises to 22% of UK adults

In the space of the past four months, the use of ad blockers has risen by 4%, a study by the IAB UK reveals. While 18% of UK adults were using ad blockers in October 2015, the number has now risen to 22%.

Source: IAB UK Ad Blocking Report, February 2016

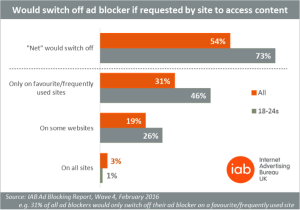

54%, however, answered that they turn off their ad blocking software in order to access desired content. In the younger age group (18-24 year-olds), 73% responded that they would switch off their ad blocker in order to access content.

Asked about the reasons for disabling their ad blockers, 45% said they were less likely to block ads if they did not interfere with what they were doing. Other reasons cited were “having fewer ads on a page” (29%), and more relevant ads (12%).

Guy Phillips, CEO, IAB UK, believes that creating more awareness among users about the trade-off between free content and monetisation through ads is needed: "If they realise it means they can’t access content, or that to do so requires paying for it, then they might stop using ad blockers. It requires reinforcing this 'trade-off' message – ads help to fund the content they enjoy for free.”

Only 20% of people who have previously downloaded an ad blocker said that they no longer use them, citing the use of a new device as the most common reason for disabling their ad blocking software.

Ad blockers are currently being used predominantly on laptops (72%) and desktop PCs (41%), with smartphones and tablets less often equipped with ad blocking software (26% and 21%, respectively).

Users linger 90% longer on sites with video content

Ooyala backs up their article 'How Publishers and Brands Can Build ROI with Original Video Content' with some interesting statistics on the impact of video.

According to Ooyala, customers are significantly more likely to follow through with a purchase if they have been exposed to video content: nearly two-thirds of consumers are more likely to buy; 25% of consumers lose interest in a company that doesn’t have video.

In general, the average internet user spends nearly 90% more time on a website that has video, Ooyala says. And video has proven to increase online publisher revenue by 20%, by displaying video ads on content, the company claims.

For publishers looking to take their first steps in video, Ooyala has some calming advice: videos do not have to be feature-length masterpieces. In fact, 95% of the videos tracked by the Ooyala for the study were less than five minutes long, with the 'sweet spot' being around 2.5 minutes.

Ad BlockingAd ServerDigital MarketingDisplayEMEAMobileProgrammaticUKVideo

Follow ExchangeWire