Now & Next: Mobile Gaming

by Hugh Williams on 24th Oct 2017 in News

Think you might be obsessed with gaming on your mobile? You’re not alone.

- In 2016, 53% of South Korean mobile gamers spent between 30 and 120 minutes playing mobile games every day

- By 2020, it is predicted that 77% of the American mobile population will be mobile gamers

- This year, in India, 43% of smartphone users will download a new game on a weekly basis, with 16% downloading one daily.

Whether it’s Angry Birds, Clash of Clans, or Candy Crush, mobile gamers are always on the lookout for their newest distraction. This edition of ExchangeWire’s Now & Next looks at key players in the space; how advertisers are exploiting the opportunity; and what lies ahead for an industry which is expected to reach USD$64.9bn (£49.8bn) by 2020.

A booming behemoth

The size of the mobile gaming market is colossal. This isn’t a niche revenue opportunity that will fall off the radar in a couple of years. The big players in the industry (such as Tencent and Supercell) are making vast sums of money right now. One of Supercell’s most recent games – Clash Royale – garnered USD$1bn (£767m) in just under a year.

The opportunity in the market hasn’t gone unnoticed by investors – deals such as gaming giant Activision’s acquisition of King for USD$5.9bn (£4.52bn) back in 2015 prove this. However, developers aren’t the only ones looking to jump on the mobile gaming bandwagon; and the promise of such high use on a global scale is attracting advertisers to gaming apps.

Making the money

Despite advertiser demand for mobile gaming inventory, there are numerous monetisation methods available to publishers, aside from advertising. This means media buyers face a fight for a larger slice of the gaming monetisation pie. The most popular of these alternative methods include:

Rewarded video ads: Short videos that gamers can choose to watch in return for extra lives (allowing them to play the game for longer)

Display ads: Banners appearing around the gaming content, similar to desktop, tablet, and standard mobile ads

Upfront payment: Gamer pays a fixed price for the app upon install

Downloadable content (DLC) and upgrades: This method is the basis of the ‘freemium’ model, with in-app purchases allowing gamers to unlock special features

When comparing the favoured methods of monetisation for publishers, to gamers and advertisers, we see a discrepancy. While more than half (54%) of gamers share advertisers’ desire for more in-app advertising (through rewarded video ads, rather than banner or interstitial ads), only 29% of publishers cite ad-supported apps as their preferred method of monetisation. In contrast, 58% of publishers say they would prefer to monetise through up-front payments for games. Only 18% of gamers share this opinion.

It’s unrealistic for publishers to expect to receive upfront payment for their games. Gamers won’t pay for something they are uncertain they’ll like. Publishers who do not look beyond this model will struggle to drive significant revenue. Instead, they need to acknowledge this, and collaborate with media buyers to adjust their offerings accordingly, because advertisers feel that a lack of quality inventory is the main factor inhibiting the growth of mobile video advertising.

The future of mobile gaming

As we’ve seen, publishers have been reluctant to adopt ad-supported monetisation strategies to date. However, with high demand for ad-supported gaming from buyers and consumers, publishers will be forced to re-evaluate their monetisation models going forward. If they do not, they will see a severe drop in revenue.

As this happens, more publishers in the mobile gaming ecosystem will test the waters and create more appealing and engaging ad formats and placements. With 93% of all mobile gaming ad spend on video in Q4 2016, it is likely publishers will start to experiment with new video formats on a small percentage of their inventory, before rolling this out on a larger scale. One such opportunity here is to better leverage gamer data to create more dynamic creative. Tools such as Facebook’s ‘App Event Optimization’, which serves mobile app install ads to people likely to take a specific action (such as purchase) in your app, will help drive this.

Better integration of header bidding will also incentivise app publishers to increase their available inventory. At present, header bidding is helping publishers increase their yield and revenue far more on mobile web, than on mobile app. Unlike on mobile web or desktop, header bidding within mobile apps involves the integration of multiple SDKs. This causes page latency issues and a poor user experience. Because of this, publishers are reluctant to go down this route.

Investment from advertisers

Publishers will only implement new ad formats on their wider inventory if the prototypes they are testing attract investment from advertisers. This means, if buyers want to engage the vast proportion of the mobile population who are gamers, they are going to have to dig into their pockets, to convince publishers it is worth making more such inventory available.

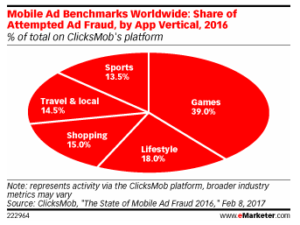

Currently, one factor preventing this spend is fraud. A report released earlier this year by ClickMob outlined that games are the most likely app type to be targeted (39%), more than twice as likely as any other app type. This is not surprising, as fraud has always followed ad spend. However, just because fraudsters are targeting mobile app ads, it does not mean they are successful. Unlike desktop and mobile web ads, in-app ads place more emphasis on conversion-based KPIs, as opposed to campaign-based measurements such as CTR – which have been vulnerable to click farms. In-app transactions are far harder to falsify. If buyers are to allocate their budgets towards in-app advertising, the assurances around low levels of fraud, as well as high levels of quality inventory, need to be in place.

The potential for in-app mobile gaming ads to become a staple for advertisers and publishers alike is clear. For this to happen, publishers must ask buyers what they want from new formats; and buyers must be willing to invest in these once they are supplied. If this doesn’t happen, the opportunity available to both may never be fully realised.

Header BiddingMobileSocial Media

Follow ExchangeWire