Sojern Reveals Latest COVID-19 Impact on Middle East and Africa Travel

by on 12th May 2020 in News

With access to real-time traveller audiences and unmatched visibility into global travel demand, Sojern is in a unique position to share current Middle East and Africa (MEA) travel trends. These insights are based on data collected on the 11th May, 2020, and we will be reviewing our data on a weekly basis in order to provide a regular view of trends and patterns in consumer behaviour. Sojern's insights are based on over 350 million traveller profiles and billions of travel intent signals, however it does not capture one hundred percent of the travel market.

Local Facilities Reopening Has Positive Impact on Domestic Travel

Across the region, there are very early signs that solutions are being implemented to begin the process of returning to ‘normal’ day-to-day life. For example, Saudi Arabia installed self-sanitisation gates at Mecca Grand Mosque, but have limited gatherings to less than five individuals. People who violate any of the measures in place face being sent to jail. Similarly, the Abu Dhabi Department of Economic Development have reiterated that precautionary measures must be in place when reopening, and that non-compliance may include fines, and/or facilities being closed.

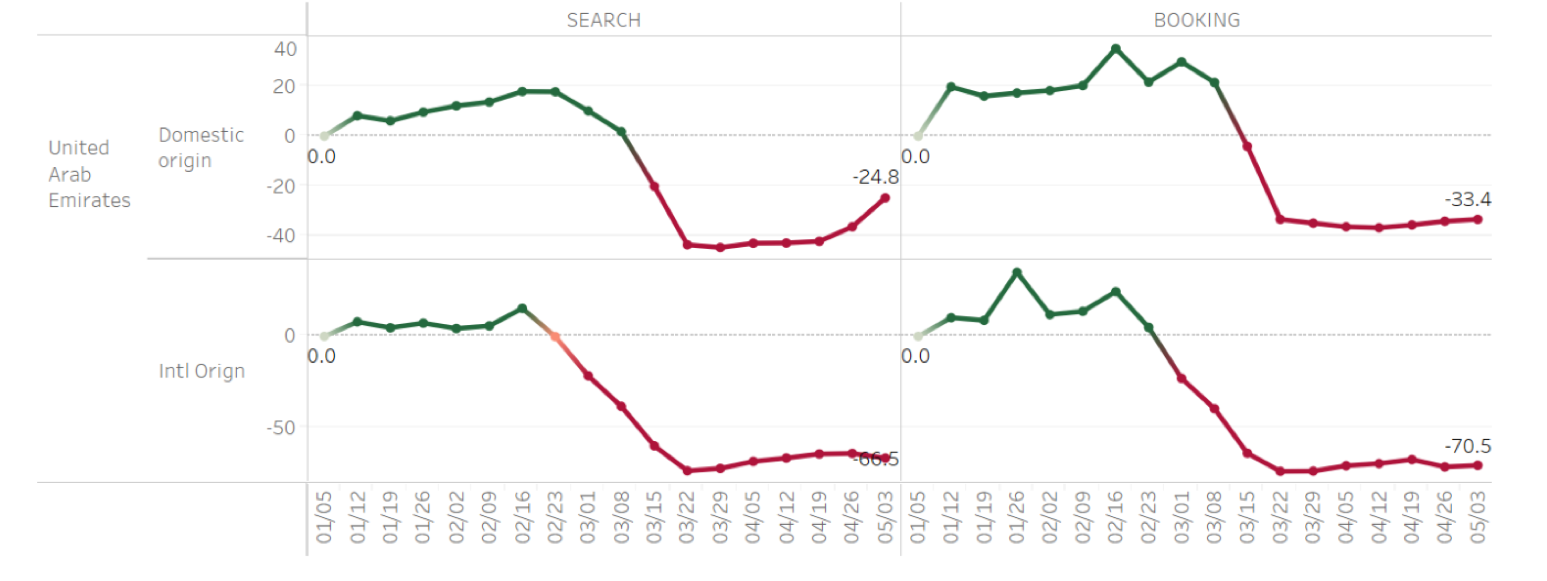

As local facilities begin to reopen, it is expected that domestic travel will continue to increase. Those looking for a short break or holiday after weeks or months in lockdown will take advantage of being able to visit attractions or malls. As restrictions on regional and international flights remain in place, domestic trips will be the first port of call. Hotel searches and booking data to the United Arab Emirates (UAE) shows clearly that interest is rising domestically first.

United Arab Emirates Hotel Searches and Bookings - Indexed to 5th January 2020

Luxury Hotels See The Most Positive Signs of Early Recovery

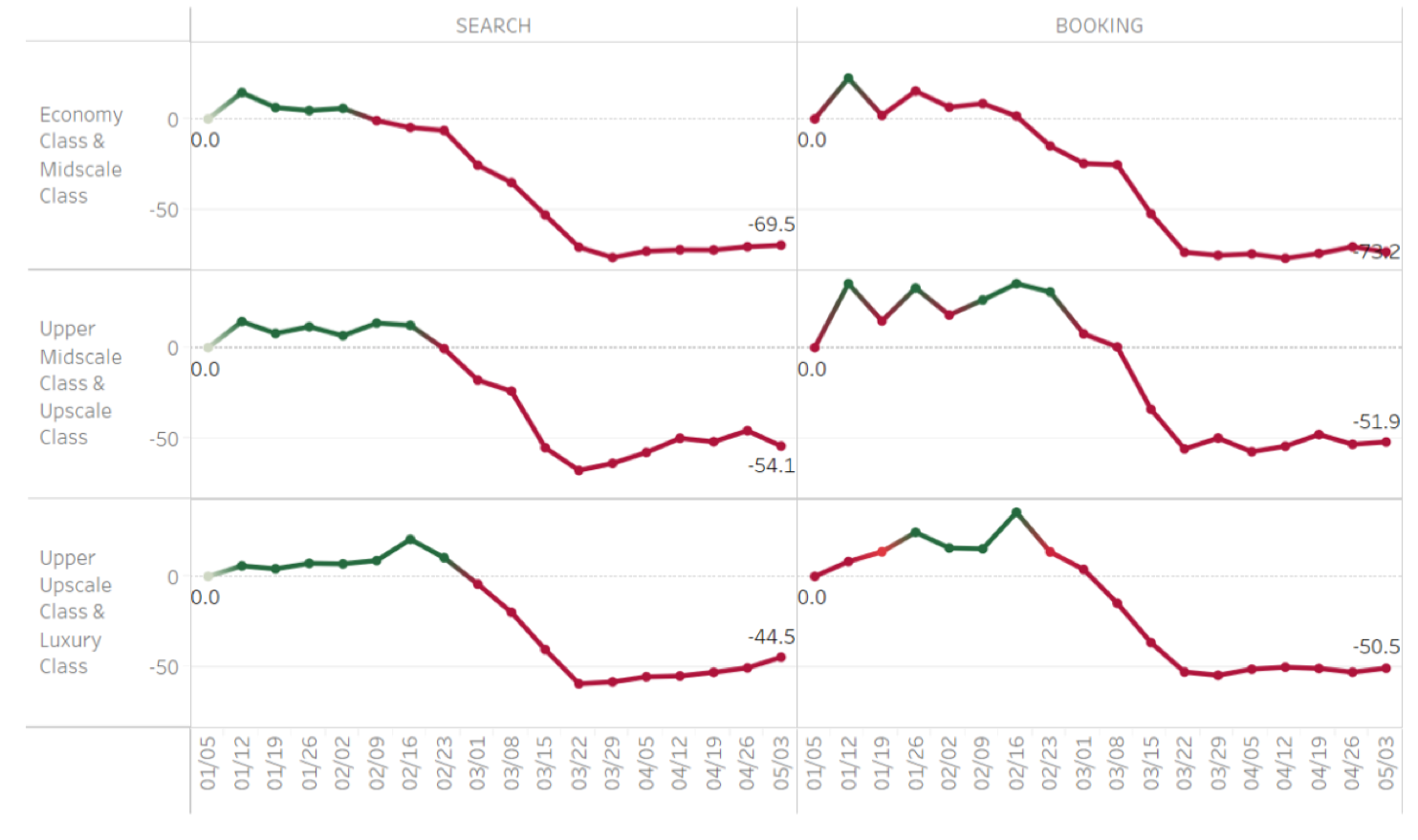

Although all bookings and searches remain down on last year by a considerable number, there has been a gradual increase in interest, especially for high-end hotels. When looking at the UAE, and removing the volume of bookings by indexing back to 5th January 2020, comparatively, upper and luxury class hotels have maintained the highest level of searches and bookings. Economy and midscale bookings at the beginning of May were down 73%, compared to upper and luxury classes which were down by just 51%.

This reflects the notion that luxury staycations are on the rise as residents seek home comforts, pools, and beach access amid travel restrictions.

United Arab Emirates Hotel Searches and Bookings Split by Class - Indexed to 5th January 2020

Domestic Trips Booked in April Had Shorter Lead Times Than in January

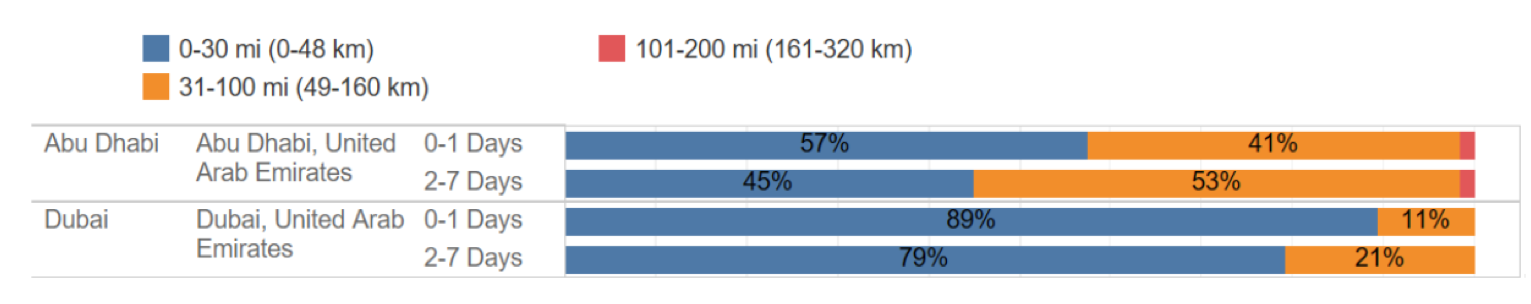

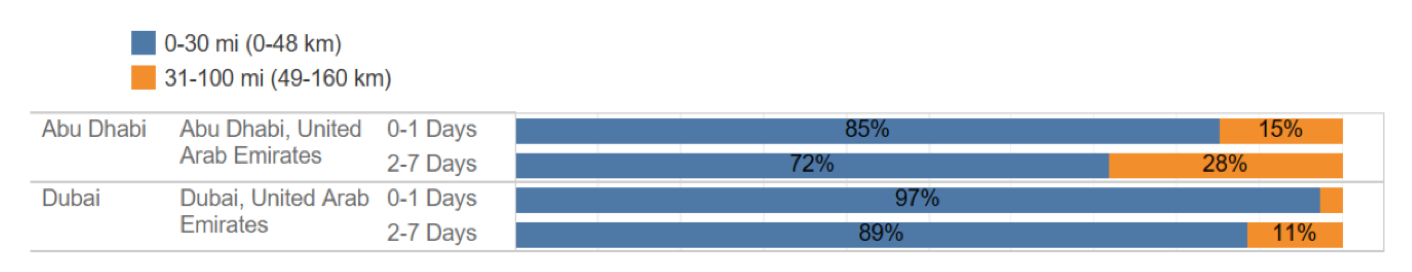

As travellers in the region are beginning to plan local trips, it appears they are booking with shorter notice. Hotel bookings in Abu Dhabi and Dubai from a 48km radius have displayed an increase in same day, or previous day bookings from 57% and 89% in January, to 85% and 97% respectively. The same pattern is observed for hotels in the 49-160km radius.

Dubai and Abu Dhabi Hotel Booking Lead Times - Travel up to 160km

January

April

Domestic Business Travel Intent to the UAE Rises

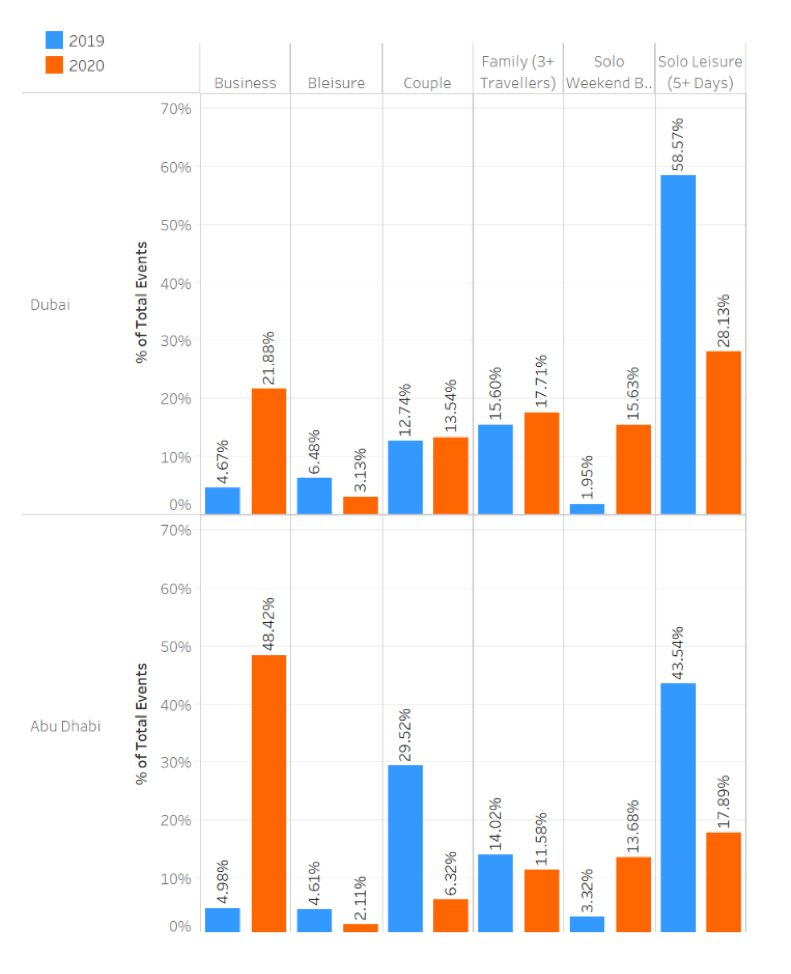

A few weeks back, when looking at the composition of travellers searching for trips to Dubai, the biggest increase year-over-year was from those looking for a solo leisure trip of five or more days. In contrast, when looking at Abu Dhabi, business travellers were the key segment planning to visit the city.

Looking more closely at domestic searches to Dubai and Abu Dhabi, searches from the last 14 days show that the largest growth in travel intent has happened with business travellers, rising from 5% in 2019 to 22% in 2020 for Dubai, and 5% to 48% for Abu Dhabi.

Domestic Flight Searches to The UAE in the last 14 days – Year-Over-Year Comparison of Traveller Composition

As facilities begin to reopen we continue to see domestic travel regaining strength. The pent-up demand for travel, combined with the relaxation of some lockdown measures in the region, has meant people are booking their local trips with less notice. Luxury hotels are seeing the most positive signs of early recovery, and business travel intent to the UAE is showing the highest increase. We will continue to share more insights as we monitor the situation. These forward looking insights will hopefully help travel marketers shape their strategies when the industry starts to recover from this outbreak.

For the rest of the COVID-19 insights series click here.

AfricaCovid-19MeasurementMiddle EastTravel

Follow ExchangeWire