Why Mobile Is Primed For Ad Tech Innovation – And That Emoji Ad Network

by Ciaran O'Kane on 22nd Feb 2016 in News

It's the mobile industry's big week – when thousands of opinion formers, C-level execs, and journalists from the mobile industry flock to Barcelona to discuss all things mobile for a full week.

Amid the blizzard of hardware launches and high-level keynotes from industry leaders (Zuckerberg is keynoting again!), ad tech will again play its bit part at the show – occupying the fringes instead of rightly being prime time.

Despite its 'minor' role at MWC, ad tech is playing a vital part in mobile content monetisation – which is critical for the industry, given the current struggles.

Having moderated a number of mobile-focused panels over the past few months, you get the sense that the industry can't quite figure out how it will compete against Google and Facebook outside of desktop.

Most agencies can't make mobile work, opting instead to buy mobile, by proxy, via Facebook.

On the supply-side, publishers continue to suffer the economic hardships of bargain-bin CPM pricing.

The situation is changing slowly. But the mobile ad business for publishers remains a challenging one – with many of them desperate for a quick-fix solution.

The rise of closed content offerings, like Instant Articles, is a prime example of this. In the face of adversity, publishers are countenancing the unthinkable: outsourcing their content distribution to a hugely conflicted scaled media player and severing a direct connection with their users.

Despite the gloom, there is lots of innovation in the mobile space right now to suggest that ad tech is well placed to address some of these industry pain points.

In this post we will examine some of these, and show why, in this MWC week, the mobile space is primed for ad tech innovation.

The Device Graph

The first-party fiefdoms command the lion's share of mobile ad spend – mostly because of their logged-in deterministic data.

Without a scaled first-party solution, the rest of the industry has struggled to eat into the marketshare held by Facebook, Google and Twitter.

The probabilistic model, while a little haphazard, is starting to gain traction. Agencies now realise that a fractured walled-garden ecosystem, where a lack of interoperability between Facebook, Google, and Twitter, is not helping them hit their client's KPIs.

The device graph is ad tech's answer to the cross-device conundrum – and could well help our industry compete with the the first-party fiefdoms. The recent acquisition by Telenor of Tapad and the Cisco investment in AdBrain highlights the growing importance of the technology.

For the rest of the industry, the device graph offers a viable cross-device targeting solution to ad buyers. The technology is evolving, and it's only a matter of time before probabilistic will trump isolated pockets of deterministic data.

The Rise Of Programmatic Native

This is a huge opportunity for ad tech. The real estate of the mobile device is limited, and it is clear that standard IAB ad units are not working in terms of yield and user experience.

The rise of ad blocking among a small percentage of internet users has rightly alerted the industry to the abuse of the user experience. Desktop content monetisation will not work on mobile.

Newspaper publishers still think like old media companies. Banners, pop-ups, and auto play video ads remain the monetisation strategy for most publishers. This myopic approach is pushing users into the arms of the opportunistic ad blocking solutions; who continue to bleat about user privacy while whitelisting ad tech vendors for tens of millions of dollars.

The success of native advertising from the likes of Twitter and Facebook shows that user-first ad experiences can work at scale.

Ad tech should be looking at scaling native, and offering bespoke ad solutions from premium publishers for programmatic buyers.

If the industry can make this work, more budget will doubtlessly flow into mobile – and publishers would benefit from the uptake in mobile programmatic native spend.

That Emoji Ad Net

While in discussion with a Japanese industry colleague during ExchangeWire's recent ATS Tokyo event, I got an insight into emoji monetisation in the APAC region. Much of it revolves around selling bespoke emoji stickers that users can use in messaging apps like Line and WeChat.

Advertisers, desperate to reach a scaled audience, are paying big money to put their 'brand' emojis in front of users.

But the process revolves around a clunky way of selling what amounts to be branded inventory. Those soft brand metrics might work in Japan – but on a global basis you need something more performance-based.

What if somehow you could aggregate emoji use across multiple messaging apps, and back that into a specific DR metric?

The following is a basic DR model around emoji use on messaging and keyboard apps. It demonstrates the interesting angles that exist in mobile right now – and how ad tech can help open up new monetisation opportunities.

Emotional Retargeting: The Emoji Ad Net Breakdown

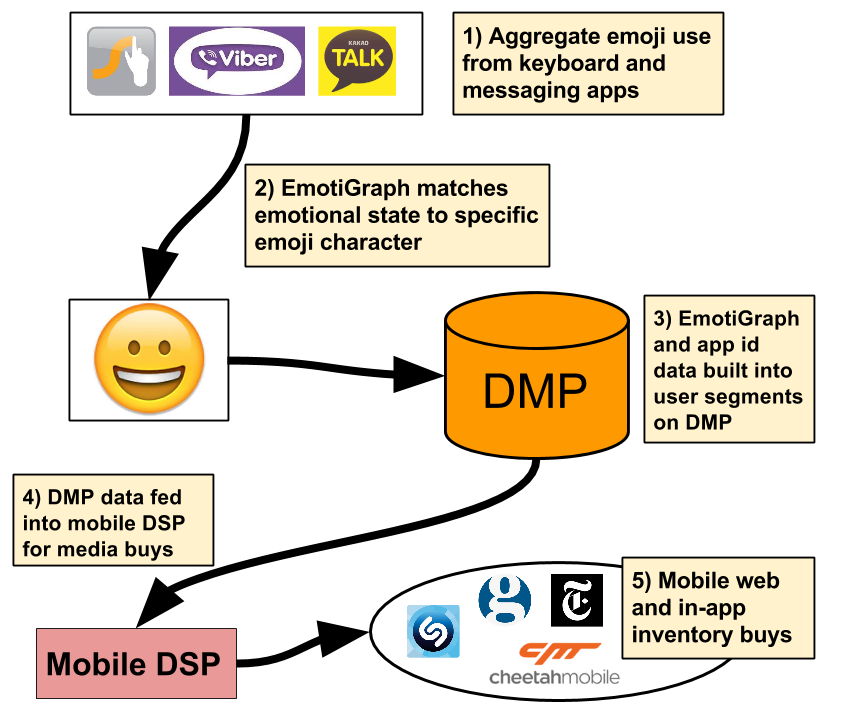

Those Emoji Monetisation Steps In Full

1. Aggregate emoji use from keyboard and messaging apps

Thanks to the open APis of both Android and iOS, there are hundreds of keyboard apps in operation. Coupled with second-tier messaging apps there is an opportunity to aggregate global emoji use at scale.

2. EmotiGraph matches emotional state to specific emoji character

This step requires the help of linguistic specialists to help build the EmotiGraph – a probabilistic model that links emoji use to specific real-time emotional states. There will surely be a margin of error. But if someone has indicated via an emoji that they are hungover, it's likely brands such as Berocca, KFC et al would buy media using that specific segment.

3. EmotiGraph and anonymised app id data built into user segments on DMP for media buys

The real value prop here will be the segments built by the DMP, combining EmotiGraph data and anonymised app ids. These segments will be used for programmatic media buys.

4. DMP data fed into mobile DSP for media buys

There is no need to build bidder tech or execution infrastructure given so much of this has already been built. The real value is the segments built for programmatic buys.

5. Inventory bought across mobile web and app inventory in real time

By leveraging scaled emoji use, advertisers can target a specific emotion data point in real time. Buying in-app or mobile web inventory via a mobile DSP allows brands to customise messaging to users on a mobile device.

The simple examples above demonstrates why mobile continues to be a hotbed of innovation for ad tech.

It is true that Facebook and Google dominate the mobile ad industry, but there are so many interesting avenues that independent ad tech players can go down, in terms of monetisation. This is where we, as an industry, continue to excel. Maybe the majority of MWC attendees will never know, but mobile ad tech is an exciting place to be right now.

Follow ExchangeWire