Strongest UK Adspend for 12 Years

by Rebecca Muir on 24th Mar 2016 in News

ExchangeWire Research’s weekly roundup brings you up-to-date research findings from around the world, with additional insight provided by Rebecca Muir, head of research and analysis, ExchangeWire. In this week’s edition: UK adspend forecast to grow 9.2% in 2016; A quarter (26%) of all transactions through mobile; and Programmatic online video shows strong growth in Europe.

According to global media agency, ZenithOptimedia's recently released global ad spend forecast, ad spend in the UK is expected to have its strongest year since 2004, seeing a 9.2% growth in spend in 2016.

UK highlights:

– UK adspend forecast to grow 9.2% this year – the strongest year since 2004

– Growth in the UK will be driven by huge growth in mobile advertising, which is forecast to grow this year by 57%

– The growth in mobile adspend is counterbalanced by a 9% decline in desktop adspend

– TV is due to grow by 3% this year, after a strong year in 2015, when it grew by 8.5%

– Between 2015 and 2018 the global ad market is predicted to grow by USD$75bn (£53bn). China will contribute 25% of this extra ad expenditure, closely followed by the US, which will contribute 24%. The UK comes third, contributing 7%

Despite significant global economic uncertainty, advertisers’ confidence has remained largely unshaken, and forecasts for global growth in 2016 have barely changed.

Crisis-hit European markets now enjoying rapid recovery

In the medium term, most of the European ad markets that suffered the deepest cuts from the financial crisis, and its aftermath, are now enjoying sustained recovery and will expand rapidly over the next few years. Adspend in Ireland, Portugal, and Spain fell by a total 45% between 2007 and 2013.

Adspend in these markets recovered by 8.9% in 2014, and 7.3% in 2015, and average growth is forecast to be 6.7% per year to 2018.

Other European markets that fell sharply during the crisis, but are now growing at a rapid pace, include Croatia (forecast to grow by 6.1% per year to 2018), Denmark (7.3%), Hungary (5.2%) and Romania (6.3%). Even Greece is expected to enjoy annual growth of 3.9%. These markets have room to grow rapidly for several years to come.

Thirty Rising Media Markets with long-term potential for rapid growth

In the longer term, many smaller advertising markets are now opening up to international advertising; and have the potential to growth at double-digit rates for many years to come.

ZenithOptimedia's Thirty Rising Media Markets, looks at a selection of 30 up-and-coming markets for the first time. It is estimated that advertising expenditure across these 30 markets came to USD$7.7bn (£5.4bn) in 2015.

Internet will now overtake television next year

As usual, internet advertising is the main driver of global adspend growth. The reports says internet advertising as a whole will grow at more than three times the global average rate this year – by 15.7%, driven by social media (31.9%), online video (22.4%), and paid search (15.7%).

Internet advertising’s growth rate is slowing as it matures (it was 21.1% in 2014); but it is expected to remain in double digits until 2018. This sustained growth, combined with downgrades to television in Brazil in China, has led to the forecast that internet advertising will overtake television advertising globally in 2017, a year earlier than previously thought.

Mobile to contribute 92% of adspend growth

The great majority of new internet advertising is targeted at mobile devices, thanks to their widespread adoption and their ever-tighter integration into consumers’ daily lives. It is forecast that mobile advertising expenditure will increase by USD$64bn (£45bn) between 2015 and 2018, growing by 128% and accounting for 92% of new advertising dollars added to the global market over these years.

“Rapid growth from countries that are relatively new to the international advertising market, combined with a resurgence of established markets that were damaged by the financial crisis, will keep the global ad market on track for healthy growth for at least the next few years”, said Jonathan Barnard, head of forecasting at ZenithOptimedia.

A quarter (26%) of all transactions through mobile

Zanox have released the 2016 edition of their Mobile Performance Barometer. The report highlights findings from analysis of mobile shopping behaviours, based on data gleaned from over 4,300 advertisers across 11 territories, spanning retail, travel, finance, and travel sectors.

Highlights include:

– 79% increase of mobile sales in 2015 vs 2014

– 26% of all transactions through mobile

– 65% revenue share for iOS

– Over 5.3 million sales during the Black Friday & Christmas season

Sales via mobile devices are still rising sharply. The strong growth rates show that the mobile market has not yet matured, but is constantly developing.

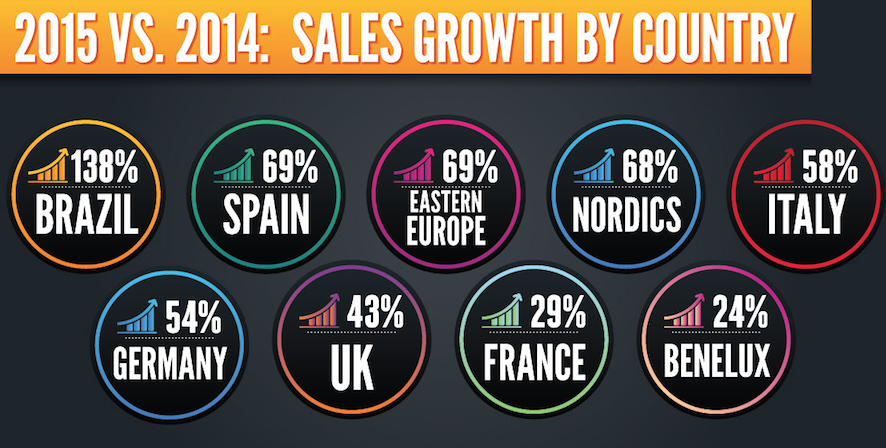

The rate of growth of mobile sales differs from market to market (see below). The report shows 138% growth in Brazil, a relatively immature market and a big opportunity for advertisers. The rate of growth in France (29%) and Benelux (24%) was lower than the UK (43%). This is somewhat surprising as these markets are generally considered to lag behind the UK in maturity.

Source: Zanox

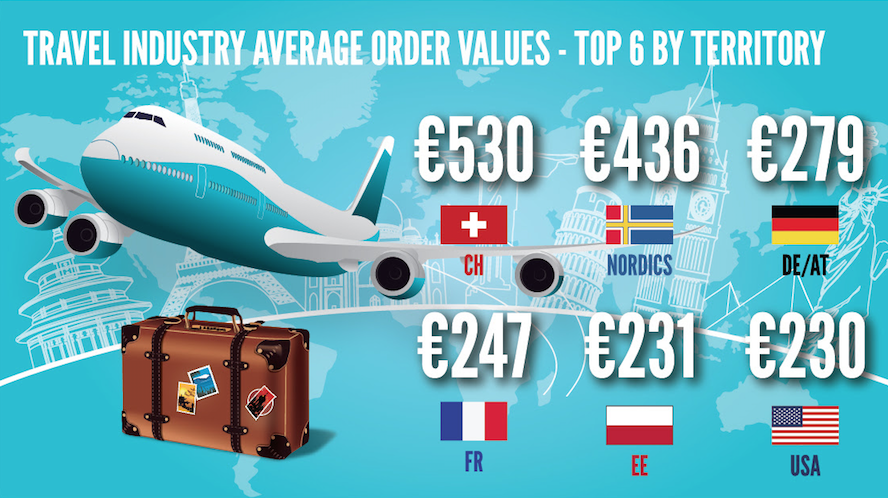

Average order value also varies by market. The top six are shown below. Topping the charts are the Swiss and the Nordics, which shows there is a big e-commerce opportunity to be had in those markets.

Source: Zanox

Mobile sales development in 2015 follows a similar increase as the previous year, peaking high towards the end of the year.

Looking at the sales development throughout the year, significant seasonal variations become clear in different markets. Whereas Spain experiences a typical summer recess between July and September, its neighbour Italy doubles its sales during this period, compared to March, due to a strong travel booking season. Eastern Europe shows a steadier growth of sales throughout the year, peaking significantly at the end of 2015.

The data highlighted in the report shows that, more than ever, it’s crucial for advertisers and publishers to ensure their sites are optimised for mobile and able to provide a seamless consumer journey.

To view the full-size infographic, click here.

Programmatic online video shows strong growth in Europe

Last week, SpotX released an infographic charting the rise of programmatic online video advertising across Europe.

The industry has grown almost twenty-fold from €22m (£17m) in 2012 to €375m (£296m) in 2015; and will grow at a rate of 39% between now and 2020, to become a €2bn (£1.6bn) industry in 2020; by which time more than half of all online video advertising revenue in Europe will be generated programmatically.

The ‘big five’ European markets are highlighted as responsible for three-quarters (76%) of programmatic online video advertising revenue generated in 2015.

Based on research conducted by global analyst firm IHS (NYSE: IHS), the source of information and insight, the infographic shows the UK as the largest market for programmatic video advertising in the region, generating more than one-third of all programmatic online video revenue in Europe in 2015 (36%).

Mike Shehan, CEO of SpotX explains: “The data shows the dramatic rise of video advertising across Europe; which has been reflected in our own growth across Europe, with rising revenues every year. We introduced video real-time bidding in 2010, and now have established offices in London, Hamburg, and Amsterdam, contributing to the global growth of SpotX. The UK, France, and the Netherlands are leading the adoption of programmatic online video in Europe, followed by a sizeable and important market in Germany, as well as emerging markets with high potential, including the Nordics, Spain, Italy, Switzerland, and Austria.”

Daniel Knapp, senior director of advertising research at IHS, adds: “This infographic illustrates the research we conducted showing how programmatic online video advertising has exploded across Europe from experimentation in 2013, to ubiquity by 2015. Publishers and broadcasters have embraced a programmatic mindset. They are innovating with video content and exploring different programmatic video advertising strategies, including acquisitions and partnerships, as well as building in-house capabilities to drive revenue growth.”

The infographic is based on research titled ‘Video Advertising in Europe: The Road to Programmatic Ubiquity’ commissioned by SpotX, from IHS. The full report from IHS can be downloaded here.

DisplayMedia SpendMobileProgrammaticVideo

Follow ExchangeWire