Yahoo & Netflix Struggle While IBM Surges Forward

by Rebecca Muir on 19th Jul 2016 in News

Yesterday (18 July), Netflix (NASDAQ:NFLX), Yahoo! Inc. (NASDAQ: YHOO) and IBM (NYSE:IBM) revealed Q2 2016 performance figures. In this piece we discuss: How Yahoo continues struggle as sale looms; The end of Netflix's explosive growth period; and IBM close to showing year-on-year growth for the first time in 17 consecutive quarters.

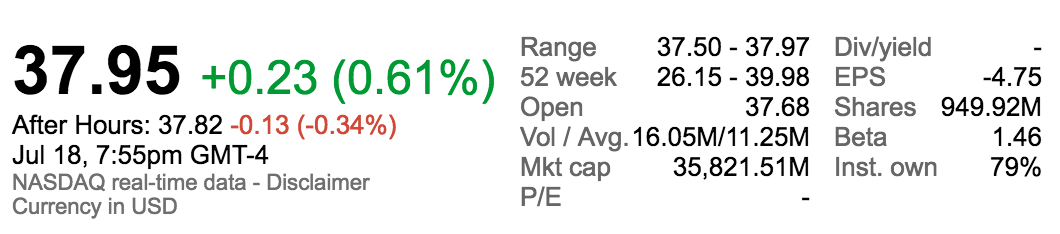

Yahoo reported a year-on-year increase in revenue for the quarter ended 30 June. Both search and display revenue saw declines, dropping 13% and 7% year-on-year, respectively. Search revenue was USD$711m (£538m) for the quarter, while display revenue was USD$470m (£356m).

At this point, of course, most investors are focused on the potential sale of Yahoo, as opposed to the ongoing challenges in its business. The company is reported to be accepting the final rounds of bids from interested buyers of its core internet business on Monday (18 July) afternoon.

Highlights

– Revenue for Q2 2016 was US$1.3bn (£0.98bn), up from USD$1.24bn (£0.94bn) in Q2 2015, a 5% increase*

– Q2 adjusted earnings per share (EPS): USD$0.09 (£0.07) per share vs USD$0.10 (£0.08) per share expected

– Q2 Revenue ex-traffic acquisition cost (TAC): USD$841m (£636m) vs USD$810m (£613 ) - USD$850m (£643m) expected

– Mavens (mobile, video, native, and social) revenue represented 36% and 40% of traffic-driven revenue in Q2 2015 and 2016, respectively. Excluding the impact of the Change in Revenue Presentation, Mavens revenue would have been USD$385m (£291m) and represented 38% of traffic-driven revenue in Q2 2016.

– Search revenue was USD$711m (£538m) in Q2 2016. Excluding the impact of the Change in Revenue Presentation, which contributed search revenue decreased by 13% year-on-year.

– The number of paid clicks decreased 24% year-on-year, however, cost per click increased 8%.

– Display revenue was US$470m (£356m) in Q2 2016, a 7% decrease year-on-year.

– The number of ads sold increased 9%, compared to the second quarter of 2015.

- Price-per-ad decreased 15% compared to the second quarter of 2015.

During Q2 2016, Yahoo announced several product developments that bring new opportunities for advertisers. Yahoo's partnership with Moat has presented new opportunities in native video (Yahoo Gemini); a new content marketing offering, Yahoo Storytellers; and a new mobile offering, Yahoo Tiles, for advertisers, are now available. Yahoo Mail remains one of the highest-rated mail apps in both the App Store and Google Play. Support for Live Video on Tumblr with YouNow, YouTube, Kanvas, and Upclose is now available meaning Tumblr can serve as a publishing and discovery platform to broadcast, watch, and share live videos, no matter where they're created.

"With the lowest cost structure and headcount in a decade, we continue to make solid progress against our 2016 plan. Through disciplined expense management and focused execution, we delivered Q2 results that met guidance across the board and, in some areas, exceeded it", said Marissa Mayer, CEO of Yahoo. "In addition to our efforts to improve the operating business, our board has made great progress on strategic alternatives. We are relentlessly focused on delivering shareholder value."

*Second quarter GAAP revenue and Cost of revenue - TAC were impacted by a required change in revenue presentation related to the Eleventh Amendment to the Microsoft Search Agreement. Excluding the impact of this change, GAAP revenue would have been USD$1.06bn (£0.8 bn), a 15% decline from Q2 2015, and Cost of revenue - TAC would have been USD$214m (£162m), a 7% increase from Q2 2015.

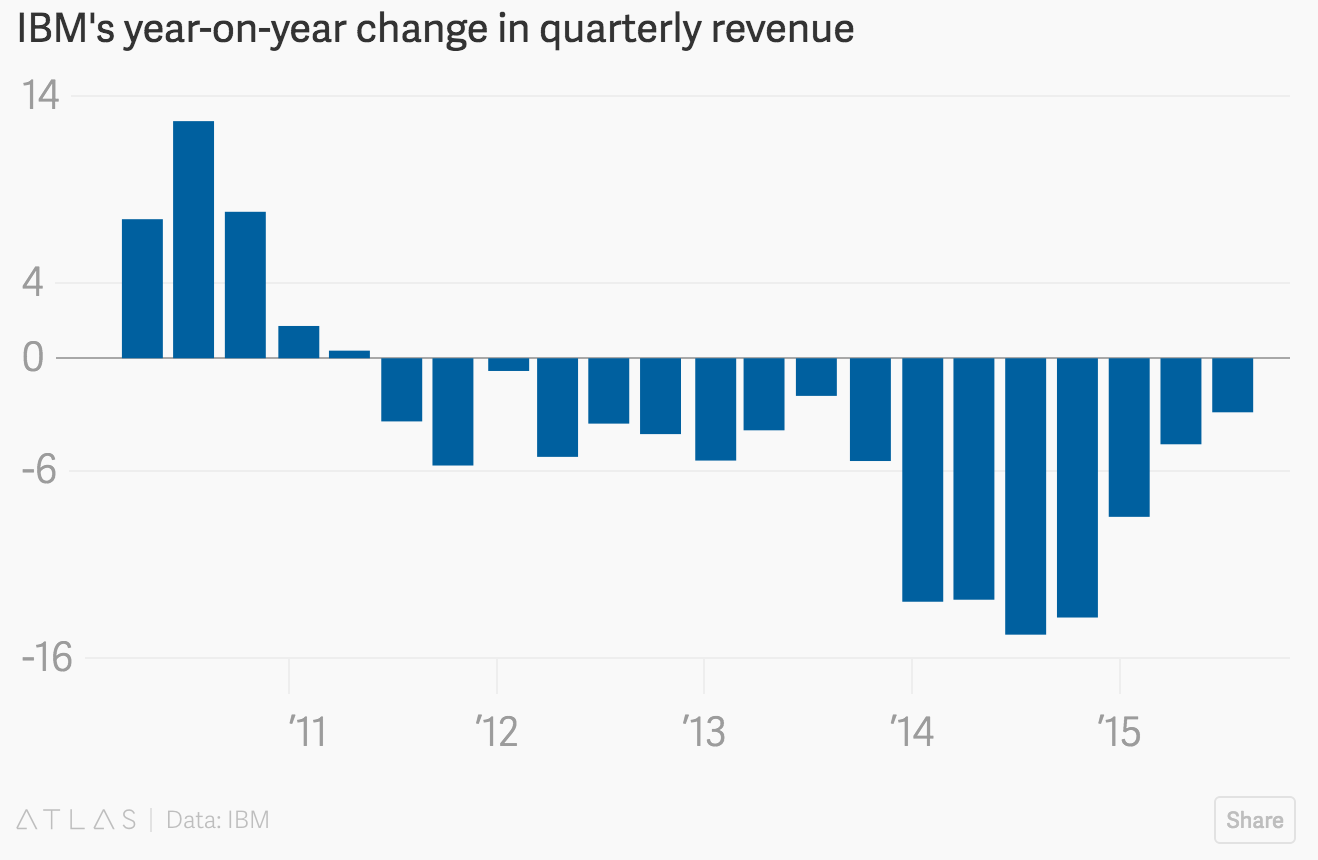

IBM continue to push forward

It has been 17 quarters since IBM showed year-on-year revenue growth; however, we may be about to see that change.

Overall, the company achieved USD$20.2bn (£15.3bn) in revenue in Q2 2016 — just shy of the $20.6bn it brought in during the same quarter last year.

Yesterday (18 July) the computing giant beat Wall Street consensus, reporting earnings of USD$2.95 (£2.23) per share and revenue of USD$20.2bn (£15.3bn) for Q2 2016 – easily clearing analysts' estimates of USD$2.89 (£2.19) and USD$20.03bn (£15.16bn) in revenue from analysts.

This was IBM’s third consecutive earnings beat.

IBM continue to focus on cloud computing; cloud, mobile, social, security and Watson and analytics are now 38% of the company’s overall revenue, up from 37% in Q1. The company reported cloud revenue growth of 30%.

“IBM continues to establish itself as the leading cognitive solutions and cloud platform company”, Ginni Rometty, CEO, IBM said in a statement. “In doing so, IBM is pioneering new business opportunities beyond the traditional workplace.”

A series of 11 acquisitions made so far in 2016, totalling USD$5bn (£3.78bn), contribute to what has been the heaviest acquisition spend in the company’s long history and will no doubt have impacted the bottom line.

The most high-profile of those has been its purchase of The Weather Company, which IBM has repurposed as a play in the ‘Internet of Things’ while appointing former chief David Kenny to lead its Watson unit.

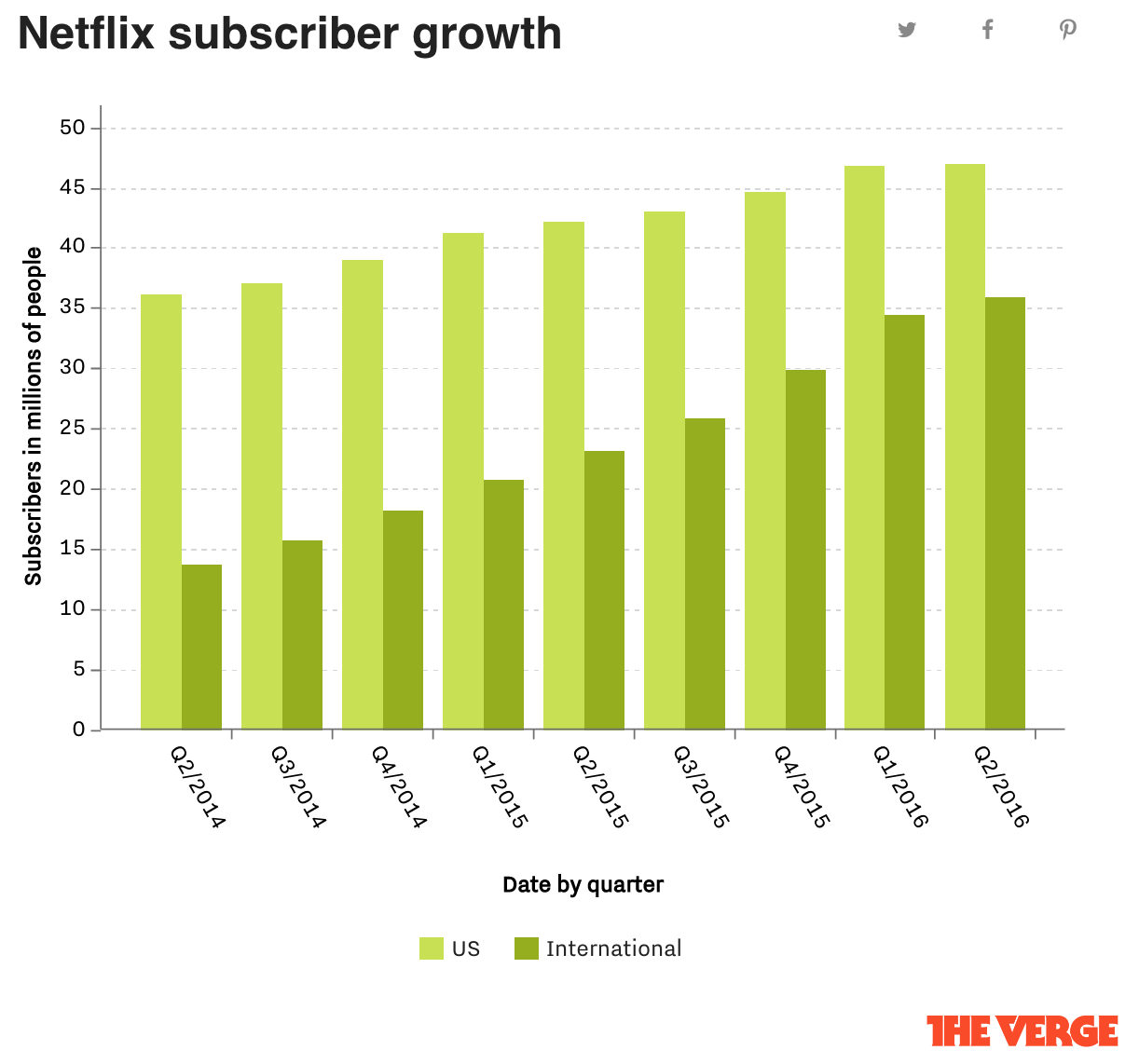

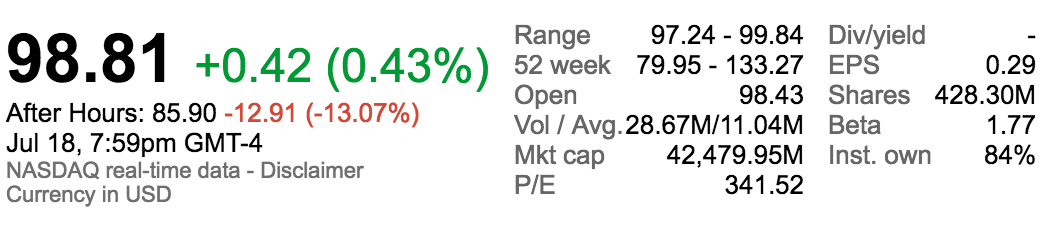

Netflix may have seen the end of explosive growth

Amid news of a price increase, yesterday (18 July) Netflix reported adding fewer than 1.7 million new subscribers in Q2 2016, the lowest growth rate the company has seen and well below expectations of 2.5 million. Netflix said churn increased slightly during the quarter with older members exiting the platform following price increases. For the third quarter, Netflix said it expects to add two million subscribers internationally.

Source: The Verge

Netflix need to increase revenues; because, in recent years, they have invested significantly in global expansion and original content. Netflix gained 13 million new subscribers in 2014, and another 17 million in 2015.

A price increase is one way to increase revenues; however, Netflix may soon have a new revenue stream in the US, as they gain access to Comcast's X1 box, and perhaps hubs for other cable providers in the near future. Such partnerships are not guaranteed revenue generators; in its investor letter, Netflix wrote: "It does not include any boost in the US from the Comcast X1 launch due to uncertainty on timing as we and Comcast will only release Netflix on the X1 when the viewer experience is great."

Larry Haverty of Gabelli Funds told CNBC's 'Closing Bell' that while he is a customer and thinks "it's a nice business", the stock may fall even further.

"The company is just not generating enough cash. The content costs are increasing. I think the international expansion is low quality", he said on Monday.

Haverty also said that Netflix has more challenges ahead as the competition gets tougher.

"Competition is only going to get worse in this business. Content is being created at an exponential rate. And the valuation is very, very high. […] I look at it as the coyote just went over the cliff and it's kind of an ugly finish", he said.

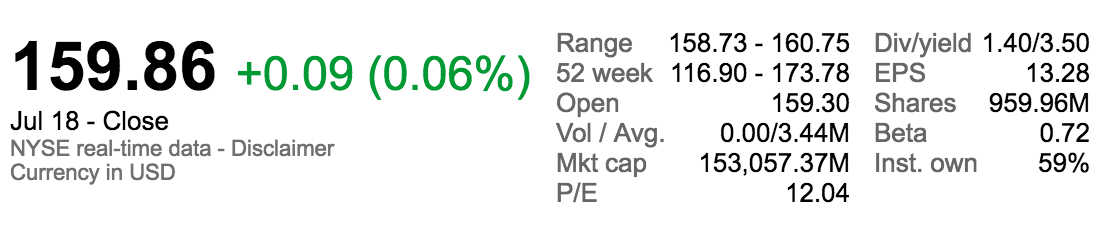

Yahoo: Source, Google Finance

Netflix: Source, Google Finance

IBM: Source, Google Finance

Follow ExchangeWire