Organisations Struggling to Activate Their Data; Similarities Between Sainsbury’s & Asda Customers

by Hugh Williams on 10th May 2018 in News

RetailTechNews’ weekly roundup brings you up-to-date research findings from around the world. In this week’s edition: Organisations Struggling to Activate Their Data; Similarities Between Sainsbury’s & Asda Customers; and The Battle for Mobile Wallet Dominance Continues.

Organisations Struggling to Activate Their Data

While sales and marketing teams put a high priority on using data and analytics to improve their business, most are not doing it effectively and lack a consistent data structure to link systems, according to research by Dun & Bradstreet.

![]()

This is making it difficult for teams to activate campaigns in a scalable way. Although only 52% of decisions are currently based on data, the survey showed that the number-one priority for sales and marketing teams over the next year is to increase their use of data and analytics to better meet business needs.

Businesses are still struggling to share data and insights across the organisation, resulting in a siloed effect that leaves customers with choppy and incomplete communications. The large majority (82%) of respondents cited managing data across the business as a challenge. In addition, 80% said managing the volume and velocity of data as a challenge, making it difficult for most businesses to pull actionable insights from the data in order to take action and turn it into scalable customer engagement strategies.

The study showed that organisations with data activation maturity were more likely to report increases across marketing/sales and customer metrics, with 73% reporting more rapid sales cycles, 73% reporting a higher return on marketing spend, and 77% reporting increased customer retention and loyalty.

Similarities Between Sainsbury’s & Asda Customers

The customers of both Sainsbury’s and Asda have very similar levels of brand loyalty, finds a study by Location Sciences and Retail Economics.

Mark Slade, CEO, Location Sciences, says that “for Sainsburys and Asda, the respective loyalty for each brand is very similar, with shoppers visiting the stores 2-3 times per month on average. The overlap, particularly in key retail locations, is however pronounced, with over 25% of consumers shopping at both supermarkets”.

Even before the merger, the research shows that the two supermarkets have more in common than they might realise. Richard Lim, chief executive, Retail Economics, notes that “over 25% of shoppers are found to use both supermarkets and, in some locations, this rises to over a third”.

The research is based off a panel of more than 70,000 consumers across five stores.

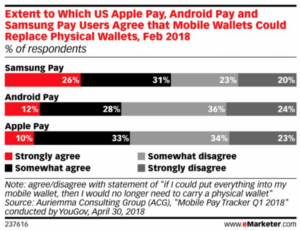

The Battle for Mobile Wallet Dominance Continues

There is no mobile wallet in the U.S. to emerge as a clear market leader as of yet, according to Auriemma Consulting Group (ACG). U.S. mobile wallet adoption has grown from 27% in Q1 2016 to 34% in Q1 2018. The research showed Apple Pay with a 34% share, followed by Android Pay (31%) and Samsung Pay (22%).

While Samsung Pay had fewer users, they were the most likely to characterise themselves as “very active" mobile pay users, with 30% of respondents identifying themselves that way. By comparison, 9% of Android Pay users and 8% of Apple Pay users described themselves as very active mobile pay users. The average spend bears this out.

Samsung Pay users said they had spent USD$119 (£88) using mobile pay in the past week, which is USD$18 (£13) more than Android Pay users and USD$45 (£33) more Apple Pay users. Among the three platforms, Samsung Pay users were also the most likely to agree (57%) that if they could put everything in a mobile wallet, they wouldn’t need a physical wallet anymore.This content was originally published in RetailTechNews.

DataE-CommercePaymentTechnology

Follow ExchangeWire