Where the Money will Flow in 2015

by on 15th Jan 2015 in News

January wouldn’t be January without the deluge of predictions which come forth from all corners of the online advertising boxing ring. Here, ExchangeWire Research’s Rebecca Muir gives her summary of the most popular themes which have emerged in some of this year’s predictions.

Programmatic trading boomed in 2014, the IAB UK predicted that 47% of display advertising was traded programmatically in 2014, nearly doubling from 28% the previous year. This explosive growth has been fuelled by several factors, including: education; improved inventory, and better tracking plus targeting.

Programmatic video inventory to come on to market

This year, programmatic video is expected to advance rapidly with 40% of digital video ad spend predicted to come from programmatic by 2016, according to research from eMarketer. So far, lack of programmatic video inventory has been a major barrier to mass adoption.

Programmatic video advertising is somewhat unique in the online advertising landscape, with buyers looking to combine the precise targeting and spending efficiency of programmatic display buying with the more traditional securities of TV buying inventory guarantees, specifically premium ad placements and brand-safe environments.

Buy-side solutions are typically not able to meet programmatic video buyers’ demands in their entirety today, resulting in a relatively small number of campaigns booked.

However, as publishers start to embrace the opportunity offered to them by programmatic we will start to see more premium video inventory being made available, which will tick one of the last remaining boxes for buyers and spur a surge of advertising budgets towards programmatic video advertising.

‘Programmatic’ will no longer be ‘a channel’

In 2015, we will see programmatic morph from a channel to a buying mechanism as more inventory in a number of formats starts to be traded programmatically and this moves towards becoming standard.

The most obvious stepping-stone is the $70bn TV advertising industry. Late last year, Channel 4 announced a European trading first, from 2015 it will offer advertisers a digital marketplace to buy advertising programmatically – with access to its first-party viewer data – on its new on-demand (VoD) platform, All 4.

This announcement was made alongside pioneering research with Cog Research and neuroscientist Dr Amanda Ellison at Durham University, which found that advertising on TV on-demand players outperforms YouTube (and other network, social and auto play video platforms) for viewer acceptance, engagement and attention.

Adap.tv, Videology and TubeMogul have all partnered with Channel 4, and it would not be surprising if we start to see these DSPs offer combined TV and online video programmatic campaigns.

At the moment, this would require significant advances in data integration, as no Channel 4 first party-data is to be shared with partnering DSPs, but there is no denying that it is technically possible to join online browsing data with programmatic TV advertising.

Native advertising debate to come to the fore

Native advertising has received a lot of attention over the last 12 months and has been the subject of many debates as to its worth. Opponents say native advertising is misleading with consumers mistaking it for editorial content, whereas supporters praise the opportunity to target informative content towards an engaged audience, rather than bombard internet users with stalker-like advertising.

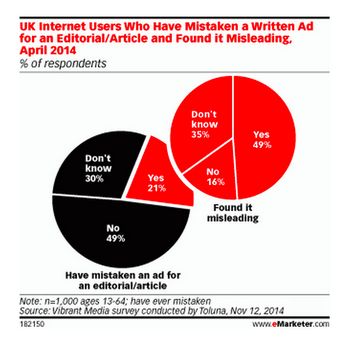

According to eMarketer, just 21% of UK internet users have mistaken a written ad for editorial content, but among that group almost half confirmed said they did find it misleading, with only 16% confirming that they did not find it misleading.

This poses a dilemma for brands and publishers considering native advertising. How can native advertising be differentiated from editorial to avoid negative reactions from consumers? If differentiation is achieved, we can expect to see huge growth in native advertising.

Display to spur mobile advertising

Mobile advertising means different things to different people. There’s mobile search, mobile display advertising and in-app mobile advertising.

Mobile search is a relative mature discipline, the transition from desktop search to mobile search was relatively seamless, and it is anticipated that in 2015 mobile search will surpass desktop.

However, we’re still seeing predictions for huge growth in mobile budgets which is being spurred by developments in mobile display and in-app advertising.

The first change that was needed in order for mobile advertising to thrive was the optimisation of the browsing experience for mobile devices.

Although certainly not a level playing field, this is an endeavour which is somewhat complete among major brands and publishers. The same cannot be said for tracking of performance campaigns on mobile devices and the scale which can be achieved. Both tracking and scale are vital ingredients for any advertising channel to succeed.

This year will see mobile analytics become more developed, expect to see real advances in the capabilities and adoption of cross-device tracking and a reduced reliance on cookies. Independent point solutions offering cross-device tracking are gaining traction and we’re also seeing steps being taken by Google, Facebook and Apple.

What remains to be seen is whether marketers are going to accept help from stack solutions, which will mean giving away extremely valuable campaign information and potentially increase media costs, or whether they will place their trust in independent solutions and take on the burden of external data integration and analysis in order to fuel optimisation decisions, which will then need to be executed separately.

Late in 2014, Apple announced that iAd is now providing access to ad inventory across more than 250,000 apps in over 100 countries to leading demand-side platforms (DSPs) and ad tech companies, including MediaMath,The Trade Desk, Rubicon Project, GET IT Mobile, Accordant Media, Adelphic, and AdRoll.

The offering lets advertisers leverage Apple’s exclusive targeting data or automatically find the best audiences for a given ad using insights from billions of Apple transactions. Media buyers will also benefit from streamlined campaign set-up and management and a wide range of reporting, including metrics from tap-through rates to video completes. If these partnerships work as promised, we will see a significant increase in budgets dedicated to in-app advertising.

Consolidation of martech

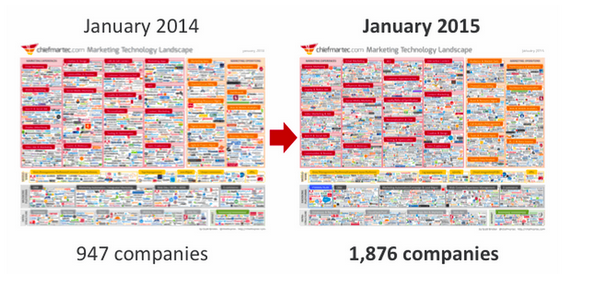

Scott Brinker of chiefmartech.com charts the evolution of marketing technology companies, producing a visual depiction of the landscape (see below). In January 2014, there were 947 companies mentioned, today, there are 1,876. What is extraordinary about this increase is that Brinker has done an excellent job of removing any potential double counting.

For example, Oracle bought Blue Kai. Blue Kai does not appear in the landscape, Oracle does. This means that the growth in numbers is more or less entirely down to the creation of new companies.

Brinker’s landscape is broken out into 43 categories. That’s a potential 43 companies that any given agency or brand needs to engage with in order to complete their marketing efforts.

Brinker’s landscape is broken out into 43 categories. That’s a potential 43 companies that any given agency or brand needs to engage with in order to complete their marketing efforts.

That’s potentially overwhelming, unless you’re blessed with a huge workforce with highly specialised skills. There’s a little group of companies in their own category towards the bottom, on the left hand side, and these are the marketing suites, or stack solutions.

A high-resolution version of the Marketing Technology Landscape can be downloaded from here. Read the rest of Brinker’s predictions here.

It’s this group who could step in and rescue an overwhelmed publisher and advertiser community who will ultimately seek to work with fewer partners, opting for partners with full-funnel marketing suites.

This likely will result in further acquisitions from this group, and the big media players (Google, Facebook, Apple etc.) consolidating the fragmented ad tech market. Amazon, Facebook, Google and Yahoo spent more than $40bn on acquisitions in 2014, it is expected that this figure will be higher in 2015. It will be interesting to see what market share the remaining independent solutions can maintain during the acquisition phase and how many hold out for IPO.

Publishers catch up with programmatic

Historically, publishers have preferred to work with ad networks and other programmatic ad tech partners to outsource their programmatic ad targeting. 2014 saw a number of key publishers bring programmatic in-house, and invest in technology infrastructure (predominantly DMPs) to manage their audience data in order to better monetise their ad inventory through programmatic behavioural ad targeting.

This has a knock-on impact of improving the consumers’ browsing experience by providing more relevant advertising.

This year will see more publishers start to adopt this approach, which will create more available programmatic ad inventory. This is much needed as at the moment, demand for programmatic advertising outweighs supply, which is having a knock-on impact on bid prices and pricing some advertisers out of programmatic.

The industry should also prepare for an overall increase in the price of programmatic advertising, which would naturally follow these current market conditions.

Viewability and fraud

Advertisers who invest in programmatic advertising are crying out for transparency. They know that some of their ads go unseen, they know that there is fraudulent traffic and the media’s obsession with this idea fuels misconceptions that programmatic advertising is fundamentally flawed because of these issues.

The level of technical sophistication in these areas has dramatically improved in recent years, making it possible to quantify viewability and fraud, leading to increased levels of accountability among agencies and buy-side technologies.

In 2015 we should see increased levels of understanding about viewability and fraud as leading technology companies seek to educate the market and rationalise scare stories. We will also see increasing attention given to ad blockers which are becoming popular among users who are increasingly seeking an irrelevant-advertising-free online environment. Such companies will be under scrutiny, by both publishers and buy-side solutions, as it is reported that some offer companies the chance to pay to bypass the blocker technology.

This article was written by ExchangeWire Research. To learn more and be a part of the launch of the new division, click here.

Ad FraudAd VerificationAdvertiserMedia SpendMobileNativeTargetingTradingTransparencyVideoViewability

Follow ExchangeWire