ExchangeWire Research Weekly Roundup

by Romany Reagan on 23rd Apr 2015 in News

ExchangeWire Research’s weekly roundup brings you up-to-date research findings from around the world, with additional insight provided by Rebecca Muir, ExchangeWire, head of research and analysis (pictured). In this week’s edition: last year saw UK advertising grow 5.8% to £18.6bn – the highest rate of growth since 2010; only 6% of marketers have a single customer view and Mobile grabs nearly 40% of sellers' programmatic inventory, but only 30% of buyers' spend.

Drive to digital sends UK advertising to its highest growth for four years

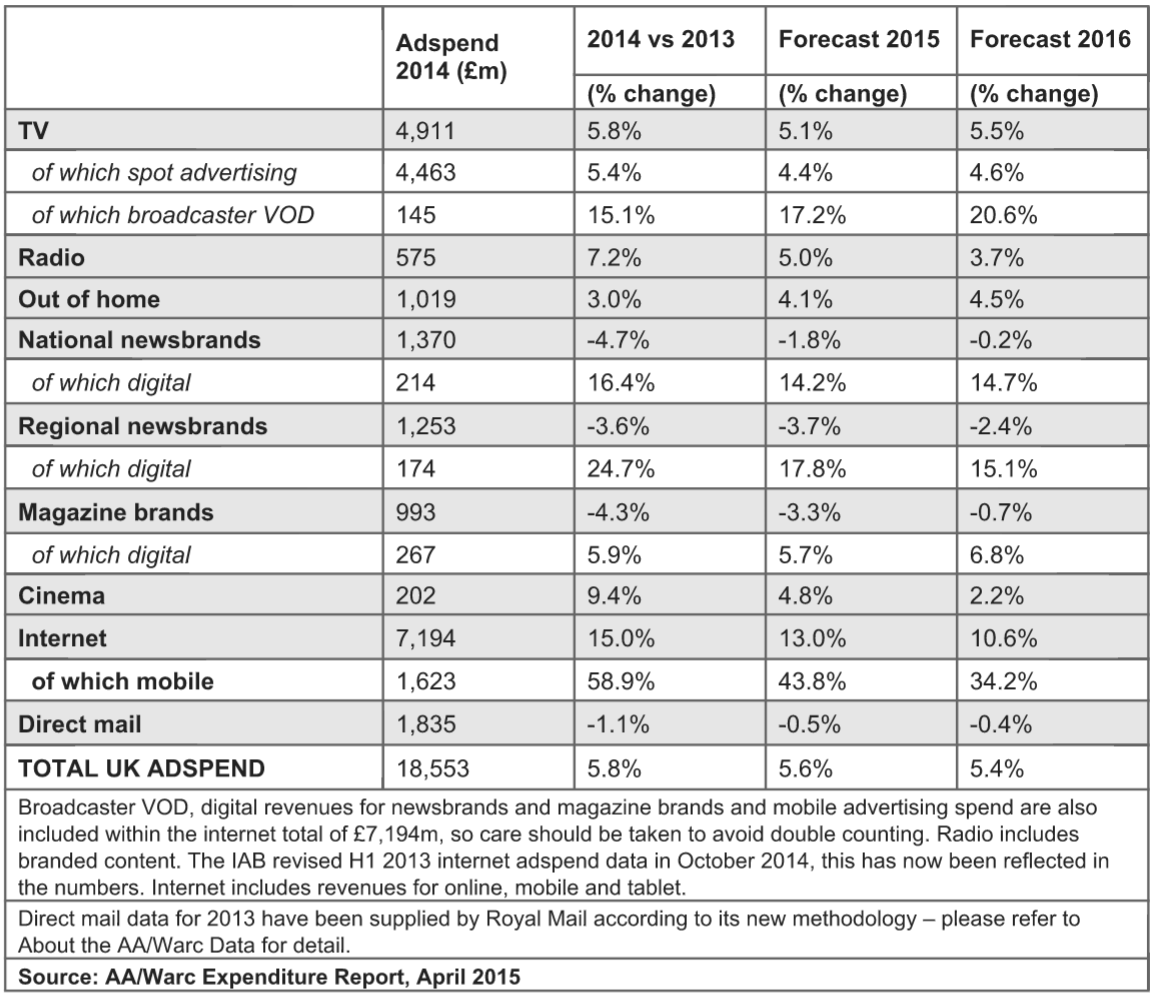

The UK’s authoritative advertising statistics, released this week by the Advertising Association/Warc, show UK advertising grew at its highest rate since 2010 last year, increasing 5.8% to £18.6bn. This strong growth is forecast to continue, with adspend predicted to break the £20bn barrier in 2016.

Internet advertising (+15.0%) and mobile (+58.9%) continue to grow strongly, but digital advertising through traditional channels also took off in 2014. Broadcast video-on-demand (+15.1%), digital national (+16.4%) and regional (+24.7%) newsbrands were stand-out performers, but the upward trend is also reflected in magazines and outdoor.

Tim Lefroy, Chief Executive at the Advertising Association said: “It’s time to stop thinking of digital as something that lives on the internet. In cinemas, outdoor, news, television, and elsewhere, advertising is seizing the opportunity of new technology. That trend is transforming our media, driving growth, and keeping UK advertising ahead of the global competition.”

The increasing proliferation of programmatic advertising means that marketers are in possession of more data than they probably ever imagined. Therefore, it is no surprise that the results of a recent study by ExchangeWire Research showed that “data and technology integration” is the joint priority for marketers in 2015. Early adopters of emerging programmatic trading models in traditional channels who successfully integrate data from existing campaigns will enjoy highly targeted ad buys and good return on their investments. Those who lag behind will have a lot of work to do to catch up.

Separate data recently released by the AA predicts that 70,000 new advertising-related jobs will be created over the next five years – double the rate of the UK average, bringing the total number of people working across the sector to over 434,000 by 2019.

The Advertising Association/Warc Expenditure Report is the definitive measure of advertising activity in the UK. It is the only source that uses advertising expenditure gathered from across the entire media landscape, rather than relying solely on estimated or modelled data. With total market and individual media data available quarterly from 1982, it is the most reliable picture of the industry and is widely used by advertisers, agencies, media owners, and analysts.

Single Customer View – the Holy Grail of Marketing

The continued growth in mobile (43.8% in 2015) will fuel further development of cross-device identification solutions. Cross-device tracking is one part of the marketers quest to create a single customer view, which is often thought of as the holy grail of marketing and customer retention.

A recent post by Signal reported that less than 40% of marketers are able to collect and integrate mobile app data, and half are unable to connect their CRM data. Furthermore, nearly two-thirds of brands still cannot measure the impact of ad impressions in the customer journey. Without a single view of the customer, effective marketing, measurement, and personalisation are out of reach.

Finally, eMarketer reported this week that programmatic buyers of mobile inventory are lagging behind their seller counterparts. Mobile accounts for almost 40% of sellers’ programmatic inventory, but just 30% of buyers’ spend. The difference is not surprising to me, publishers have been quick to react to changes in consumer behaviour, specifically the mass adoption of mobile devices as a primary vehicle to consume content. In an effort to monetise this new media, publishers have embraced programmatic trading to avoid costly direct sales teams and slow order processing associated with traditional ad sales.

Buyers are likely to be lagging behind when it comes to buying the available mobile inventory offered by publishers for many reasons, including the previously mentioned issue of cross-device tracking. When brands are unable to accurately quantify the effect of mobile advertising on subsequent sales, they are reluctant to invest in mobile, preferring to invest in more accountable channels such as paid search and email marketing.

Cross-ChannelExchangeWire ResearchMobileProgrammatic

Follow ExchangeWire