Sojern Publishes Latest COVID Impacts on Europe

by on 1st Sep 2020 in News

With access to real-time traveller audiences and visibility into global travel demand, Sojern has released its latest findings on how the COVID crisis is effecting travel to, from, and around Europe. Based on data collected on the 24th August 2020 from over 350 million traveller profiles and billions of travel intent signals, Sojern offers a comprehensive, yet not exhaustive, picture of the travel market.

Travel corridors and quarantine lists - the impact on European travel

As travellers around the world react to the fast-changing travel restrictions and re-openings, the popularity of European summer and autumn holiday destinations is fluctuating correspondingly. As COVID-19 cases in Portugal currently remain steady, a Portuguese holiday is back on the cards for many holidaymakers across the globe. For British travellers the ‘travel corridor’ means that they can visit the country for the first time since early June. The announcement of the travel corridor has increased global travel confidence in trips to Portugal for the time being.

On the other hand, countries including Austria and Croatia are seeing cases increase, meaning the reintroduction of quarantine rules for travellers entering and exiting the countries. The announcement made on Saturday 22nd August meant a large number of visitors were urged to shift their flights to an earlier time or day, in order to avoid a 14-day quarantine period on arrival home. Changes in government recommendations can impact or invalidate travel insurance policies, which is likely having an impact on travel intent and confidence. It has also been suggested that Greece may be next on the quarantine list , which means over the coming weeks and months, the previously positive trends we have been seeing for Greece may be impacted.

The announcement of travel restrictions to and from Croatia appears to have had an instantaneous impact on travel intent and confidence. Searches and bookings have decreased to -34% and -53% respectively. These volumes reflect a significant negative impact on year-over-year (YoY) volumes from the previous week—pre-announcement. This is a potential reflection of how volatile each market is, how quickly traveller’s plans are changing, and how important it is that travel brands are prepared to constantly adapt.

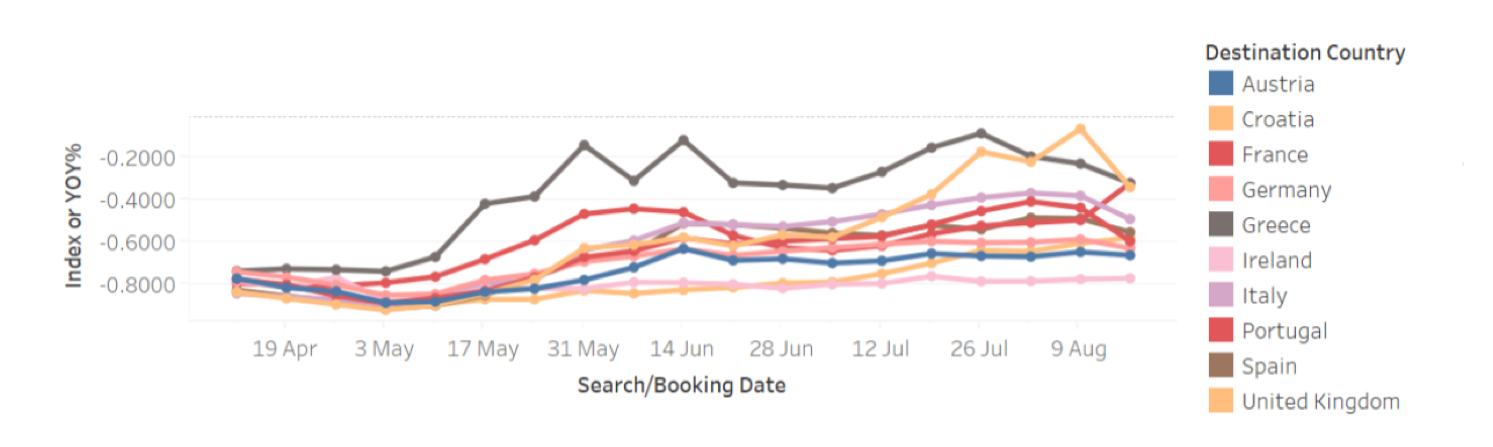

YoY% global flight searches to key European markets

Countries from highest to lowest (w/c 16th Aug): Greece, Portugal, Croatia, Italy, Spain, United

Kingdom, France, Germany, Austria, Ireland

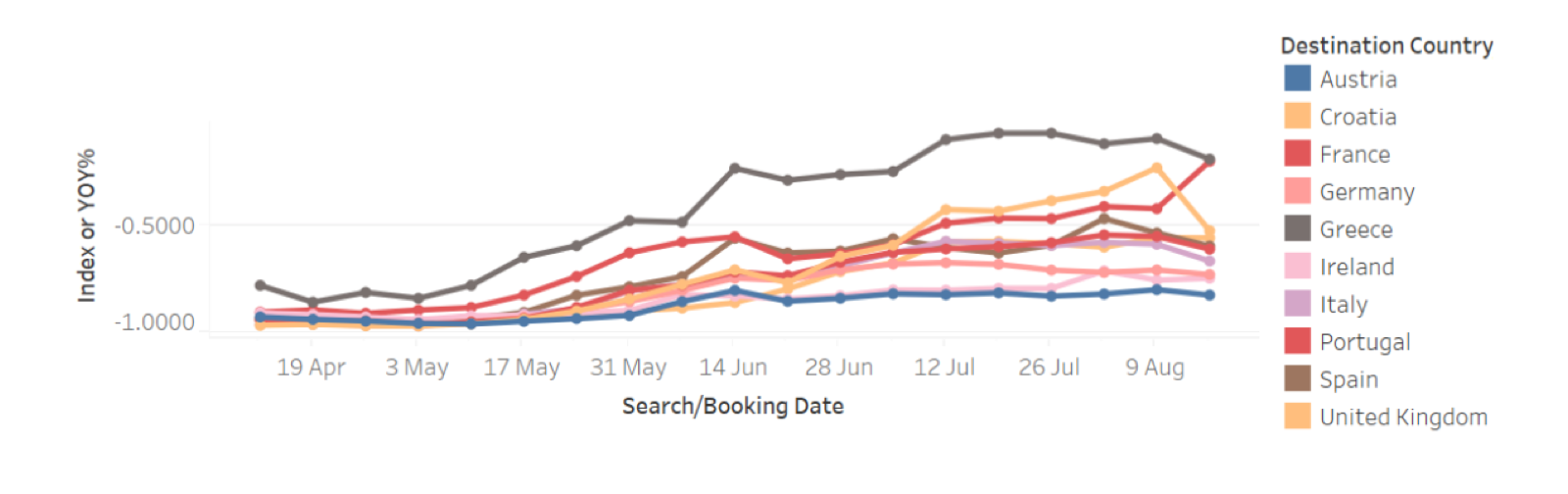

YoY% global flight bookings to key European markets

Countries from highest to lowest (w/c 16th Aug): Greece, Portugal, Croatia, United Kingdom,

Spain, France, Italy, Germany, Ireland, Austria

Regionally the picture for flight bookings to key markets is almost identical to that of global bookings. Bookings to Portugal, Greece, and Croatia have the highest value of YoY bookings, with Greece and Portugal around just 20% below bookings from the same period in 2019, and bookings to Croatia approximately 55% below 2019 volumes.

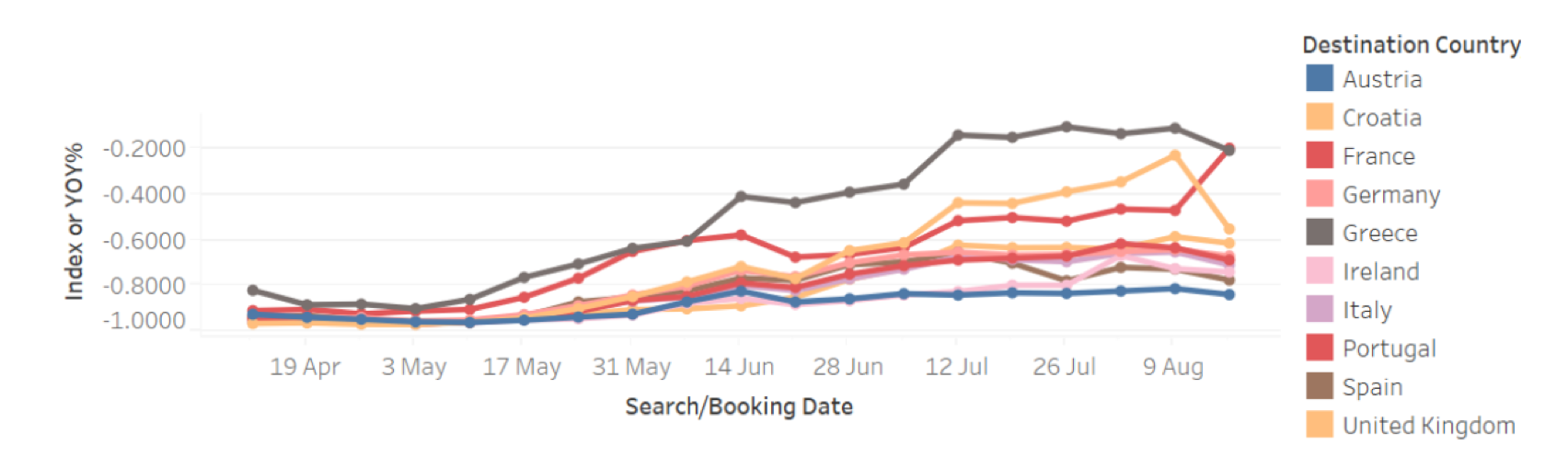

YoY% regional flight bookings to key European markets

Countries from highest to lowest (w/c 16th Aug): Portugal, Greece, Croatia, United Kingdom,

Germany, France, Italy, Ireland, Spain, Austria

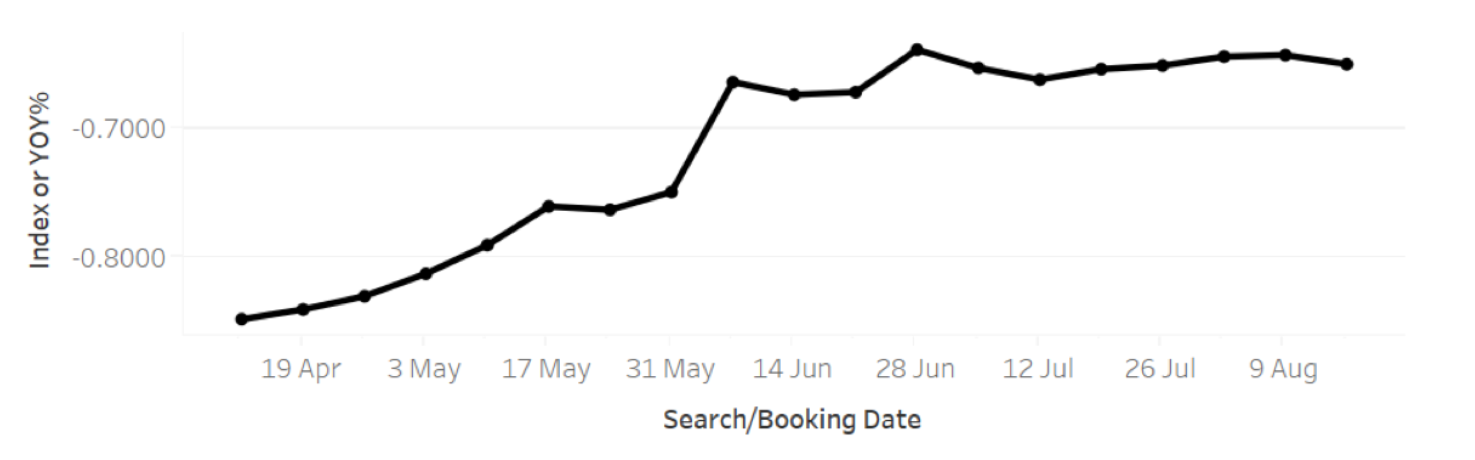

International travel to Europe plateaus

Despite fluctuations in searches and bookings to key markets in the region on a country level,

as a whole, it appears that international travel bookings have levelled out at around -65% YoY.

Although this is nowhere near 2019 figures, back in the middle of April when the impact of

COVID-19 on travel was at its highest, volumes were down -85% YoY. This is a positive sign

that international traveller confidence in European travel is not deteriorating as local restrictions

continue to be implemented.

YoY% international flight bookings to Europe

Travellers remain optimistic about trips to France

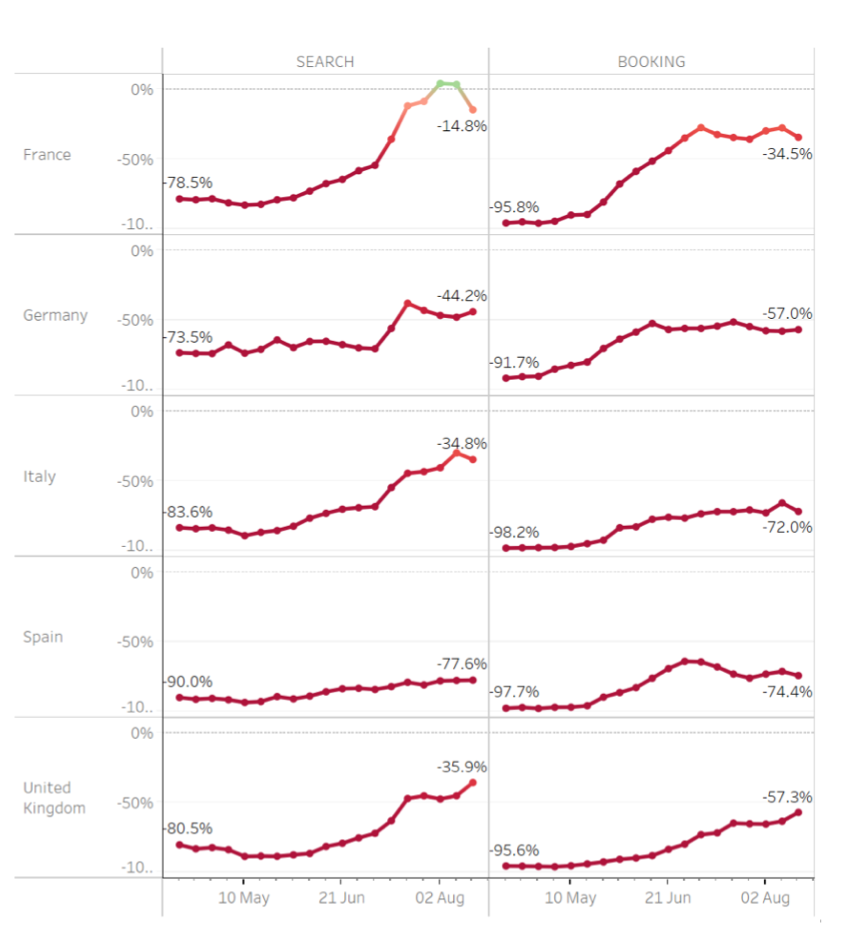

When comparing global searches and bookings for hotels across key European countries, France is showing positive signs of recovery. Both searches and bookings are higher YoY, when compared to those for properties in Germany, Spain, Italy, and the United Kingdom. Travel intent is now only 15% below that of 2019, and travel confidence stands at -35% YoY. Both very encouraging numbers when considering the effect on travel that the pandemic has had on neighbouring countries in Europe, and globally.

YoY% global hotel searches/bookings for key European markets

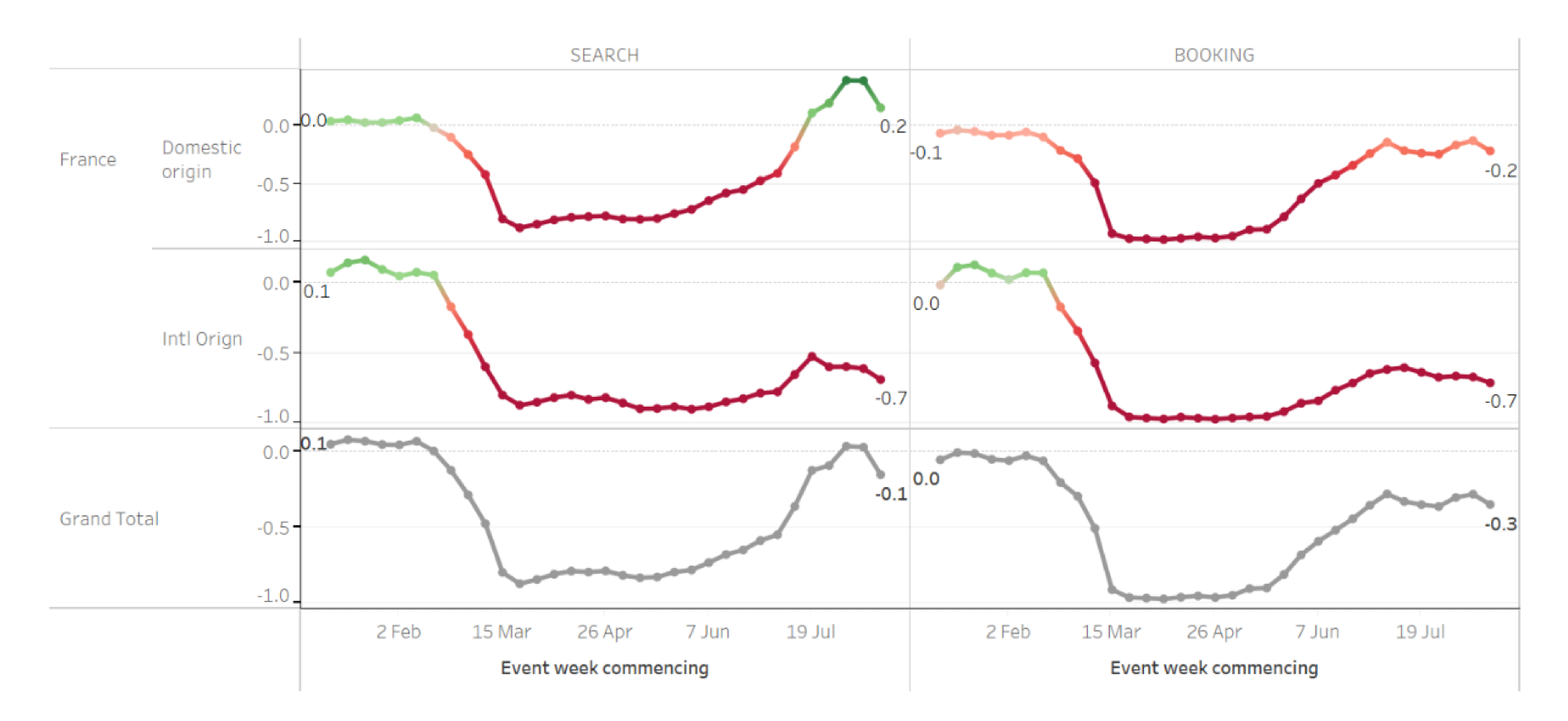

Although global travellers are showing interest in trips to France, it remains clear that domestic travel leads the way to recovery. Domestic searches for hotels are up 20% YoY, compared to - 70% when looking at international searches. Domestic bookings are also looking positive at only 20% below 2019 volumes.

YoY% hotel searches and bookings for France – domestic vs. international origin

Nice and Lyon are Currently the Most Sought After French Cities for Travel

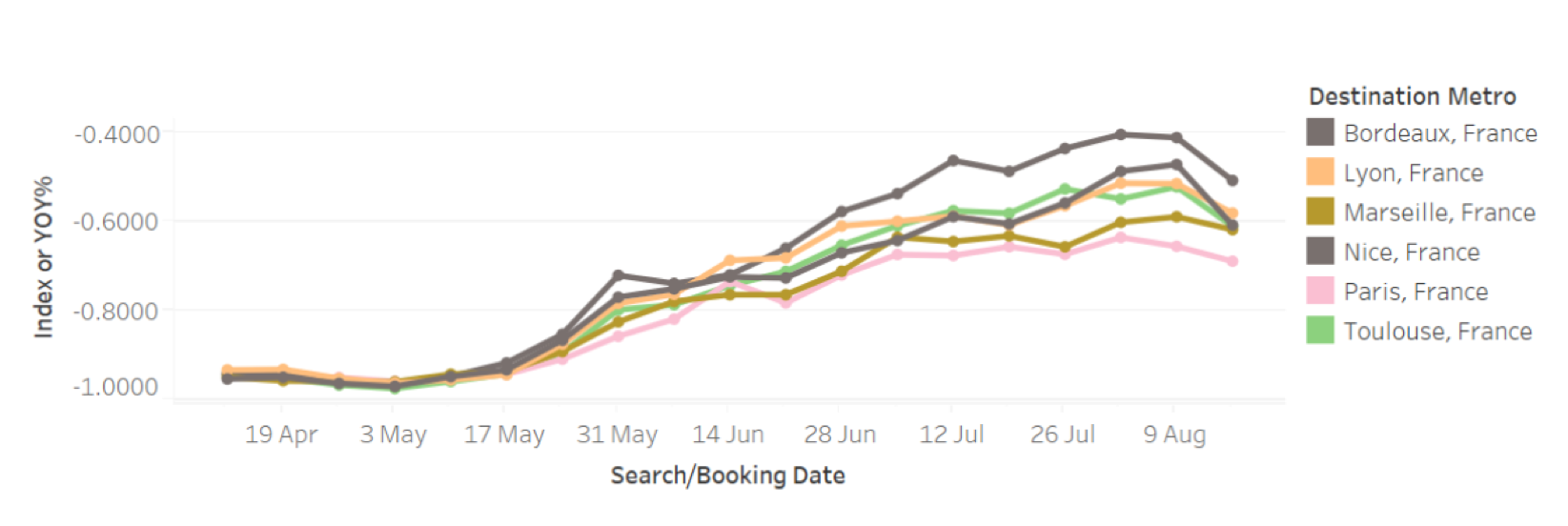

Looking more closely into which areas are seeing an increase in travel interest, Nice and Lyon top the list of popular French destinations. On the contrary, Paris is seeing lower booking levels from global travellers. This could be a reflection of the sentiment that travellers are looking to make trips to lesser populated areas, with lower risk of COVID-19 transmission.

YoY% global flight bookings to French cities

Cities from highest to lowest (w/c 16th Aug): Nice, Lyon, Bordeaux, Toulouse, Marseille, Paris

Traveller behaviour closely reflects the latest announcements of quarantine rules being enforced, and travel corridors opening up. Overall, international travel to Europe plateaus and France is showing positive signs of recovery. We will continue to share more insights as we monitor the situation. These forward looking insights will hopefully help travel marketers shape their strategies as the industry recovers from this outbreak.

For the rest of the COVID-19 insights series click here.

Covid-19EuropeMeasurementRegulationTravel

Follow ExchangeWire