Record 22% Revenue Growth for Apple, 80% Growth for Rubicon Project & Mobile now Driving 86% of Twitter's Ad Business

by Rebecca Muir on 28th Oct 2015 in News

Yesterday, October 27, 2015, Apple, Twitter and Rubicon Project announced quarterly financial results. All three Companies reported growth, however, Twitter shares slumped by 13% overnight due to light guidance for the following quarter.

22% revenue growth: a new record for Apple

Apple posted quarterly revenue of USD$51.5bn and quarterly net profit of USD$11.1bn, or $1.96 per diluted share. These results compare to revenue of USD$42.1bn and net profit of USD$8.5bn, or $1.42 per diluted share, in the year-ago quarter. Gross margin was 39.9%, compared to 38% in the year-ago quarter. International sales accounted for 62% of the quarter’s revenue.

The growth was fuelled by record fourth-quarter sales of the iPhone, the expanded availability of Apple Watch, and all-time records for Mac sales and revenue from services.

“Fiscal 2015 was Apple’s most successful year ever, with revenue growing 28% to nearly USD$234bn. This continued success is the result of our commitment to making the best, most innovative products on earth, and it’s a testament to the tremendous execution by our teams,” said Tim Cook, Apple’s CEO. “We are heading into the holidays with our strongest product lineup yet, including iPhone 6s and iPhone 6s Plus, Apple Watch (with an expanded lineup of cases and bands), the new iPad Pro, and the all-new Apple TV, which begins shipping this week.”

“Apple’s record September quarter results drove earnings per share growth of 38% and operating cash flow of USD$13.5bn,” said Luca Maestri, Apple’s CFO. “We returned USD$17bn to our investors during the quarter through share repurchases and dividends, and we have now completed over USD$143bn of our USD$200bn capital return program.”

Twitter share price slumps by 13% despite strong quarterly results

Twitter, Inc. also announced solid financial results for the quarter ended September 30, 2015. However, guidance for the following quarter was light, which has caused Twitter's share price to slump by almost 13%.

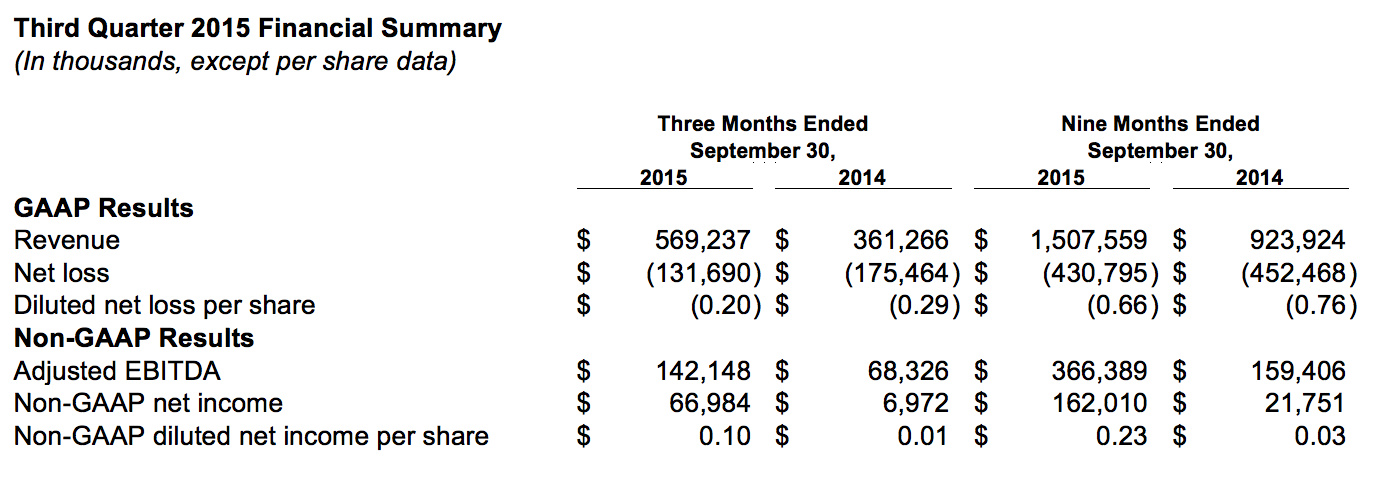

Financial Highlights

– Advertising revenue totalled USD$513m, an increase of 60% year-over-year. Excluding the impact of year-over-year changes in foreign exchange rates, advertising revenue would have increased 67%

– Mobile advertising revenue was 86% of total advertising revenue

– Data licensing and other revenue totalled USD$56m, an increase of 37% year-over-year

– US revenue totalled USD$370m, an increase of 54% year-over-year

– International revenue totalled USD$199m, an increase of 65% year-over-year

– Q3 revenue of USD$569m, up 58% year-over-year, and above the previously forecast range of USD$545m to USD$560m. Excluding the impact of year-over-year changes in foreign exchange rates, revenue would have increased 64%

– Q3 GAAP net loss of USD$132m and non-GAAP net income of USD$67m

– Q3 GAAP EPS of USD$0.20 and non-GAAP diluted EPS of USD$0.10

– Q3 adjusted EBITDA of USD$142m, up 108% year-over-year, and above the previously forecast range of USD$110m to USD$115m, representing an adjusted EBITDA margin of 25%

“We continued to see strong financial performance this quarter, as well as meaningful progress across our three areas of focus: ensuring more disciplined execution, simplifying our services, and better communicating the value of our platform,” said Jack Dorsey, CEO of Twitter. “We’ve simplified our roadmap and organisation around a few big bets across Twitter, Periscope, and Vine that we believe represent our largest opportunities for growth.”

Business Highlights

Monthly Active Users – Total average Monthly Active Users (MAUs) were 320 million for the third quarter, up 11% year-over-year, and compared to 316 million in the previous quarter. Excluding SMS Fast Followers, MAUs 2 were 307 million for the third quarter, up 8% year-over-year, and compared to 304 million in the previous quarter. Mobile MAUs represented approximately 80% of total MAUs.

Consumer Products – Twitter launched Highlights on Android, Music on Vine, and landscape view and web profiles for Periscope. We introduced an updated version of the logged-out Twitter.com desktop home page. We also removed the 140-character limit on direct messages.

Advertising Products – Twitter launched video auto-play on all devices, expanded its self-service ads platform to over 200 countries and territories, and extended the offerings of the Twitter Audience Platform (formerly the Twitter Publisher Network) to include additional targeted objectives and new creative formats. For performance marketers, Twitter introduced new optimisation and bidding enhancements. Twitter also introduced event targeting as well as ads editor, a new tool that enables advertisers to seamlessly create and edit numerous campaigns at once.

Partnerships – Twitter announced commerce partnerships with platforms that power ecommerce sites, including Bigcommerce, Demandware, and Shopify, and retailers and brands such as Best Buy, Adidas, and PacSun. These commerce partnerships are powered by Stripe Relay. Twitter partnered with Square to enable US political donations through Tweets. Twitter also extended its existing agreement with Bloomberg to bring more Twitter data to financial professionals.

Rubicon project report record earnings driven by mobile and RTB

Financial Highlights

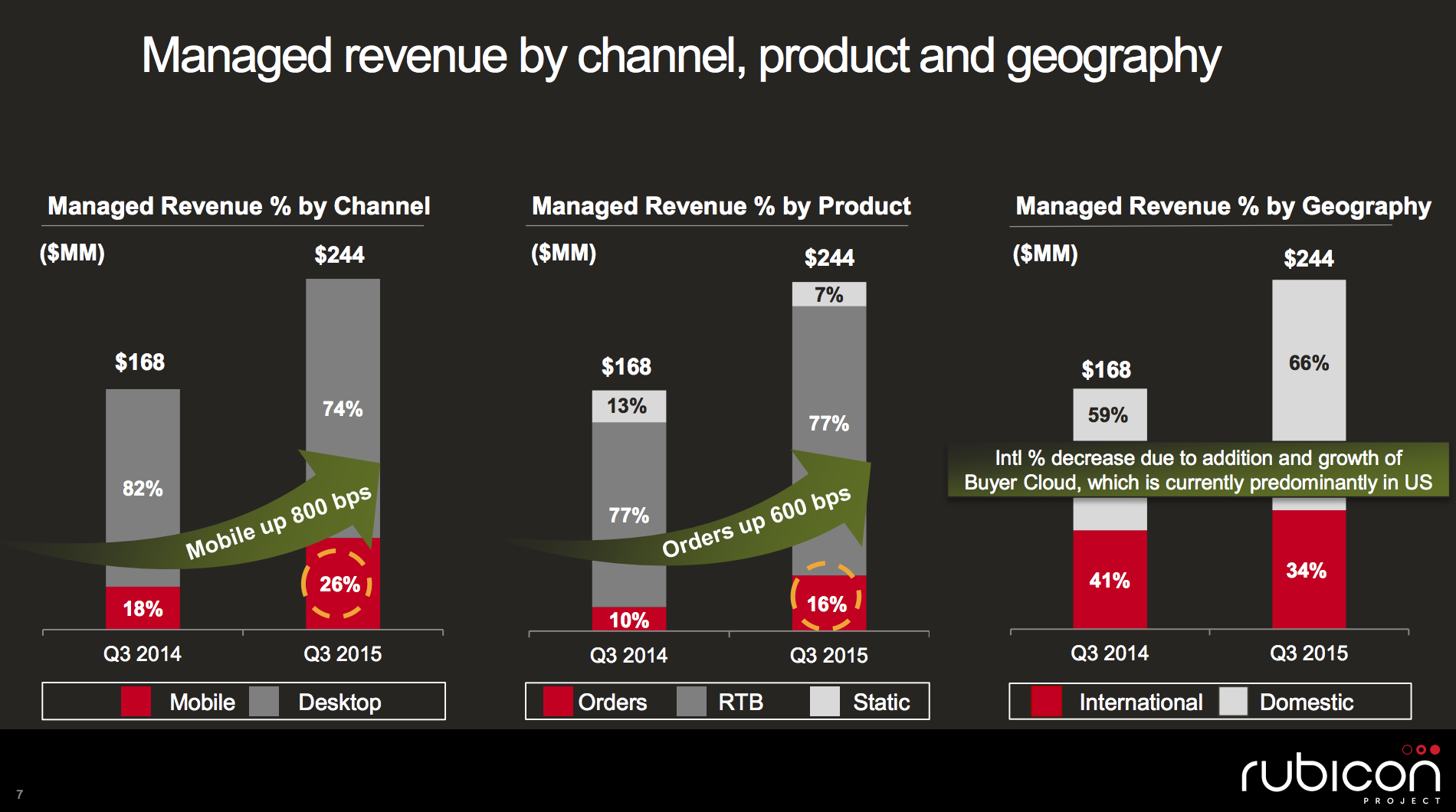

– Managed revenue, which is the advertising spending transacted on the platform, for the third quarter of 2015 was USD$244.4m compared to USD$168.2m in the third quarter of 2014, an increase of 45% year-over-year.

– The increase in managed revenue was primarily driven by an increase in both pricing and bidding activity, led by RTB, which continues to represent the largest portion of the business.

– Managed revenue was comprised of 77% RTB, 16% Orders and 7% Static.

– By channel, managed revenue was comprised of 74% desktop and 26% Mobile.

– GAAP revenue was USD$64.3m compared to USD$32.2m in the same period in 2014, representing a year-over-year increase of 100% and slightly ahead of expectations.

– Non-GAAP net revenue was USD$57.9m compared to USD$32.2m, an increase of 80% year-over-year and ahead of expectations.

– The non-GAAP net revenue associated with the GAAP revenue guidance that was provided last quarter was USD$53.8m, therefore, the attainment of USD$57.9m this quarter represents a favourable variance of 8% over expectations.

– GAAP loss per share was (USD$0.07) in the third quarter of 2015, compared to a loss of (USD$0.14) per share during the third quarter in 2014.

– Non-GAAP earnings per share in the third quarter of 2015 was USD$0.23, compared to non-GAAP earnings per share of USD$0.05 in the same period in 2014

– Average CPMs continued to increase and were higher year-over-year.

– Paid impressions associated with Orders and RTB were higher year-on-year; while paid impression from Static transactions were lower year-on-year. The growth in Average CPM was primarily due to algorithm efficiency, Orders, increased buyer spend, buyer cloud initiatives, and a continued shift from static inventory purchases to RTB.

“Rubicon Project’s talented team, solid execution and innovative technologies drove another quarter of record performance for our business,” said Frank Addante, CEO, founder and chief product architect of Rubicon Project.

“As we enter the fourth quarter, and look to 2016, the market for advertising automation continues to heat up as both buyers and sellers seek powerful new tools to shape the future of consumer engagement,” Addante added. “From mobile to desktop to video, Rubicon Project’s differentiated position as a leading independent platform for the buying and selling of advertising uniquely positions us to continue to grow and win in the market.”

Stock Prices

AppleDisplayEarningsMobileProgrammaticSocial MediaSSP

Follow ExchangeWire